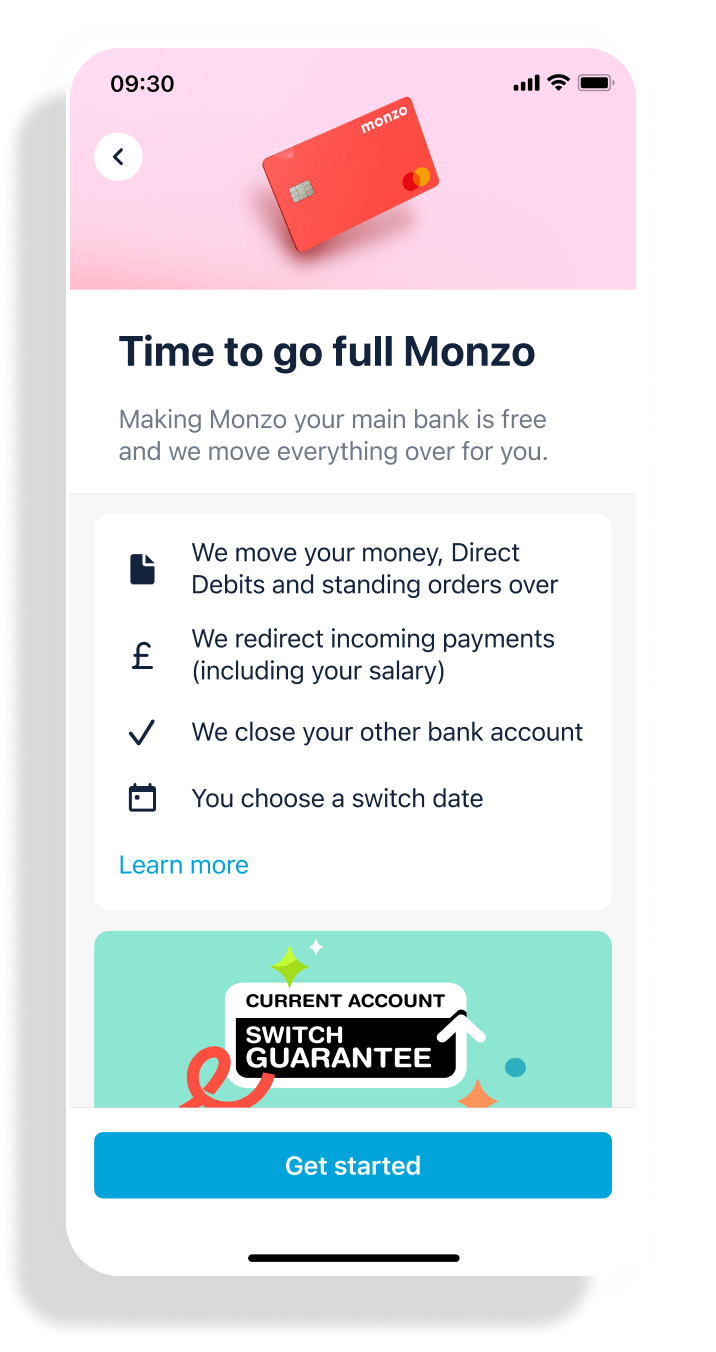

Switch to Monzo

The Current Account Switch Service means moving payments or making Monzo your main account is a breeze.

What’s the Current Account Switch Service?

The Current Account Switch Service is a not-for-profit organisation that lets people move quickly and easily between bank accounts. We’ve teamed up with them so it’s painless for you to switch your personal, joint and business accounts to Monzo.

You’re covered

Full switches are covered by the Current Account Switch Guarantee, so if anything goes wrong you won’t be left out of pocket. And we’ll make sure any payments to your old account always make it to the right place, even after your old account is long gone.

Switch to Monzo hassle-free

No trips to the bank. No messing with ID and statements. You just need to tell us when you want to move, and we'll do the rest in 7 working days.

Move your whole account

We’ll move your money and payments (like Direct Debits and standing orders), and close down your old account for you.

