Key stats

750k

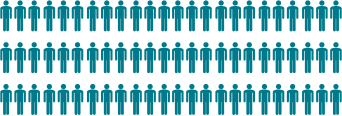

More than 750,000 customers

using current accounts

Our team has grown to

more than 300 people

The cost to run one active account

has reduced by 80%

in 10 months

July 2017

£50

September 2017

£65

February 2018

£30

June 2018

£15

£2bn

£2 billion’s been spent through Monzo so far

We ended the prepaid card programme on 4th April 2018, and 94% of active users upgraded to current accounts

We have a new mission

Monzo makes money work for everyone

Chief Executive’s review

In February this year we celebrated Monzo’s third birthday! It feels like a lot has changed in those three years.

Back in 2015 we were a scrappy startup, offering prepaid cards to a few thousand people. Today, we’re a fully-licensed, regulated bank with more than 750,000 people using current accounts. Our users have spent more than £2 billion through Monzo so far. And our founding team of a dozen people has grown into a company of more than 300.

Since the start, our commitment to transparency has been our guiding principle and underpins everything we do at Monzo today. It means our teams can work effectively and independently, with access to all the information they need to make good decisions. And, crucially, it helps us earn our customers’ trust. As we grow, I want to make sure we always keep that commitment, even when it isn’t easy.

Last year

We focussed on growth for the first six months of the last financial year. From just 50,000 users in September 2016, in one year we grew to almost half a million prepaid customers.

By September 2017, we were ready to offer current accounts, so we paused new signups for three months as we asked existing users to upgrade.

This process was tricky and technically complex. But we worked hard to make sure upgrading was as easy and convenient as possible for our customers. When we closed the prepaid programme on 4th April 2017, 94% of active users had upgraded to current accounts.That’s remarkable in an industry where inertia can be hard to overcome.

Moving to current accounts has given our customers access to all the power and protection that comes with a full banking licence. But it’s also helped us begin to address our next challenge: profitability.

In September 2017, each active prepaid account cost us £65 a year to run: we paid third parties to process payments and let users add money to their accounts by topping up from another debit card. We were also absorbing ATM costs for cash withdrawals customers made abroad and investing heavily in customer service.

The bank now runs entirely on technology we’ve built from scratch ourselves. As well as letting us respond quickly to changing customer demands, it also costs us less. By February 2018, we were able to run a full account for only £30.

Since then, we’ve further reduced costs by encouraging people to make bank transfers or pay salaries directly into their Monzo account, rather than topping up with a debit card. We’ve also been able to make savings by helping our customer support team become more efficient. Together, this has helped us lower the cost per account to around £15 in June.

About £10 of this cost goes towards providing fast, friendly support: the team who speak to our customers and solve their problems every day, in-app, over the phone and on social media. We see that £10 as an investment that lets us provide an effective, delightful service that’s reflected in a Net Promoter Score of almost +80.

All in all, that means we’ve reduced the cost to run each active account by almost 80% in just ten months.

The year ahead

In the next few months we’ll keep improving our unit economics: the money we lose or make on each current account. Our goal is to break even on each new customer very soon, then reach overall profitability as a business in the future. To work towards profitability, we’ll do two things.

First, we’ll work to lower the cost of providing customer support, while making sure the service stays world-class. We’ll do that by helping our staff work more effectively with better tools and automation. And we’ll reduce the number of questions coming in with a smarter help screen that lets customers find their own answers faster.

We’ll also work to generate revenue through lending. We started making overdrafts available in January, and around 37,000 people have now enabled them. Over the next few months, we’ll build new features that let people borrow in ways that are convenient, transparent and affordable.

All of our customers should be able to rely on Monzo as their main account. So at the same time we’ll keep working to make sure Monzo is reliable and equipped with everything they need to manage their money. At the end of May we published a list of all the basic but essential features that Monzo was still missing. We’ve been working through that list at pace, keeping track of our progress by ticking things off and sharing live updates with our community @MakingMonzo.

We’ll also start to work on growth again. More than 60,000 new people open Monzo accounts each month now, and in the next few months there’ll be one million people using Monzo. We plan to increase growth by adding product features with real network effects, that help people use Monzo together.

The way we use money is inherently social: we use it to do things with our family, friends, partners and colleagues on an almost-daily basis. But it isn’t always easy to use money together. It often means back-and-forths on WhatsApp, copy-pasting account numbers, and confusion about who’s paid and who hasn’t. Traditional banking isn’t built for the way we use our money today as part of our everyday lives.

Right now, the average user has 15 friends on Monzo, and 80% of our growth comes from word of mouth referrals. To maximise that viral growth we’ll add product features that work better the more people you know on Monzo.

By the end of 2019, our goal is that several million people in the UK will be using Monzo.

Our mission

We’ve always said that our vision is to build Monzo into a marketplace. A “financial hub” or “control centre” that gives people visibility and control of all of their money.

But a "control centre” feels a bit like the cockpit of a jumbo jet – a bewildering array of buttons and dials. It doesn’t communicate the simplicity and peace-of-mind that we strive to give our customers.

So we wanted to find a better way to articulate our mission to the world. Here’s what we came up with:

“Monzo makes money work for everyone”

I like this as a mission statement because it’s bold, positive and ambitious.

“It just works” - We believe that money doesn’t need to be complicated or stressful. A nod to Apple’s famous slogan, we use design thinking to deliver simple, intuitive interfaces.

Putting your money to work - We also want to make sure our customers get the most out of their money, whether that’s earning cash back or rewards, making smart investment decisions, or finding affordable ways to borrow.

Monzo is for everyone - Our aims are ambitious: our goal is to bring Monzo to one billion people and beyond. But it’s not just about how many people use Monzo, it’s also about who.

One and a half million adults in the UK don’t have a bank account and almost a quarter of the world’s population are unbanked. Without access to basic financial services like bank accounts, you pay more and save less. You can’t use vital services, or do basic things like pay rent or buy a phone. In the next few years, we’ll do more to help the financially excluded access bank accounts through Monzo.

We’ll also keep supporting vulnerable customers and continue developing an empathetic approach to debt management. And through clear communications and educational content, we’ll do what we can to improve financial literacy and help everyone better understand their money.

Tom Blomfield

CEO

27 June 2018

General Information

Directors

T Blomfield

T Brooke (acting Chairman)

E Burbidge

Baroness D Kingsmill (resigned 6 April 2018)

G Dolman

M Grimshaw

K Woollard

A Kirk

Registered Office

1st Floor

230 City Road

London EC1V 2QY

Registration number

09446231

Auditors

Ernst & Young LLP

25 Churchill Place

Canary Wharf

London E14 5EY

Bankers

NatWest Markets Plc

280 Bishopsgate

London EC2M 4RB

Solicitors

Taylor Wessing LLP

5 New Street Square

London EC4A 3TW

Strategic report

The directors present their strategic report for the year ended 28 February 2018 for Monzo Bank Limited (the “Bank”, “Monzo” or the “Company”).

