Missed appointments are a huge problem for the NHS. Despite getting automated reminders about the date and time of their appointments by text, plenty of patients still miss their slots. It wastes doctors' time and makes waiting lists longer for everyone else.

But by changing the text message to tell patients that missing an appointment costs the NHS about £160, unattended appointments fell by 25%!

This is one of the most famous examples of ‘nudge theory’, an area of behavioural economics that’s dedicated to understanding the interesting, often irrational ways we think and make decisions. And using that to influence our behaviour for the better.

But can we apply nudge theory to our own finances, to help us make the most of our money?

Well, the Money Advice Service teamed up with the government’s Behavioural Insights Team – a department that uses nudge theory to improve public services. They put together a report about how behavioural science can make a difference to the way we manage our money.

Here are a few ideas from the report you might want to try.

1. Make good decisions by default

Making something the default option has a powerful effect on our behaviour. In fact, according to the Behavioural Insights Team, when a particular choice is presented as the default option, we’re on average 23% more likely to continue with that option rather than choosing a different one in a wide range of situations, from paying into our pensions to donating our organs.

The difference between opting in or opting out can be a big one. So find ways to use it to your own advantage.

Try:

Think about how you can organise your finances so you’re making good decisions by default.

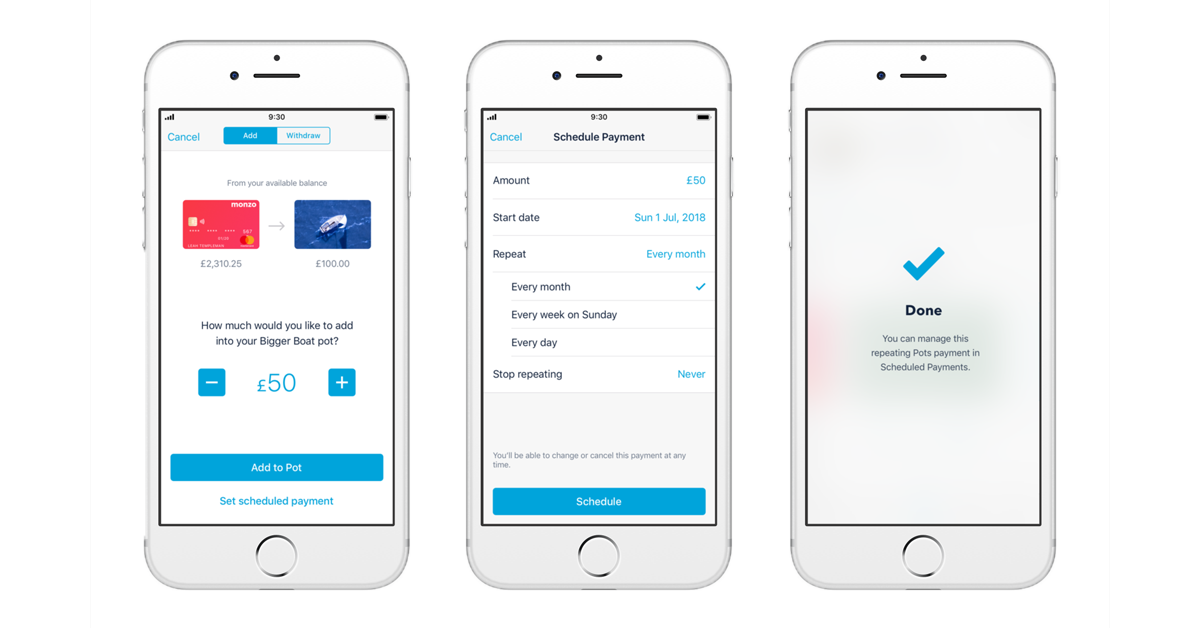

Why not set up a regular payment into a Pot so you’re saving as much as you can every month? That way if you want to skip saving one month or save a little less, you’ll have to actively take the money out of your Pot and explicitly ‘opt out’ of saving.

