Do I need a Monzo current account to have Monzo Home Insurance?

Yes - you need to have an open Monzo current account to have Monzo Home Insurance. You must keep your Monzo current account open for the whole time you have Monzo Home Insurance.

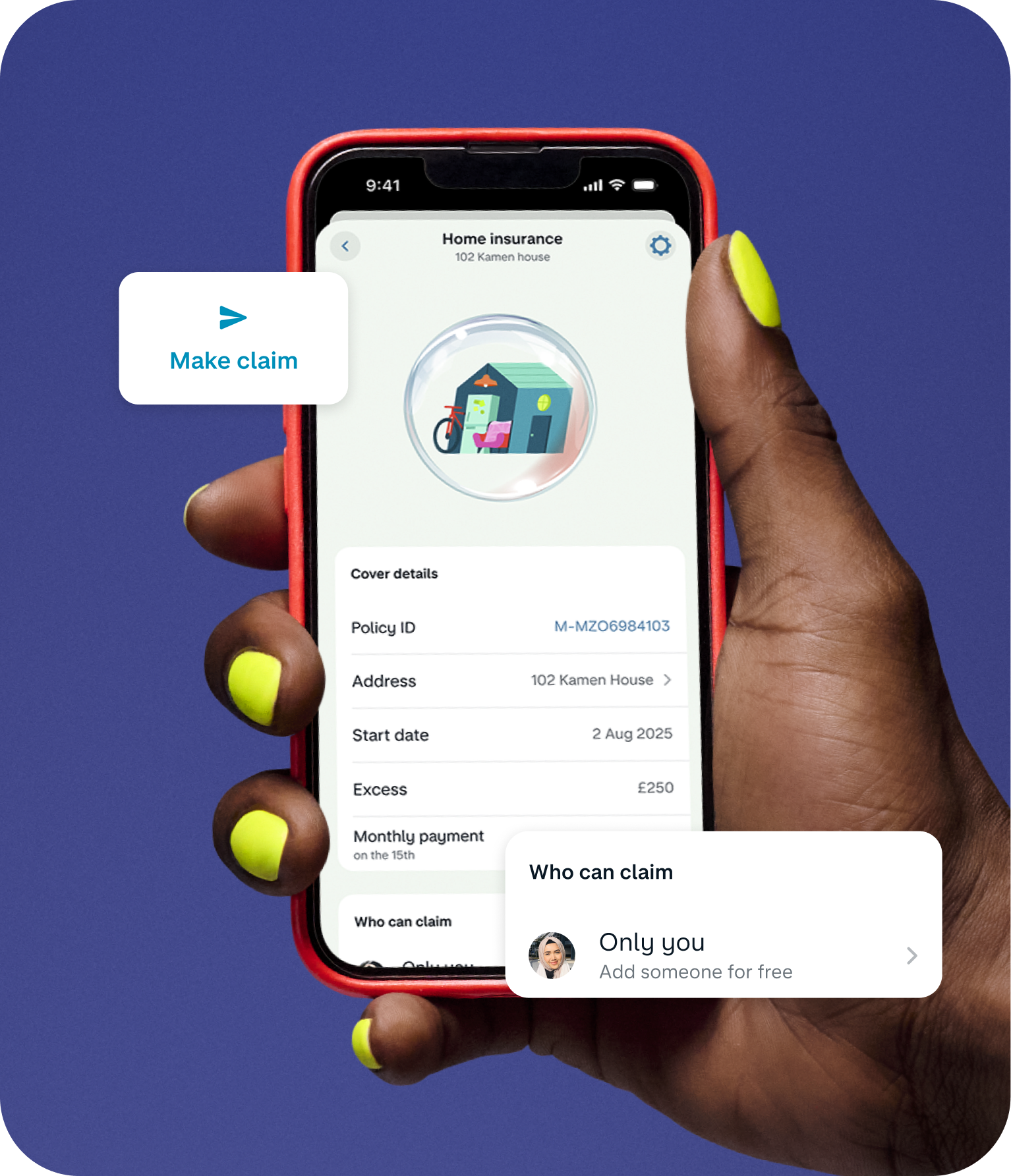

How do I make a claim?

If you need to make a claim, you can do so directly from the Monzo app. Go to the insurance section in your app, tap on your active policy and tap 'Make a claim'. If you'd prefer to speak to someone, you can call 0345 2661980.

Who is Chubb?

We have worked with an insurer called Chubb to create our Monzo Home Insurance product. Chubb are underwriting the product, this means they are the ones who actually provide the cover, work out how much it costs you and are responsible for dealing with any claims you make.