Business review and key financial and other performance indicators

We’ve included a review of the business and other performance indicators as part of the Chief Executive’s review.

The loss for the year before tax was £33.1m (2017 £7.9m) primarily as a result of an increase in our operating costs.

Our costs increased by £26.9m to £34.9m in the current year (2017 £8m) as a result of investment in the banking operations with the Company becoming a fully operational bank during the year.

The total equity increased to £56.2m (2017 £18.4m) as a result of two fundraising rounds undertaken in the year and the Bank continued to be in a capital surplus position during the year.

We’ve developed our governance structure to support our launch as a bank

It comprises a Board of Directors supported by 4 Board committees, each of which has membership drawn from the independent non-executives on the Board. The 4 committees are:

Risk & Compliance Committee

Audit Committee

Remuneration Committee

Nomination Committee

Day to day running of the business is delegated to the CEO who has established 2 management committees to support him: an Executive Committee for general business matters, and an Assets and Liability Committee on balance sheet matters.

Strong risk management is at the heart of everything we do

At Monzo, we’re exposed to a number of risks through our business model and business strategy. Identifying, assessing, managing and reporting on those risks is central to the way we run the Bank. Good risk management lets us achieve our strategic objectives without putting us or our customers at risk of harm, while being compliant with all relevant rules and regulations.

Staff describe our culture as one of transparency, honesty, respect and putting the customer’s needs first. This culture stems from the “tone at the top” set by the executive team and filters through the organisation. Our incentives (including share options) are structured to support the long-term health of the organisation rather than any short-term gains.

Risk Management Framework

Our approach to risk management supports the wider business strategy. Our Risk Management Framework comprises 6 key components: risk appetite, policies, a 3 line of defence organisation structure, risk procedures, tools and techniques, risk reporting, and an appropriate governance structure.

Principal Risks

Our principal risks are:

-

Strategic and Business Model Risk – risk or threats that materially affect the business strategy, business model and consequently whether our business plan succeeds.

-

Customer Outcome Risk – risk that our culture, behaviours and/or actions result in poor customer outcome and/or detriment to customers through our product and services not meeting their needs.

-

Retail Credit Risk – risk that customers who borrow don’t meet their obligations with us.

-

Operational Risk – risk of direct or indirect loss from failed internal processes, people and systems and/or from external events.

-

Financial Risk – risks which impact the financial profile of the business including market risk on financial instruments, capital adequacy risk and liquidity risk.

-

Compliance Risk – risk of failing to meet with the relevant legislation and/or regulations.

Risk Profile

Our key risks currently include different types of operational risk like financial crime, IT resilience, cyber security (including data security). But this is always evolving as we develop our current account and acquire credit risk from lending in the form of overdrafts.

On behalf of the Board

Tom Blomfield

Director

27 June 2018

Directors’ report

The directors present their report and financial statements for the year ended 28 February 2018 for the Bank. These financial statements have been prepared under International Financial Reporting Standards as adopted by the European Union. The registration number of Monzo is 09446231.

Information regarding a review of the business, and likely future developments are disclosed in the Chief Executive's review and information regarding risk management is disclosed in the Strategic report.

Results and dividends

The loss for the year after taxation amounted to £30.5m (2017 loss of £6.7m). The directors do not recommend a final dividend (2017 – £nil).

Principal activities of the business

The principal activity of Monzo is to provide retail banking services in the UK.

During the period Monzo continued building the ability to provide banking services to its customers and had the restrictions on its banking licence lifted in April 2017. The Company launched a current account for its customer base and an overdraft facility for a subset of its customers.

Directors

The directors who served the Company during the year and up to the date of the approval of the financial statements were as follows:

T Blomfield

T Brooke (acting Chairman)

E Burbidge

Baroness D Kingsmill (resigned 6 April 2018)

G Dolman

M Grimshaw

K Woollard

A Kirk

Directors’ liabilities

The Bank has indemnified all directors of the Bank against liability in respect of proceedings brought by third parties, subject to the conditions set out in section 234 of the Companies Act 2006. Such qualifying third party indemnity provision was in force during the year.

Going concern

The going concern basis is dependant on maintaining enough capital and funding the balance sheet. The directors have considered a number of factors including the projections for the Company and its capital and funding position. Having considered this and other appropriate enquiries the Directors consider that the Company has raised enough equity to make sure that it can operate for at least 12 months from the date of approval of the financial statements. Details of equity raised are contained in Note 20. Consequently the financial statements have been prepared on a going concern basis.

Financial instruments

The Bank finances its activities through the issue of ordinary shares as disclosed in Note 20 and through cash deposits held as disclosed in Note 13. The Bank also holds customer deposits classified as a financial liability, and issues overdrafts to customers which are classified as a financial asset. Other financial assets and liabilities like trade creditors arise from the Bank’s operating activities.

The Bank doesn’t use any other financial instruments.

Research and development activities

Monzo invests in the development of its own platforms and products, so has applied to claim Research & Development (R&D) relief from HMRC, see Note 15.

Donations

The Bank hasn’t made any charitable donations exceeding £2k and hasn’t made any donations or incurred any expense to any registered UK political party or other EU political organisation.

Events since the balance sheet date

The key events that have occurred since the balance sheet date are listed below:

-

The prepaid card product was discontinued effective 4 April 2018.

-

The Bank signed a 2-year lease for new office space on 6 March 2018 with an anticipated move in date of August 2018 at which point the existing office space lease will be surrendered.

There have been no other material post balance sheet events.

Disclosure of information to the auditors

So far as each person who was a director at the date of approving this report is aware, there’s no relevant audit information, being information needed by the auditor in connection with preparing its report, of which the auditor is unaware. Having made enquiries of fellow directors and the Company’s auditor, each director has taken all the steps that they’re obliged to take as a director to make themselves aware of any relevant audit information, and to establish that the auditor is aware of that information.

Auditors

Ernst & Young LLP have been re-appointed pursuant to section 487(2) of the Companies Act 2006 unless the members or directors resolve otherwise.

On behalf of the Board

Tom Blomfield

Director

27 June 2018

Statement of director’s responsibilities

The directors are responsible for preparing the strategic report, director’s report and the financial statements in accordance with applicable United Kingdom law and those International Financial Reporting Standards as adopted by the European Union.

Under Company Law the directors must not approve the financial statements unless they are satisfied that they present fairly the financial position, financial performance and cash flows of the Company for that period. In preparing those financial statements the directors are required to:

-

select suitable accounting policies in accordance with IAS 8: Accounting Policies, Changes in Accounting Estimates and Errors and then apply them consistently;

-

present information, including accounting policies, in a manner that provides relevant, reliable, comparable and understandable information;

-

provide additional disclosures when compliance with the specific requirements in IFRSs is insufficient to enable users to understand the impact of particular transactions, other events and conditions on the Company's financial position and financial performance;

-

state that the Company has complied with IFRSs, subject to any material departures disclosed and explained in the financial statements; and

-

make judgements and estimates that are reasonable and prudent.

