A free bank account that fits your finances

Organise your life with Pots. Earn 2.75% AER (variable) on instant access savings. Spending insights you’ll actually use. All wrapped in one cool, hot coral package.

UK residents only. Ts&Cs apply.

A Monzo bank account means...

Modern banking, in your pocket. No branch queues, no hidden charges, no complex language. Just award-winning products and innovative features that make managing your money feel like a breath of fresh air.

A fully licensed UK bank

Monzo Bank Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Protection for your money

The Financial Services Compensation Scheme (FSCS) protects all your eligible deposits in Monzo up to a value of £120,000 per person.

Simple ways to pay and get paid

Send and receive money in just a few taps. There's no need to share your bank details (or have those awkward 'pay-me-back' conversations).

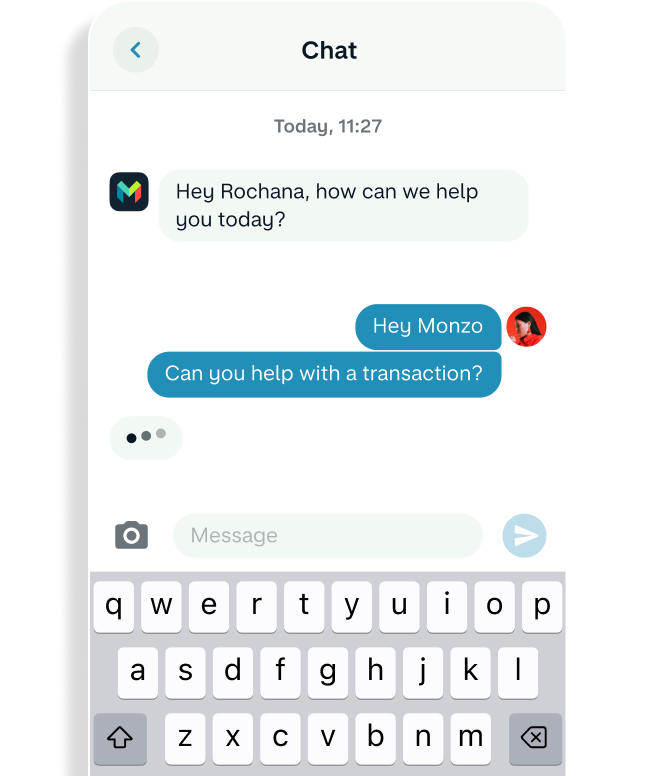

24/7 customer support

Our in app chat is managed by friendly humans ready to answer your questions, any time, any place.

Loans and overdrafts

We offer loans up to £25,000 and overdrafts up to £2,000. You can check if you're eligible without affecting your credit score.

Interest on your savings

Earn 2.75% AER (variable) paid monthly with an Instant Access Savings Pot. There’s no minimum deposit, and you can access your money anytime.

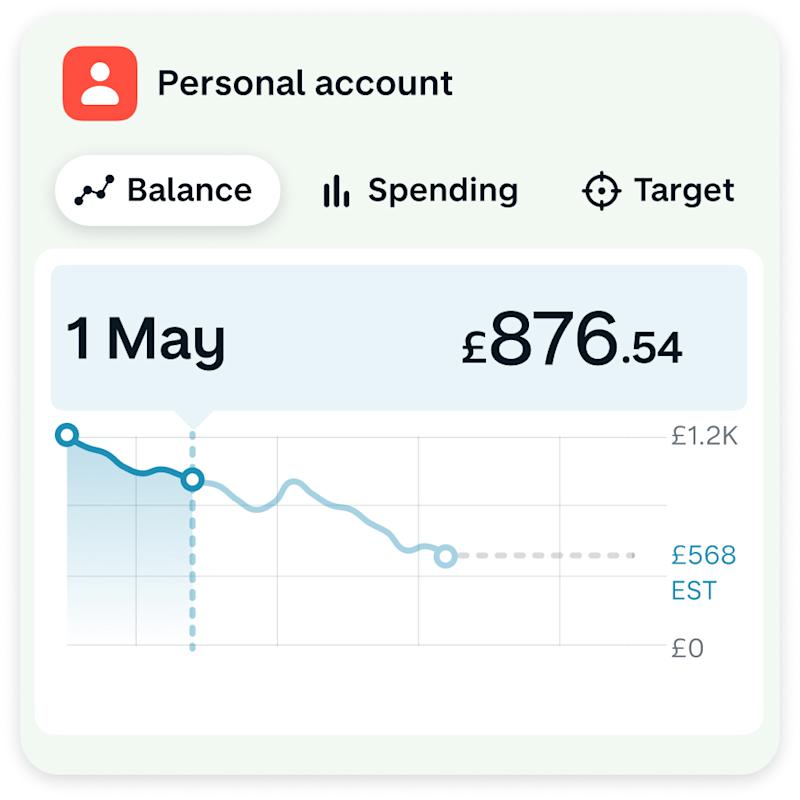

Spending insights you'll actually use

Instant notifications tell you how much you’ve spent and where, so you’re in the know wherever you go.