By forcing yourself to ‘opt out’ of saving, you could make it easier to stick to your goals. To set up a savings Pot to kick off your saving, download Monzo!💰

2. Put your decisions into context

We make dozens of decisions every day. Sometimes we take each individual decision as it comes. And sometimes we group decisions together into ‘brackets’.

Say you’re trying to save money by ordering fewer takeaways. According to the report, whether or not you’re able to cut down successfully depends on how you group those decisions together.

Imagine you’re hungover on a Sunday or feeling lazy after work, and you’re weighing up whether or not to order one. The financial impact of each individual takeaway might not seem too bad. But what if you were confronted with the cost of every single takeaway you ordered in a year?

Try:

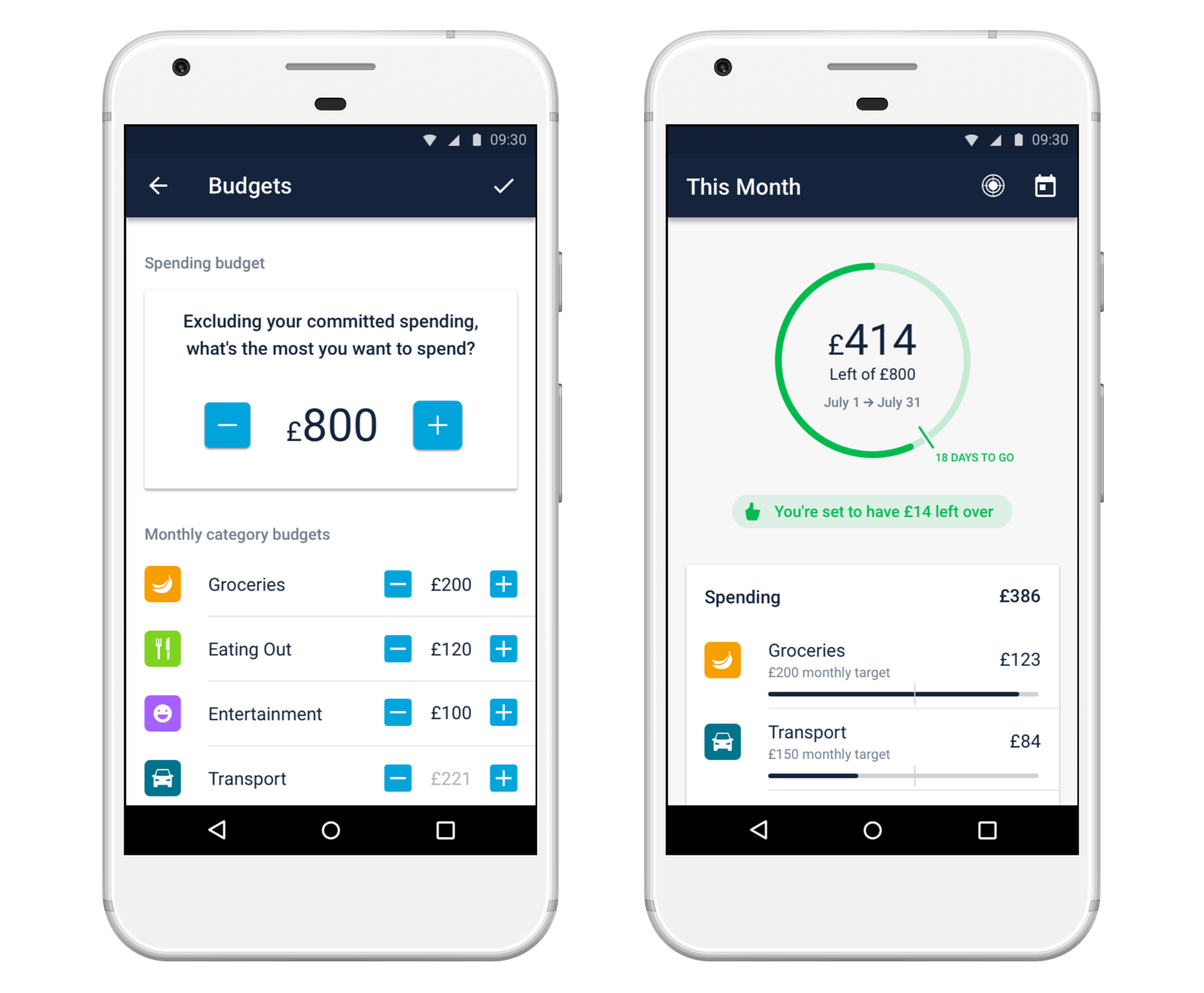

Putting your decision into the context of other similar ones forces you to confront the cumulative cost of making many similar decisions over time. It might not seem unreasonable to spend a tenner on a takeaway. But when you realise you’re spending hundreds of pounds every year, you might change your mind.

If you use Monzo, make sure you read your monthly spending report or look at the categories in your app. It’ll show you how much you’ve spent on eating out or shopping in the last month, or the last year. Download Monzo to try this technique today!

If you’re looking to cut down on buying lunch while you’re at work, you can even send yourself a message to show you how much money you might have wasted by buying food instead of saving or investing it instead.

