The cost of living crisis is affecting all of us in some way. We’ve been speaking to customers about their experiences and worries, and we’ve summarised how we can help as the situation evolves.

We’re here to support you

We’ve got multiple teams working on how we respond to the cost of living challenges our customers could face, so that we can adapt to changes and keep supporting you. We have award-winning specialist teams who work exclusively to help people in vulnerable circumstances of any kind, including financial difficulties. They’re on hand whenever you need them.

Let us know if things have changed

Whether you’re feeling the pressures of rising costs yet or not, if you’re worried about keeping up with your repayments on a borrowing product, or something’s changed in your circumstances, you can let us know. Head to the Help tab in-app, where you can get more info and chat to us, if you need to.

Depending on your circumstances, there are lots of ways we can help. We tailor repayment plans to what you can afford. If you’ve missed a payment, we don’t charge any late fees as standard across our borrowing products, and that hasn’t changed.

Contact specialist teams discreetly

It can sometimes be helpful to tell us a bit more about yourself. If there’s anything that affects the way you deal with your money, how you communicate with us, or if you have somebody helping you with your banking we can use that knowledge to help in a way that suits you.

You can leave a note for our Specialist Team through ‘Share with us’ about anything you'd like us to know - they'll reach out as soon as they can and offer any support that may help you.

Access more specialist advice

Sometimes, the support you need might not be best coming from us. If you tell us a little about your situation, we can point you to relevant specialist organisations who offer free, impartial advice on topics from managing debt to dealing with anxiety.

If we do suggest you get some independent advice, that doesn’t mean we won’t also do whatever we can to help.

Be aware of fraudsters

Unfortunately fraudsters are always trying to take advantage of people. We’ve gathered advice on how to spot suspicious activity, including people pretending to be the police, utility suppliers, HMRC or your bank.

If you’ve been tricked into sending someone money, speak to us immediately either over the phone or through the app.

Budgeting and saving in the Monzo app

Customers have told us that they’re using the tools and features within the Monzo app more than ever before, and that they’re proving helpful when it comes to saving and budgeting at every opportunity. We know that for some people though, budgeting tools won’t be enough. The situation is beyond their control with even the strictest budgeting and good financial habits.

We’ve outlined the features our customers are using the most at this time:

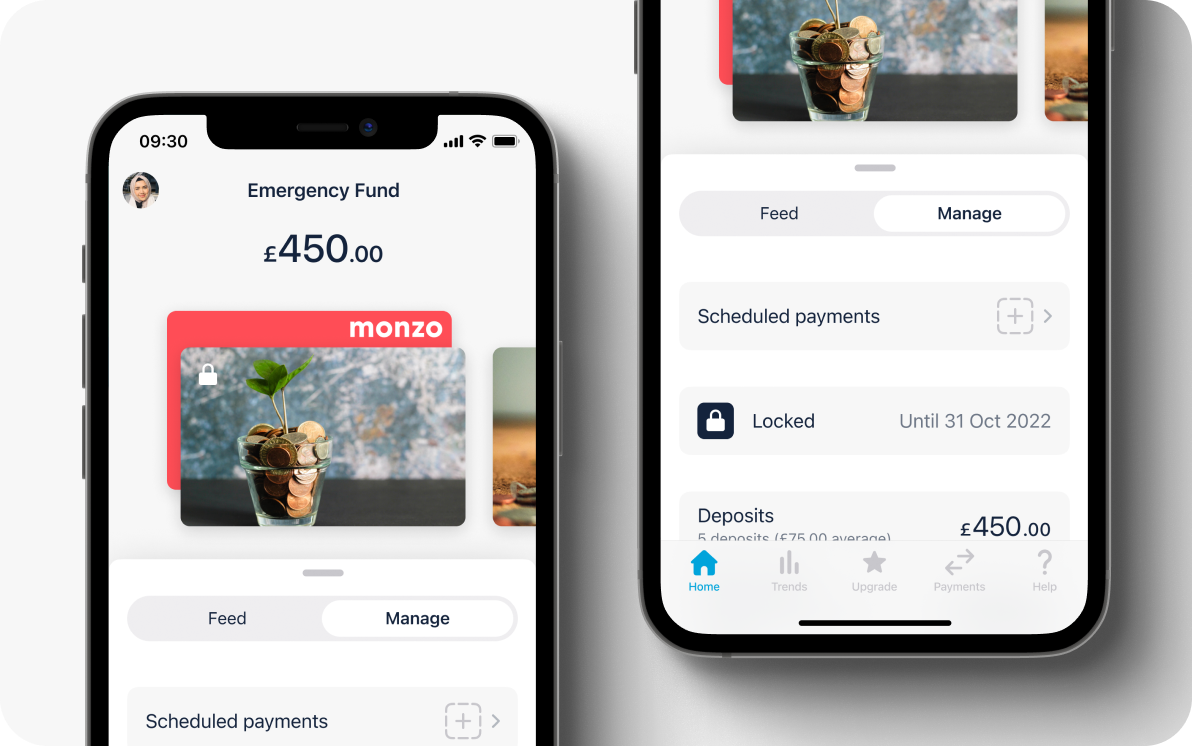

Pots: neatly separate your spending, savings and bills

Pots let you turn your one main account into lots of little separate areas for your money. If you put physical cash aside to save up for special occasions, or to make sure your bills are covered, Pots let you do the same thing but inside your Monzo account.