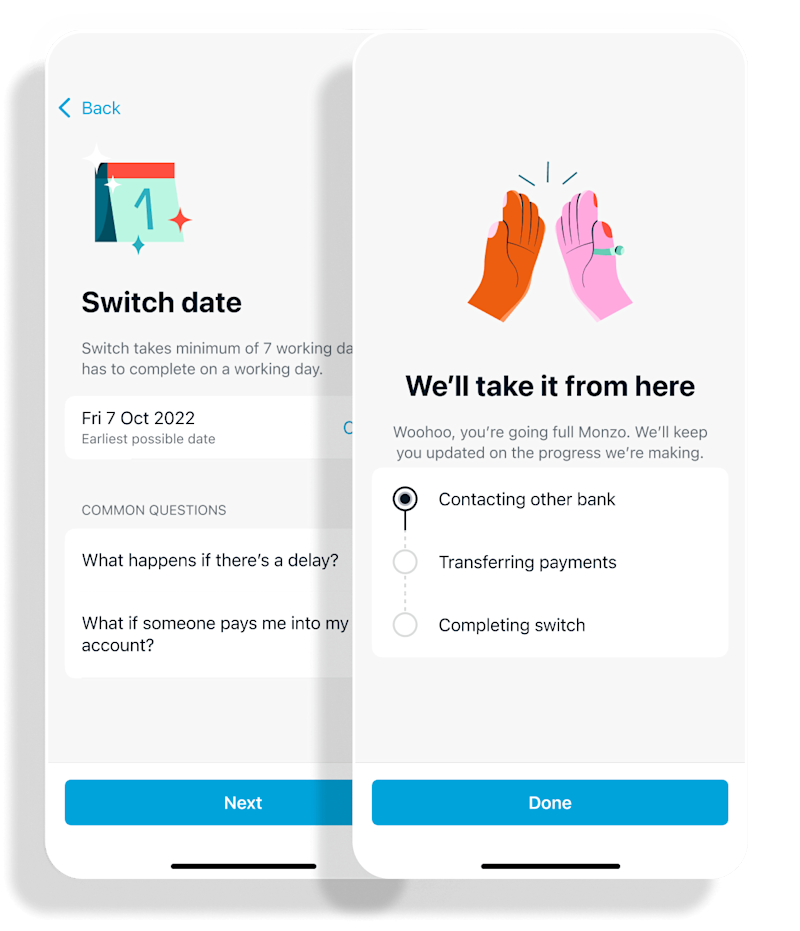

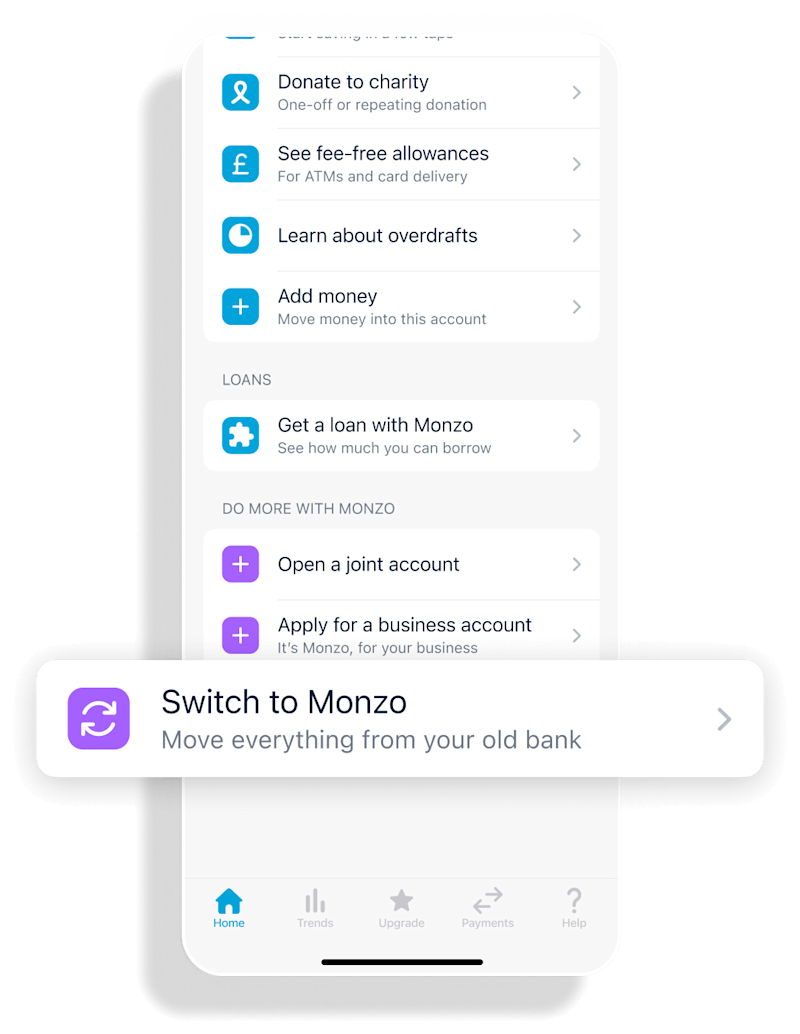

Want to switch?