The directors are responsible for keeping adequate accounting records that are sufficient to show and explain the Company's transactions and disclose with reasonable accuracy at any time the financial position of the Company and enable them to ensure that the financial statements comply with the Companies Act 2006. They are also responsible for safeguarding the assets of the Company and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

Independent auditors’ report to the members of Monzo Bank Limited

Opinion

We have audited the financial statements of the Company for the year ended 28 February 2018 which comprise the Statement of Comprehensive Income, the Statement of Financial Position, the Statement of Changes in Equity, the Statement of Cash Flows and the related notes 1 to 28, including a summary of significant accounting policies. The financial reporting framework that has been applied in their preparation is applicable law and International Financial Reporting Standards (IFRSs) as adopted by the European Union.

In our opinion, the financial statements:

-

give a true and fair view of the Company’s affairs as at 28 February 2018 and of its loss for the year then ended;

-

have been properly prepared in accordance with IFRSs as adopted by the European Union; and

-

have been prepared in accordance with the requirements of the Companies Act 2006.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the financial statements section of our report below. We are independent of the Company in accordance with the ethical requirements that are relevant to our audit of the financial statements in the UK, including the FRC’s Ethical Standard as applied to public interest entities, and we have fulfilled our other ethical responsibilities in accordance with these requirements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Use of our report

This report is made solely to the Company’s members, as a body, in accordance with Chapter 3 of Part 16 of the Companies Act 2006. Our audit work has been undertaken so that we might state to the Company’s members those matters we are required to state to them in an auditor’s report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Company and the Company’s members as a body, for our audit work, for this report, or for the opinions we have formed.

Conclusions relating to going concern

We have nothing to report in respect of the following matters in relation to which the ISAs (UK) require us to report to you where:

-

the directors’ use of the going concern basis of accounting in the preparation of the financial statements is not appropriate; or

-

the directors have not disclosed in the financial statements any identified material uncertainties that may cast significant doubt about the Company’s ability to continue to adopt the going concern basis of accounting for a period of at least twelve months from the date when the financial statements are authorised for issue.

Overview of our audit approach

| Key audit matters |

|

|---|---|

| Materiality |

|

Key audit matters

Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the financial statements of the current year and include the most significant assessed risks of material misstatement (whether or not due to fraud) that we identified. These matters included those which had the greatest effect on: the overall audit strategy, the allocation of resources in the audit; and directing the efforts of the engagement team. These matters were addressed in the context of our audit of the financial statements as a whole, and in our opinion thereon, and we do not provide a separate opinion on these matters.

| Risk |

Overdraft recoverability (2018 £12k, 2017 £0) Overdrafts are a new product for the Company. There is currently limited historic information showing the repayment profile of the customer base and this therefore impacts the valuation of the asset. An impairment may be required over the asset if it is not deemed fully recoverable. Given the nature of the product and the client base of the Company, we have considered there to be a risk of recoverability over the overdrawn balances – which translates into a risk of overstatement of the net overdraft asset. This is a new risk for the current year audit as this is the first year the Company will have an overdraft product on the balance sheet. |

|---|---|

| Our response to the risk |

All controls existing around the processes that drive the impairment provision are heavily reliant on the completeness and accuracy of reports generated by the core banking platform at the Bank. Due to these controls being implemented for part of the year under audit, we are unable to place reliance on them for the full year. We have therefore adopted a substantive testing audit approach. We, along with our specialists, have reviewed the accounting policy documentation and assessed whether management’s process to identify impairment is sufficiently robust and compliant with the underlying accounting guidance (as prescribed in International Accounting Standard 39). We performed the following procedures during our audit:

|

| Key observations communicated to the Audit Committee |

Our validation of key inputs to the impairment calculation model revealed that data flows to the underlying model were materially complete and accurate. The impairment model assumptions and methodology were found to be appropriate. Our procedures around stress testing and sensitivity analysis of key inputs did not reveal any material errors over the calculated provision. Based on our work performed, we have concluded that the impairment provision in respect of overdrafts is materially correct as at 28 February 2018. |

| Risk |

Improper revenue recognition (2018 £2,041k, 2017 £112k) We reviewed the revenue streams earned by the Company, and assessed which of these could give rise to a material error in the financial statements. We determined that Interchange fees were a significant risk based on size and complexity around recording transaction volumes which determine Interchange revenues. This is a new risk for the current year’s audit as this is the first year the income has become material. |

|---|---|

| Our response to the risk |

The key risk for us is the recording of Interchange fee in the incorrect period. As noted above, due to the controls not having operated for the full year of audit and the resulting lack of maturity in the control environment, we adopted a substantive testing audit approach which included increased sample sizes and substantiation across the population to gain assurance. To address the identified risk, we performed the following audit procedures:

|

| Key observations communicated to the Audit Committee |

We are satisfied that the Company has recorded revenue in line with its accounting policy. Based on our work performed we can conclude that the Company has recorded and recognised Interchange revenue appropriately in the year under audit. |

| Risk |

Risk of management override International Auditing Standards (UK & Ireland) mandate the consideration of management override of internal controls as a fraud risk on all audits. The susceptibility of an accounting estimate to management bias increases with the subjectivity involved in making it. As part of our response to the risks of material misstatement involving management (i.e., the risk of management override), we review significant accounting estimates for evidence of management bias. We remain alert to the possibility that management’s involvement in the preparation of the financial statements, and its responsibility for the judgments and assumptions relating to significant estimates, increases the risk of material misstatement due to fraud. Our risk assessment incorporated specific consideration of significant transactions and estimates, including:

|

|---|---|

| Our response to the risk |

As previously noted, due to the controls not having operated for the full year of audit and the resulting lack of maturity in the control environment, we adopted a substantive testing audit approach which included increased sample sizes and substantiation across the population to gain assurance. In each area where we identified an associated risk of management override, we performed the following audit procedures: Share based payments

R&D tax credit claim

Journals with higher risk characteristics As a standard procedure in response to the risk of management override we completed our journal entry testing for the year under audit. This testing focused on significant or unusual journals, focusing on significant risk areas, journals posted around key estimates and any topside adjustments using data analytics. |

| Key observations communicated to the Audit Committee |

Share based payments Based on our work performed, we have concluded that the Bank has appropriately valued the share based payments as at the year end date, using the Black Scholes option pricing model. R&D tax credit claim Our specialists performed an analysis to establish a reasonable range of estimates resulting in a provision which we believe is reasonable. The range was determined based on our understanding of the management’s claim, our review of their responses to HMRC queries, and our industry knowledge. We reviewed management’s claim within this range. Based on this work performed and our assessment of the provision that management has recorded, we believe that the amount of the provision recorded against their claim is reasonable at the year end. Journals with higher risk characteristics We did not identify any unusual journals from the testing performed. |

| Risk |

Incomplete and / or inaccurate transfer of assets from third party systems to the core banking system at the Company (2018 £26.4m, 2017 £0) During the year, the Company migrated the majority of its existing prepaid card customers, previously maintained by a third party (the Prepaid Third Party), to its in-house core banking system. There is a risk of inaccurate or incomplete transfer of key customer data during the migration process, which took place in phases. |

|---|---|

| Our response to the risk |

To address the identified risk, we performed the following audit procedures:

|

| Key observations communicated to the Audit Committee |

The balances recorded in the financial statements as receivable due from the Prepaid Third Party as at the year end in respect of migrated account balances are complete and accurate. We note from our review of post migration activity reports from, and communication with, the Prepaid Third Party that migrated customer balances are no longer managed by the Prepaid Third Party. Our confirmation procedures, and alternative procedures for non-responses, provided assurance over the accuracy of migrated customer balances, with no exceptions noted. Based on our work performed, the Company has migrated customer balances completely and accurately from the Prepaid Third Party to its core Banking system. |

