Monzo Business Banking

It just works, so you can too

Monzo Business Banking helps small businesses stay on top of their finances. Starting at no monthly fees.

What you need to know about Monzo Business bank accounts

Get better visibility and more control over all your money with a Monzo Business bank account. Less time on finances means more time for the important stuff.

We're a fully regulated UK bank

We're regulated by all the same rules as high street banks

Open a business account online, straight from your phone

Customers voted Monzo the 2022 Best Business Banking Provider (British Bank Awards)

24/7 customer support

You get the best of Monzo

Move money easily with free, instant UK bank transfers

Get notified the second you pay, or get paid

Set money aside, separate from your balance, with Pots

- Earn interest on savings with our Instant Access Savings Pot. Ts&Cs Apply.

Built for your business

Give customers simple ways to pay online

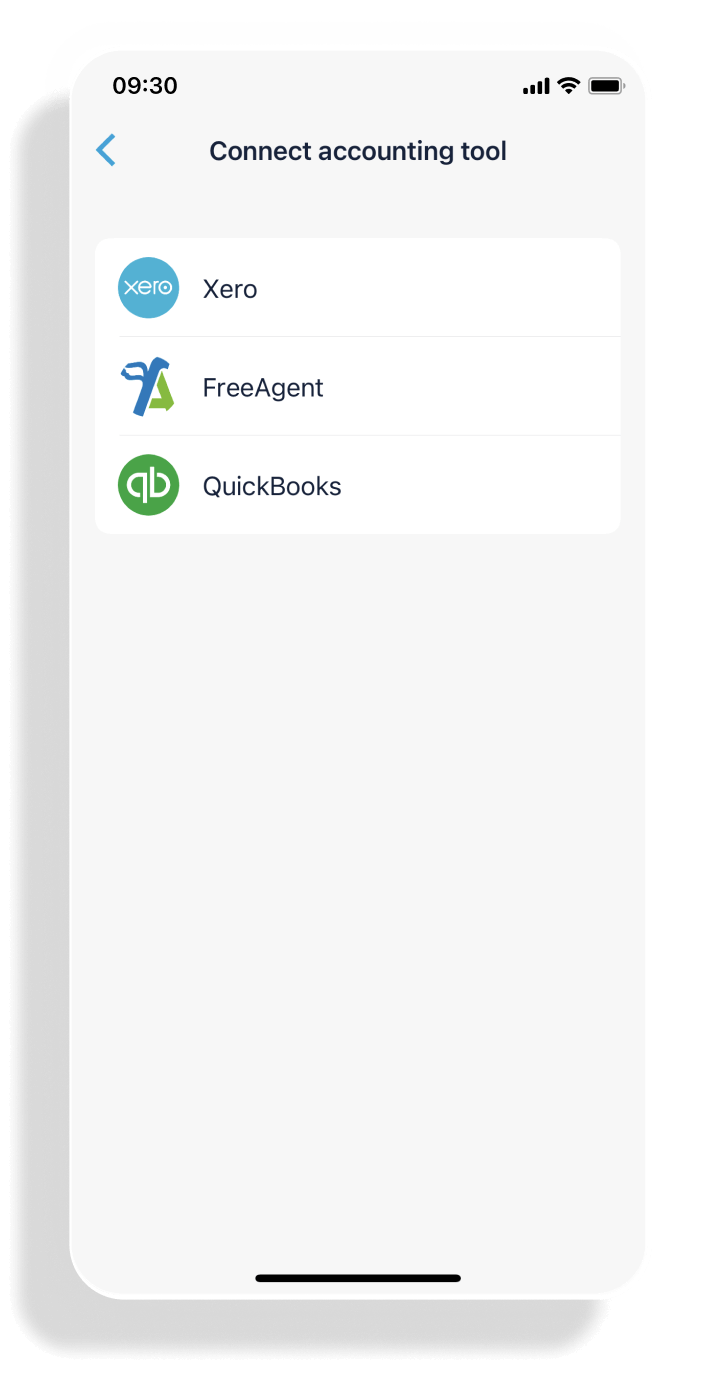

With Monzo Business Pro, connect your banking with your accounting tool (Xero, FreeAgent or Quickbooks) in the app

Manage your business account wherever you are, with mobile and web access

Use separate virtual cards for each Pot you create, helping you control where you spend from with Monzo Business Pro

We're here to help, 24/7

How we help:

