Saving money isn’t easy. Lots of us want to do it, but actually getting started and sticking with it can feel really hard. Through research, we heard that while people wanted to save, they didn’t really know where to start and some struggled to stick to the habit. This was true for Monzo customers, but also more broadly for UK adults.

That’s where the 1p Saving Challenge comes in: a simple, easy and magical way to put away a little each day, and watch it turn into something meaningful. It’s a simple product that automatically saves 1p on day 1, 2p on day 2, and so on until £3.65 on day 365, saving you a total of £667.95 in a year.

Uncovering the need & shaping the mechanics with research

The best ideas often come directly from the people who use the product. Our 1p Challenge is a perfect example: it didn't start in a design meeting, but with one of our power users back in 2018. They leveraged our IFTTT (If This Then That) integration to invent this saving mechanic. It quickly became popular and expanded to a small group, becoming a social media phenomenon that drove countless people to set up the complicated integration that we then made official.

This organic excitement confirmed what our researchers later found: people really want to save, but it's challenging for multiple reasons, whether that’s time, effort, or simply not knowing how to start and stick to it.

Once we had identified the need, we continued to work with the user research team and the design team to identify potential solutions, and the challenge came up as one of the most popular ones. We tested a few features, some challenges and other gamified approaches, and the 1p Saving Challenge was the one that resonated the most. We then explored how to frame the exact solution, so it felt both achievable, delightful and magical.

We also tested different challenge benefits, from prize draws to interest boosts, and refined the mechanics until we were confident they would resonate. Research helped us test our hypothesis, but also pushed us to think harder about how the challenge would work day to day. We continued to refer back to these research insights as we designed the detailed solution.

Designing the details

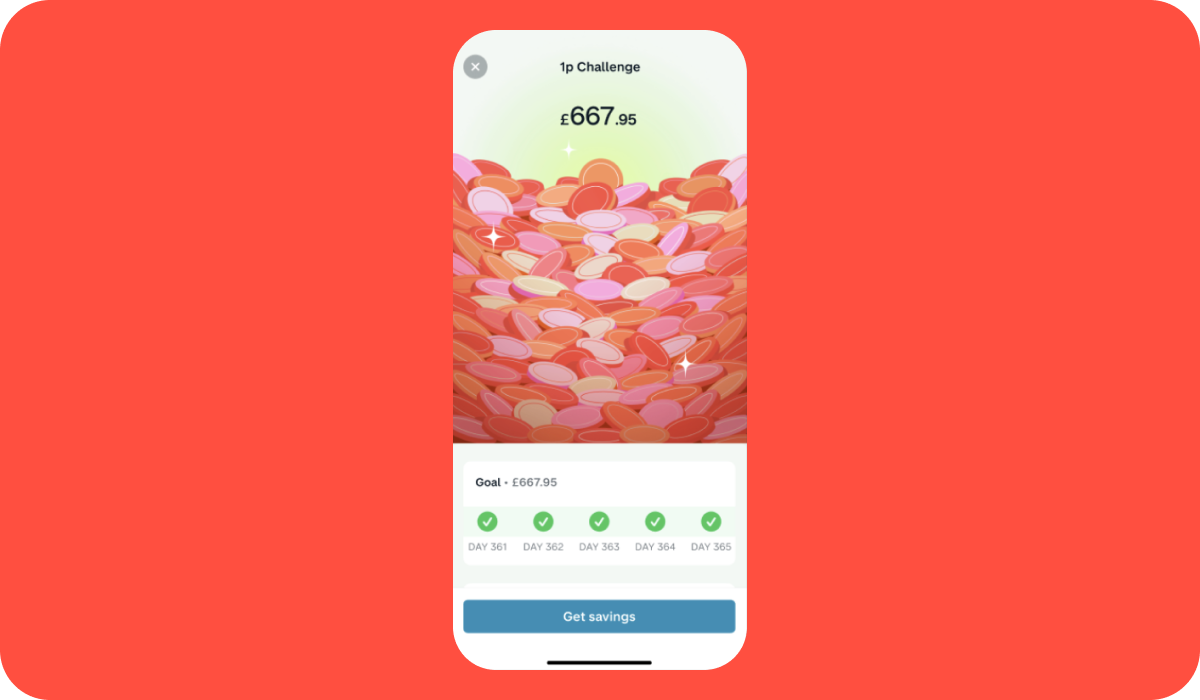

Once we had the concept, our design team made it feel delightful in every way, where the first moment when you’re saving the first penny feels magical with the animation. One of the details we sweated was the coin-drop animation. Our motion designer worked closely with product designers to get the movement right, adjusting timing and flow until it felt fun and satisfying. This focus on eliminating friction and creating comfort extended directly to the product mechanics.