An overview of the scope of our audit

Tailoring the scope

Our assessment of audit risk, our evaluation of materiality and our allocation of performance materiality determine our audit scope for the Company. This enables us to form an opinion on the financial statements. We take into account size, risk profile, the organisation of the Company and effectiveness of controls, including controls and changes in the business environment when assessing the level of work to be performed. All audit work was performed directly by the audit engagement team.

Our application of materiality

We apply the concept of materiality in planning and performing the audit, in evaluating the effect of identified misstatements on the audit and in forming our audit opinion.

Materiality

The magnitude of an omission or misstatement that, individually or in the aggregate, could reasonably be expected to influence the economic decisions of the users of the financial statements. Materiality provides a basis for determining the nature and extent of our audit procedures.

We determined materiality for the Company to be £600k (2017 £132k), which is 1% of equity (2017 2% of admin expenses). We believe that equity provides us the appropriate magnitude on which an omission or misstatement that, individually or in the aggregate, in light of the surrounding circumstances, would reasonably be expected to influence the economic decisions of the users of the financial statements. The change from administrative expenses compared to prior year is due to the progress made by the Company and thereby changes in the focus of the users of financial statement.

Performance materiality

The application of materiality at the individual account or balance level. It is set at an amount to reduce to an appropriately low level the probability that the aggregate of uncorrected and undetected misstatements exceeds materiality.

On the basis of our risk assessments, together with our assessment of the Company’s overall control environment, we have set performance materiality at 50% (2017 50%) of our planning materiality, equating to £300k (2017 £66k). The ongoing development of new products and internal processes has also contributed to our assessment of setting performance materiality at this level.

Reporting threshold

An amount below which identified misstatements are considered as being clearly trivial.

We have reported to the directors all uncorrected audit differences in excess of £30k (2017 £6k), which is set at 5% (2017 5%) of planning materiality, as well as differences below that threshold that, in our view, warranted reporting on qualitative grounds.

We evaluate any uncorrected misstatements against both the quantitative measures of materiality discussed above and in light of other relevant qualitative considerations in forming our opinion.

Other information

The other information comprises the information included in the annual report set out on pages 1 to 12, other than the financial statements and our auditor’s report thereon. The directors are responsible for the other information.

Our opinion on the financial statements does not cover the other information and, except to the extent otherwise explicitly stated in this report, we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If we identify such material inconsistencies or apparent material misstatements, we are required to determine whether there is a material misstatement in the financial statements or a material misstatement of the other information. If, based on the work we have performed, we conclude that there is a material misstatement of the other information, we are required to report that fact.

We have nothing to report in this regard.

Opinions on other matters prescribed by the Companies Act 2006

In our opinion, based on the work undertaken in the course of the audit:

-

the information given in the strategic report and the directors’ report for the financial year for which the financial statements are prepared is consistent with the financial statements; and

-

the strategic report and directors’ report have been prepared in accordance with applicable legal requirements.

Matters on which we are required to report by exception

In the light of the knowledge and understanding of the Company and its environment obtained in the course of the audit, we have not identified material misstatements in the strategic report or directors’ report.

We have nothing to report in respect of the following matters in relation to which the Companies Act 2006 requires us to report to you if, in our opinion:

-

adequate accounting records have not been kept; or

-

the financial statements are not in agreement with the accounting records and returns; or

-

certain disclosures of directors’ remuneration specified by law are not made; or

-

we have not received all the information and explanations we require for our audit.

Responsibilities of directors

As explained more fully in the directors’ responsibilities statement set out on page 12, the directors are responsible for the preparation of the financial statements and for being satisfied that they give a true and fair view, and for such internal control as the directors determine is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, the directors are responsible for assessing the Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the directors either intend to liquidate the Company or to cease operations, or have no realistic alternative but to do so.

Auditor’s responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs (UK) will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

Explanation as to what extent the audit was considered capable of detecting irregularities, including fraud

The objectives of our audit:

-

in respect to fraud, are; to identify and assess the risks of material misstatement of the financial statements due to fraud; to obtain sufficient appropriate audit evidence regarding the assessed risks of material misstatement due to fraud, through designing and implementing appropriate responses; and to respond appropriately to fraud or suspected fraud identified during the audit. However, the primary responsibility for the prevention and detection of fraud rests with both those charged with governance of the entity and management; and

-

in respect to irregularities, considered to be non-compliance with laws and regulations, are to obtain sufficient appropriate audit evidence regarding compliance with the provisions of those laws and regulations generally recognized to have a direct effect on the determination of material amounts and disclosures in the financial statements (‘direct laws and regulations’), and perform other audit procedures to help identify instances of non-compliance with other laws and regulations that may have a material effect on the financial statements. We are not responsible for preventing non-compliance with laws and regulations and our audit procedures cannot be expected to detect non-compliance with all laws and regulations

Our approach in summary was as follows:

-

We obtained a general understanding of the legal and regulatory frameworks that are applicable to the Company and determined that the direct laws and regulations related to elements of company law and tax legislation, and the financial reporting framework. Our considerations of other laws and regulations that may have a material effect on the financial statements included permissions and supervisory requirements of the Prudential Regulation Authority (‘PRA’) and the Financial Conduct Authority (‘FCA’).

-

We obtained a general understanding of how the Company complies with these legal and regulatory frameworks by making enquiries of management, internal audit, and those responsible for legal and compliance matters. We also reviewed correspondence between the Company and UK regulatory bodies; reviewed minutes of the Board and Risk Committee; and gained an understanding of the Company’s approach to governance, demonstrated by the Board’s approval of the Company’s governance framework and internal control processes.

-

For direct laws and regulations, we considered the extent of compliance with those laws and regulations as part of our procedures on the related financial statement items.

-

For both direct and other laws and regulations, our procedures involved: making enquiry of those charged with governance and senior management for their awareness of any non-compliance of laws or regulations, inquiring about the policies that have been established to prevent non-compliance with laws and regulations by officers and employees, inquiring about the Company’s methods of enforcing and monitoring compliance with such policies, and inspecting significant correspondence with the FCA and PRA.

-

We understood the activities of the Company to primarily include deposit taking, with overdrafts as the main product offering. The Company received its full banking license in April 2017.

