Loans for £5,000 with Monzo

Whether you’re looking to buy a new car, renovate your home or bring all your payments into one place, a personal loan with Monzo could help you get there faster.

Monzo Current Account required • UK residents aged 18+ • Eligibility criteria and Ts&Cs apply • Missed payments may negatively impact credit scores.

Our representative APR for loans of more than £10,000 and up to £35,000 is 12.0% APR. For loans up to £10,000 it's 21.8% APR.

Loans, the Monzo way

You could use a £5,000 personal loan from Monzo to pay for a new car, to pay for a home improvement, or bring all your monthly payments to one place.

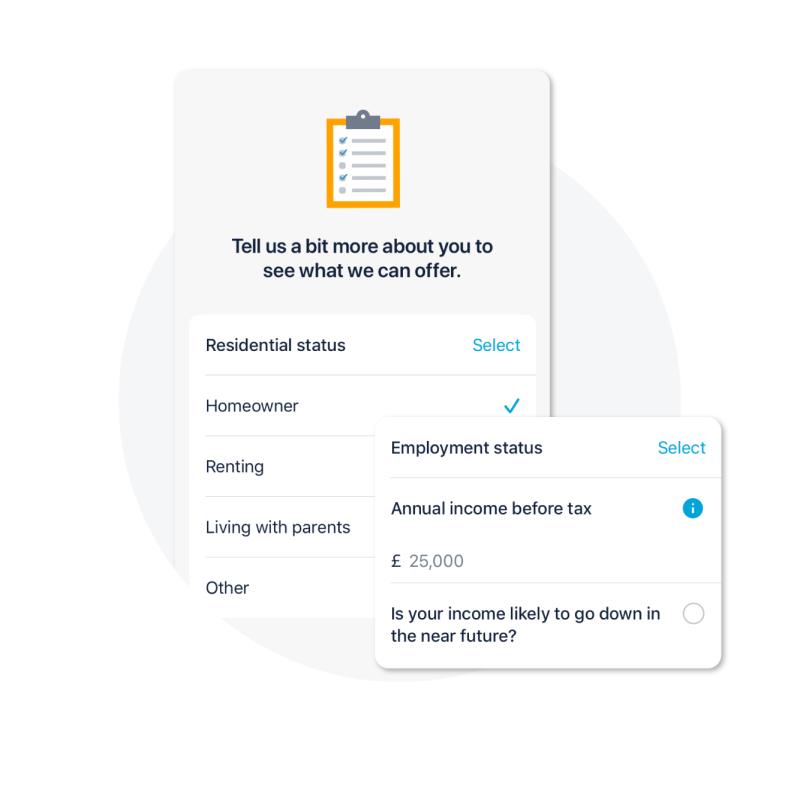

Check to see if you’ll be eligible for a loan and it won’t affect your credit rating.

You'll only need to answer three questions, and we'll let you know exactly what you can get.

Want to get an idea first? Use our personal loan calculator to estimate your repayments.

If you need a different loan amount, we offer loans up to £25,000.

Quick and simple

We'll only ask a few questions, and once you've applied, you'll have the money in your account in minutes

Flexible

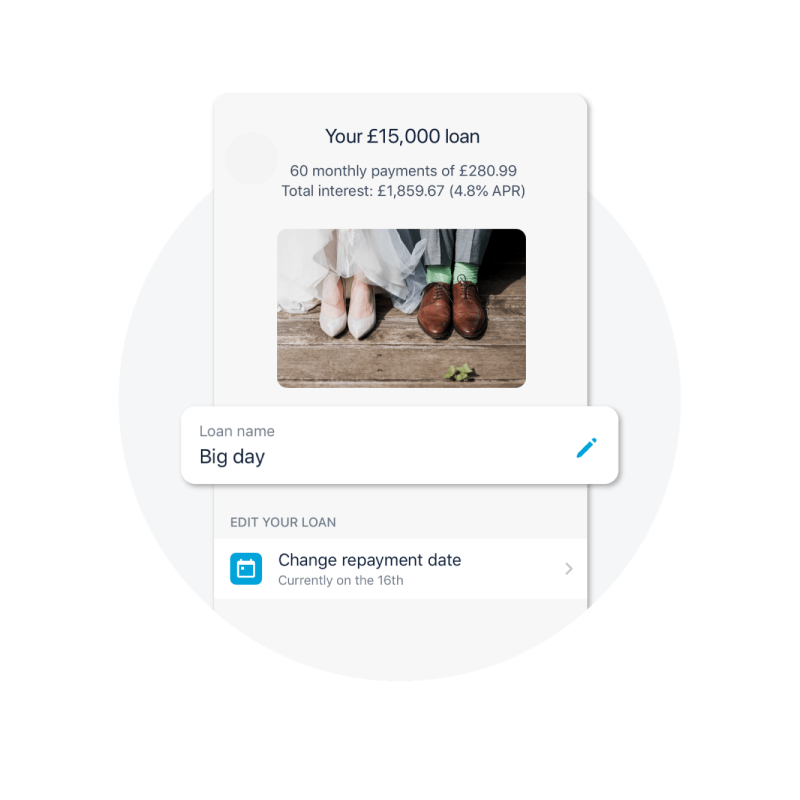

You can change your repayment day in the Monzo app. And, there's no fees to do so

Repay early, if you'd like

If you can afford to pay more, or pay your loan off completely, you can. With no fees to do so

Apply in minutes

No long paper forms. Just answer three questions in your Monzo app, and see what you could get straight away with our loans calculator.

And, you can use our loans calculator without affecting your credit score.

Total control

We won't hide fees or give you unfair charges.

Keep on track with your loan alongside your everyday spending.

Make extra payments, or pay off your loan completely, with no extra fees.

Give your loan a purpose

Give it a name and add an image of your choice.

Your loan sits alongside your Pots, so you can see where you're at at a glance.

Representative example: Borrowing £4,500.00, over 36 months, with 35 monthly repayments of £167.00 and one final payment of £156.17, at an annual interest rate of 19.9% (fixed), with a representative 21.8% APR, the total amount you'll repay is £6,001.17. Correct as at 17/02/2026

Human help, when you need it most

We want you to feel comfortable telling us when something’s wrong (whether that’s struggling with your mental health, losing your job, or something else).

If you need some extra support, we’ll do everything we can to help you get back on track.

The best way to get in touch with us is via in-app chat to discuss your circumstances with a financial difficulties specialist and find out how we can support you. You can also see how we can support with money worries if you experiencing difficulties.

We also provide tips on managing your loans and your debt in the loans help section on our blog.