You can open a Pot in a few taps. You can hide them or lock them, to avoid the temptation to dip in. And you can give them names and personalise how they look to help visualise whatever you’re saving for.

You can also set up bills to be paid from Pots rather than your main balance (so there’s no danger of overspending), and open Savings Pots which earn interest. With interest rates rising this year, savings options are improving – see how much you can earn on easy access and long term options here. Read all about the different kinds of Pots and how they work.

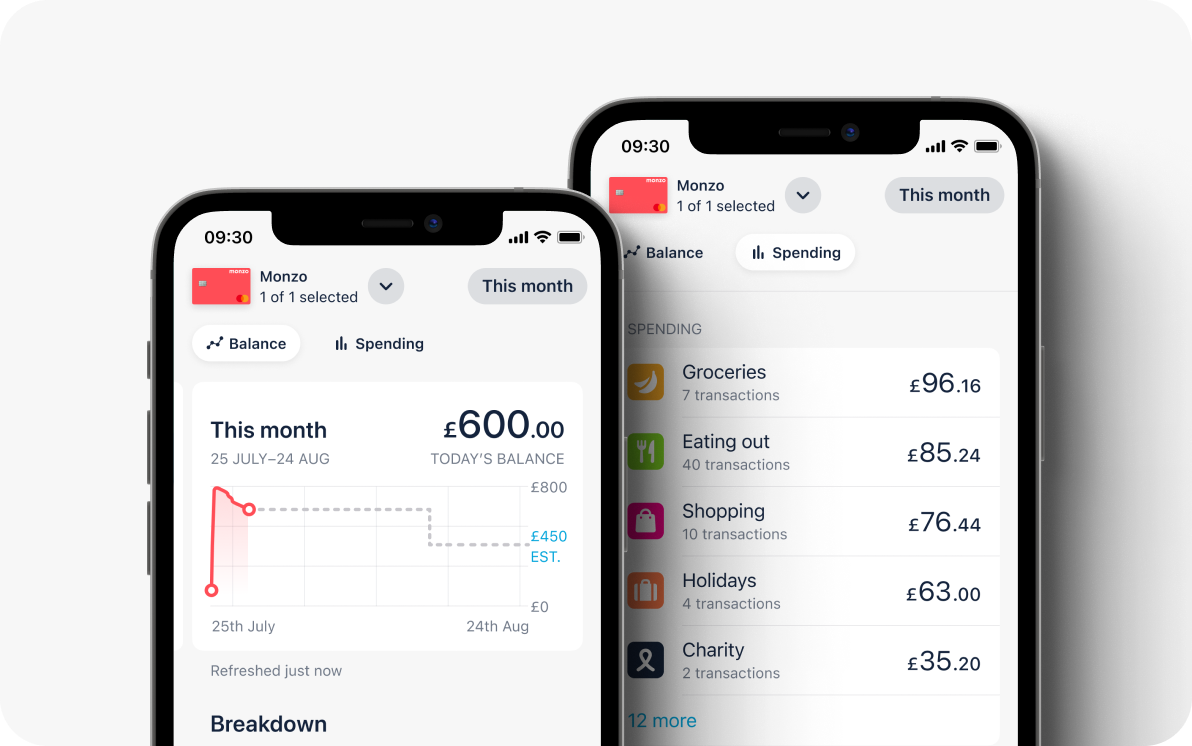

Categories and Trends: Gain visibility and control over your spending and savings

We automatically categorise your transactions into things like ‘Bills’, ‘Entertainment’ and ‘Groceries’, to give you an overview of where your money goes each month. You can set budgets for each category too and we’ll let you know if you’re on track to stay under budget, or if it looks like you’ll go over.

The Trends tab shows you your spending and saving over time, split by category. This means you get a better sense of your own habits and can see where to reinforce the ones you want to keep, and where you might want to make a change. We’re also now rolling out Balance, which helps with planning how you use your salary by showing upcoming payments and what you have left to spend

See your upcoming bill payments

If you pay bills through Monzo, we’ll remind you the day before they’re due to go out, and warn you if you need to move money around to cover the full cost. We also tell you if they’re different from month to month, so you can keep track of things like shifting energy prices.

Save little and often with roundups and IFTTT (If This Then That)

Roundups enable our customers to automatically round up and save spare change into a pot every time they pay for something. Customers tell us that they don’t notice it going out of their account and it all adds up very quickly.

Connect your Monzo to the IFTTT platform and create rules to save by moving money around your account. You can use IFTTT for practically anything but one of the most popular challenges we see at Monzo is the 1p Savings Challenge.

Get paid early through Monzo

If you get paid into Monzo, you can get your money from 4pm the day before it’s due. It doesn’t just work on salary payments – it works on any incoming ‘Bacs’ payment. Most people are paid by Bacs, and things like Department of Work & Pensions (DWP) payments also come by Bacs.

Change your spending limits and block certain kinds of transactions

You can choose to set your contactless spending limits to levels you’re comfortable with, directly through the Monzo app.

Turning on our gambling block has also helped customers with controlling their gambling transactions. You can also reduce your daily spending and transfer limits in the app too.

We’ll keep listening

We’re always thinking of more ways to support you, and we’ll keep hearing your feedback.

If there are things about using Monzo which you find helpful, please let us know so we can highlight them for other people. We’d also love to hear specific ideas on what we can do to better support you – you can contribute to this conversation with our community here.