-

We assessed the susceptibility of the Company’s financial statements to material misstatement, including how fraud might occur by inappropriate recognition of revenue and management override of controls.

-

We continued to identify weaknesses in the Company’s control environment in excess of what would be considered normal in the banking industry. This limited the opportunities that we had to place audit reliance on the design, implementation and operating effectiveness of the key controls that management relies on for the proper functioning of the Company’s systems and processes. This is because the control environment is not mature and is currently under development. This substantially increases operational risk, and required us to identify and test any compensating manual controls and undertake further additional substantive testing in most areas of the Company’s operations.

-

The Company operates in the banking industry which is a highly regulated environment. As such the Senior Statutory Auditor considered the experience and expertise of the engagement team to ensure that the team had the appropriate competence and capabilities, which included the use of specialists where appropriate.

A further description of our responsibilities for the audit of the financial statements is located on the Financial Reporting Council’s website at https://www.frc.org.uk/auditorsresponsibilities. This description forms part of our auditor’s report.

Javier Faiz (Senior statutory auditor) for and on behalf of

Ernst & Young LLP,

Statutory Auditor

London

27

June 2018

Notes:

-

The maintenance and integrity of the Monzo Bank Limited web site is the responsibility of the directors; the work carried out by the auditors does not involve consideration of these matters and, accordingly, the auditors accept no responsibility for any changes that may have occurred to the financial statements since they were initially presented on the web site.

-

Legislation in the United Kingdom governing the preparation and dissemination of financial statements may differ from legislation in other jurisdictions.

Statement of comprehensive income

for the year ended 28 February 2018

|

Notes |

Year ended |

Year ended |

|||

|---|---|---|---|---|---|

|

28 February 2018 |

28 February 2017 |

||||

|

£'000 |

£'000 |

||||

|

Interest income |

150 |

- |

|||

|

Fee and commission income |

2,201 |

112 |

|||

|

Fee and commission expense |

(834) |

- |

|||

|

Net fee and commission income |

6 |

1,367 |

112 |

||

|

Other operating income |

309 |

8 |

|||

|

Credit impairment charges |

7 |

(12) |

- |

||

|

Net operating income |

1,814 |

120 |

|||

|

Personnel expenses |

8 |

(9,214) |

(2,529) |

||

|

Depreciation and Amortisation expense |

16,17 |

(250) |

(41) |

||

|

Other operating expenses |

11 |

(25,426) |

(5,477) |

||

|

Total operating expense |

(34,890) |

(8,047) |

|||

|

Loss before tax |

(33,076) |

(7,927) |

|||

|

Taxation |

12 |

2,530 |

1,238 |

||

|

Loss after tax |

(30,546) |

(6,689) |

|||

|

Total comprehensive loss |

(30,546) |

(6,689) |

The results for the current and prior year are derived entirely from continuing operations.

The notes 1 to 28 form an integral part of these financial statements.

Statement of financial position

for the year ended 28 February 2018

|

Notes |

28 February 2018 |

28 February 2017 |

|||

|---|---|---|---|---|---|

|

£'000 |

£'000 |

||||

|

Assets |

|||||

|

Cash and balances at bank |

13 |

96,943 |

14,874 |

||

|

Loans and advances to customers |

14 |

160 |

- |

||

|

Other assets |

15 |

41,880 |

4,402 |

||

|

Property, plant and equipment |

16 |

823 |

178 |

||

|

Intangible assets |

17 |

14 |

24 |

||

|

Total assets |

139,820 |

19,478 |

|||

|

Liabilities |

|||||

|

Customer deposits |

18 |

71,276 |

- |

||

|

Other liabilities |

19 |

12,365 |

1,080 |

||

|

Total liabilities |

83,641 |

1,080 |

|||

|

Equity |

|||||

|

Called up share capital |

20 |

- |

- |

||

|

Share premium account |

93,989 |

26,298 |

|||

|

Other reserves |

871 |

235 |

|||

|

Accumulated losses |

(38,681) |

(8,135) |

|||

|

Total equity |

56,179 |

18,398 |

|||

|

Total liabilities and equity |

139,820 |

19,478 |

The notes 1 to 28 form an integral part of these financial statements. The financial statements on pages 12 to 48 were approved and authorised for issuance by the Board on 27 June 2018 and signed on its behalf by:

Tom Blomfield

Director

Statement of changes in equity

for the year ended 28 February 2018

|

Share |

Share |

Other |

Retained |

Total |

||

|---|---|---|---|---|---|---|

|

capital |

premium |

reserves |

losses |

equity |

||

|

£'000 |

£'000 |

£'000 |

£'000 |

£'000 |

||

|

Balance as at 1 March 2016 |

- |

2,000 |

14 |

(1,446) |

568 |

|

|

Shares issued |

- |

24,288 |

- |

- |

24,288 |

|

|

Cost of issuance |

- |

(63) |

- |

- |

(63) |

|

|

Share based payments reserve |

- |

- |

294 |

- |

294 |

|

|

Exercise of options |

- |

73 |

(73) |

- |

- |

|

|

Losses for the year |

- |

- |

- |

(6,689) |

(6,689) |

|

|

Balance as at 28 February 2017 |

- |

26,298 |

235 |

(8,135) |

18,398 |

|

|

Shares issued |

- |

67,849 |

- |

- |

67,849 |

|

|

Cost of issuance |

- |

(437) |

- |

- |

(437) |

|

|

Share based payments reserve |

- |

- |

915 |

- |

915 |

|

|

Exercise of options |

- |

279 |

(279) |

- |

- |

|

|

Losses for the year |

- |

- |

- |

(30,546) |

(30,546) |

|

|

Balance as at 28 February 2018 |

- |

93,989 |

871 |

(38,681) |

56,179 |

The share capital as at 28 February 2018 was £11 (2017 £7) which is shown as £nil (rounded to £’000) in the above table. See Note 20 for further detail.

Statement of cash flows

for the year ended 28 February 2018

|

Notes |

Year ended |

Year ended |

||

|---|---|---|---|---|

|

28 February 2018 |

28 February 2017 |

|||

|

£'000 |

£'000 |

|||

|

Cash flows from operating activities |

||||

|

Loss for the year |

(30,546) |

(6,689) |

||

|

Adjustments for non-cash items: |

||||

|

Depreciation of property plant and equipment |

241 |

36 |

||

|

Amortisation of intangible assets |

10 |

5 |

||

|

Share based payments |

916 |

294 |

||

|

Provisions |

12 |

- |

||

|

Changes in operating assets and liabilities: |

||||

|

Net increase in loans and advances to customers |

(160) |

- |

||

|

Net increase in customer deposits |

71,276 |

- |

||

|

Increase in other assets |

15 |

(37,477) |

(4,082) |

|

|

Increase in other liabilities |

19 |

11,285 |

904 |

|

|

Net cash used in operating activities |

15,557 |

(9,532) |

||

|

Cash flows from investing activities |

||||

|

Acquisition of property, plant and equipment |

16 |

(886) |

(201) |

|

|

Acquisition of intangible assets |

17 |

- |

(29) |

|

|

Net cash from investing activities |

(886) |

(230) |

||

|

Cash flows from financing activities |

||||

|

Net proceeds from issuance of ordinary shares |

67,398 |

24,225 |

||

|

Net cash from financing activities |

67,398 |

24,225 |

||

|

Net increase in cash and cash equivalents |

82,069 |

14,463 |

||

|

Cash and cash equivalents at beginning of the year |

14,874 |

411 |

||

|

Cash and cash equivalents at end of year |

13 |

96,943 |

14,874 |

Notes to the financial statements

for the year ended 28 February 2018

-

Reporting entity

Monzo Bank Limited is a private limited Company incorporated and registered in England and Wales. Individual financial statements have been presented for the Company.