Click the 'Home' tab at the bottom of the app

Click the circle with your face on, top left

Scroll down to 'Do more with Monzo'

Click 'Switch to Monzo' and follow the process

Third Party Provider permissions

If you've given permission to third-party providers (like payment services, money management apps or financial comparison sites) to make payments on your behalf or access any of your data, that access won't transfer automatically when you use the Current Account Switch Service to switch to Monzo.

If you want to bring access to the same services across with you will need to:

Cancel and re-authorise these with your new account details.

Contact the third party providers directly to discuss arranging set up at your new bank

Check which third-party provider permissions you have on the old account before the account is closed. Make a list of the ones you want to keep.

Once your switch to Monzo is finished, follow the third-party provider instructions on how to update your details.

Please bear in mind that not all third-party services are supported by all banks and building societies, so you might not be able to keep using all the same services with your new account.

Current Account Switch Guarantee

We have designed the Current Account Switch Service to let you switch your current account from one bank or building society to another in a simple, reliable and stress-free way. It will only take seven working days. As your new current-account provider we offer the following guarantee.

The service is free to use and you can choose and agree your switch date with us.

We will take care of moving your payments going out (for example, your Direct Debits and standing orders) and those coming in (for example, your salary).

If you have money in your old account, we will transfer it to your new account on your switch date.

We will arrange for payments accidentally made to your old account to be automatically redirected to your new account. We will also contact the sender and give them your new account details.

If there are any issues in making the switch, we will contact you before your switch date.

If anything goes wrong with the switch, as soon as we are told, we will refund any interest (paid or lost) and charges made on either your old or new current accounts as a result of this failure.

Current Account Switch Guide

About the service

The Current Account Switch Service makes switching current accounts from one UK bank or building society to another simple, reliable and stress-free. The service is available to consumers and small businesses, charities and trusts and allows you to choose a switch date that suits you.

The benefits

The new service provides all of the following benefits: • All your payments (in and out) will be moved to your new account. • Any remaining credit balance in your old account will be transferred to your new account and your old account will automatically close. • If any payments are accidentally made to your old account after your switch date, they’ll be automatically redirected or forwarded to your new account. • The switch process will be managed entirely by your new bank or building society and will be backed by the Current Account Switch Guarantee.

The guarantee provides the following:

The Current Account Switch Guarantee ensures your current account will switch on a day of your choice, your payments will be automatically transferred and redirected to your new account, and in the unlikely event anything goes wrong with your switch, we will refund any interest and charges (incurred on your old or new current accounts) as a result of this failure as soon as it is brought to our attention.

How to switch

Step 1. Complete a Current Account Agreement Form so your new bank can set up your switch. Step 2. Complete a Current Account Closure Instruction Form to authorise closure of your old account. Step 3. Agree a switch date that is at least 7 working days after your new account has been set up. Step 4. Relax as your new bank manages the switch (you will be contacted if there are any payments that cannot be transferred). Step 5. Continue to use your old account until your switch date.

On your switch date

All of the following will happen on your switch date: • Your payments (such as Direct Debits, Standing Orders and Bill Payments) will have all been transferred to your new account. • Any credit balance from your old account will have been transferred to your new account. • Your new account will be ready to use. • Your old account will be closed.

Other useful information

Third party providers

If you have given permissions to Third Party Providers to make payments on your behalf, or to access your financial data, access to these services won’t be transferred automatically to your new account as part of the Current Account Switch Service.

Before you close your old account, check whether you have any Third Party Provider permissions set up and if so, who with.

Once your new account is open you can give your permission to the Third Party Provider to access your new account by providing them with your new account details. You will need to contact the Third Party Provider directly yourself to set this up.

If you are unsure as to whether your new bank will support the Third Party Provider permissions on your account, you will need to discuss this ahead of your switch with your new provider who will be able to advise you of this. Please check your new provider’s terms and conditions for more information about Third Party Providers.

Continuous Payment Authority (CPA)

A CPA payment is a type of recurring payment that a merchant sets up on a customer's account using the debit card details. Examples of common CPA payments are Spotify and Netflix. CPAs do not transfer to your new bank during a switch so if you want to continue using them you will need to set them up again with the merchant.

