The scam report

Behind every elaborate scam, there’s someone pulling the strings – targeting our bank accounts, and our emotions.

We surveyed 2,000 people around the UK to help us spot when and how scammers strike.

UK residents. Ts&Cs apply. Survey in partnership with Censuswide.

Scams are designed to trick anyone

It’s easy to think it’ll never happen to you, but the truth is, anyone can be a target – no matter who you are or what you do. Scammers are always evolving their tactics to take advantage of our emotions and catch us out. They know when we're stressed, busy or distracted, and that's exactly when they act.

Nearly two thirds of respondents had been scammed

58% of those we surveyed had been scammed, with nearly a third (32%) being scammed more than once.

People lost almost £2,000 on average

Respondents in the UK reported losses of £1,833.30 on average from scams.

The North East lost the most money from scams

People in the North East lost £2,641.03 on average – the highest amount across all UK regions.

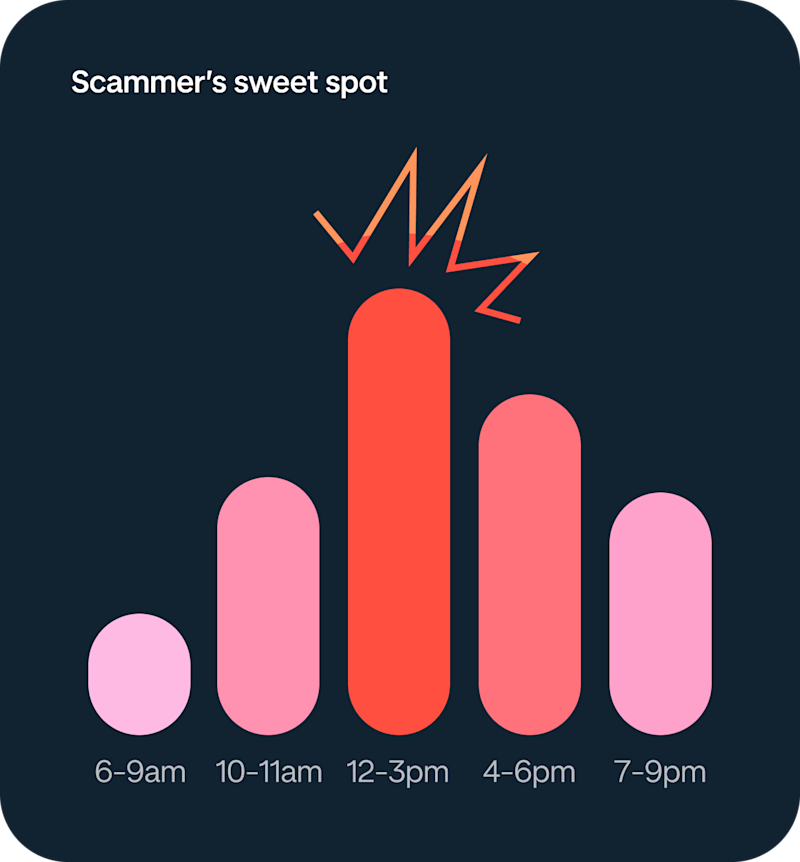

Scammers love an afternoon slump

Ever wondered why scammers strike at the most inconvenient times? Data suggests that most people are targeted on Wednesday afternoons. It’s no coincidence. Scammers pounce when we're typically less focused – maybe after a big lunch, or in a rush to get things done before the end of the day.