-

Basis of preparation

The financial statements have been prepared on an historical cost basis in accordance with International Financial Reporting Standards (‘IFRSs’) as adopted by the European Union and Companies Act 2006.

The financial statements are presented in Sterling (£’000 or £k), which is also the Company’s functional currency.

The amounts expected to be recovered or settled for assets and liabilities in the financial statements are due no more than 12 months after the reporting period unless specifically stated.

-

New accounting standards

As at the date of these financial statements, certain standards were in issue and effective for periods beginning on or after 1 January 2018, and have not been early adopted for the year ended 28 February 2018. These standards have been adopted from 1 March 2018.

IFRS 9 Financial instruments

IFRS 9 will replace IAS 39 for annual periods on or after 1 January 2018. In preparation for the adoption of IFRS 9 from 1 March 2018 for the financial year ending 28 February 2019, the Company established an IFRS 9 governance framework and programme for implementation in compliance with the standard and regulatory guidance. The programme involved multiple functions across the Company and external consultants with a steering committee established providing oversight. The key responsibilities of the programme included defining IFRS 9 methodology specifically in respect of credit loss provisioning, identifying data requirements, development of expected loss models, and establishing an appropriate operating model and governance framework.

From a classification and measurement perspective, the new standard will require all financial assets, except equity instruments and derivatives, to be assessed based on a combination of the entity’s business model for managing the assets and the instruments’ contractual cash flow characteristics. The accounting for financial liabilities will largely be the same as the requirements of IAS 39, except for the treatment of gains or losses arising from an entity’s own credit risk relating to liabilities designated at fair value through profit and loss (FVPL).

The adoption of IFRS 9 for the financial year beginning 1 March 2018 has not resulted in a significant change to the current financial asset and liability classification, with cash and balances at bank, loans and receivables and customer deposits, continuing to be measured at amortised cost under IFRS 9.

There has been a change in measurement bases specifically in regards to a change of basis of provisioning to a view of expected loss for financial assets such as overdrafts for Monzo. This change has not had a material impact in comparison to the provisions recorded under IAS 39. Further details are provided in Note 25.

The expected loss on other financial instruments such as cash and other assets is not considered material and as such has not been calculated.

IFRS 15 Revenue from contracts with customers

The Company has reviewed the requirements of the new standard and there has been no significant impact.

As at the date of these financial statements, certain standards were in issue but not yet effective and have not been applied.

IFRS 16 Leases (effective date for periods beginning on or after 1 January 2019)

This standard will result in lessees recognising both a right of use asset and a lease liability on the balance sheet under a single lease model removing the distinction between finance and operating leases.

A detailed analysis of the impact on the Company has not yet been performed though it is likely that on adoption there will be an increase in both assets and liabilities.

-

Critical accounting estimates, judgments and assumptions

The preparation of the financial statements requires the use of accounting estimates and assumptions. Estimates and judgements are continually evaluated based on historical experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. In the future, actual experience may differ from these estimates and assumptions.

Management considers that the accounting estimates relating to fair valuing stock based compensation (Note 10), going concern (see Director’s report), the recognition of a research and development (R&D) credit (Note 15) and the recognition (or not) of deferred tax assets for carried forward tax losses (Note 12) as the most material to the financial statements.

-

Summary of significant accounting policies

This note provides a list of the significant accounting policies adopted in the preparation of these financial statements to the extent they have not already been disclosed in the other notes above.

-

Interest income

Interest income is recognised in the income statement for all instruments measured at amortised cost using the effective interest rate method to the extent that it is probable that the economic benefits will flow to the Company and can be reliably measured. Included within interest income is the interest earned on the Company’s overnight deposits with Bank of England based on the bank rates.

-

Fee and commission income/expense

Fees and commission income is recognised in the income statement as services are provided to the extent that it is probable that the economic benefits will flow to the Company and can be reliably measured.

Fees and commission expense is recognised in the income statement as services are received.

-

Financial assets and liabilities

The Bank applies IAS 39 to the recognition, classification and measurement, and derecognition of financial assets and liabilities.

There are no financial assets held as available-for-sale, or held-to-maturity and there are no financial assets and liabilities held at fair value through profit and loss.

-

Loans and advances to customers

Loans and advances to customers consist of overdrafts and overdrawn balances (unarranged overdrafts) are classified as ‘loans and receivables’. These are initially measured at fair value and subsequently measured at amortised cost less provision for impairment. The daily fee charged on overdrafts doesn’t contain an interest element so no effective interest rate method has been applied. The fee charged on overdrafts is recognised within fee and commission income.

See Note 25 for more details in respect to the provisions held for loans and advances to customers.

-

Customer deposits

Customer deposit liabilities are recognised initially at fair value and are subsequently measured at amortised cost.

-

Other assets

Receivables are recognised initially at fair value and subsequently measured at amortised cost.

-

Other liabilities

These amounts represent liabilities for goods and services provided to Monzo before the end of the financial period which are unpaid. The amounts are unsecured and usually paid within 30 days of recognition. Other liabilities are presented as current liabilities. They are recognised initially at fair value and subsequently measured at amortised cost.

-

-

Property, plant and equipment

Items of property, plant and equipment are stated at cost less accumulated depreciation and impairment. Historical cost includes expenditure that is directly attributable to the cost of the assets.

Depreciation is provided on all property, plant and equipment, and calculated using the straight-line method to allocate their cost, net of residual values, over their estimated useful lives, as follows:

Office and IT Equipment – 3 years

Fixtures and fittings – 3.5 years

Fixtures and fittings include office fit out costs and legal costs of acquiring the office lease are recognised on a straight-line basis over the life of the lease.

-

Intangible assets

Intangible assets are stated at cost less accumulated amortisation and accumulated impairment losses. Externally acquired software and licenses are capitalised and amortised on a straight line basis over the length of the license (between 1 and 10 years).

-

Impairment of non-financial assets

The Bank assesses at each reporting date whether there are any indicators of impairment. If any indicators exist, the Bank estimates the asset’s recoverable amount. The recoverable amount of an asset is the higher of its fair value less costs to sell and its value in use. If the carrying amount of the asset exceeds its recoverable amount, the asset is considered impaired, and is written down to its recoverable amount.

