This Monday, 23rd September, we'll start upgrading everyone to the shiny new Monzo 3.0 app. Some 450,000 customers are already using it, and if you joined us in the last couple of months there's a good chance you're already there!

This is Monzo for the future. We've outgrown our current app, and it's time to shake things up. Right now there are features that customers tell us they have a hard time finding (like interest-earning Savings Pots), and we plan to add a lot more to Monzo very soon...

Here's what's happening

Don't worry: you don't need to do anything, and this won't affect your money, or any payments, in any way. It's not a change to your actual bank account, it's just about the way the app looks.

You'll still be able to do everything you can now, but things are going to look and feel different.

We'll be emailing everyone on the old version of the app to let them know that this change is coming.

On 23rd September, we'll start moving people across. We'll do it in stages, and you'll get a notification from us to let you know when you can try it out. When we do move you over, the change will be instant – the next time you open the app, you'll see the new version!

We've outgrown the current Monzo app

The current app was originally designed with a prepaid card in mind. As we've added more features over the years it's become obvious we need to evolve — we want Monzo to be the centre of your financial life, the home for everything to do with your money. We hope this new version of the app, and the features we're launching along with it, can tempt you away from your old bank for good.

You might notice we removed the Pulse Graph (the wiggly line showing your balance at the top) from the home screen. It's something we introduced during our prepaid programme and it was no longer serving the purpose it was originally designed for. But don't worry, in the future we want to take some of the core functionality from Pulse and make it more useful for the product we have today.

We've made it easier to find new and existing features

Customers sometimes tell us they have a hard time finding new features in the app. Lots of people don't know that we offer loans, or that we have things like roundups, or Joint Accounts.

With the new app we've made it much easier to see everything you can do with your Monzo account. Through the Discover card you can add more things to your Monzo, and try out some of our most loved features - like pots!

We’ve given you more visibility of your money

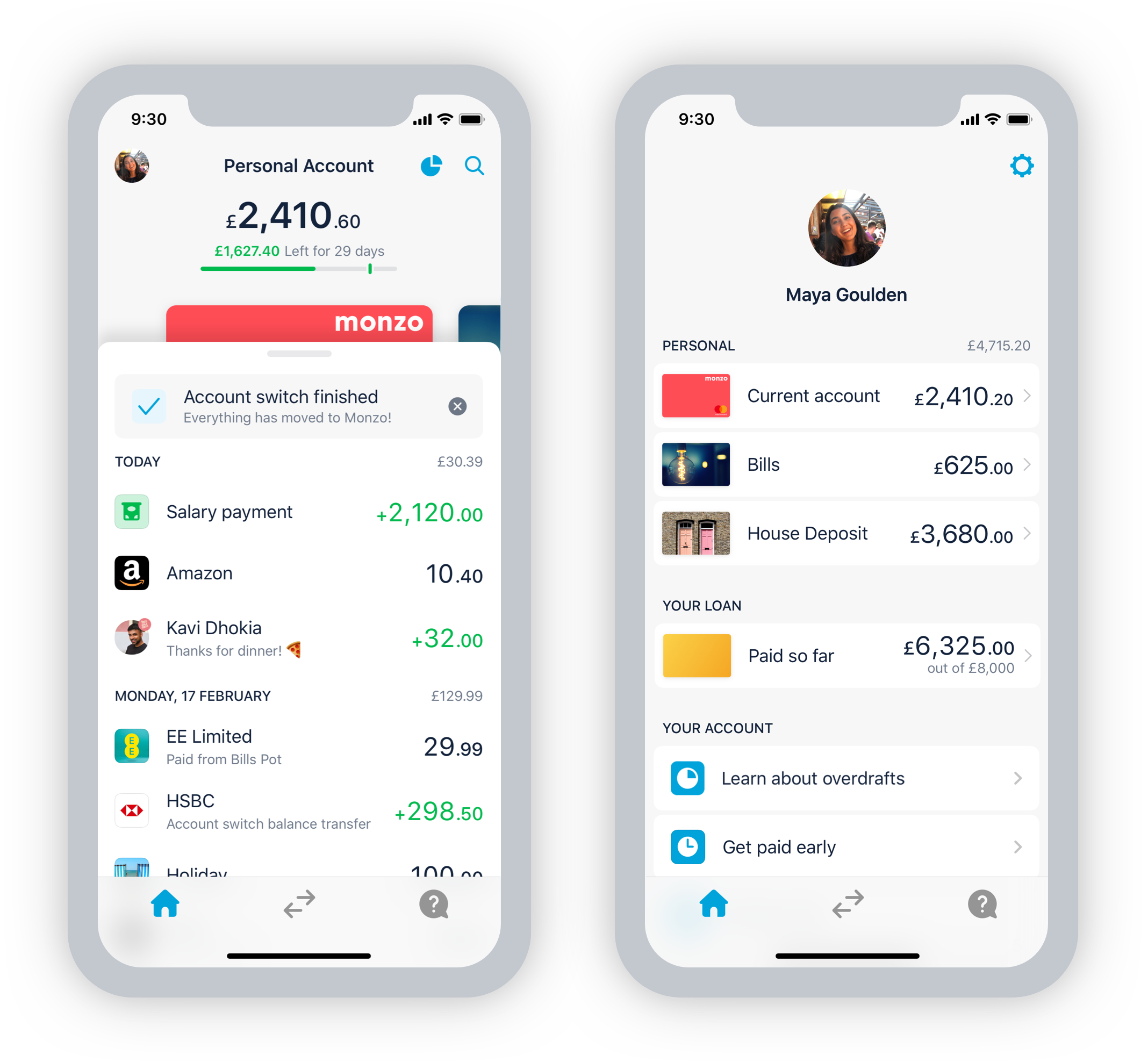

Switching between your different accounts, pots and other things you've added to your Monzo is much simpler - now you can quickly swipe between them.

There's also a new accounts list that gives you a complete overview of your financial life in a neatly organised place, just one tap away on your profile picture. It's part of our effort to give you more visibility of your money, and put you in control of your spending.

We've made room for the Monzo that's coming

We're not done yet. We have some new features that we'll be releasing soon; keep an eye out on our blog for more announcements soon.

When it comes to the new app structure itself, one problem high on our list to solve next is how pots are organised. We've heard from our community that the ability to rearrange pots would make them easier to manage and we're also looking into helping people hide pots that they'd rather keep out of sight and out of mind, to help them reach their savings goals.

We want to build the right tools to give you visibility of where you stand today, to put you in control of your spending and make better decisions. It's all part of our journey to make money work for everyone.

Building it with you

For the last few months, we've been developing the new version of Monzo with you. We got over 5,000 pieces of feedback from the community, feedback through customer support, street and lab testing. We also called customers to hear what they thought, and ran satisfaction surveys. The qualitative feedback loop was a critical part of our product process.

We'll continue bringing you into the centre of everything we do. Thank you to everyone that contributed to this project, through your feedback, insights, and challenge! We couldn't have done this without you.

The Product Platform Team (Bruno, Alessio, Annabel, Beth, Bradley, Felix, Hugo, James, Josh, Kasia, Kavi, Olga, Robin, Sarah B, Sara M, Stuart, Vuokko, Yvette)