Credit scores can indicate how much money you can borrow, and things like whether you can get a phone contract or car finance.

And having a higher credit score could mean:

Better chances of getting approved for credit

Higher credit limits – lenders may be willing to let you borrow more

Lower interest rates on the money you borrow

If you might borrow money in the future, like a loan, a mortgage or a credit card. Looking after your credit score could help you get a good deal.

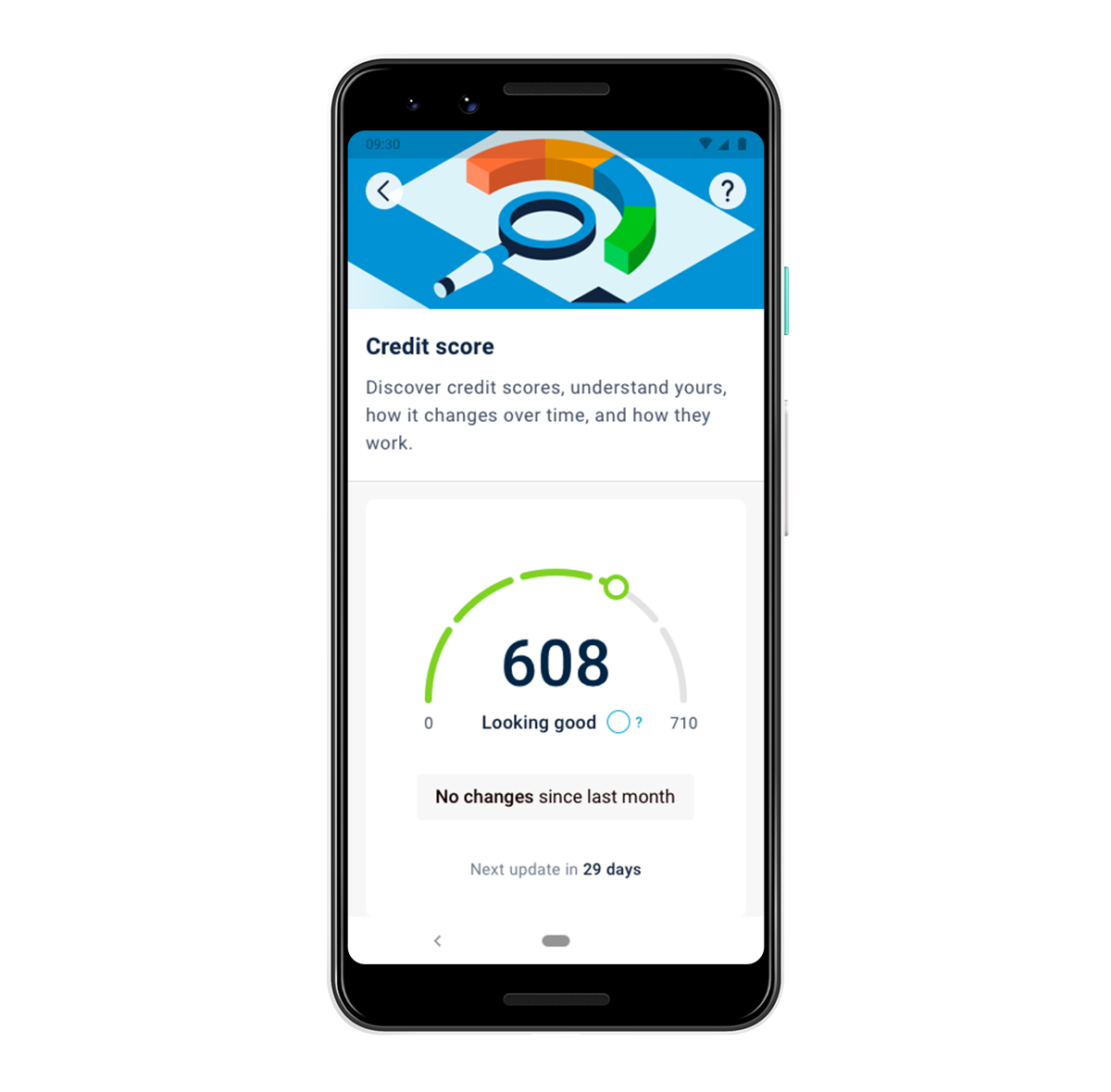

Track your credit score with Monzo Plus

Credit Tracker helps you look after your credit score and understand what goes in it.

See your credit score, in Monzo. Track how it changes over time, all in one place, with no long forms to fill in.

