Twice a year, the Competition & Markets Authority (CMA) asks that an independent survey score current account providers across Great Britain on service quality in 4 different categories.

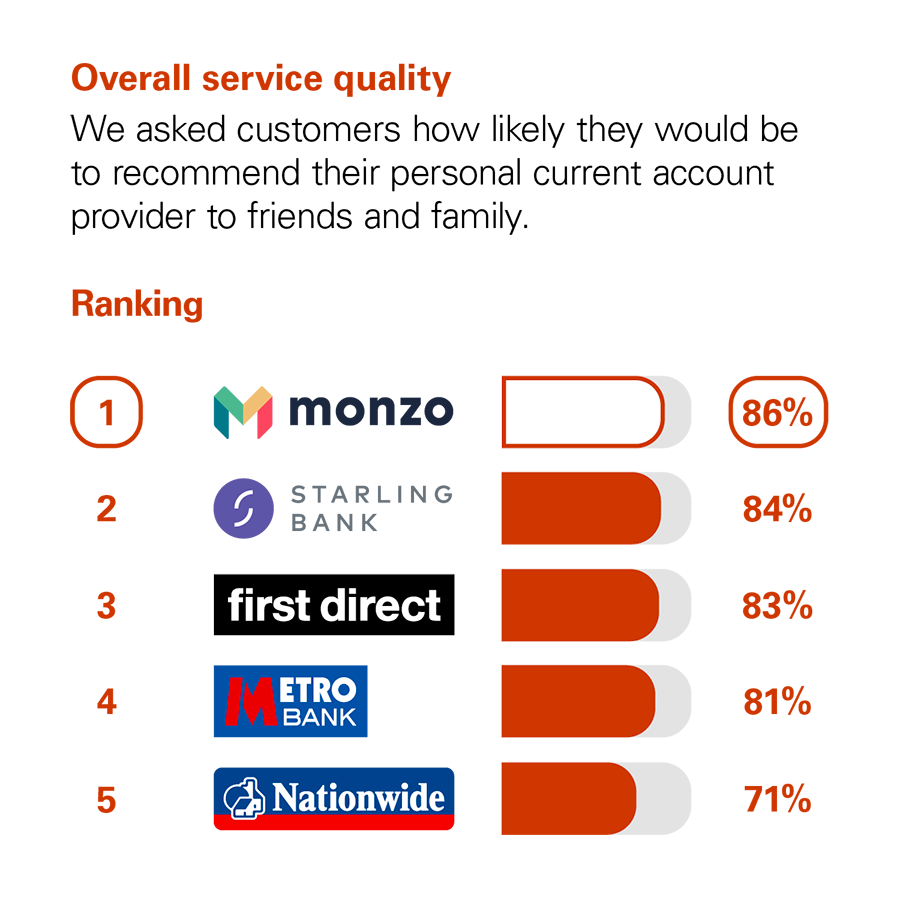

We’re excited to announce that this year we ranked #1 in the Overall Service Quality and Online and Mobile Banking Services categories!

We came fourth in the Overdraft Services category. And because we don’t have branches, we didn’t get a score for the fourth category: Services in Branches.

We want to say a massive thank you to all of you for coming on this journey with us. Our customers, investors, team and everyone else in between have got us to where we are today. We’ve got plenty of work to do, but today we’re celebrating how far we’ve come.

The results for each category

Independent CMA survey carried out in Great Britain by Ipsos MORI between July 2019 and June 2020 – Overall Service Quality, Online & Mobile Banking Services, Overdraft Services. Results at www.ipsos-mori.com

Voted for by 19,000 people across the UK

From July 2019 to June 2020, Ipsos MORI asked approximately 19,000 people across Great Britain how likely they were to recommend their provider to someone else. The results gave providers scores in the 4 categories we already mentioned.

It’s the first year we’ve been included

You might be wondering why we haven’t reported these scores before. It’s because this is the first year we’ve met the threshold for number of accounts to be included in the rankings.

The CMA promote competition for the benefit of consumers

It might be helpful to explain who the CMA are, in case you don’t know. They’re a government organisation that believe that:

“Competition is good for consumers and businesses. It means that people get better products at lower prices, and it helps ensure the most consumer-focused and innovative businesses are the ones that succeed.”

They ask that twice a year an independent survey investigates service quality in the British personal current account market. Providers and banks (like us) are then required to publish the results on their websites so consumers can easily compare service quality from one bank to the next.

They introduced customer satisfaction reporting after they conducted a market investigation into the banking sector in 2016.