From the venue to the guest list to the cheesy tunes playlist, there’s a lot of planning (and saving) that goes into a wedding. It can take months or even years of crafting Pinterest boards, adding money to a joint account and making spreadsheets, all to create one special day. And if you’re planning a wedding, it can be hard to decide what to prioritise while staying within budget.

Luckily, we’ve consulted the experts in planning the perfect wedding budget – the people who’ve done it twice! Our research provides insights on:

The cost of a first wedding versus the second

Whether their priorities changed

How they paid for each wedding

Which traditions they skipped to save money

Their biggest financial regrets

We also looked at 80,000 Monzo Savings Pots named ‘wedding’ to get insights on how people save for the big day.

People tend to spend less on their second weddings

According to our research, the average cost of a first wedding was £10,546.65, compared to £8,861.04 the second time around. That means people spend an average of 16% less on their second wedding.

Over half (51%) of those asked had a smaller second wedding, but where did they make those savings? The biggest difference was in the location. On average, people spent around a quarter less on the venue for their second wedding. We also found that people cut down on décor and flowers (spending 22% less), food and catering (21% less), and outfits (20% less).

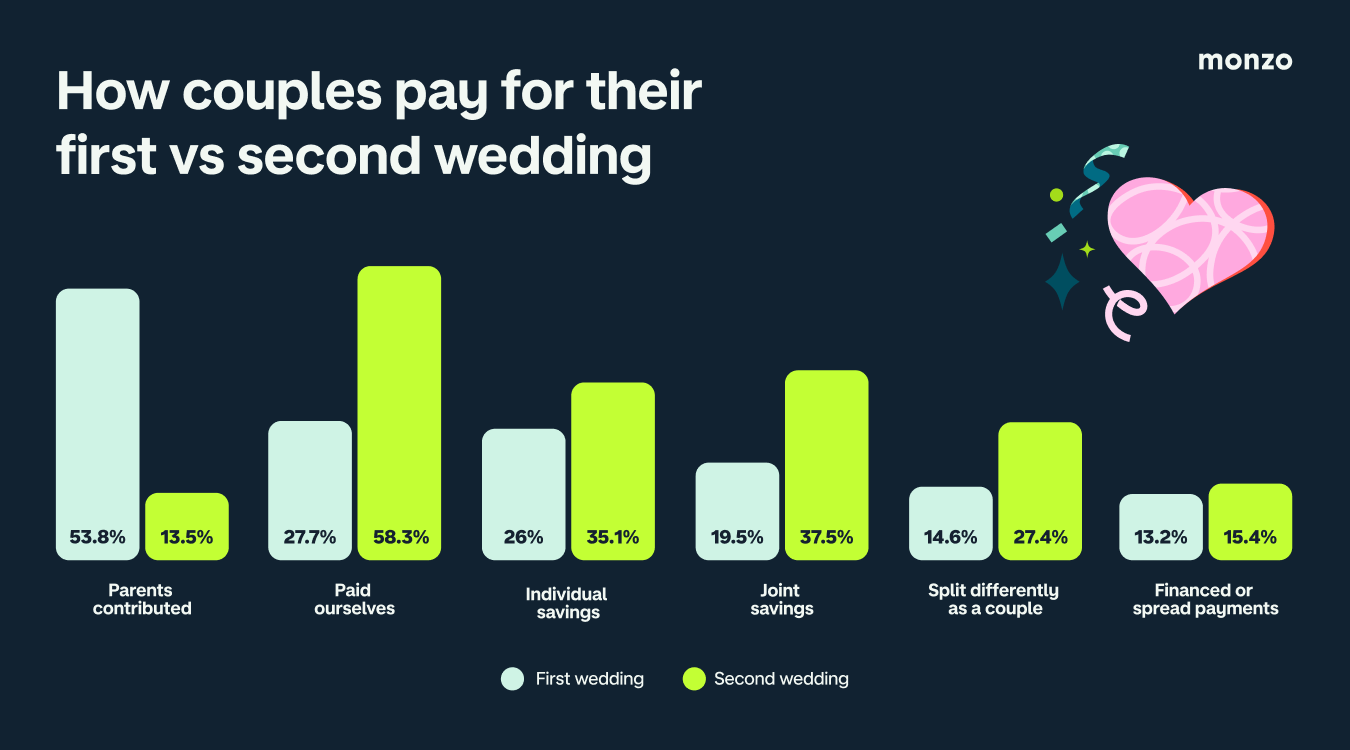

Most couples pay for second weddings themselves, without help from parents

While over half (54%) relied on contributions from their parents to pay for their first wedding, 58% paid for their second wedding themselves.