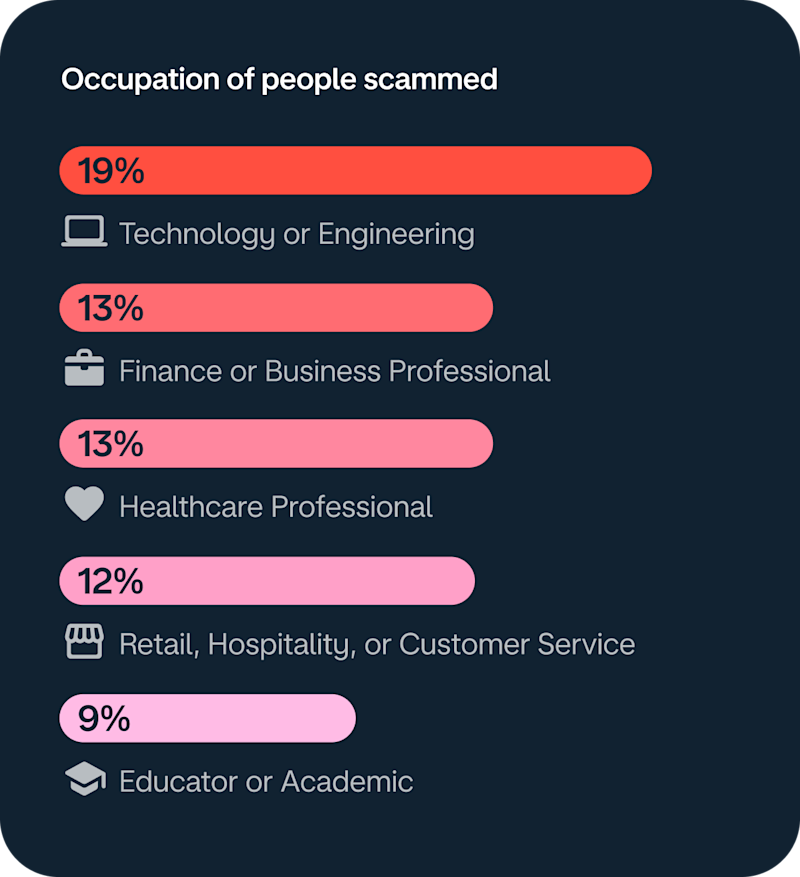

Tech-savvy doesn't mean scam-savvy

It's easy to assume that if you're more tech savvy, you're less likely to be scammed. But this false sense of security is exactly what scammers count on. Because the truth is, no one’s immune. In fact, our data shows that 19% of people who’ve been scammed work in tech or engineering, and 13% work in finance.

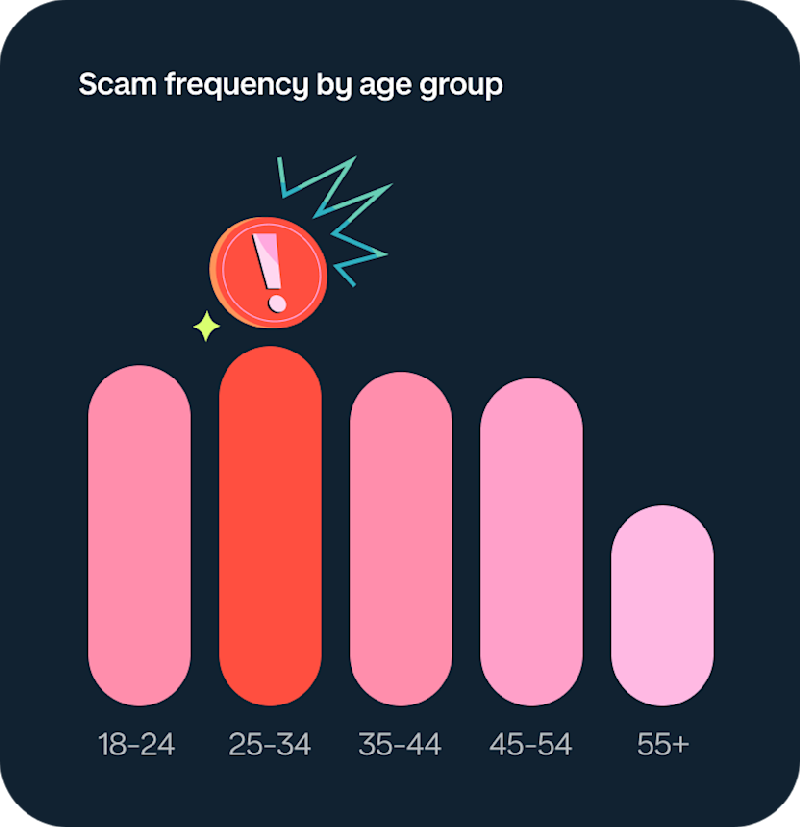

Young people are hit hardest

It’s a common myth that scams only happen to older people. But our data reveals 25-34 year olds report being scammed more than any other age group, followed by 18-24 year olds. Plus, younger people often lose more money, with 25-34 year olds losing an average of £2,118 in the past year, while those over 55 lost an average of £1,566.

Who's being targeted and how?

Men are more likely to experience investment scams

14% of men reported being scammed with promises of high investment returns from crypto, property or fake funds.

Women are more likely to experience purchase scams

This is when you buy something that doesn’t really exist. 27% of women experienced this kind of fraud on social sites like eBay and Facebook Marketplace.

We’re all likely to experience phishing

Phishing is when scammers use texts and emails to lure you into clicking on dodgy links and sharing your personal information. 9% of those surveyed had been targeted this way.

How to stay safe when buying online

Clothes, cars, the latest tech – there’s no limit to what you can buy online. And there’s also no limit to the amount of scams that are designed to catch you out. Here’s how to keep yourself safe.

Pay by card instead of bank transfer

Bank transfers aren’t protected in the same way as card payments, so once you send money to a scammer, it can be hard to get it back.

Look out for warnings from your bank

Don’t ignore warning messages from your bank when sending money. It could be a sign that something’s not right.

Buy from trusted merchants

Try to buy from shops and companies you know and trust. And if you’re shopping on social sites, don’t pay or message sellers outside of the platform.

