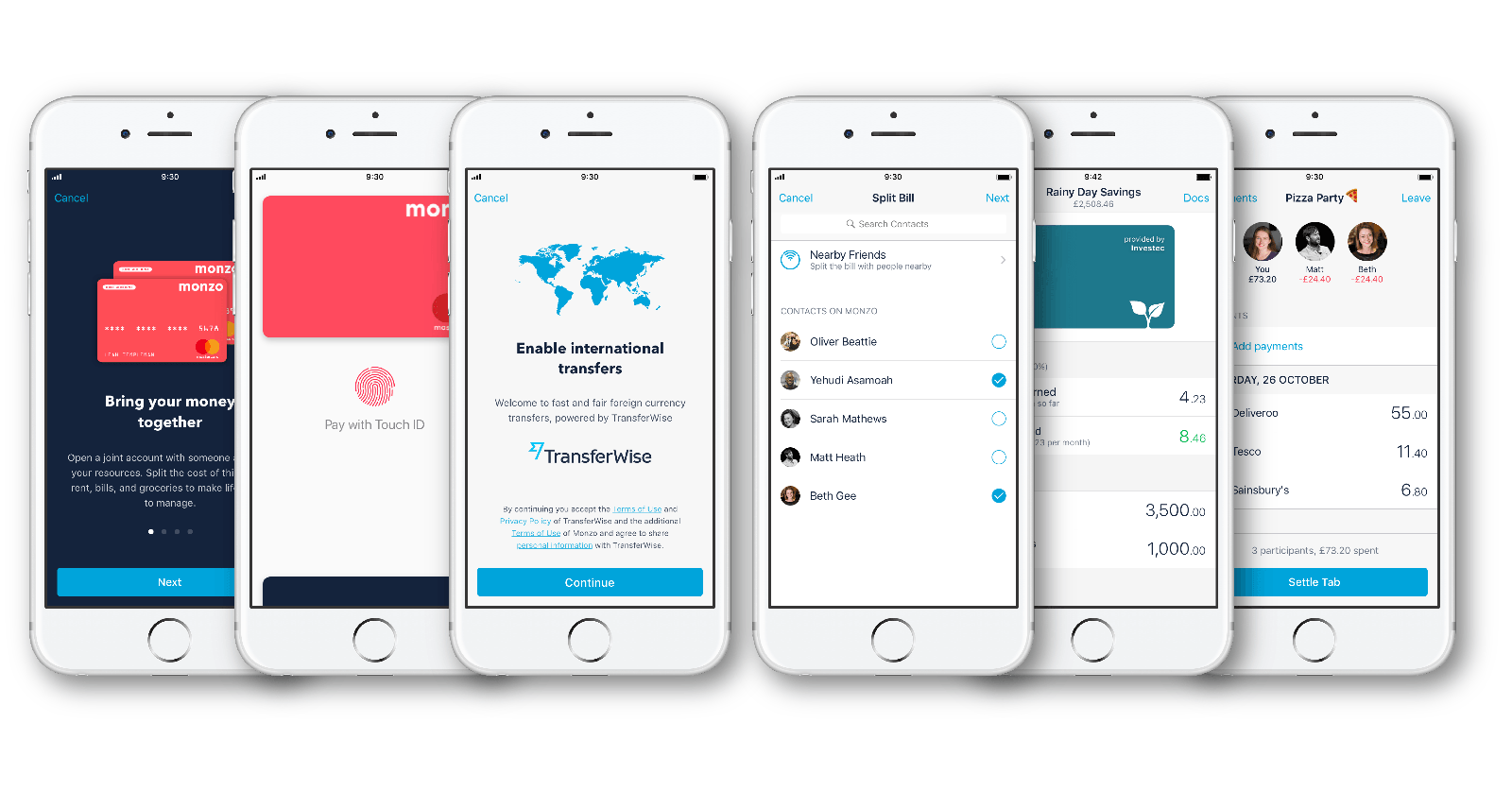

2018 has been a fantastic year for Monzo. We started the year with most people still on the ‘beta’ programme (our prepaid card scheme), which seems like a lifetime ago. But 94% of people came with us to open full UK current accounts, and since then we’ve gone from strength to strength. We’ve launched lots of new features, like joint accounts, Apple Pay, international payments through TransferWise, savings accounts with Investec, bill splitting and Shared Tabs. And we’ve brought in new things that signal a change in the banking industry, like our gambling block, or our industry-first integration with IFTTT.

We now have well over one million customers, and Monzo has grown from around 200 to over 500 staff. We’re the fastest growing bank in the UK, and our customers are the most satisfied according to Which? Magazine.

There was an incredible show of faith from our customers in our most recent crowdfunding round, too. In early December, you invested £20 million in record-breaking time, and we can’t thank you enough. We now have an incredible 35,913 crowd shareholders!

We’ve spent the last four years building a bank alongside our community of customers, aiming to solve real problems in an empathetic, transparent, ethical way. In 2019, we’ll maintain that, and strengthen it, and keep listening to your feedback to make sure Monzo is always giving you what you need. We’ve heard calls for business banking, and that’s something we’re planning to launch later this year.

But we didn’t set out just to be the best bank in the UK. We set out to make money work for everyone. In terms of achieving that mission, we’re only at the starting line.

To really become the centre of your financial life, and make you effortlessly financially savvy, we need to try big, bold things that go beyond what any other bank is offering. Monzo will move mountains in the background to give you a simple, straightforward way to manage your money.

We’ll be launching a range of smart integrations to help make your money work – if you’re paying bills, Monzo will fight to make sure you’re on the best deal; you should never have to worry about renewing or switching tariff. If you’re saving or investing, Monzo will make it feel effortless. And if you’re borrowing, you’ll be able to do so in a way that’s fair, transparent and affordable. As ever, your ideas and feedback are absolutely crucial. Some things we try won’t work, but some will hopefully revolutionise how people interact with their money, and how they feel about their finances.

We want to finish 2019 with a whole host of new features that make people say “I can’t believe banks haven’t always done it this way”.

Watch this space – we’re in for a hugely exciting year, and I can’t wait to get started.