-

Current Taxation

Current income tax assets and liabilities for the current period are measured at the amount expected to be recovered from or paid to the taxation authorities and involve a degree of estimation and judgement. The tax rates and tax laws used to compute the amounts are those that are enacted or substantively enacted, at the reporting date, when the Company generates taxable income. Management periodically evaluates positions taken in the tax returns with respect to situations in which applicable tax regulations are subject to interpretation and establishes provisions where appropriate.

Tax assets and liabilities relating to open and judgemental matters, including those in relation to the R&D reclaim are based on the Bank’s assessment of the most likely outcome based on information available and probability of potential challenge. The Bank engages constructively and transparently with the tax authorities with a view to resolution of any uncertain tax matters.

-

Deferred tax

Deferred tax is recognised on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the financial statements. Deferred income tax is determined using tax rates (and laws) that have been enacted or substantively enacted by the reporting date and are expected to apply with the related deferred income tax asset is realised or the deferred income tax liability is settled.

Deferred income tax assets are recognised only to the extent that it is probable that future taxable profits will be available against which the temporary differences can be utilised. No deferred tax assets have been recognised as at 28 February 2018.

-

Leases

The Company applies IAS 17 Leases to its operating lease of office premises. As a lessee, rentals payable under operating leases are expensed to the income statement on a straight line basis over the period of the lease including any rent free periods.

-

Share-based payments

Employees (including senior executives) may be entitled to receive remuneration in the form of share options, as a reward for performing well and to incentivise them to make Monzo a success.

The share options issued are equity settled with no cash settlement options. Service vesting conditions apply; options vest evenly over fours years with a one year cliff where if an employee is a leaver within the first year of employment, all vested options at that date are forfeited. There are no non-market vesting conditions.

The cost of the employee services received in respect of the share options granted is recognised over the period that employees provide services. This is generally the period in which the award is granted or notified and the vesting date. The overall cost of the award is calculated using the number of shares and options expected to vest and the fair value of the options at the date of grant.

The fair value of options at the grant date is recognised as an employee expense with a corresponding increase in other reserves within equity over the period that the employees become unconditionally entitled to the awards. The grant date fair value is determined using valuation models which take into account the terms and conditions attached to the awards. Inputs into the valuation model include the risk free rate and the expected volatility of the Company’s share price (see Note 20).

-

Pensions

The Company participates in a single defined contribution pension scheme. The contribution payable to a defined contribution plan is in proportion to the services rendered to the Company by the employees and is recorded as an expense under personnel expenses. Unpaid contributions are recorded as a liability.

The Bank does not operate a defined benefit pension plan.

-

Foreign exchange

The Bank’s financial statements are presented in GBP, which is the Bank's functional currency. That is the currency of the primary economic environment in which the Bank operates. Transactions in foreign currencies are initially recorded at the functional currency rate prevailing at the date of the transaction. Monetary assets and liabilities denominated in foreign currencies are retranslated at the functional currency spot rate of exchange ruling at the reporting date. All differences are taken to the Statement of Comprehensive Income. Non-monetary items that are measured in terms of historical cost in a foreign currency are translated using the exchange rates as at the dates of the initial transactions. Non-monetary items measured at fair value in a foreign currency are translated using the exchange rates at the date when the fair value is determined.

-

-

Net fees and commission

Year ended

Year ended

28 February 2018

28 February 2017

£'000

£'000

Fees and commission income

Fee income on banking services

160

-

Interchange fee income

2,041

112

Fees and commission expense

Fee expense on banking services

(834)

-

Net fees and commission

1,367

112

The reported fees and commissions are those which do not contain an interest element and do not form part of any effective interest rate calculations.

-

Credit impairment charges and other provisions

Year ended

Year ended

28 February 2018

28 February 2017

£'000

£'000

Credit impairment charge on overdrafts and overdrawn balances

12

-

Credit impairment charges

12

-

See Note 25 for further information on the impairment charge in respect of overdrafts and overdrawn balances.

-

Personnel Expenses

Employee benefit expenses (including Directors) comprise:

Year ended

Year ended

28 February 2018

28 February 2017

£'000

£'000

Salaries

7,167

1,995

Social security contributions

860

239

Contributions to defined contribution plans

194

-

Share based payments

916

295

Other personnel expenses

77

-

9,214

2,529

The average number of employees of the Company during the period was 183 (2017 47). All were employed in management, operations and administration roles.

The increase in staff costs to £9.2m (2017 £2.5m) reflects the additional employees required to support the operational running of the Company.

-

Director’s remunerations

Year ended

Year ended

28 February 2018

28 February 2017

£'000

£'000

Total Directors’ emoluments

Wages and salaries

473

65

Share based payments

279

73

Contributions to defined contribution plans

2

-

754

138

Highest paid Director

Wages and salaries

139

60

Share based payments

166

-

305

60

As at 28 February 2018 there were no loans outstanding to directors (2017 £nil) and there were no loans made to directors during the period (2017 £nil).

-

Share-based payments

The Company operates two share options schemes for the benefit of certain members of staff. The first is an HMRC approved Company Share Option scheme (‘CSOP’), where awards can be made to employees subject to conditions. The strike price for these options is set according to the fair market share price at the time of issue as agreed with HMRC. The fair market share price was based on the pricing achieved in the funding round immediately preceding the issuance given the shares are not actively traded. For the Non-CSOP scheme, awards are made with the strike price set equal to the £0.0001.

The Company measures the cost of equity-settled options based on the fair value of the awards granted. The fair value is determined based on an appropriate valuation model (Black Scholes) given the share options are not actively traded. The use of an option valuation model to determine the fair value requires the input of highly subjective assumptions including the expected price volatility, expected life of the award and dividend yield. Changes in the subjective assumptions can materially affect the fair value estimates.

The main assumptions that have been used in deriving the value of the options at grant are;

Risk free rate – 0.84%

Volatility – 35%

Dividend yield – nil

Expected life – 4 years

The fair value of options at grant date is recognised as an employee expense with a corresponding increase in other reserves over the period that the employees become unconditionally entitled to the awards. The total expense in the year ended 28 February 2018 was £916k (2017 £294k).

CSOP

Non - CSOP

Number

Number

Outstanding 18 February 2015

–

–

Granted during the period

12,615

28,990

At 29 February 2016

12,615

28,990

Share split

1,261,500

2,899,000

Granted during the period

1,698,407

714,698

Lapsed

(131,211)

(43,820)

Exercised

–

(355,459)

At 28 February 2017

2,828,696

3,214,419

Granted during the period

2,601,094

1,752,032

Lapsed

(216,599)

(240,096)

Exercised

(47,415)

–

At 28 February 2018

5,165,776

4,726,355

The range of exercise prices for the CSOP share options is £0.1997 - £2.35. The range of exercise prices for the non-CSOP share options is £0.0001. The weighted average remaining life of the CSOP and non-CSOP share options is 2.73 years.

