Monzo for all your money

Get clear on your spending. Unlock smarter ways to save. Invest with confidence.

UK residents. Ts&Cs apply.

Our signature hot coral current account that fits your finances.

Enjoy fee-free payments abroad, instant notifications, credit insights, Pots and automated roundups.

UK residents. Ts&Cs apply.

An award-winning credit card with Section 75 protection.

Get credit you can count on with a credit limit up to £10,000, 29% APR representative (variable), £1,200 credit limit, 29% yearly interest (variable).

Eligibility criteria and Ts&Cs apply. Age 18+. UK residents. Not keeping up with payments may negatively impact your credit score. Each purchase is repaid over a maximum of 24 monthly payments.

A shared bank account that helps you manage joint costs.

Get dedicated joint account cards, and save together with Instant Access Savings Pots.

You'll both need a Monzo account. Aged 18+. UK residents. Ts&Cs apply.

Protect the things that matter with worldwide travel and phone insurance, UK & Europe breakdown cover, and more.

Upgrade your current account from £17 a month.

Ages 18-69. UK residents. 3 month minimum term. Ts&Cs apply.

Enjoy the best of Monzo with a boosted savings rate and added benefits like an annual Railcard and weekly Greggs treat.

Upgrade your current account for £7 a month.

Age 18+. UK residents. Ts&Cs apply.

Unlock more money tools, see your other banks and credit cards in Monzo, and create custom spending categories.

Upgrade your current account for £3 a month.

Age 18+. UK residents. Ts&Cs apply.

A free account for kids that keeps up as they grow up.

Set spending limits and see what they're up to with instant notifications.

Ages 6-15. UK residents. 18+ parent/guardian account needed. Ts&Cs apply.

A free account for kids that keeps up as they grow up.

Set spending limits and see what they're up to with instant notifications.

Ages 6-15. UK residents. 18+ parent/guardian account needed. Ts&Cs apply.

A free account for kids that keeps up as they grow up.

Set spending limits and see what they're up to with instant notifications.

Ages 6-15. UK residents. 18+ parent/guardian account needed. Ts&Cs apply.

An account packed with everything you need to make life easier for you and your customers.

Awarded Best Business Banking Provider at the 2024 British Bank Awards.

Only sole traders or limited company directors in the UK can apply. Ts&Cs apply.