We also saw that people are more likely to make a joint effort to save for their second wedding. 37% used joint savings to pay, compared to one in five (19%) for first weddings. Monzo Savings Pots titled ‘wedding’ have six times higher joint ownership than other Savings Pots, and nearly one in three Pots involve both partners. And the great news is, joint wedding Pots save twice as much as personal ones (£6K vs £2.9K on average). So, forget traditional proposals – how about “Will you start a Monzo wedding Pot with me?” Now that’s romance.

Monthly payday saving is the most popular wedding savings method

According to our wedding Pot data, there are 6 types of wedding saver personas:

Disciplined Budgeters: who save monthly, every payday

Major Wealth Fund: high earners with big budgets

Roundup Heroes: they know that spare change adds up!

Lump Sum Payers: likely to be moving money from other banks

Steady Contributors: their saving is occasional but meaningful

Pocket Change: they add smaller deposits here and there

Disciplined Budgeters are the most common type of wedding savers, and the group most likely to have a joint savings account with their partner. So when it comes to wedding saving, it appears to work best when it’s automated, monthly and shared between two.

Lessons learnt: From budgeting to shifting priorities

Financial security is the priority at second weddings

The majority of those surveyed (83%) agreed that financial security was more important than a big extravagant wedding. Similarly, over half (56%) said they learnt from the financial mistakes of their first wedding, which led half to set a much stricter budget second time around.

However, prioritising financial security doesn’t make the special day any less special – over two thirds (68%) agreed that their smaller second wedding made them happier than their first.

Unnecessary spending is the biggest financial regret

Over three in five (60%) of those surveyed had financial regrets from their first wedding. The most common one was spending money on things they didn’t need. People also regretted paying for guests they no longer stay in touch with (we’re looking at you, second cousin’s ex-boyfriend), and wished they’d set a clearer budget.

Second weddings are far less likely to go over budget

Whatever lessons people learnt from their first wedding, it seems to have paid off (at least when it comes to staying within budget). While 27% of those surveyed went over budget for their first wedding, only one in ten (11%) went over budget for their second. So, what’s their secret?

Saving money? Skip the free bar

Over 85% of couples skipped traditions at their second wedding to save money, and these were the most popular ones to cut out:

People also found more inventive ways to cut costs at their second weddings, with a quarter (26%) digging out the glue gun to make DIY decorations, and one in ten (9%) resorting to an AI wedding planner. However, it turns out that ‘something borrowed’ doesn’t apply to the wedding dress, since using a second-hand outfit was the least popular money-saving hack.

If you’re determined to get your wedding right the first time, it’s invaluable to look at what people do differently for their second. From choosing a more affordable venue to skipping the videographer, there are plenty of lessons to be learned.

Whether it’s your first or second wedding, it’s wise to set a clear goal and timeline. With Monzo, you can use features like Savings Pots, savings targets, scheduled payments and round-ups, so couples can turn good financial intentions into automated habits to help build steady momentum toward their wedding fund.

Everyone’s dream wedding looks different, and Monzo is here to help you save for yours. Opening a joint account lets you manage your money together, making it easy to stay on top of shared wedding expenses. Plus, you each get a matching pearlescent white debit card. What could be more romantic?

You'll both need a Monzo account. Aged 18+. UK residents only. Ts&Cs apply.

The research was conducted by Censuswide, among a sample of 2,001 UK Adults who have been married more than once. The data was collected between 02.01.2026 - 12.01.2026. Censuswide abides by and employs members of the Market Research Society and follows the MRS code of conduct and ESOMAR principles. Censuswide is also a member of the British Polling Council. Data can be found linked here.

Internal aggregated and anonymised Monzo data. This analysis is based on a sample of approximately 84,000 ‘Wedding’ Savings Pots created by Monzo customers between 1 October 2022 and 31 January 2025. All data has been anonymised in accordance with UK GDPR; no individual customer data was accessed or identified for the purposes of this study.