If the uncertainty caused by coronavirus means you’re looking to start an emergency budget, or you just want to get into some good budgeting habits, we’ve put together a guide that explains:

what a budget actually is

and how to start one!

We’ve also explained how Monzo Plus can help you budget better, with powerful budgeting tools that give you visibility over your money.

With Monzo Plus, you earn 1.00% AER/Gross (variable) interest on the money in your balance and regular Pots, up to £2,000. Which we’ll pay you each month. And more!

You can get Monzo Plus for £5 a month with a three month minimum term, if you're over 18 and open a Monzo account.

Here’s how you can start a budget and budget better with Monzo Plus👇

What’s a budget?

A budget can help you manage your money. It sets out how much you expect to get and how much you expect to spend over a certain period of time.

Budgeting lets you check that your income can cover your expenses. And if it can, how much money you’ll have left over.

Good budgeting can help you make better decisions and reach your financial goals, like paying off debt, getting out of your overdraft, or saving for a house. It can also help you keep track of your money and spot any problems (like missed payments) earlier.

But creating a budget and setting a savings goal isn’t always easy. And if you find yourself struggling to create a budget and actually stick to it, you're definitely not alone.

How to start a budget

First, work out your income. This might be your salary (after tax), benefits you get, plus any other sources of income (like dividends)

Next, work out how much money you spend on essentials like bills and groceries. You should also include any debts you’re paying off.

Then work out how much you spend on non-essentials like going to the cinema or shopping online.

Work out how much of your income is left after those expenses.

If there’s more money going out than coming in, review your expenses to see if you can cut back. Start with the non-essential expenses you covered in Step 3.

If there’s anything left over, why not put that amount towards your financial goals? That could be paying off debts, planning a holiday or saving for the future. You could commit to put that amount straight towards your goal, every time you get paid.

If you want to save more or pay off your debts faster, you could try looking at your expenses and working out if there’s anywhere you can cut back. Cutting down on your expenses will leave you with more money to save, or could help you pay off debt faster.

If you use Monzo, you can set aside your savings automatically every month (before you can spend them!).

This could be a useful savings plan if you’d like to save monthly without really thinking about it.

Here's how to do it:

Tap your profile photo to head to ‘your account’

Tap ‘Create a Pot’

Schedule a regular payment into your Pot for the amount you worked out earlier

Set the ‘start date’ to the date you get paid, and repeat every month. That way you don’t even get to touch it, and it goes straight towards your savings goals 🍯

How to use Monzo Plus to power up your budgeting

Monzo Plus is a Monzo current account that comes with powerful tools that give you visibility over your money and help you budget better.

1. Use custom categories to track your spending

Monzo Plus lets you create your own custom categories to suit the budgeting plan you’ve made.

You can choose the name, icon and colour for each custom category, to help you manage and track your spending to suit exactly what you need.

If you know exactly what you’re spending your money on, you can decide if you're spending too much on certain things, and what you could cut down on.

For example, if you’re one of the people who found themselves in Deliveroo’s top 1% of customers in Year in Monzo (we feel you), it might be useful to make a custom category for your takeaways, so you can track exactly how much you’re spending.