Chat to us in app any time, or call or email if you'd prefer

We'll answer your questions and help solve any problems you have

No need for branches, and no need to make an appointment

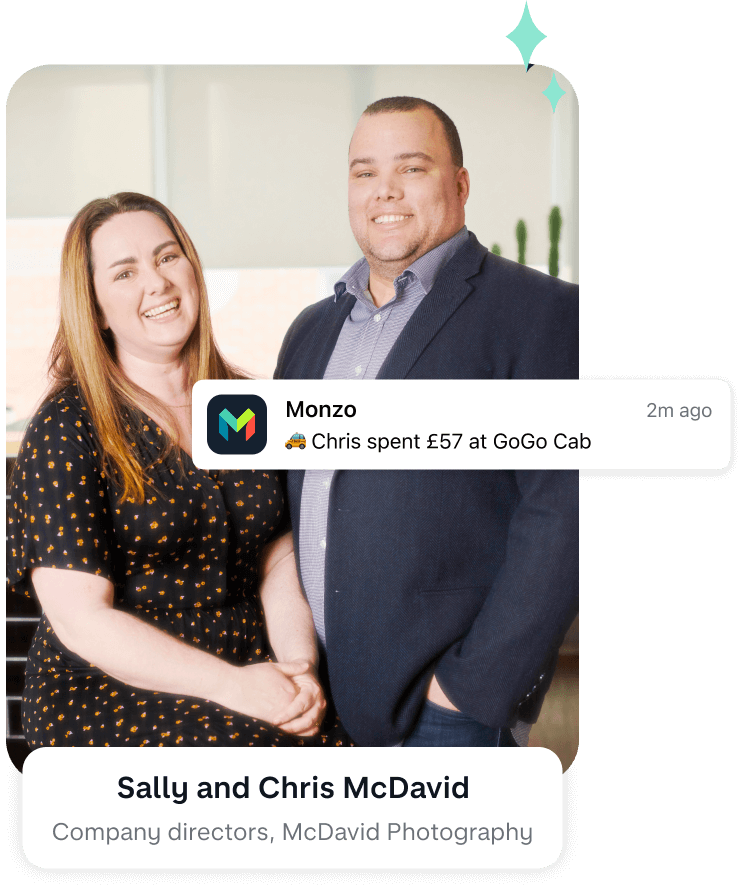

"It's nice to know when you've been paid. You know what's gone out, what's gone in, instantly."

Sally and Chris use instant notifications to:

Know when they're paid right away

Keep track of their spending

Stay on top of their invoices

Simple pricing, no commitment

Simple pricing, no commitment

Built for business

Including the best of Monzo

Plus the essentials

We charge £1 to pay in cash at PayPoints and Post Offices across the UK. And for countries outside the European Economic Area, you can take out £200 cash for free every 30 days. After that, we charge 3%. These charges cover our costs for these services and everything else is included in the plan price. No hidden fees.