Watch out for deals that seem too good to be true

Like an item that’s a lot cheaper than it should be, or an investment that promises large, guaranteed returns.

If it's a company, check they're regulated

Check the Financial Conduct Authority (FCA) register for financial services, and for travel companies, use ABTA.

Trust your gut

If something feels off, it probably is! Always give yourself time to think, and don’t be rushed into making a payment.

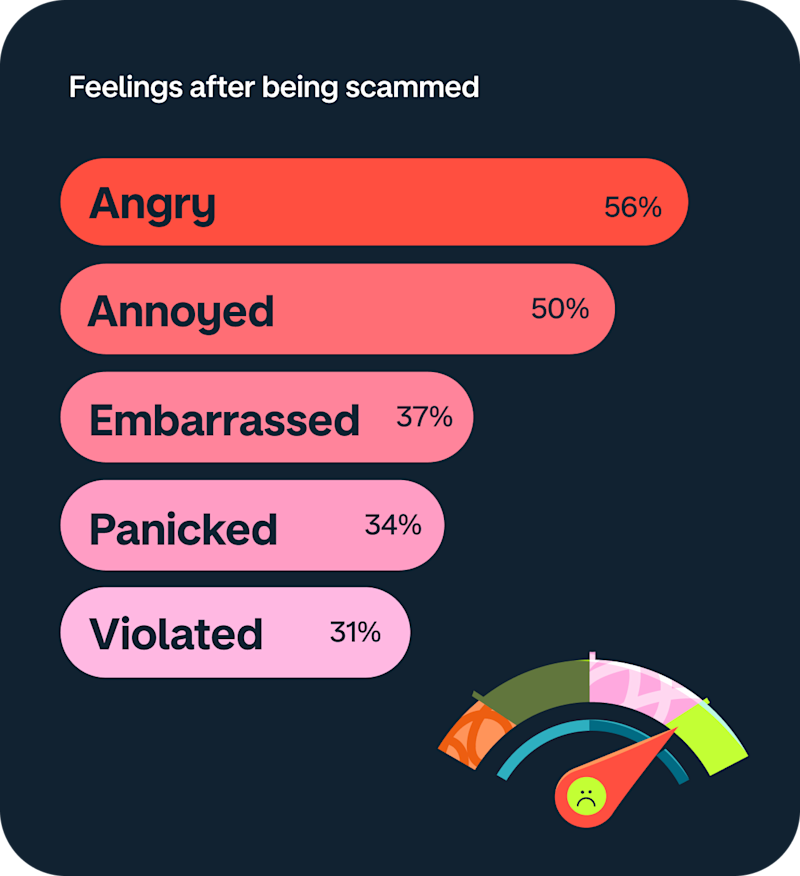

Being scammed hurts more than your wallet

There’s a lot of stigma around ‘falling for’ a scam, which can lead to negative emotions like shame or guilt. And if you’re feeling like this, you’re not alone:

Over 4 in 5 (83%) say being scammed had a lasting emotional or psychological impact

Around half (51%) blamed themselves, with the highest self-blame among 25-34 year olds (56%)

37% felt embarrassed after being scammed

Why do we feel shame?

Scammers are experts who use emotional and psychological methods to deceive us. Yet when we get scammed we feel silly, like we failed a test we should’ve passed.

We spoke to psychologist Jo Hemmings, who explained that it’s natural to experience something very similar to the five stages of grief after a scam. The key to coming to terms with it is allowing yourself to feel those feelings without judgment. “Remind yourself that being targeted doesn’t mean you’re foolish – scammers are highly skilled manipulators. Giving yourself permission to feel helps you start releasing, rather than suppressing, those emotions.”

Innovative security powered by humans

Biometric login

Face or fingerprint ID make it almost impossible for a fraudster to guess or steal your login credentials.

Trio of extra security controls

Verify large payments by paying from a known location, confirming it with someone you trust, or scanning a secret QR code to prove it's really you.

Call Status

This industry-first feature tells you if you're really speaking to Monzo, or if it could be a scammer. It helps prevent 700 fraud attempts a month.

Proactive protection

Our goal is to stay one step ahead of scammers by combining cutting-edge technology with human expertise.

Card freeze

Instantly freeze your card in the app if it gets lost, stolen or you suspect fraud. Lost your phone? Log into your account on another device, like a laptop or tablet.

Instant notifications

Get notified the second you spend on your card, so you’re in the know wherever you go.

Stopping scams at the source

At Monzo, we believe in the ‘Take Five’ ethos. This means we encourage moments of pause in high-risk situations, making it difficult for scammers to take advantage of panic.

This includes warning screens to create positive friction between a customer and a risky payment, and allowing customers to undo a bank transfer if they think they’ve made a mistake.

Open a free Monzo account

Download the Monzo app on iOS or Android and join more than 14 million personal and business customers who've changed the way they bank.