Other types of recurring payments such as Direct Debits or standing orders will transfer to your new bank.

Overdrafts

If your new bank or building society agrees, bank accounts that include an overdraft can switch using the Current Account Switch Service. If you’d like to have an overdraft with your new bank account, speak to your new bank or building society before starting your switch. Your new bank or building society will be able to advise if you’re eligible for an overdraft, dependent on their lending criteria and your credit status.

Current Account Switch FAQs

1a. Personal Can I switch my current account?

Yes, you can use the service to switch accounts from and to any of the participating banks and building societies.

1b. Business Can I switch my current account?

Yes, so long as you have an annual turnover that does not exceed £6.5 million and you employ fewer than 50 people. If you are a small trust with a net asset value of less than £6.5 million you can also use the service. If you are still unsure whether you qualify, speak to us in-app.

2. Can I switch my savings account?

No, we can’t switch savings accounts or ISAs.

3. I have a joint account. Can I switch my current account?

Yes, as long as both parties agree to the switch and you are switching to another joint account. It is not possible to use the service to switch a joint account to a sole account.

4. Can I switch my current account if I am overdrawn?

Yes. You will need to agree any overdraft facilities you require with us before you switch.

5. Is the Current Account Switch Guarantee the same for all banks?

Yes, all banks and building societies that display the Current Account Switch Guarantee Trustmark will follow the same switching process and must offer the same guarantees. There are over 40 participating banks and building societies in the UK and you can see them here:

www.currentaccountswitch.co.uk/banksandbuildingsocieties.

6. What if my bank is not signed up to the Current Account Switch Guarantee?

If your old or new bank is not signed up, then you won't be able to use the Current Account Switch Service. You should talk to your new bank to find out how to switch your account.

7. Who provides the guarantee?

As a participant of the Current Account Switch Service, Monzo guarantees your switching process. Bacs, the people behind Direct Debits and Direct Credits in the UK, manage and oversee the service.

8. Can I choose my switch date?

Yes, you can choose and agree a switch date with us. Just make sure you allow seven working days for the switch to take place and that your chosen date isn't a Saturday, Sunday or Bank Holiday.

9. Are account opening and account switching all part of the same process

Account opening and account switching are separate processes. We carry out ‘know your customer’ security checks as part of our account opening process. Once these are complete you can choose and agree your switch date.

10. When does the switch begin?

Once you have applied for and opened your new account, you can choose the switch date to suit you. The date of your switch must be at least seven working days from this point.

11. Will the Current Account Switch Service automatically transfer new payment arrangements if I set them up at my old bank within 7 working days of the switch date agreed with Monzo?

No. The Current Account Switch Service will take care of all payment arrangements at your old bank up until 7 working days before your agreed switch date. If you want to set up new payment arrangements during the 7 working day period leading up to your switch date you must do this on your new account.

12. Will my recurring card payments be transferred over as part of a switch?

Recurring card payments, or Continous Payment Authority (CPA) payments are not transferred over as part of a switch, you will need to set them up with the merchant on your new bank. Examples of common CPA payments are Spotify and Netflix. Other recurring payments such as Direct Debits or standing orders will transfer to your new bank.

13. Do I have to close my old account?

If you use the Current Account Switch Service to switch, your old bank will close your old account. This ensures that any payments made to your old account are automatically redirected to your new account. If you would like to keep your old account open then you are free to do so, but you won’t be able to use the Current Account Switch Service to do this, and you will not be covered by the Guarantee. Speak to us in-app and find out more.

14. What happens to payments that people send to my old account?

All incoming and outgoing payments will be automatically redirected to your new account. Each time a payment is redirected, an automatic message is sent back to the originator advising them of your new account details so they can update their records. Some organisations may contact you directly to confirm your details have changed. If you do not want your new details to be given to someone who sends a one-off payment, contact us in-app.

15. When will the money in my old account be transferred to my new account?

You will be able to access the funds in your old account up to and until your switch date, when they will be transferred to your new account.

16. If the switch is delayed for any reason, can I still use my new account?

Yes, if the new account is open and you have money in it (or an overdraft agreed) then you can use it.

17. What happens to any debit card transactions or Direct Debits that I have asked my old bank to stop?

The Current Account Switch Service will not interfere with this process and any debit card or Direct Debit transactions that you have asked your bank to stop should remain stopped after your switch.