These tricks can help you understand how each single expense adds up over time. Then it’s up to you to weigh up whether or not you want to be spending your money.

3. Set clear goals

Setting clear goals can help you manage your spending more effectively. And according to the research, setting a single savings goal (for a holiday) is often more effective than setting multiple goals (like saving for a holiday, a new phone and repairs on your car).

Love it @monzo a little reminder why I need to save 😁 pic.twitter.com/7SNMHj4vW1

— Beth Romais 🏴 (@FPS_Beth) March 16, 2019

Try:

Sit down and work out what you’re trying to save towards, how much you need overall, and how you’re going to get there.

If you use Monzo, create a Pot for your goal and give it a clear name so you know what you’re saving for. Then set a goal so you know the total amount you’re aiming to save.

Consider adding an image to your Pot to remind yourself what you’re working towards. Another study even found that using photos of your goals can make you less likely to spend your savings!

To create a Pot and start setting saving goals, download Monzo. 💳

4. Make the most of positive friction

Adding friction into processes can be a useful obstacle to discourage a certain behaviours, like dipping into your savings, spending, or going over your budget.

As the Behavioural Insights Team puts it, “Small changes to the difficulty of completing an action can have disproportionately large effects on the likelihood that people will complete that action.”

Put simply, make it easy to do the things you should do. And make it hard to do the things you shouldn’t!

Try:

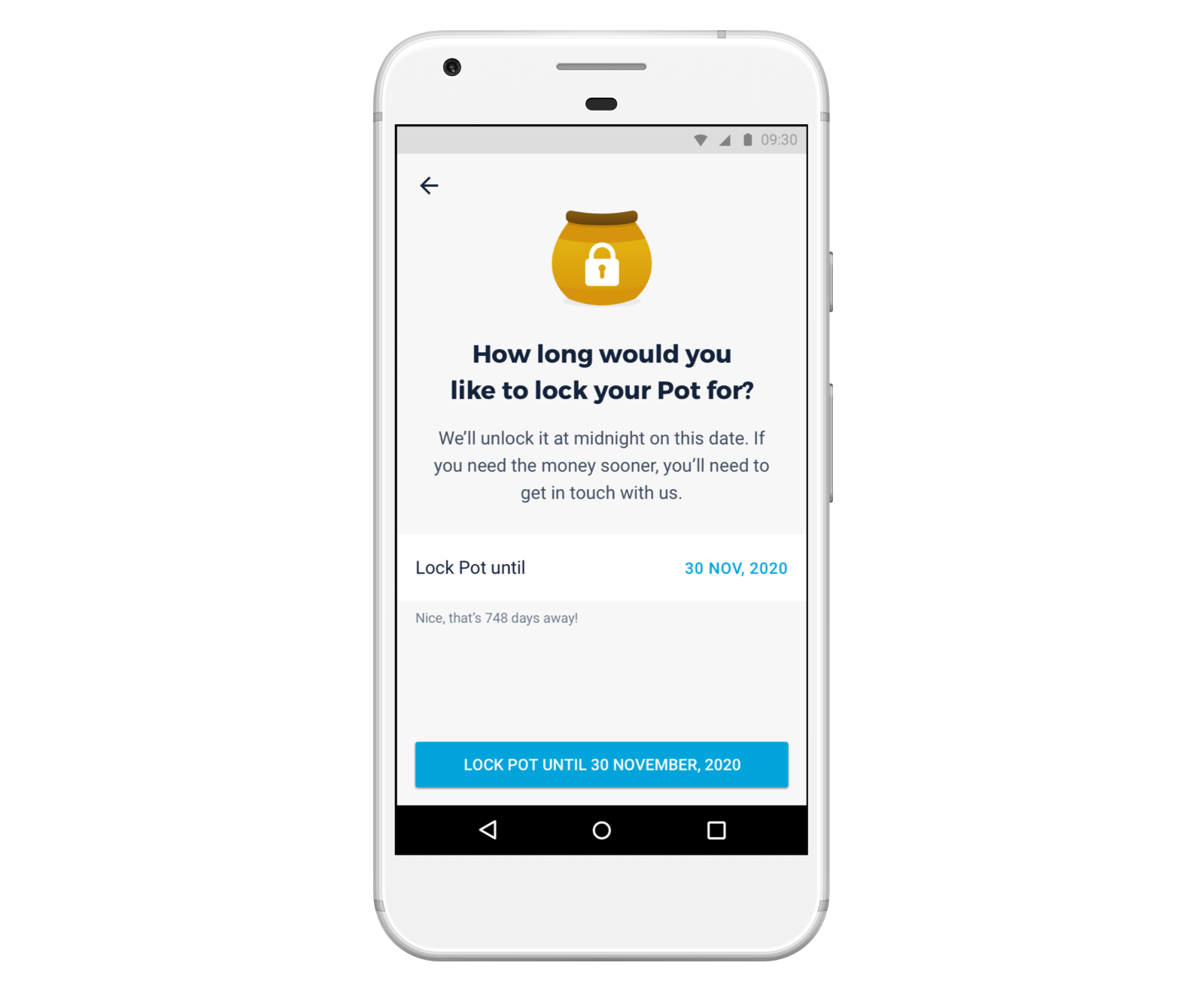

If you’re building up your savings, try not to keep the money in your main account “just in case,” as this makes it really easy to spend it! Instead, set aside any savings in a Pot, so you need to move it back into your main account if you want to spend it.

You can even try locking your Pots until a certain date, to stop yourself dipping in. If you try to take money out of a locked Pot, we’ll ask you to confirm whether you really want to. This extra friction is designed to make it harder to spend your savings.

So even when you’re running low on money at the end of the month or see something you like on ASOS, your savings will be safe.

5. Don’t give in to information avoidance

Do you ever avoid opening your banking app because you're scared to see the balance?

A study found that almost 90% of people wouldn’t want to know the date or details of future negative events like death or divorce. And it suggested this could be driven by a strong desire to avoid negative feelings.

The researchers suggested that this same wish to avoid negative feelings affected the way we dealt with our finances. If our mortgage is in arrears or we’re facing other problem debts, they said our desire to avoid these feelings could lead us to purposefully avoid information about our situation.

And while it might help to avoid painful feelings now, it could lead to serious problems in the future.

Monzo using the Apple emoji when I was actually buying chocolate is the level of hypocrisy I do not need pic.twitter.com/8GfEvkAVj8

— Callum Hill (@BeingCallum) April 23, 2019

Try:

Make sure you have visibility over your money. If you use Monzo, we send you a notification immediately, every time you spend. And your balance updates instantly and you can see it clearly in the app. So you know exactly how much you’re spending, and on what.

Especially if you’re in debt, it can be stressful and feel easier to ignore your finances. But it’s important to engage with what’s going on. It’s worth reaching out to a debt charity like StepChange and asking someone you trust for support.

Have you done anything to nudge yourself into better financial habits? Let us know in the community!

Download Monzo to try out some of these techniques today!