See your mortgage in Monzo

Connect a mortgage from any lender to your Monzo account in 60 seconds. Make monthly progress on what you own, see the impact of overpaying and get insights that could save you thousands.

You'll need a Monzo account to use this feature. UK residents only. Ts&Cs apply.

Your mortgage, demystified

See your progress

Find out what you own, not just what you owe – updated automatically every month.

Plan ahead

Get a straightforward view of your mortgage, including reminders for when your deal is up.

Pay less interest

Get insights that could save you thousands over the long term and help you be mortgage free faster.

Find out what you could save

Our overpayment calculator shows you the impact of making regular or one-off overpayments.

You’ll also get insights that could save you thousands over the long term – totally tailored to you.

Connect in 60 seconds

Connect your mortgage in a few taps. No details needed, no fuss.

We get your mortgage information from credit reference agency TransUnion.

Be remortgage-ready

Our interest rate change calculator shows you what a change in interest rate could mean for your monthly payment. So you can take out the guesswork.

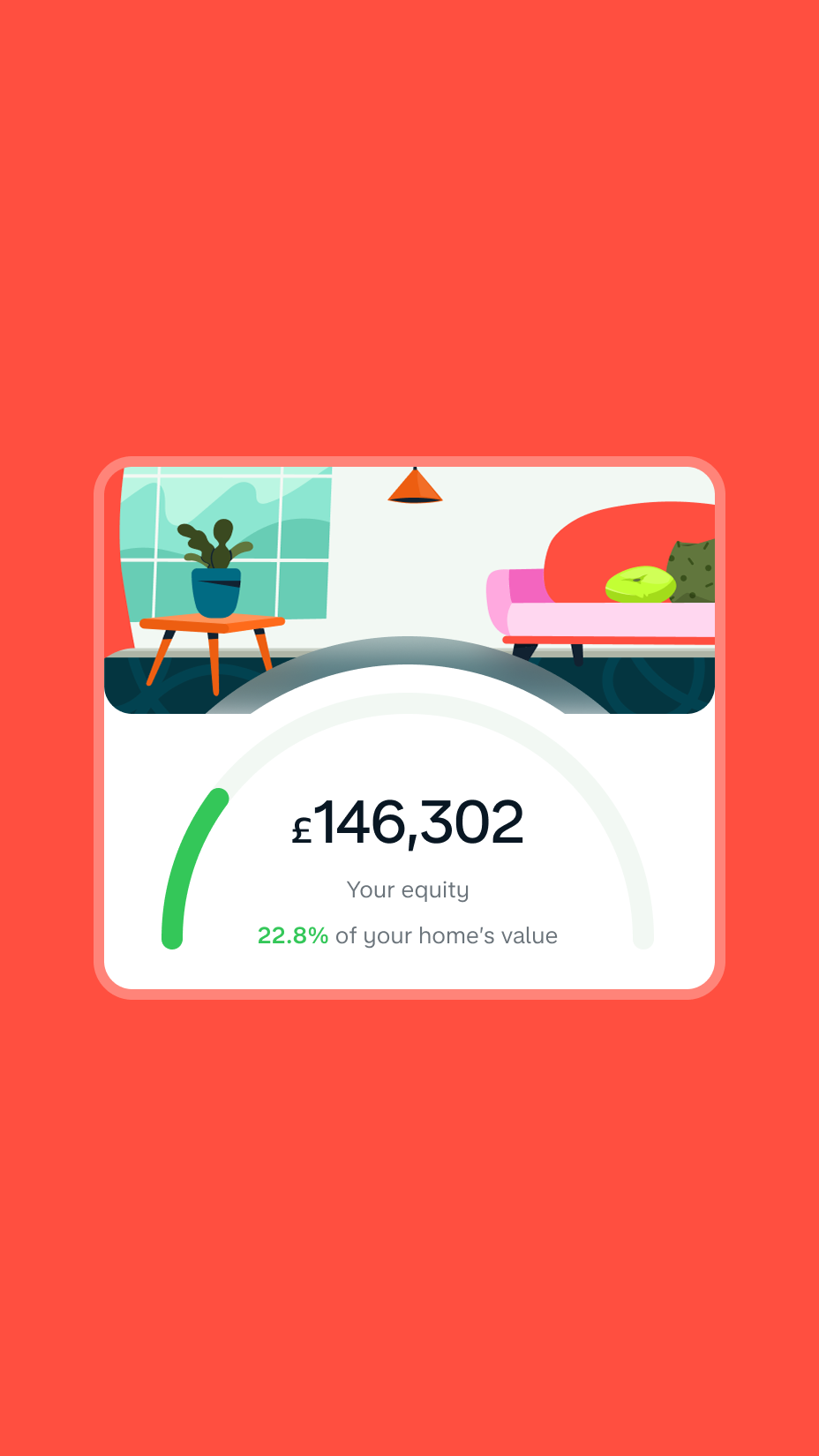

See what you own month by month

Find out your equity and how much your home could be worth.

We update you monthly so you always know where you’re at, without the hassle of using an equity calculator or working it out yourself.

Tools for every stage as a homeowner

Bought your first home

If you’ve just got onto the property ladder, we can help.

Understand the ins and outs of your new mortgage. Learn about overpayments and use our calculator to see if you can save.

Just keeping track

Mid-term on your mortgage deal and just want visibility? We can help there too.

Keep tabs on your home’s value, check your equity and get updates when things change. Plus, learn how to get a better rate if you remortgage.

Remortgaging soon

Our interest rate change calculator shows you what a change in interest rate could mean for your monthly payment.

How it works

1. Open Monzo

In the app, tap ‘+’ in the top right and then ‘Add mortgage'.

2. Add your mortgage

Follow the steps – we'll find your mortgage information from TransUnion.

3. See your equity

You can also see how much your home is worth.

Mortgages explained

Equity and loan to value explained

Learn about equity and loan-to-value (or LTV) with Monzo, whether you're buying your first house or currently looking to remortgage.

What kind of mortgage do I need?

Whether you're an aspiring or current homeowner, there are many types of mortgage available. This blog is the Monzo guide to mortgages.

What is remortgaging and how does it work?

The Monzo guide to remortgaging. We've also partnered with the regulated online mortgage broker, Better.co.uk to help you plan for and navigate every stage of the remortgaging process.