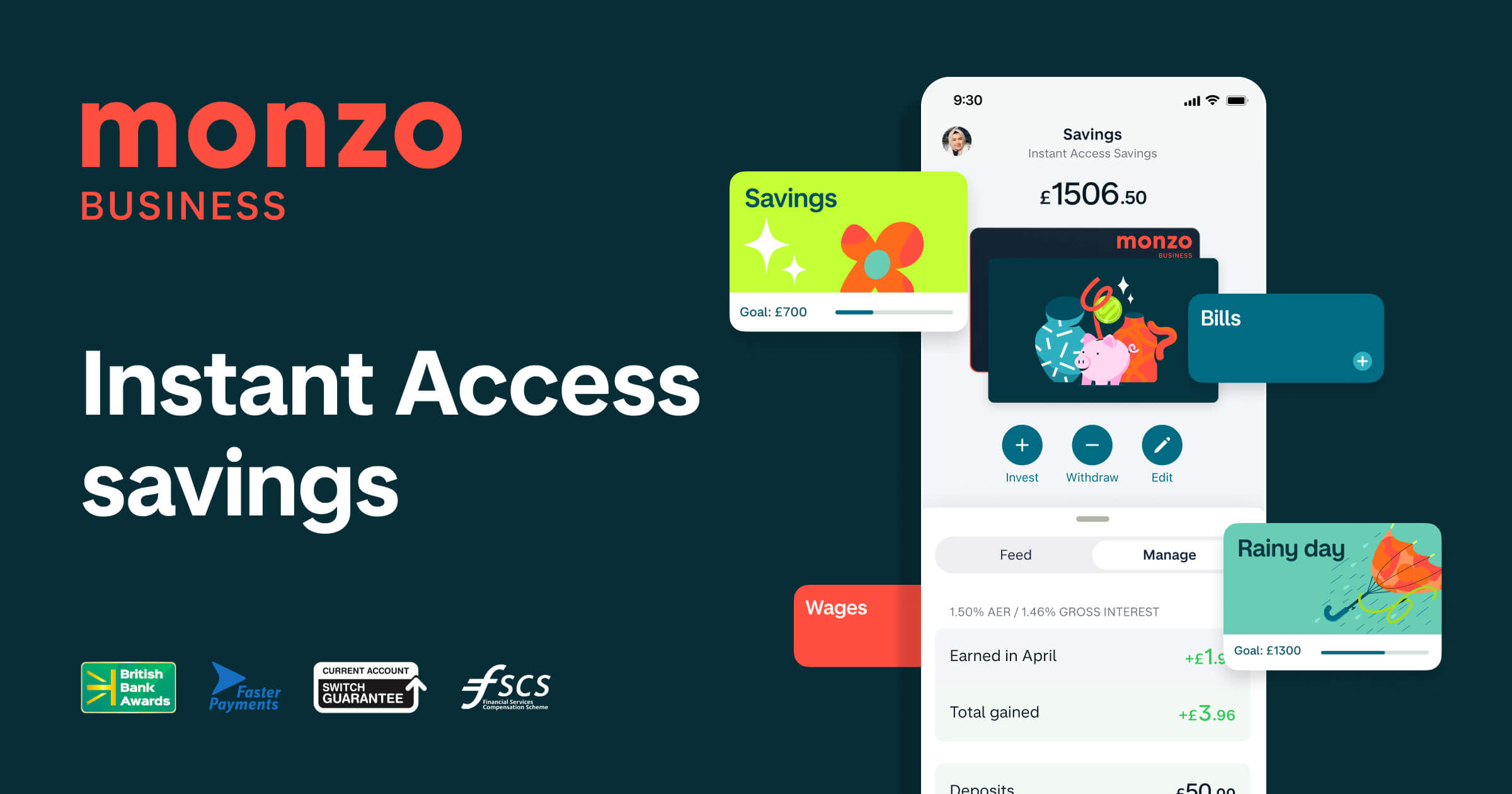

Put your spare money to work earning interest

Use Savings Pots to:

Put your spare money to work, earning 1.30% AER interest (variable) paid monthly with no minimum deposit and a maximum £1,000,000 balance (Ts&Cs apply)

Automatically set aside money for unplanned business expenses, a big purchase, or to reinvest in your business

Withdraw money instantly when you need it most

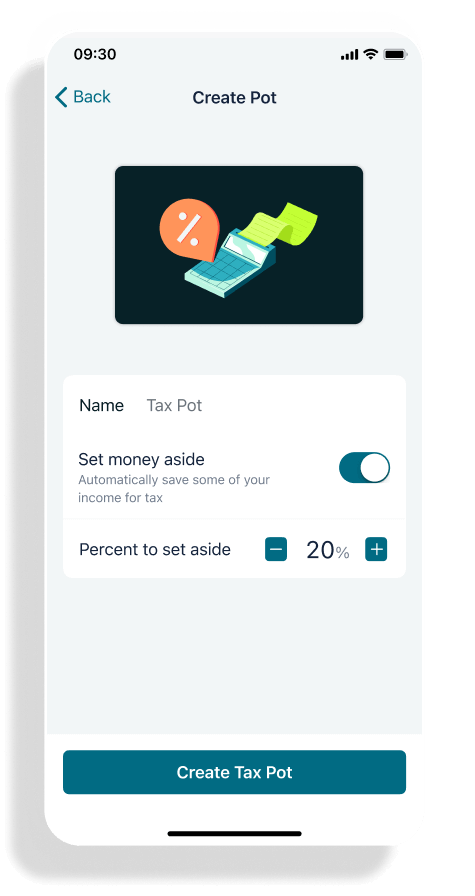

Choose what to set aside for tax

Use Tax Pots to:

Automatically set a percentage of your income aside when you're paid

Neatly separate your money, all in one bank account

Stop worrying about saving, and spend more time on your business

Only available on Monzo Business Pro for £5 a month

Get paid, the easy way

Target Tuition use a Monzo Business bank account to:

Create payment links or invoices in a few taps

Offer customers simple ways to pay by card or easy bank transfer

Save time on admin with all your payments in one place

Automate accounting with tools you already use

Integrate accounting tools like Xero, FreeAgent and QuickBooks to automatically share your balance and transactions every day with Monzo Business Pro.

If you use other tools, or don’t use any, easily export a file of your transactions or statements (CSV, PDF or QIF) whenever you need to. We’ll never share your data with anyone else unless you agree to it, or ask us to.

With Monzo Business Pro, new Xero users can get 6 months of the cloud accounting platform free (terms apply). Learn more.

"The team has access. We know who paid what and when. Monzo's allowed us to have transparency."

The Malt Films team uses multi-user access on Monzo Business pro to:

Manage their finances together

Improve visibility across the business

Split up their workload, especially if someone's away

Meet the people behind the businesses

Monzo Business lets them get on with what they love: running their business.