Nothing feels like a loss because you can pause, withdraw, close it and put it in an interest bearing product. Design also crafted the challenge’s visual identity that worked consistently across every touchpoint: in the app, on our website, in emails, and across marketing materials. That consistency helped the challenge feel bigger than a single feature, and made it instantly recognisable wherever people saw it.

A snippet of the 1p Saving Challenge home view

Building with engineering

Making the challenge work behind the scenes was no small task. One of the tricky parts was automating the savings themselves: each day, the amount set aside increases, and it all accrues automatically. On the surface, that feels simple, but there are lots of edge cases to handle, such as creating a unique product that had a deposit structure, and was earning interest in some cases. We worked with the engineers on the squad and beyond the squad to think through all those scenarios and make the experience seamless. Subscription engineers who hadn’t worked on interest-bearing products worked closely with engineers who were experts on this topic, and partnered on proposals, reviews, and testing.

Part of the team celebrating hitting one million challenges created!

Thinking carefully about scope

The moment we had agreed on the approximate release date, we knew we had to make tradeoffs. That meant we couldn’t build everything we imagined in one go. Together with the team, we stripped out what we felt was essential, and which ideas could wait for later iterations. That discipline helped us deliver something meaningful and .. almost on time. Releasing on January 1st was ideal because customers who knew about the 1p Saving Challenge through other tools were aligned with the first deposit starting January first. It was a challenge for us to launch on that day, as we needed to balance out capacity and any potential issues. During this week, we received quite a lot of requests from customers asking where the challenge was, and saying they expected it to be there already.

We wanted to prioritise shipping a feature that we felt really comfortable putting in customers’ hands, so we decided to launch it a few days later to get additional testing time.

Bringing it to life with marketing

Working with marketing was one of the most important parts of this project, from working hand in hand on product development, to figuring out how to communicate it with a marketing campaign. It was through those conversations that we realised timing was crucial. We could have launched earlier, but working with marketing made it clear that January, when people are most motivated to start new habits, would give the launch much more impact.

The marketing team planned a campaign that ran across every channel: in-app, on our website, through paid and organic social, and across multiple channels. Because the design, messaging was so consistent, everything felt cohesive and magical.

The response was incredible: customers shared their progress and excitement on social media, and the challenge was even featured on Lorraine on ITV!

Example of some of the great responses we received from customers!

Using data to build and learn

Data was another key part of the project. Early on, data helped us understand and model how the feature would work. During development, we worked with data scientists to help scope out the value proposition of the challenge to understand the potential cost implications for offering customers higher interest rates, prizes etc. To shape the challenge, we combined different data points on customers’ saving habits, from user research to quantitative surveys.

Since launch, data has also been central to learning. We can see how many people are completing the challenge, when they tend to drop off, and what kinds of nudges help them keep going. Over 1 million people joined the challenge, of which a lot of people became first time savers with Monzo. These insights helped us understand the impact of the challenge on customer habits, and helped us decide how to quickly iterate after the initial customer launch.

Conclusion

The 1p Saving Challenge has been a genuine cross-team effort.

Research uncovered the need. Design made it delightful and consistent across touchpoints; Engineering solved the tricky mechanics to make it seamless, Marketing helped us launch it at the right moment; Product thinking shaped how it worked for free and paid customers; Data gave us the confidence to make good decisions along the way; and our risk partners made sure it was safe and fair for everyone.

For me personally, it has been one of the highlights of my first year at Monzo. It shows what’s possible when we work across teams to solve customer problems.

And this is only the beginning. Stay tuned for what’s next, 2026 is coming soon!

Interested in a career at Monzo?

If what you’ve read here resonates and you’re passionate about making money work for everyone, we’re hiring designers, engineers, product managers and many more across Monzo! Take a look at our careers page to see if we have the right role for you.