Getting paid for spending money? It sounds too good to be true. But simply put, that's how cashback works.

Getting cashback on a purchase means you can get back a percentage of the money you spent on it. 5% cashback on a £300 TV means you’ll get £15 back after buying it.

You can get cashback on your purchases by using a cashback website, a cashback card — and when you spend with Monzo!

How to get cashback with Monzo

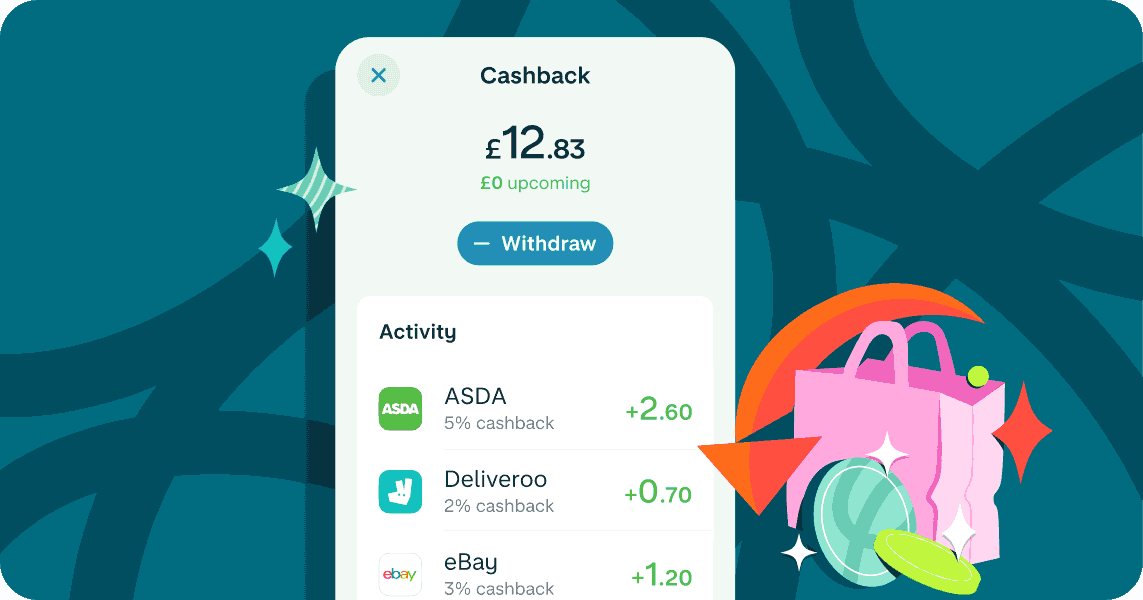

To earn cashback with Monzo, activate offers from top retailers like Asda, Boots, eBay and Deliveroo and spend with your Monzo card of choice – personal account (includes Plus and Premium), joint account and Flex Credit Card all work.

Want in? Find out what makes cashback with Monzo refreshingly simple.

You'll need to download Monzo. UK residents only. Ts&Cs apply.

How to use cashback sites

Once you’ve signed up to a cashback site, you can use it to search for retailers. You can usually see what percentage of cashback you’ll get for shopping with them. If you click through to a retailer’s website and buy something, they'll add the money to your cashback account.

Wondering what’s in it for the cashback site? Essentially, you’re helping them make a profit. Retailers pay cashback sites for sending customers their way – and cashback sites give you a slice of that payment to keep you coming back.

Popular cashback sites include Quidco, TopCashBack and Airtime Rewards, but there are loads to choose from. Just make sure you understand how and when you’ll get cashback before you sign up.

What to look out for

Fees – lots of cashback sites let you sign up for free, but some charge for membership or premium features.

Link tracking – you can usually only earn cashback when you’ve clicked through to shop from the cashback site. Otherwise they can't trace the transaction back to the cashback site and they won't get their commission.

Cookies – if you browse a retailer’s website, then go back to it through a cashback site, they might not be able to track your transaction properly. This is because the retailer may have already stored cookies on your computer (i.e. information about your browsing history). You may need to clear your cookies first so it’s clear you came through the cashback site.

Better deals – before you buy something through a cashback website, it’s worth comparing prices elsewhere. Otherwise, you may be missing out on a better deal.

Delayed payment – there can be a wait between earning cashback and seeing it in your bank account. Also, some cashback sites won’t pay you until you’ve earned a certain amount of cashback.

Tips to make the most of cashback sites

Referring a friend – some cashback sites will reward you when you refer a friend to them. You’ll normally only get the reward once your friend starts spending through the site.

Big purchases – buying something big (like a holiday or mobile phone contract) through a cashback site can really boost your earnings.

Gift cards – you can usually withdraw cashback via a bank transfer or PayPal. But some cashback sites offer to increase the amount if you withdraw it as a gift card with one of their retailers.

Offline cashback – some sites let you earn cashback on in-store purchases. Check out Quidco’s ClickSnap app and TopCashback's OnCard scheme.

You'll need to download Monzo. UK residents only. Ts&Cs apply.