Car loans with Monzo

If you're heading to the dealership to buy a new or used car, you could use a Monzo personal loan to help you buy it.

Monzo Current Account required • UK residents aged 18+ • Eligibility criteria and Ts&Cs apply • Missed payments may negatively impact credit scores.

Our representative APR for loans of more than £10,000 and up to £35,000 is 12.0% APR. For loans up to £10,000 it's 21.8% APR.

Compare it to car finance

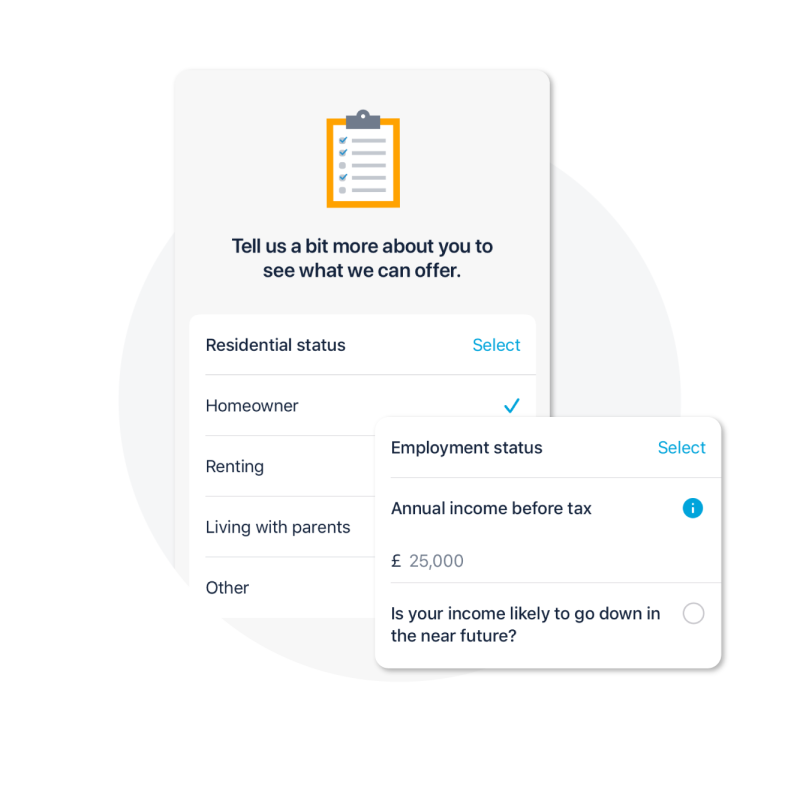

You can see what you're eligible for without impacting your credit score, so you can check if it's cheaper than car finance on the forecourt.

Monzo will do a hard credit check when you sign the loan credit agreement. This may affect your credit score. Not keeping up with repayments may also affect your credit score.

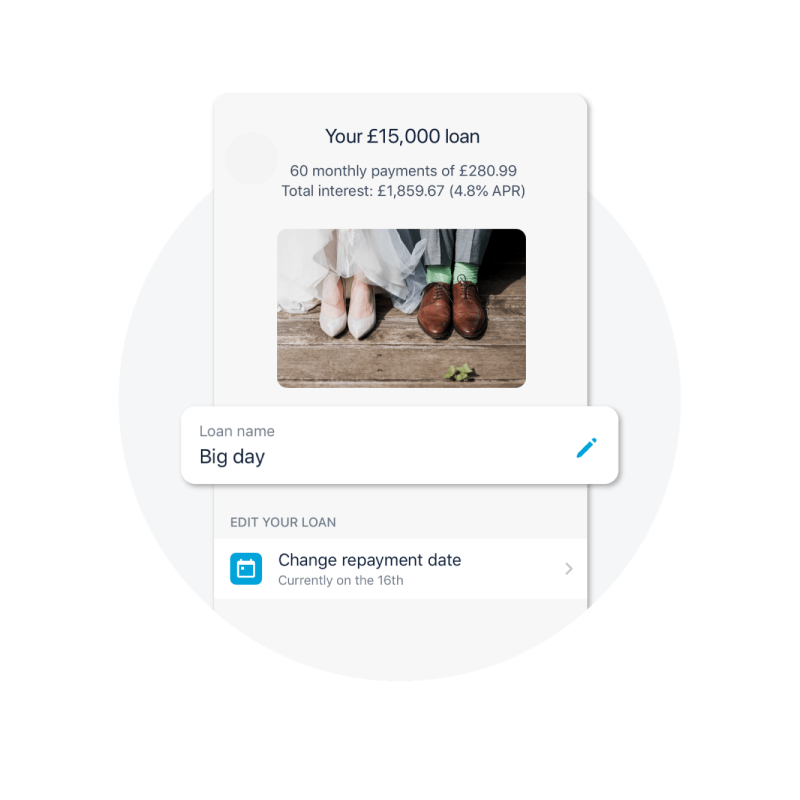

You're in control

You're able to choose your payment date, and you can pay your loan back early if you'd like.

So if you end up with a little extra cash, you can pay us back sooner.

Representative example: Borrowing £4,500.00, over 36 months, with 35 monthly repayments of £167.00 and one final payment of £156.17, at an annual interest rate of 19.9% (fixed), with a representative 21.8% APR, the total amount you'll repay is £6,001.17. Correct as at 18/02/2026

Explore in the Monzo app

By tapping the + button.

Use the loan calculator

Choose your amount, and how long you'd like your loan for. We'll show you exactly what you'll owe, with no hidden fees.

That's it!

If approved, you'll have the money in minutes.

Give your loan a purpose

Give it a name and add an image of your choice.

Your loan sits alongside your Pots, so you can see where you're at at a glance.

Representative example: Borrowing £4,500.00, over 36 months, with 35 monthly repayments of £167.00 and one final payment of £156.17, at an annual interest rate of 19.9% (fixed), with a representative 21.8% APR, the total amount you'll repay is £6,001.17. Correct as at 18/02/2026

Human help, when you need it most

We want you to feel comfortable telling us when something’s wrong (whether that’s struggling with your mental health, losing your job, or something else).

If you need some extra support, we’ll do everything we can to help you get back on track.

The best way to get in touch with us is via in-app chat to discuss your circumstances with a financial difficulties specialist and find out how we can support you. You can also see how we can support with money worries if you experiencing difficulties.

We also provide tips on managing your loans and your debt in the loans help section on our blog.