18. What will happen to any refunds applied to my old debit card after my old account is closed?

Any refunds which are applied to your old debit card after switching your account will be sent to your Monzo account. If you are expecting a refund and have not received it, please contact us in-app.

19. What if I change my mind?

You can cancel your switch up to seven working days before your switch date. If you do want to cancel, speak to us in-app.

20a. Personal

Monzo says I need to update my personal details with my old bank. Why? If the details you provide to your new bank do not match those held by your old bank you may be asked to contact your old bank and update them. Examples include if you have got married and not changed your maiden name to your married name, or if you have moved house and not told your old bank your new address. When you are updating your details with your old bank you do not have to tell them that you will be switching to a new bank.

20b. Business

Monzo says my business details do not match those held with my old bank. Do I need to update them? Yes, you need to update them, but you do not need to tell your bank that you are switching to a new bank. Examples include if you have changed your address and not told your old bank.

21. What will happen to my Paym registration when I switch?

On your switch date your old bank or building society will de-register your mobile phone number from Paym. If your new bank or building society offers Paym then you can re-register your mobile number with them. You can do this on or after your switch date, or earlier if you de-register your mobile number at your old bank or building society yourself.

22. I’ve allowed third parties (such as financial comparison websites, money management apps and payment services) access to my financial data. Will this be switched too?

No, you’ll need to cancel and re-authorise these with your new account details. You would need to contact the third party providers directly to discuss arranging set up at Monzo. If your old account is still open, your bank will be able to tell you which third parties you’ve given permission to make payments on your behalf, and/ or access your financial data.

Not all Third Party Providers services are supported by all banks and building societies, so there’s a chance that the Third Party Providers on your old account may not be able to access your new account. Please check Monzo's terms and conditions for more information about Third Party Providers.

23. Monzo doesn’t allow me to give my financial data to third parties. What will happen to third-party authorisations on my old account?

Unfortunately, you’ll no longer be able to use these services and any payments you have set up through them will end. If you’re not sure whether you have any third-party authorisations set up on your old account, check with your old bank before you close the account.

24. What happens to my old bank statements after I switch?

Your transaction history on your old account won’t be transferred through the Current Account Switch Service. If you’d like your old statements get in touch with your old bank.

25. What happens if there is a mistake or unnecessary delay in the switching process?

In the unlikely event that there are any issues in starting the switch, we will inform you before your switch date. If anything goes wrong, we will ensure that any charges or interest incurred on your old and/or new account as a result of the error will be refunded. It is for Monzo to decide whether you receive compensation above and beyond the refund.

26. Will switching my current account affect my credit rating?

Simply switching from one bank to another using the Current Account Switch Service will not affect your credit rating. However, when you open a new bank account, Monzo may run a credit score check which could affect your credit rating. In the unlikely event that during the switch you encounter any problems with payments (such as a standing order), we will correct them and ensure your credit rating is not affected.

27. Can I be sure that all payments made to my old account are redirected?

Yes, any payments made to your old account will automatically be redirected to your new account. Each time a payment is redirected, an automatic message is sent back to the originator advising them of your new account details so they can update their records. Some organisations may contact you directly to confirm your details have changed. Let us know in-app if you do not want us to provide your details to anyone.

28. My switch is not going as promised. Who do I contact?

If there’s a problem with your switch you should contact us in-app. If you've got any questions about the switching process, take a look at how to switch here: www.currentaccountswitch.co.uk/howtoswitch.

29. My Direct Debit hasn’t moved across after I’ve switched. What do I do?

If you're missing a Direct Debit and your switch is complete, contact us in-app. Remember all payments are covered by the Current Account Switch Guarantee and any charges or interest incurred on your old or new account as a result of the error will be refunded.

30. Who do I tell if I think the Current Account Switch Service does not meet my requirements? (Please note: if you have a complaint about the way the service has been delivered by Monzo please contact us in-app.)

If you think you have found a flaw, or missing feature, in the service design, or in the way that Bacs operates the service, please contact:

By email: Complete the Contact form on currentaccountswitch.co.uk, including a summary of the issue that you would like to raise.

By post: CASS Advisor, Bacs Payment Schemes Limited, 2 Thomas More Square, London, E1W 1YN. Enclosing a summary of the issue that you would like to raise.

Pay.UK will acknowledge receipt within 2 working days of receiving the email / letter and for more complex questions provide a detailed (initial) response within 10 working days.