Finding out your bank has blocked or closed your account can be stressful and frustrating. You might not understand why it’s happened, and feel powerless to change things. But blocking or closing accounts is something all banks have to do sometimes, to meet their legal and regulatory obligations, in line with their terms and conditions, and to help fight against financial crime.

Here’s some more information about why this sometimes happens.

All banks are legally required to close some accounts

We’re a regulated bank. And like all banks, we have to act in certain ways, to protect ourselves and our customers. Sometimes freezing, blocking or closing accounts is part of that.

In line with our terms and conditions, we can close an account by giving two months’ notice. And we can close an account immediately in some situations, like if we think you’ve broken the law or breached our terms and conditions.

Closing accounts can help fight financial crime

Financial crime is a serious problem across society. It impacts our economy and can affect people in devastating, life-changing ways. Criminals successfully stole £1.2bn from people in the UK in 2022 alone.

That’s why like many banks, we constantly evolve our approach to financial crime and the risks that come with it. Sometimes blocking or closing accounts is one of the ways we do this.

We can’t spell out every reason why we might block or close an account, or explain all the ways we spot fraud. Otherwise criminals would quickly figure out how to get around them!

But we can broadly explain when we might do it:

We spot unusual activity. There are some common signs that someone’s using an account for criminal activity. To protect people’s money and stop criminals using Monzo for illegal activities, we’ll block accounts when we suspect this is happening.

We identify a risky customer. Sometimes we’ll spot behaviour that makes us think a customer poses a risk to Monzo or other people. So we might block the account on our side to investigate, and close it depending on what we find.

The police tell us to. This can happen as part of a financial crime investigation, and we’ll co-operate with any requests from law enforcement.

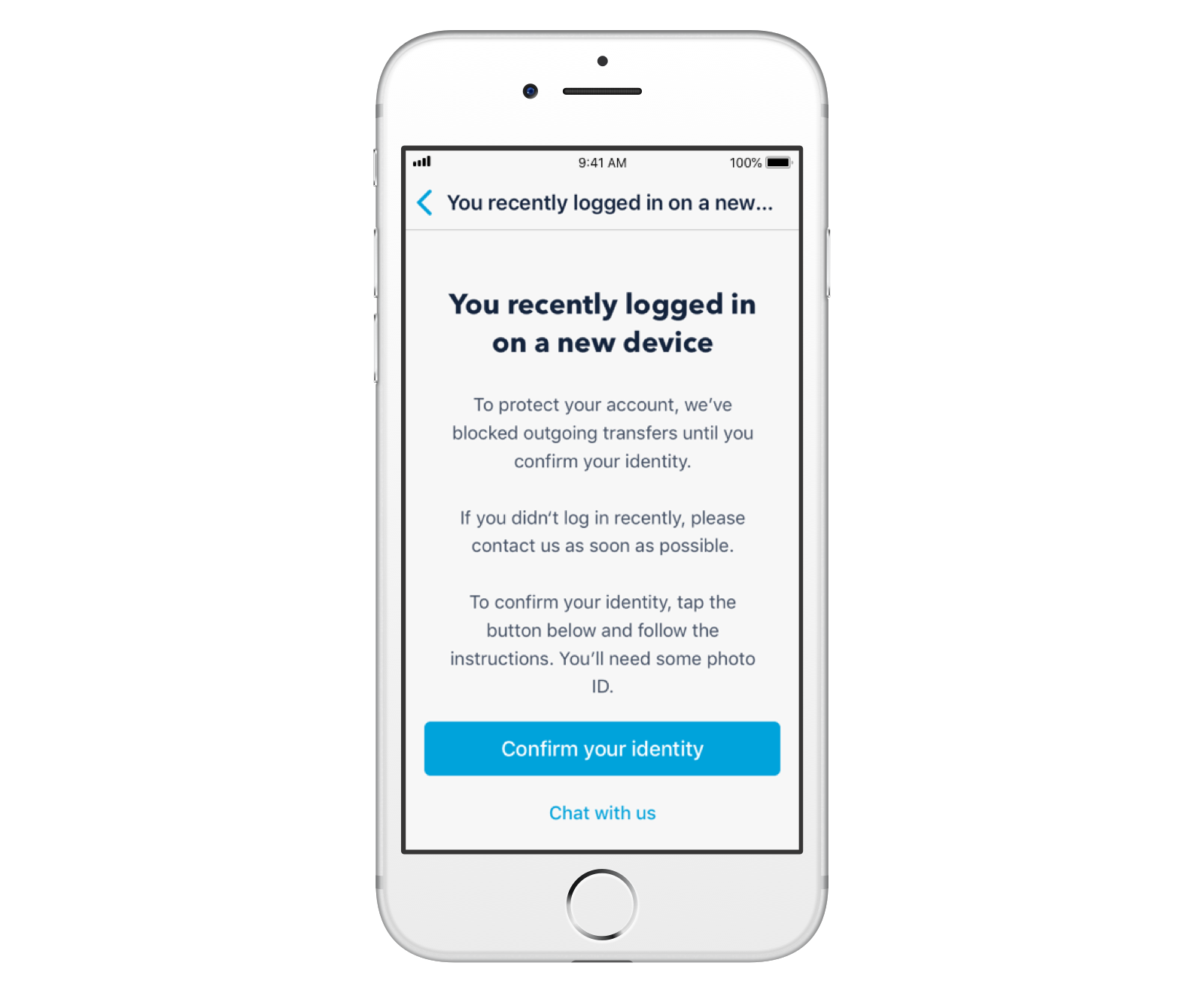

We block accounts when we think your money might be in danger

If our fraud systems believe someone else may have access to your account, we block the account to protect you and your money.

If we’re able to confirm it’s definitely you, we’ll unblock your account.

We’re not allowed to say exactly why we’ve blocked or closed an account

As we mentioned, explaining some of the reasons we close accounts could give fraudsters clues that might help them get around our security controls. That’s not an acceptable risk for us.

If we’ve blocked or closed your account, it’s very likely we won’t be allowed to tell you specifically why. We know this can be very frustrating, and we’re not being deliberately difficult. It’s just the way the law works.

There are also rules that explicitly stop us from giving information about why we’ve closed an account, to protect ongoing law enforcement investigations. (This is known as ‘tipping off’.)

In Section 14 our terms and conditions, we explain some general reasons we may close or block an account.

We can close your account by giving you at least two months’ notice. We may close your account or stop you using your card and app immediately if we believe you’ve:

broken the terms of this agreement

put us in a position where we might break the law

broken the law or attempted to break the law

given us false information at any time

been abusive to anyone at Monzo or a member of our community.

Accounts we block get reviewed by a human

When our fraud systems spot activity that might be suspicious and we decide to block an account we will aim for someone to review it, and take any necessary actions as soon as possible. If our review finds there’s a perfectly reasonable, legal explanation for the activity, we of course immediately unblock the account and apologise. This only happens very rarely, and most customers will never even know it’s happening.

If the account activity does seem suspicious, we have to report it to the National Crime Agency, and wait for their response before closing the account.

Social media doesn’t always tell the full story

Sadly it’s common for criminals to try and get into their accounts by putting pressure on us, and sometimes getting other people to join in too. This can be as simple as phoning up with a story about hardship, posting one on social media or taking one to the press. If you do come across one of these stories, it’s wise to take them with a pinch of salt.

Rest assured we investigate all cases thoroughly and only take action when we're confident about our decisions.