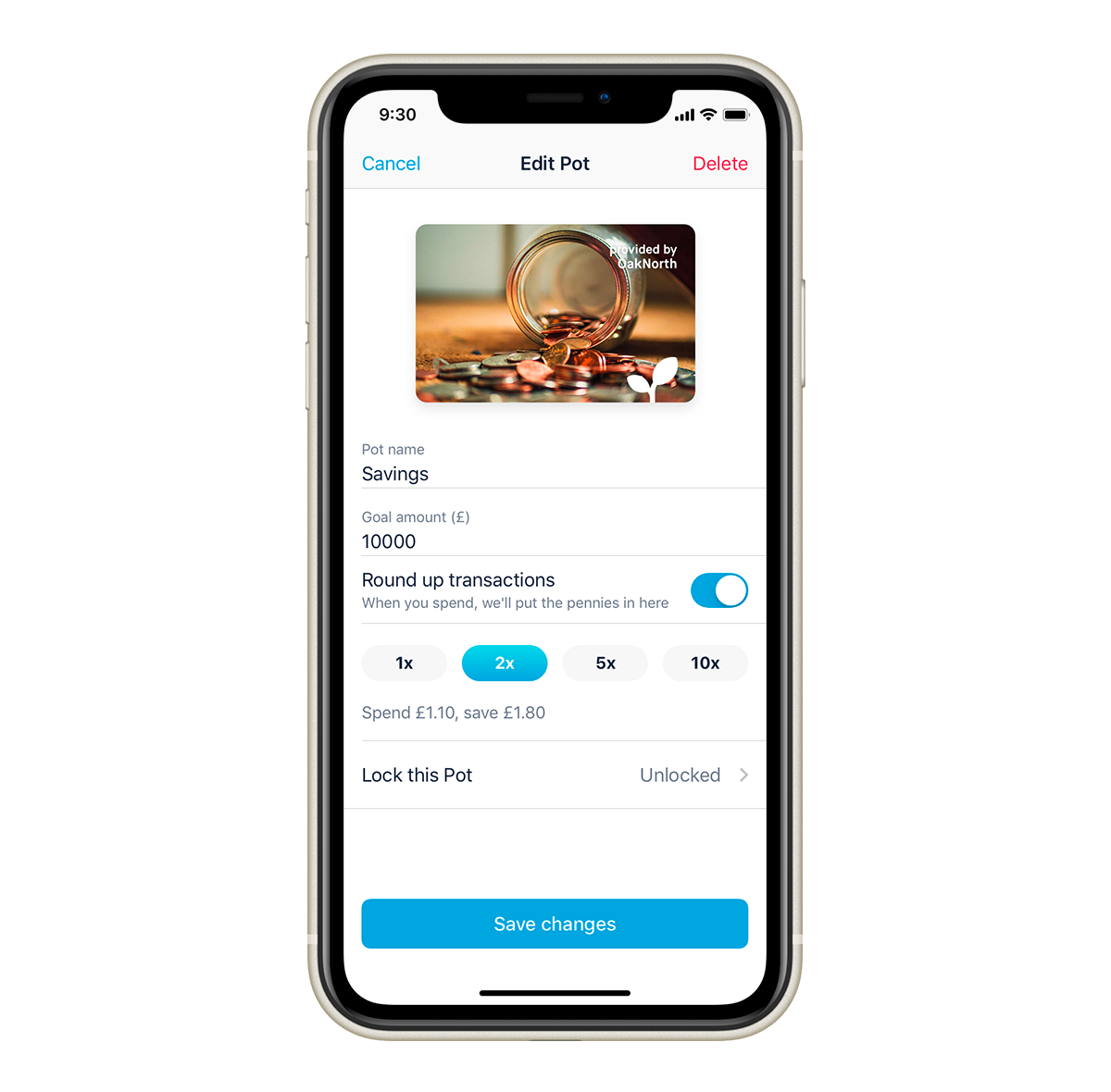

2. Round up even more of your spare change with advanced roundups

Saving money and spending it don't usually go hand in hand. But with Monzo, you can round up your spending to the nearest pound and set the money aside in a Pot.

With Monzo Plus, you can make roundups work even harder! Multiply the amount you save by adding 2, 5 or 10 times as much to your Pot.

It's a great way to save 'little and often', and you'll be surprised at how quickly it can add up towards your saving goals.

3. Divide single transactions into multiple categories

You can also divide single transactions into multiple categories with Monzo Plus, to make your spending reports really accurate.

Let’s say you're doing a big weekly shop at Ocado which includes things like your groceries and a few toiletries. You can split that one transaction into different categories like Personal Care and Groceries. You can also say how much money you've spent on each category.

Splitting these transactions up can help you understand exactly how much you're spending and on what.

