Can I check if I’m eligible without impacting my credit score?

You’ll need a Monzo current account to apply for Flex. If you have one, you can apply in the Monzo app.

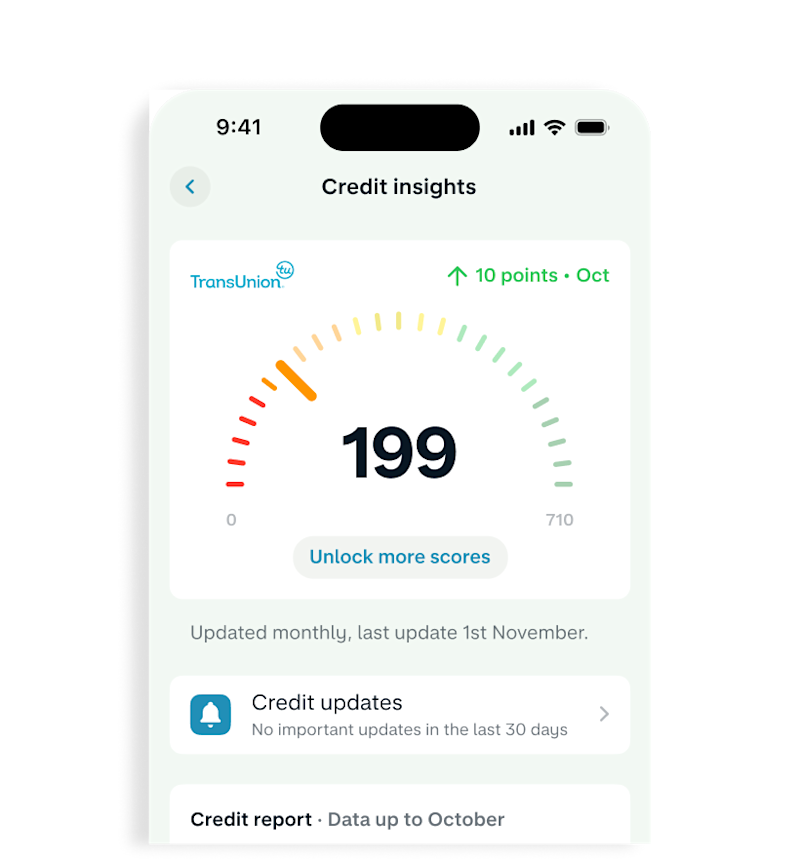

When you apply for the Monzo Flex Credit Card we’ll run a “soft” credit check – this means we can check your eligibility and give you a personalised offer without impacting your credit file.

If you decide to get Monzo Flex, we’ll let credit reference agencies know by running a “hard” search. This is something that most lenders have to do when you take out a new type of borrowing or credit. Generally, a hard search will have a small negative impact on your credit file but usually only for a few months.

Will using Flex Build help build my credit score?

We report how you use Flex Build to credit reference agencies. We tell them things like what your credit limit is, what your outstanding balance is and whether you’ve made your monthly payment on time. Staying within your credit limit and making your monthly payments on time will show other lenders that you can manage credit responsibly.

Your credit record has lots of factors that make up your credit score. How Flex impacts your credit score will depend on your other factors, including whether you’ve used credit before.

What is a security deposit?

We ask some customers for a one-time deposit based on their credit history, for example if you’re building your credit score from scratch, have recently moved to the UK or are looking to repair your score.

The deposit acts as a “security”, which means we’ll set it aside and you’ll only be able to access it in a few situations like to catch up with a missed payment or when you close your account.

If you use Flex responsibly, you’ll get an opportunity to get your deposit back in as little as 6 months. We’ll let you know more about that in the app.