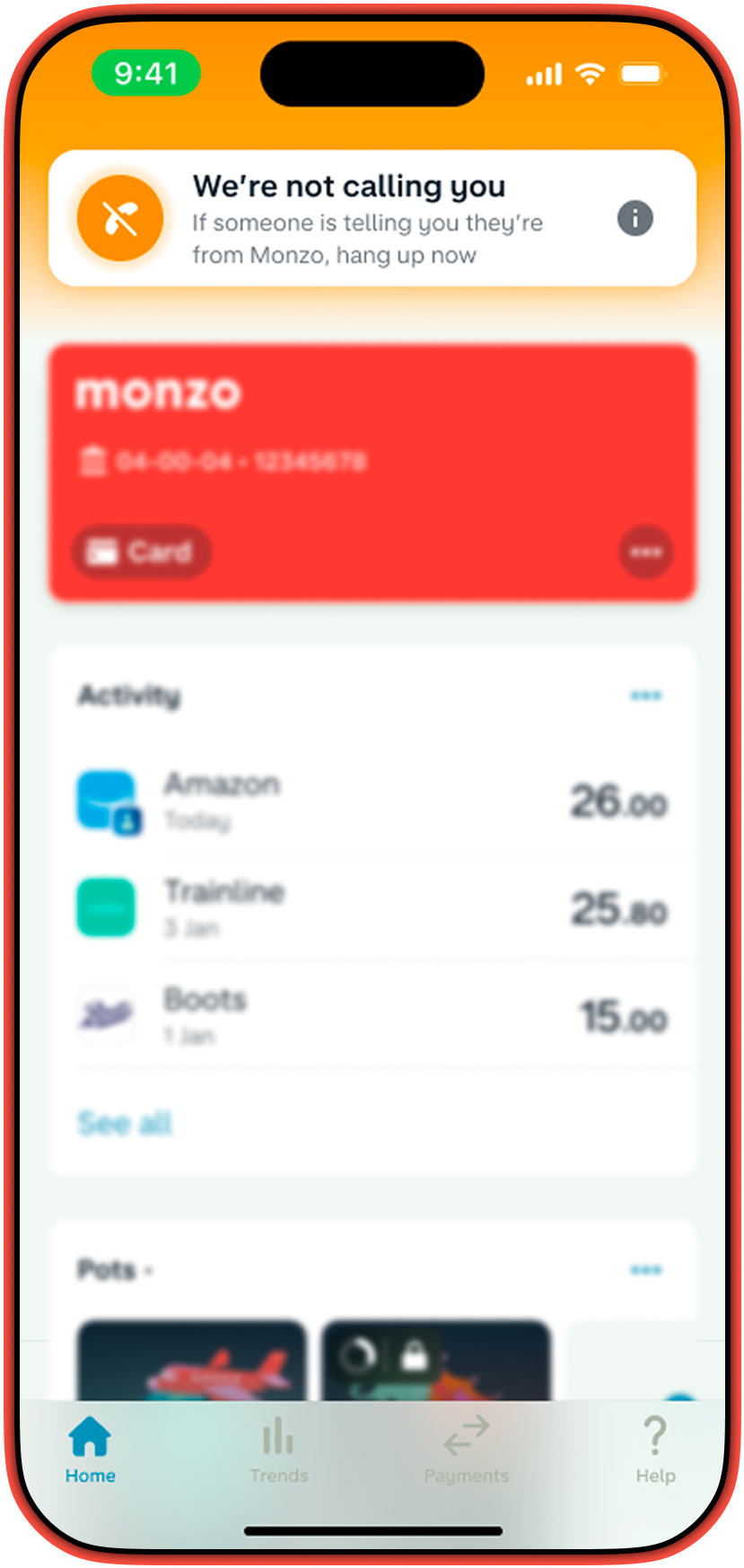

Keep your money safe with industry-first fraud protection and 24/7 support.

How we protect your money

customers joined the Monzo 1p Saving Challenge in 2025.

is how much extra our customers save on average each year using roundups.

is the total amount our customers are saving in Instant Access Savings Pots.

fraud attempts are caught each month thanks to our Call Status feature.

was the total cashback earned by Monzo customers in 2024.

Personal current accounts

As part of a regulatory requirement, independent surveys were conducted to ask customers of the largest personal current account providers in Great Britain and Northern Ireland if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

Authorised push payment (APP) scams happen when someone is tricked into transferring money to a fraudster's bank account.

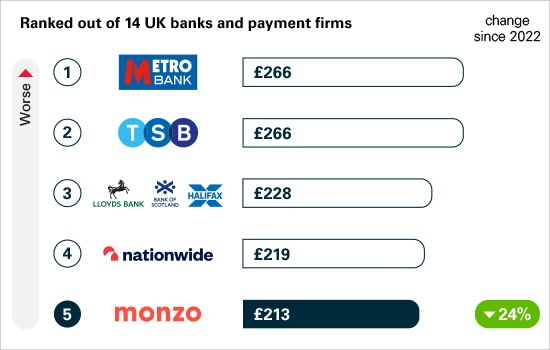

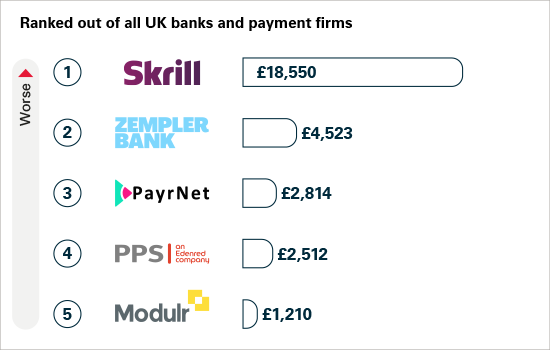

These charts use data given to the Payment Systems Regulator by major banking groups in the UK in 2023.

You can read the full report by visiting www.psr.org.uk/app-fraud-data.

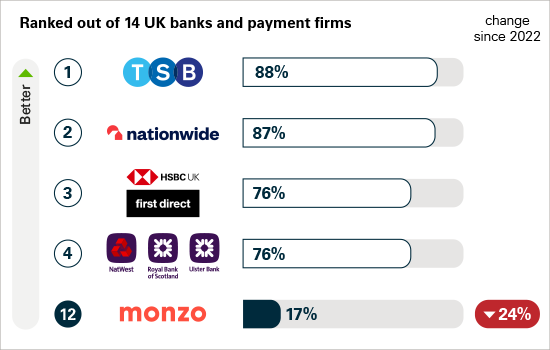

This is the proportion of total APP fraud losses that were reimbursed, ranked out of 14 firms.

See full results

See full resultsThis is the amount of money sent from the victim's account to the scammer, ranked out of 14 firms.

For example, for every £1 million of Monzo's transactions sent in 2023, £213 was lost to APP scams.

See full results

See full resultsThis is the amount of money received into the scammer's account from the victim, ranked out of all UK banks and payment firms.

For example, for every £1 million received into consumer accounts at Skrill, £18,550 of it was APP scams.

See full results

See full resultsThis is the amount of money received into the scammer's account from the victim, ranked out of all UK banks and building societies.

For example, for every £1 million received into consumer accounts at Monzo, £183 of it was APP scams.

See full results

See full results