Industry-first security you can bank on

We’re a bank with over 12 million personal and business customers. We help keep their money safe with industry-first security features, humans on hand 24/7, and advanced fraud protection.

UK residents only. Ts&Cs apply.

A fully-regulated UK bank

We’re authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

We're also a member of the Financial Services Compensation Scheme (FSCS), so your eligible deposits are protected up to a value of £85,000 per person.

Packed with security features

Daily limits, biometric logins, and freezing your card in one tap – we’re always finding new ways to help keep your money safe. And if we think something's off, like a suspicious payment, we’ll be in touch to make sure it’s really you.

Keep your savings safe from phone snatchers

Extra security controls give you another layer of protection when making big bank transfers and withdrawing from your savings. Pay from a known location, confirm it with someone you trust, or scan a secret QR code to prove it's really you.

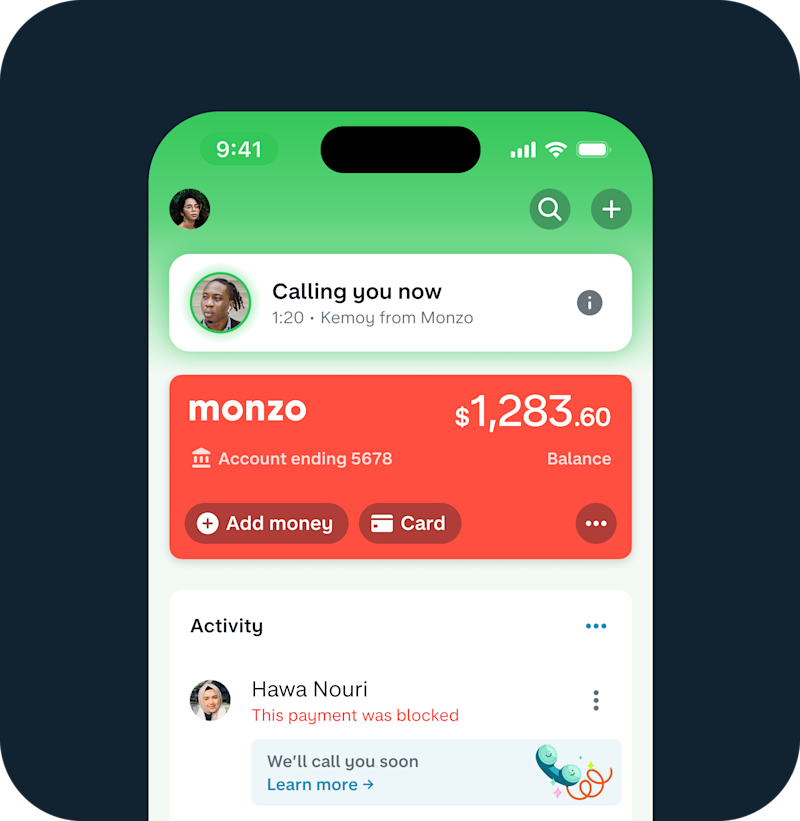

Protecting you from phone fraud

If someone calls you saying they’re from Monzo, our industry-first Call Status feature lets you check if it’s true in the app. If it doesn’t say we're talking to you, hang up because it's a scam.

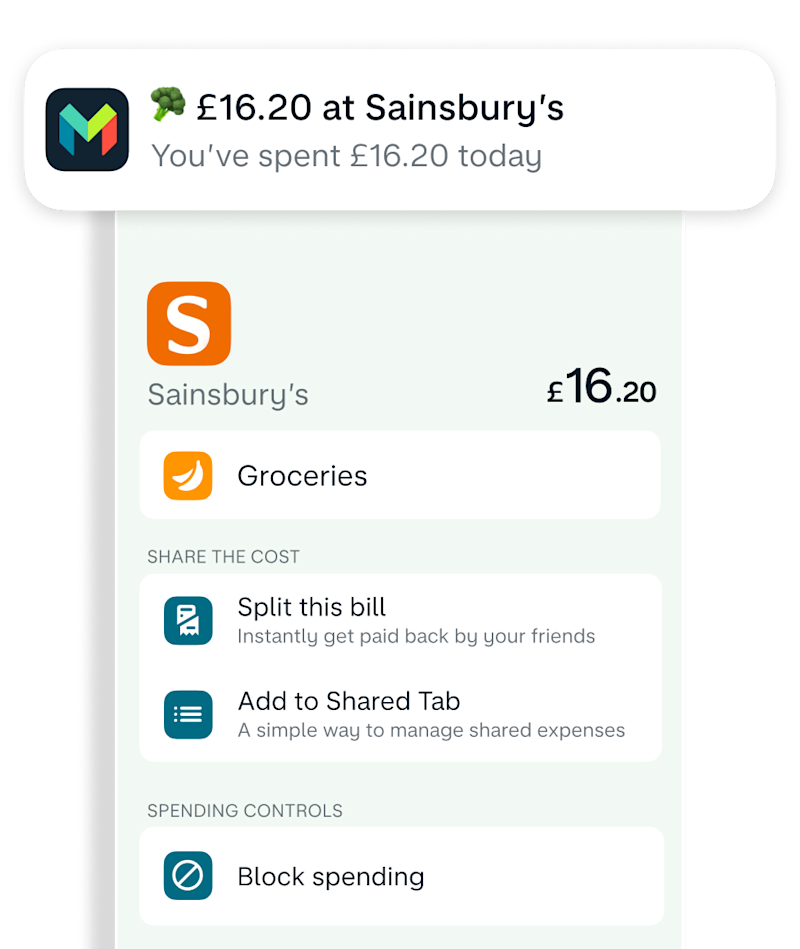

Track every transaction

Enjoy a more secure shopping experience with instant notifications. Every time your card is used, you’ll see the name of the shop, the location and the amount.

For online purchases, you’ll approve payments with a two-step verification called 3D Secure.

With subscription plans you also get ‘virtual card numbers’ that expire – handy for one-off purchases.

Single-use cards for safer shopping

With a Monzo plan you can create virtual cards for added security. Each card has a unique number which changes every time you use it, helping protect your main card’s details from fraud.

Plans start at £3 a month. UK residents aged 18+ (18-69 for Max). Ts&Cs apply.

Your identity’s protected

You can use biometrics every time you access the Monzo app on your phone. And the video selfie you take when you apply is so that no one can impersonate you when you get in touch.

Monzo’s customer support will never ask for your password or card number. Just like we’ll never ask you to make a bank transfer.

No branches, no problem

Need help or want to report something suspicious? Head to the app to chat to someone in our support team. We don’t have opening or closing hours – we’re here for you 24/7.

Working together to stop scams

Monzo is a member of Stop Scams UK. We collaborate with social media companies, phone operators and other organisations to help prevent fraud.