Spending categories sort your payments, giving you a crystal clear overview of what you’re spending on.

Direct Debits no longer feel lost – we’ll tell you if they’re about to change before they’re due.

Bigger picture banking

Whether it’s zooming into your day-to-day spend, or setting longer-term savings goals for summer plans, a Monzo bank account makes it easy to stay on track.

Automate the admin

Use our Salary Sorter to instantly move some of your earnings into Bills Pots, Savings Pots, or even ‘new house plants’ Pots.

See your money in a whole new light

Get to know your spending habits with weekly and monthly insights. And get alerts if you’re spending too fast (if you want them).

Put money aside with Pots

Use Pots to separate your money however you like – whether you're budgeting for bills or setting aside spending money for a holiday.

Payday, the Monzo way

The best day of the month just got better.

Bring the ka-ching forward. Get paid into Monzo and get your money one business day early if you’re paid by Bacs.

Feeling lucky? We choose 10 people at random every month and double their salary up to £10,000.

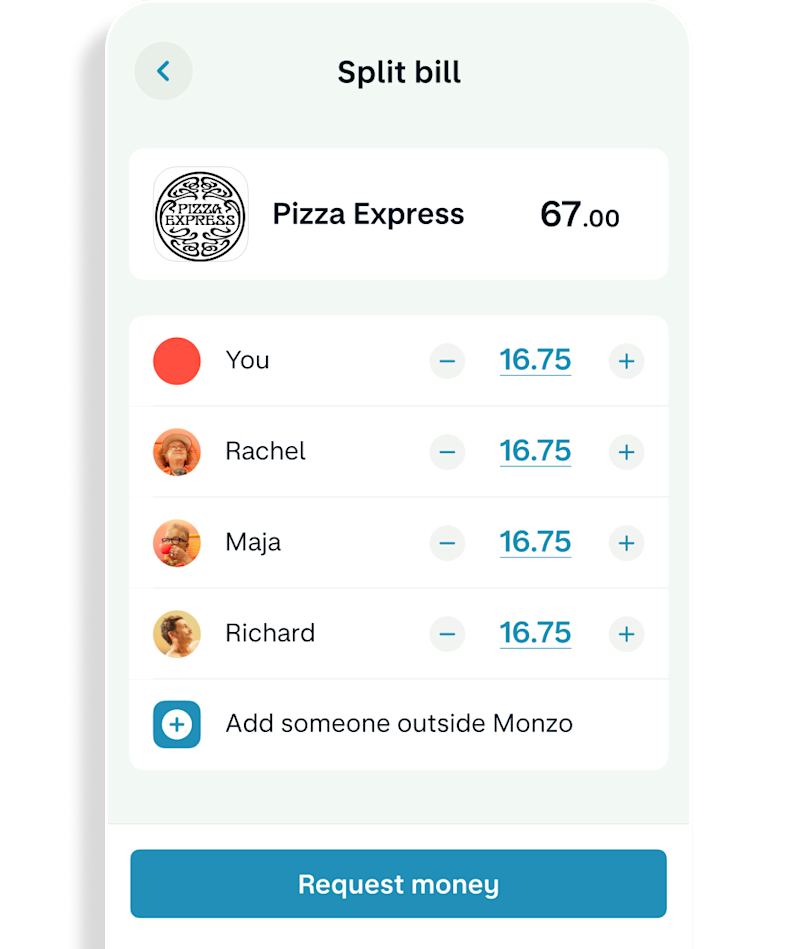

Group spending that just makes sense

Replace awkward ‘pay-me-back’ texts with secure payment requests, and send reminders if you need to. Set up Running Splits for group spending, so you’re always on top of who owes what.

Your Monzo account, on holiday

No more fees

Open a Monzo account and pay anywhere, in any currency, fee-free – on your debit or credit card.

Free ATM withdrawals

If Monzo's your main bank account, make unlimited fee-free withdrawals in the European Economic Area (EEA), and up to £200 every 30 days anywhere else. After that, we'll charge 3%.