Your questions, answered

Check if you're eligible

You can apply for a Business Bank Account if you're a UK based sole trader or director of a UK limited company.

Head to our eligibility criteria for more detail on businesses and industries we can and can’t support at the moment.

Your eligible deposits are protected

If you're a sole trader or a small business your eligible deposits may be protected by the Financial Services Compensation Scheme (FSCS) up to £85,000. 💰 To learn more about the businesses and deposits that are eligible, see here

Sign up straight from your phone

We’ll ask some questions about your business to see if you’re eligible.

If you have a Monzo Current Account, apply in your app. If you don’t have a Monzo Current Account, sign up in these 3 steps.

Find out about Monzo Business

Over 400,000 business owners have already changed the way they do business banking. Sign up from your phone to join them. Or sign up online.

If you already have a business account somewhere else, find out how to switch to Monzo Business

Let's talk business

Ideas for everything from getting started, to taking your business to the next level

We can now accept corporate-owned businesses 🎉

If your Limited Company has investment from other companies, you are now welcome to apply for a Monzo Business account!

Receive international payments into your Monzo account

Receive money from around the world. 40+ currencies converted to pounds, ready to spend.

Business Instant Access Savings are here 🎉

Introducing our all-new business Instant Access Savings Pot, grow your spare funds.

Cost of living: how we’re supporting you and your business

The cost of living crisis is affecting all of us in some way. We’ve been speaking to business customers about their experiences and worries, and we’ve summarised how we can help as the situation evolves.

Virtual Cards, explained - A new feature for Monzo Business Pro

Virtual cards are brand new to Monzo Business Pro. We designed virtual cards to help Business owners and members to stay in control of their business spend and spend safely online.

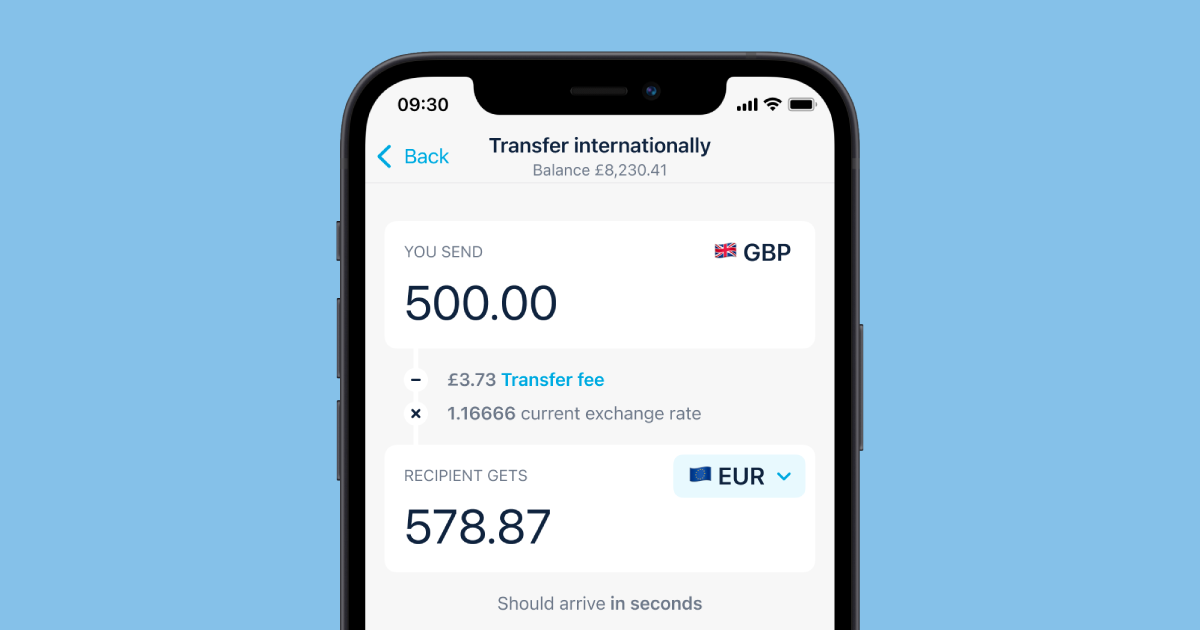

Business customers - you can now send money abroad

We’ve partnered with Wise to give you a simple, cheap way to send money abroad. Always using the real exchange rate, with no hidden fees.

Everything you need to know about starting a business, business banking and Monzo business features

Take a look at our blogs and articles covering everything from why you need a business account, to running a successful business, making hires and everything inbetween.

Virtual Cards

Virtual Cards Auto-exports

Auto-exports