Overdrafts

Arranged overdrafts can be ideal if you need to borrow a little extra money to tide you over every now and then.

Overdrafts are designed for short term borrowing, and they’ll cost you less if you pay them back quickly.

UK residents. 18+ only. Eligibility criteria and Ts&Cs apply.

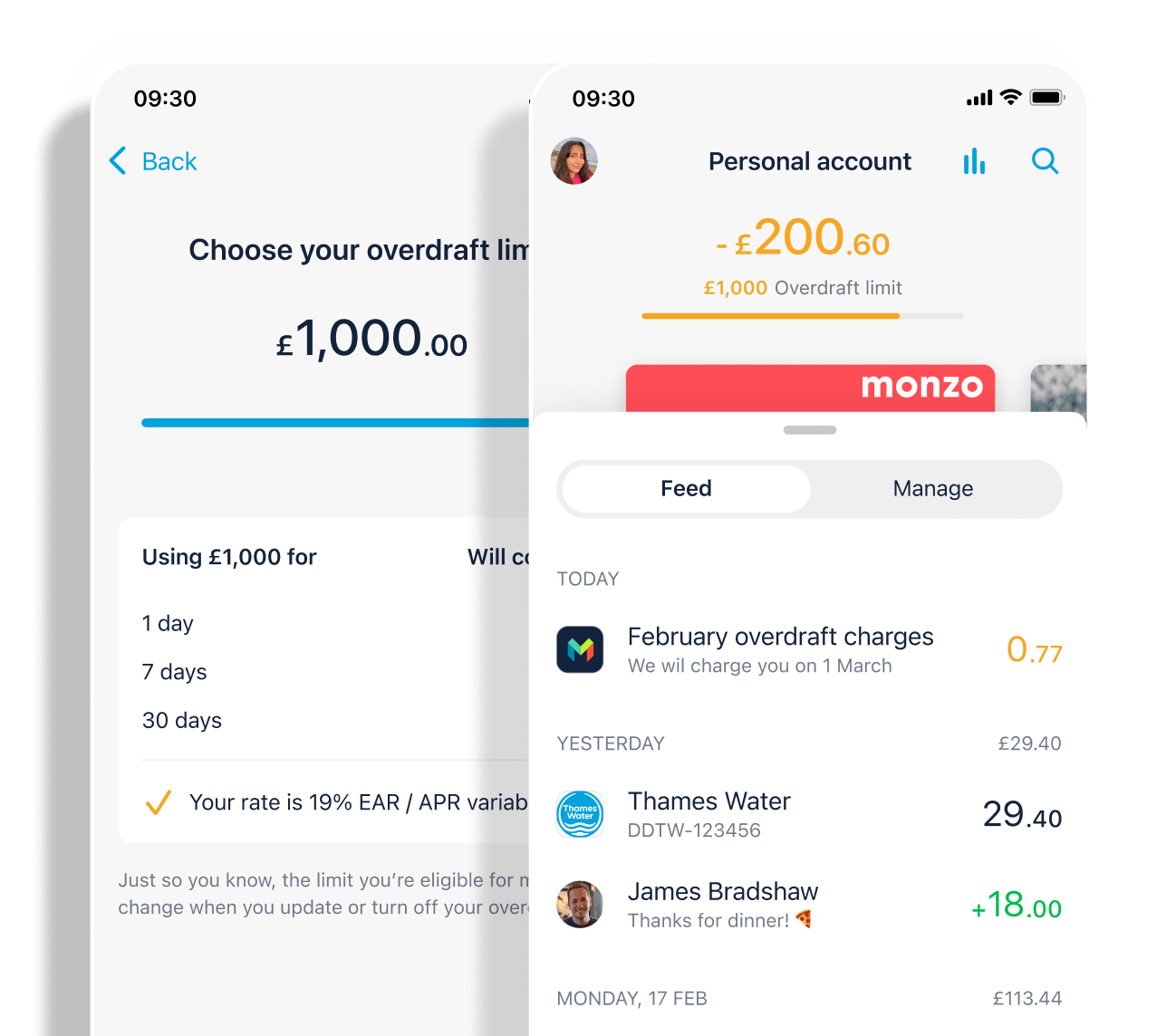

Monzo overdrafts

19%, 29% or 39% EAR (variable)

As a representative example, if you use an arranged overdraft of £1,200 for 30 days, with 39.0% EAR/APR (variable), it would cost you £32.94. 39% APR representative (variable).

Your exact rate will depend on your credit score, and you can see what rate you’re on in your Monzo app.

We’ll always tell you the exact rate you’ll pay, and what that means in pounds, before you borrow from us.

Limits of up to £2,000

If you’re eligible you could have an overdraft limit up to £2,000. As always, this won’t apply to everyone and we’re very careful about only giving people what we’re confident they can safely afford to borrow.

You can change your limit and cancel your overdraft at any time from your app. If you want to to do so you’ll need to pay the amount you borrowed back, plus any interest.

No extra fees

We won’t charge you any extra fees for going into your overdraft, and we’ll always tell you when you go into it.

How does our overdraft compare?

Our representative APR is 39.0% APR (variable). You can use the APR to compare the cost of different credit products.

What are EAR and APR?

EAR stands for effective annual rate. This is equivalent to the rate of interest you'll pay if you're overdrawn for a year. You'll pay interest on the amount you're overdrawn by, and on the interest that builds up from being overdrawn. So you'll pay less if you regularly pay off your overdraft. EAR doesn’t include other fees, like hidden or late fees – but we don’t charge these anyway.

APR stands for annual percentage rate. It is calculated in the same way as the EAR plus any additional fees (like hidden or late fees) but we don’t charge these anyway so our EAR and APR are the same.

Representative APR You may see two types of interest, representative and personal. Representative APR is the rate that we currently offer more than half of those who apply for the product. The rate you’re actually offered is your personal APR – this is usually based on things like your credit score.

Variable means we have the right to change the rate, but we’ll always give you notice if we do.

You can use the calculator below to figure out how much you would pay depending on your personal rate.

Arranged and unarranged overdrafts

When you switch on an overdraft with Monzo that's called an arranged overdraft. If you go over your arranged overdraft limit or you don't have an arranged overdraft we'll reject payments (for free), but there are some times when we can't reject payments. We've explained how it works below:

If you go over your agreed overdraft limit We’ll reject any payments that take you over your limit, and you won’t be able to take cash out. The only exceptions are ‘offline’ payments, like those you make to TfL. We can’t reject these, so you’ll go into an unarranged overdraft, but we'll tell you as soon as this happens. You should add money to your account as soon as possible, as it could impact your credit score (which might make it harder for you to borrow in future).

If you don’t have an arranged overdraft If your account is empty, we’ll reject payments unless they’re payments as described above. We’ll send you a notification as soon as this happens.

If you do become overdrawn and don’t have an arranged overdraft, you should repay the money as soon as you can, as it could impact your credit score. Further details can be found here.

Check if you're eligible for an overdraft

You can use this eligibility checker to see if you’re likely to get an overdraft with us. Please note a few things:

Using this checker doesn’t guarantee you’ll get an overdraft with us

The outcome is based solely on the accuracy on the information you give us

Using the checker won't affect your credit file in any way

Any overdraft offered by Monzo will depend on a full eligibility assessment (this will happen when you apply for an overdraft in our app)