This blog post was updated in April 2024

Cash is still the second most frequently used payment method, with over 6.4 billion payments made in 2022.

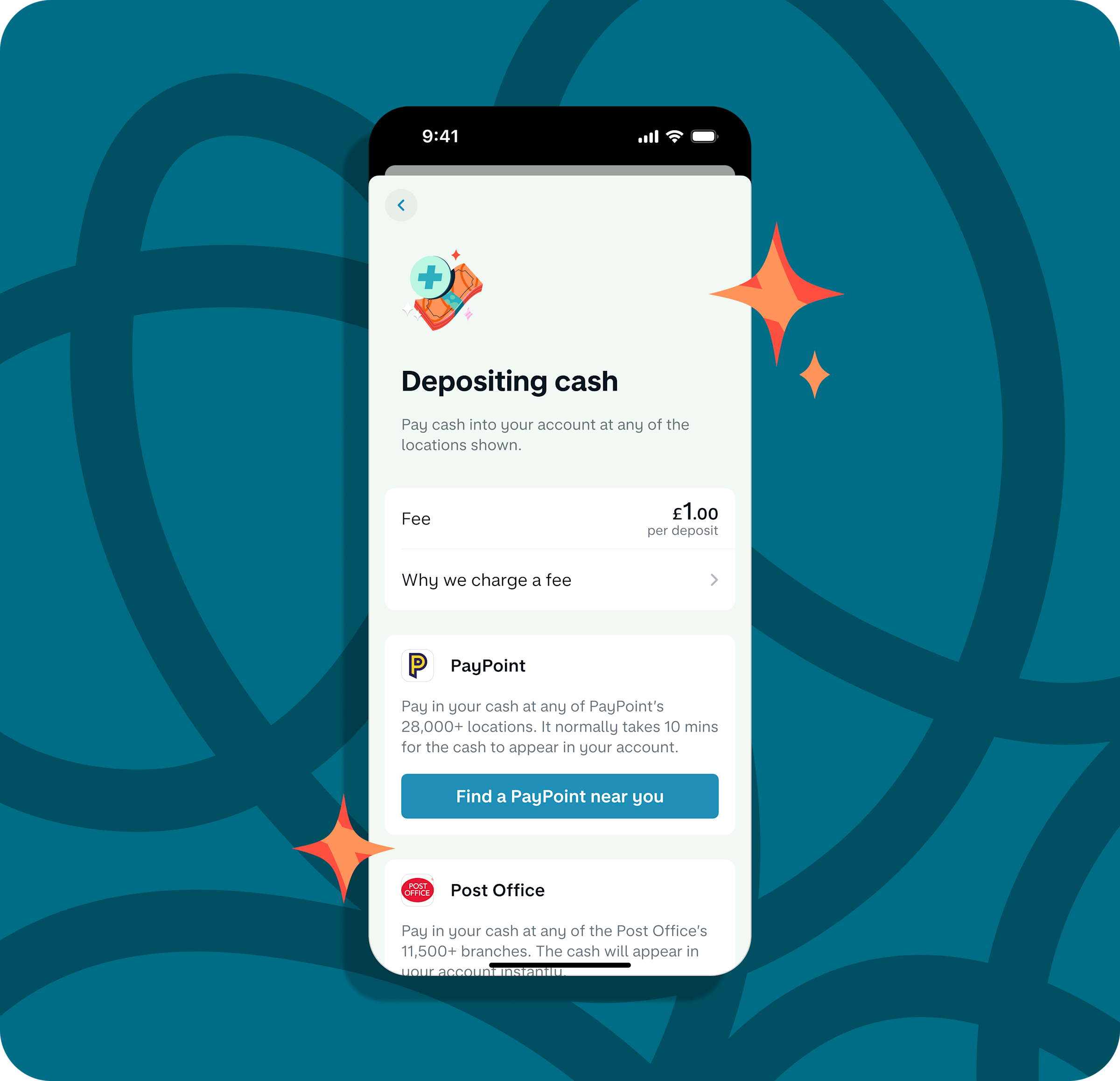

And because we don’t have branches, we’ve partnered with PayPoint and the Post Office to give you a quick and convenient way to pay cash into your Monzo account.

Paying cash into your account is easy

If you'd like to pay cash into your Monzo account, you can deposit cash at any of the 28,000 PayPoints or 11,500 Post Offices across the UK.

To deposit cash at a PayPoint

Find a shop displaying the PayPoint logo

Tell the shopkeeper you'd like to add money to your Monzo account, and how much

Hand over your card and the cash

The shopkeeper will swipe your card and return it to you with a receipt

Deposits at PayPoints will take around 10 minutes to appear in your account minus the £1 fee

To deposit cash at a Post Office

Find your local Post Office

Tell the postmaster you'd like to add money to your Monzo account, and how much

Hand over the cash

The postmaster will ask you to insert your card into the card reader and follow the instructions on the screen

After you've confirmed the amount and accepted the £1 fee, your deposit should appear in your account immediately

We’ll charge you £1 for each deposit

Working with another company usually comes with costs, and both PayPoint and the Post Office charge us for every deposit you make. To help us offer cash deposits in a sustainable way, we’ll pass on some of these costs to you when you use the feature.

We’ll charge you £1 for each deposit you make, and we’ll take the fee out of the money you pay in. So, if you deposit £300, we’ll put £299 in your account.

You can pay in a minimum of £5 and a maximum of £300

You can deposit between £5-300 in one go. And you can pay in a maximum of £1,000 every six months.

If you’re 16-17 years old, that limit is lower, so you can only deposit a maximum of £500 every six months.

These limits help reduce the risk that people will use cash deposits for financial crime, while still making sure they’re useful to most people.

We believe we can give you everything you need from a bank, without having branches. While keeping costs low and passing the benefits onto you.

Find out more about using a branchless bank. Or download Monzo to give us a try today!