-

Operating expenses

Year ended

Year ended

28 February 2018

28 February 2017

£'000

£'000

Prepaid card scheme operating costs

14,308

2,712

IT costs

1,815

917

Premises and office costs

952

233

Marketing

390

376

Legal and professional fees

857

629

Accountancy and audit fees

450

277

Current account operating costs

5,953

-

Administrative expenses

701

333

25,426

5,477

Auditors' remuneration for the audit of the financial statements was £91k (2017 £30k). There was no remuneration payable to the auditors in respect of non-audit services in the year (2017 £nil).

-

Taxation

Current tax

Year ended

Year ended

28 February 2018

28 February 2017

£'000

£'000

UK corporation tax credit on loss for the period

2,530

1,238

Year ended

Year ended

28 February 2018

28 February 2017

£'000

£'000

Loss on ordinary activities before tax

(33,075)

(7,927)

Standard rate of corporation tax

19%

20%

Expected tax credit

6,312

1,585

Effects of:

Expenses not deductible for tax

7

(27)

Additional deduction for R&D expenditure

1,882

966

Impact of surrendering losses at lower rate

(800)

(470)

Loss in year where no deferred tax asset recognised

(4,871)

(816)

Total UK corporate tax credit for the period

2,530

1,238

Deferred tax

The deferred tax included in the balance sheet is as follows:

Year ended

Year ended

28 February 2018

28 February 2017

£'000

£'000

Included in debtors

-

-

-

-

Year ended

Year ended

28 February 2018

28 February 2017

£'000

£'000

Accelerated capital allowances

(1)

(25)

Losses

1

25

-

-

A deferred tax asset has not been recognised in respect of tax losses carried forward totalling £29.6m (2017 £5m) as there is insufficient evidence as to their recoverability.

Factors affecting future tax charge

The UK Government has announced reductions in UK corporation tax to 17% by 1 April 2020. The closing deferred tax assets and liabilities have been calculated taking into account that existing temporary differences may unwind in periods subject to the reduced rates.

-

Cash and balances at bank

The balance consists of balances held at bank, mainly on overnight deposit with the Bank of England, amounting to £96.9m at 28 February 2018 (2017 £14.9m). The balance held at Bank of England includes a cash collateral account as part of the Bank being a direct settling participant of the Faster Payments scheme.

-

Loans and advances to customers

Loans and advances to customers consist of approved overdrafts provided to customers of £112.4k (2017 £nil) and overdrawn balances on current accounts of £47.6k (2017 £nil), net of impairment. See Note 25 for further information on the impairment charge in respect of overdrafts and overdrawn balances.

-

Other assets

Year ended

Year ended

28 February 2018

28 February 2017

£'000

£'000

Prepayments

2,016

348

Collateral provided to payment scheme providers

13,532

2,461

R&D tax reclaim

3,768

1,238

Accrued income

1,568

-

Deposit on premises

143

171

Receivable in respect of prepaid card program

11,288

-

Other receivables

9,566

184

41,881

4,402

Included within other assets are £36m of financial assets and £5.9m of non financial assets. The credit quality of the financial assets is considered low risk.

The recognised R&D reclaim amount is considered a non financial asset and is based on a best estimate of the eligible costs. During the year management recognised an uncertain tax provision of £2.5m in relation to ongoing enquiries from HMRC into the R&D reclaim for the 2017 year end. Due to the uncertainty associated with the nature of expenses allowable for reclaim in such tax matters, the final outcome may vary significantly.

-

Property, plant and equipment

Fixtures and

Office and IT

Total

fittings

equipment

£'000

£'000

£'000

Cost:

As at 1 March 2016

-

19

19

Additions

1

200

201

Disposals

-

-

-

As at 28 February 2017

1

219

220

Depreciation:

As at 1 March 2016

-

6

6

Charge for the period

-

36

36

Depreciation on disposal

-

-

-

As at 28 February 2017

-

42

42

Net book value as at 28 February 2017

1

177

178

Cost:

As at 1 March 2017

1

219

220

Additions

174

712

886

Disposals

-

-

-

As at 28 February 2018

175

931

1106

Depreciation:

As at 1 March 2017

-

42

42

Charge for the period

47

194

241

Depreciation on disposal

-

-

-

As at 28 February 2018

47

236

283

Net book value as at 28 February 2018

128

695

823

-

Intangible assets

Software licenses

£'000

Cost

As at 1 March 2016

-

Additions

29

As at 29 February 2017

29

Amortisation:

As at 1 March 2016

-

Charge for the period

5

Amortisation on disposal

-

As at 28 February 2017

5

Net book value as at 28 February 2017

24

Cost

As at 1 March 2017

29

Additions

-

As at 28 February 2018

28

Amortisation:

As at 1 March 2017

5

Charge for the period

10

Amortisation on disposal

-

As at 28 February 2018

15

Net book value as at 28 February 2018

14

-

Customer deposits

The Company started taking customer deposits during the year with £71.3m received by financial year end which is held on demand.

-

Other liabilities

Year ended

Year ended

28 February 2018

28 February 2017

£'000

£'000

Accruals

3,910

748

Accounts payable and other creditors

7,407

229

Other taxes and social security costs

431

103

Deferred income

617

-

12,365

1,080

Included within other liabilities are £6m of financial liabilities and £6.3m of non financial liabilities.

-

Called up share capital

Year ended

Year ended

28 February 2018

28 February 2017

£

£

Ordinary shares of £000000.1 each

11

7

11

7

Number of

Number of

Share

Nominal

ord shares

deferred

Capital

shares

£

As at 1 March 2016

0.00001

400,515

50,231

5

Shares split

0.0000001

39,650,985

4,972,869

-

40,051,500

5,023,100

5

Shares issued

0.0000001

11,676,610

-

1

Conversion to deferred shares

(13,125)

13,125

-

Cancellation of deferred shares

-

(5,036,225)

(1)

Options exercised

0.0000001

355,459

-

-

Shares issued

0.0000001

19,626,106

-

2

As at 28 February 2017

71,696,550

-

7

Shares issued

0.0000001

33,655,679

-

4

Options exercised

0.0000001

47,415

-

-

As at 28 February 2018

105,399,644

-

11

All Ordinary shares have the same full voting rights attached.

Some of the shares in issue are owned by the board, management and staff and are subject to time based vesting conditions. At the balance sheet date 3,142,018 (2017 10,636,554) shares were unvested. In the event of shares failing to vest the Company has the right to repurchase the shares at their nominal value.

-

Related party transactions and controlling parties

Controlling parties

In the opinion of the Directors there is no overall controlling party.

Transactions with key management personnel

Key management personnel are defined as those persons having authority and responsibility for planning, directing and controlling the activities of the Company excluding any Directors, for whom amounts have been separately disclosed in Note 9.

The compensation paid or payable to key management personnel is shown in the tables below:

Year ended

Year ended

28 February 2018

28 February 2017

£'000

£'000

Salaries & remuneration

433

117

Social security contributions

47

22

Share based payments

217

118

Contributions to defined contribution plans

12

-

709

317

As at 28 February 2018, there were no loans or any other amounts outstanding with any key management personnel (2017 £nil).

Transactions with related parties