Year in review 2025

Mission. Growth. Profit.

Proving they can go hand in hand, year by year

2.4m new

customers

To total of 12m+customers

48% increase

in revenue

£1.2bnin revenue

8× increase

in profit

£113.9m adjusted profit before taxin profit

“Another year of raising the bar, deepening trust with our customers and driving scale, growth and profitability! By bringing together the best of technology and banking, and remaining customer obsessed, Monzo has redefined what banking can be – and where it’s going.”

TS Anil, Monzo Group CEO

48% increase in customer deposits

Trusting us with £16.6bn

1m+

customers with subscriptions

+50% subscription income

2.3m customers with Instant Access savings

£250m+ interest paid to customers

2m

1.5m

1m

FY24

1.3m

1.3m

FY25

2.3m

2.3m

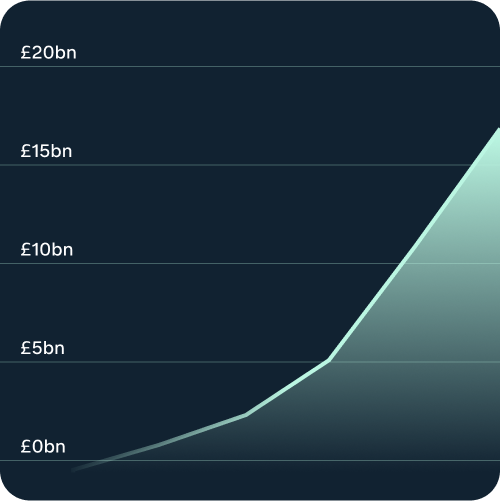

41% increase in total assets

To total of £18.3bn

£15bn

£10bn

£5bn

FY23

£6.7bn

£6.7bn

FY24

£13.0bn

£13.0bn

FY25

£18.3bn

£18.3bn

28% increase in weekly active customers

From 5.4m to 6.9m

6m

5m

4m

FY24

5.4m

5.4m

FY25

6.9m

6.9m

A bank people love

1.7m Greggs treats claimed

Including 831k sausage rolls

8.8m bill splits

10.1m payment requests

£5.45m cashback paid

Offers from 187 merchants

2025

Best British Bank

As well as Best Banking App and Best Children's Financial Provider, voted for by customers

Run by Smart Money People

2025 Brand of the Year

Awarded by The Marketing Society

Britain’s most recommended business account

for overall service quality for the last 2 years

According to an independent survey of 19,400 customers of the 16 largest business current account providers in Great Britain between January 2024 and December 2024 by BVA BDRC for Overall Service Quality and an independent survey of 18,000 customers of the 15 largest business current account providers in Great Britain between January 2023 and December 2023 by BVA BDRC for Overall Service Quality.

67% of customers join through word of mouth

+70

70

Net Promoter Score

That's how likely a customer is to recommend us.

The industry average is 30.

The industry average is 30.

#1

#1

downloaded UK banking app

More new products

than ever

Monzo's now a place where you can budget, spend, save, borrow, invest, track your mortgage, insure your contents, and combine your pensions.

Next-gen banking

We launched accounts

for Under 16s and Pensions

for Under 16s and Pensions

Starting a movement

1m+ people joined our 1p Saving

Challenge in the first week

Challenge in the first week

Safety firsts

We introduced 3 industry-first

security controls

security controls

New heights

New places

“To every customer, investor and member of the Monzo team: thank you. You’ve turned a bold idea into a thriving, category-defining business. And the best part? We’re still just getting started.”

TS Anil, Monzo Group CEO