We do the maths (on exchange rates)

Understand exactly what you're spending by seeing real-time exchange rates when you spend abroad.

Send money overseas

From London to Lagos, Manila to Madrid – what you see is what you pay.

Send 38 currencies globally and feel closer to friends and family abroad.

You may need a Wise account for some currencies. Ts&Cs & limits apply, UK residents only.

24/7 customer support

Our friendly customer support team is always available to chat in the Monzo app. We don't have opening or closing hours, so we're here wherever you need us.

Industry-first tech built to protect

We’re stopping scammers in their tracks with innovative security controls. Use known locations, a secret QR code or trusted contacts to confirm it’s you making large payments.

Our Call Status feature tells you if you’re speaking to Monzo in real time. It helps customers report over 700 fraud attempts each month.

Open a Monzo bank account today

Step 1

We're a bank that lives on your phone, so you'll need to download the Monzo app to get started.

Step 2

We'll ask you some questions to help us set up your account, but there's no lengthy paperwork to fill in. In fact, it only takes minutes.

Step 3

Once your account's open, you can start using your card straight away with your digital wallet.

Upgrade your Monzo account

We're making money work for everyone, so we have different plans for different needs.

Free

Extra

Perks

Max

Free

months minimum

Free

Free

A UK current account

Your eligible deposits are protected by the FSCS up to £120,000 per person

All the Monzo features you know and love

2.75% AER (variable) interest, paid monthly

Fee-free withdrawals up to £200

Credit Insights - TransUnion Score only

Extra

£3 a month

Includes all features from Free

A UK current account

Your eligible deposits are protected by the FSCS up to £120,000 per person

All the Monzo features you know and love

2.75% AER (variable) interest, paid monthly

Fee-free withdrawals up to £200

Credit Insights - TransUnion Score only

Includes everything from Free, plus:

Connected banks and credit cards

Virtual cards

Advanced roundups

Custom categories

Auto-spreadsheet

Credit insights - 2 scores (TransUnion and Equifax)

Billsback™ – you’ll be in with a chance to get your bills covered by us (up to £150)

Aged 18+ • Ts&Cs apply

Perks

£7 a month

Includes all features from Free

A UK current account

Your eligible deposits are protected by the FSCS up to £120,000 per person

All the Monzo features you know and love

2.75% AER (variable) interest, paid monthly

Fee-free withdrawals up to £200

Credit Insights - TransUnion Score only

Includes all features from Extra

Connected banks and credit cards

Virtual cards

Advanced roundups

Custom categories

Auto-spreadsheet

Credit insights - 2 scores (TransUnion and Equifax)

Billsback™ – you’ll be in with a chance to get your bills covered by us (up to £150)

Includes everything from Free, Extra, plus:

3.25% AER (variable) interest, paid monthly

Fee-free withdrawals up to £600

3 fee-free cash deposits

Discounted investment fees

Annual Railcard

Weekly Greggs treat

Monthly cinema ticket at Vue

Annual Uber One Membership

Aged 18+ • Ts&Cs apply

Max

From £17 a month

3 months minimum

Includes all features from Free

A UK current account

Your eligible deposits are protected by the FSCS up to £120,000 per person

All the Monzo features you know and love

2.75% AER (variable) interest, paid monthly

Fee-free withdrawals up to £200

Credit Insights - TransUnion Score only

Includes all features from Extra

Connected banks and credit cards

Virtual cards

Advanced roundups

Custom categories

Auto-spreadsheet

Credit insights - 2 scores (TransUnion and Equifax)

Billsback™ – you’ll be in with a chance to get your bills covered by us (up to £150)

Includes all features from Perks

3.25% AER (variable) interest, paid monthly

Fee-free withdrawals up to £600

3 fee-free cash deposits

Discounted investment fees

Annual Railcard

Weekly Greggs treat

Monthly cinema ticket at Vue

Annual Uber One Membership

Includes everything from Free, Extra, Perks, plus:

Personal worldwide travel insurance – provided by Zurich, powered by Qover

Personal worldwide phone insurance – provided by Assurant

Personal UK & Europe breakdown cover - provided by RAC

Add your family to your insurance and cover for an extra £5 a month

Aged 18-69 • Ts&Cs apply

Easy current account switching

With the Current Account Switch Service, you can move everything over to Monzo in 7 days without lifting a finger. We do everything for you, and you don’t need to deal with your old bank at all.