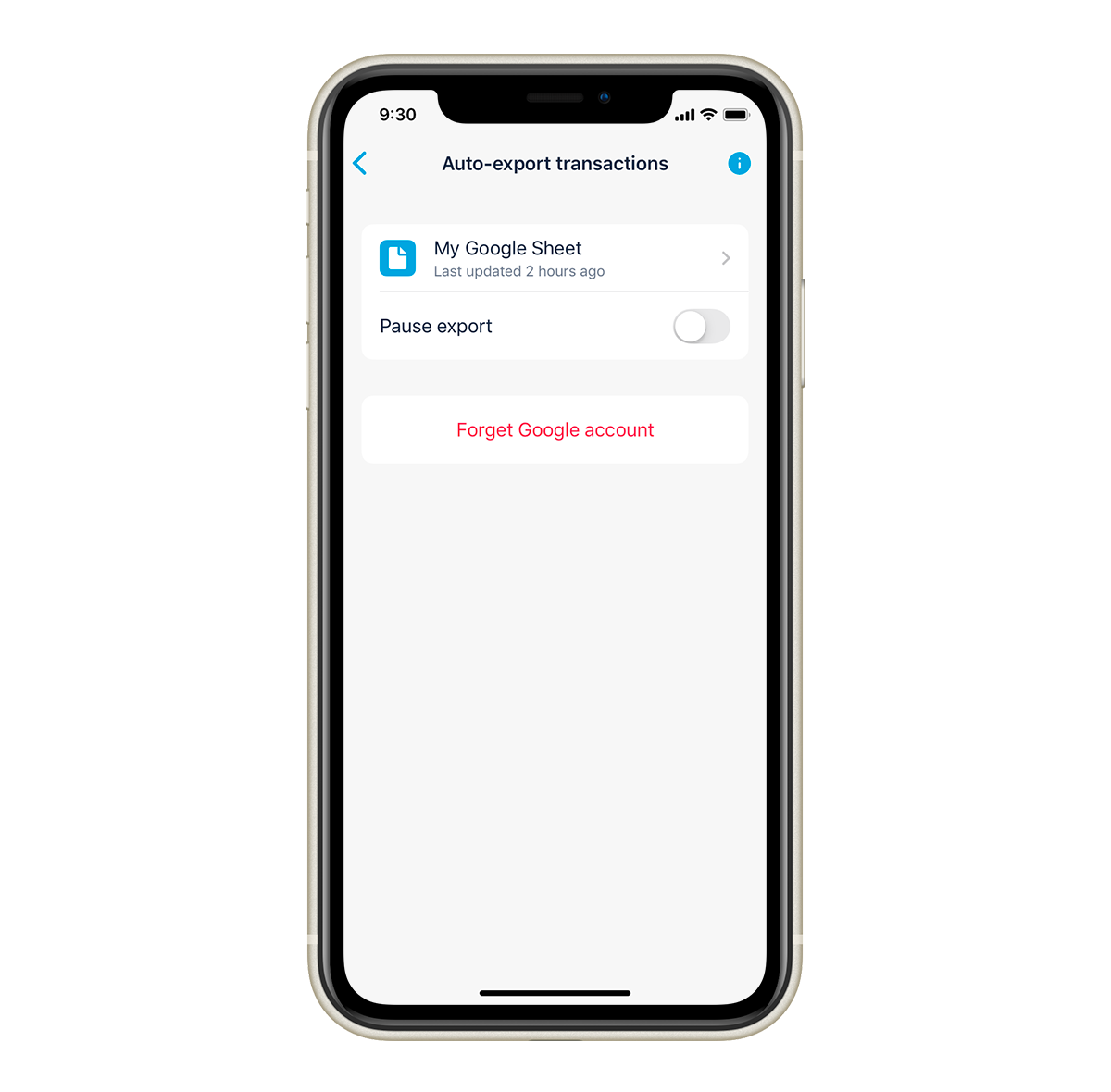

4. Export all your transactions to a Google Sheet

We’ve designed these budgeting tools to help you track your spending easily, in whatever way you like. If you consider yourself a serious budgeter or you just love spreadsheets, you’ll like this.

Every time you spend money using Monzo Plus, we’ll automatically export what you've just bought to a Google Sheet. All you have to do is turn this feature on to start!

Looking at your weekly or monthly spending as a graph or a chart in a Google Sheet can give you a full insight into your money and help you keep up good budgeting habits.

5. Use virtual cards to pay safely online

A virtual card is a temporary debit card number you can use to make payments online.

Each virtual card has a different card number, expiration date and security code. But when you use your virtual card to make a payment, you'll see the spending in your Monzo account as normal. You can cancel your virtual card in a few taps from the Monzo app, and create a brand new one whenever you need to.

They're designed to protect your actual debit card number from falling into the wrong hands. And there are lots of ways they can come in useful. Like keeping you safe when you're shopping online.

How else can Monzo help me save money?

You can earn interest on money in your balance and regular Pots with Monzo Plus

With Monzo Plus, you earn 1.00% AER/Gross (variable) interest on the money in your balance and regular Pots, up to £2,000. Which we’ll pay you each month.

So you'll know you're making the most of your money, even if you don't stash it away in an ISA or a Savings Pot.

Use Savings Pots to grow your savings

Saving is hard, so we’ve made it simpler for you. With Monzo you can create a Savings Pot in seconds to earn interest on your money. Then you can sit back and watch your money grow.

The money you put into Savings Pots is fully protected up to £120,000 by the Financial Services Compensation Scheme (FSCS). Read more about how to open a Savings Pot here.

Save money little and often

Microsaving is an increasingly popular saving strategy that involves saving small amounts, often.

By creating a saving plan that helps you save 'little and often’, you're building regular saving habits into your life. And it means over time you’ll see pennies add up into something more significant.

Rounding up your transactions using Monzo Plus is a good way to get started.

Or you could consider taking on a savings challenge like the 1p Savings Challenge or the 52 Week one.

They involve saving small amounts of money every day or every week, and gradually increasing the amount you’re setting aside. The idea is that you’ll start off saving small amounts you won’t miss, then build up momentum until your savings have added up to hundreds or even thousands of pounds.

Not only is it an easy way to save, but if you manage to complete the whole 365 days of savings, you'll have a tidy sum of £667.95 saved 😮

If you’re looking for good budgeting tips to kick-start any saving goals, here’s how to get out of your overdraft and how to start a savings plan!