3 main agencies generate credit scores, and they each do it differently: TransUnion, Equifax and Experian. We're showing you TransUnion's score. We don't control it, or how they calculate it. We'll update you on how your score changes monthly and what it could mean.

You can see your credit score with Monzo Plus: the bank account from Monzo that helps you get a grip on your finances and make your money work harder.

Get Monzo Plus for £5 a month with a three month minimum term, if you're over 18 and open a Monzo account.

How to improve your credit score

There are lots of myths around how you can actually improve your score.

Your credit score could indicate how likely lenders are to lend you money, whether they give you higher or lower limits and at what interest rate.

So, looking after your score could help you get a good deal on your next loan, credit card, mortgage or overdraft.

Remember – you don’t only have one score, you have many. Your score will vary depending on the credit reference agency making the score. And, having a good score doesn’t always mean always getting accepted for credit – lenders make their own decisions, with your score being just one factor among many.

1. Register to vote

It might sound odd, but getting yourself on the electoral roll could add points to your credit rating. It helps lenders confirm your identity and address when you apply for credit. This means they’re more likely to approve you, which will help improve your score.

If you live in the UK, you can register to vote online in just 5 to 10 minutes.

2. Try to build your credit history

Having little or no credit history can affect your credit score, especially for young adults and if you’ve moved to a new country.

Your credit history shows companies how you’ve managed money in the past. This helps them decide whether to lend to you. If there’s not enough information, they may refuse to give you credit or might not offer you the best deal.

Luckily, there are a few ways to build a credit history. For example, you could open a bank account, put household bills in your name, or get a basic form of credit like a mobile phone contract. This may cause a temporary dip in your score, but after a few months you should see it improve.

Just make sure you pay particular attention to the following points when building your credit history.

3. Space out your credit applications

When it comes to applying for credit, it’s tempting to make lots of credit applications so you can try get at least one. But making several applications in a short space of time could dent your score.

Too many applications could make lenders think you’re too reliant on credit, and as a result, they could decide it’s not responsible to lend to you at the moment. That means you’re less likely to have your application accepted, which will in turn make your score go down.

So, the best approach is to apply for one product at a time. You could try to check your eligibility before you apply for products, so you know whether you’re likely to be accepted (this doesn’t affect your credit score). And if you do need to make another application, try and wait several months.

4. Make payments on time

Paying your bills on time and in full will improve your score in the long-term. It shows lenders that you’re a responsible borrower, so they may start trusting you with higher limits and lower rates.

On the flip side, late or missed payments can damage your score. After several missed payments a lender may decide to close or ‘default’ your account. This will be recorded on your credit report for six years, whether or not you pay off the debt eventually. It can make your rating drop, so it’s definitely something to avoid if you can.

5. Minimise your credit use

Maxing out your credit card or overdraft doesn’t look too good to lenders, so your score may fall if you do. On the other hand, if you’ve been using more than half of your available credit with a lender, try to bring your usage down to around 25%. You’ll usually gain points if you use around 25% of your agreed credit limit. For example, if you have a bank overdraft of £1,000, try to only use £250 of it at a time.

Ultimately, improving your credit score is about showing lenders you’re a reliable customer, who’ll use credit responsibly and pay them back.

It’s also worth knowing that having lots of available credit, but not using it (like having a credit card you never use) could lead to a lower score, too.

How long does it take to improve your credit score?

Improving your credit score depends on which steps you’ve taken to try and give it a bump. The most important thing to remember is that it won’t happen immediately!

Even information like opening a new bank account or successfully applying for a credit card can take up to 90 days to be added to your credit report. It’s best to view your credit score as a process where you’re always acting in a responsible way, to make it healthier over time.

Keeping healthy credit scores

As well as trying to improve your credit score, here are a few ways you can try to keep a healthy credit score and keep your finances in good shape in the long run:

1. Try not to make too many credit applications

Lenders might think you’re too reliant on borrowing money if you make too many credit applications. Some credit applications will leave a record on your credit history, which credit agencies have access to. This isn’t true in all cases though. Some applications only do a soft search and a record of this isn’t added until you actually accept an agreement.

2. Try not to miss payments or make late payments

Making late payments or missing them entirely will harm your credit score. Lenders might think you’re unreliable with money and that it’s risky to lend money to you.

3. Make sure you’re only borrowing what you can afford

Your credit score will be negatively affected if you can't pay back the money you owe, you have to enter into a formal agreement to pay back the lender, or you have to declare bankruptcy.

This can stay on your credit report for six years (and it might be longer than 6 years in some cases). So make sure you can afford your repayments before you borrow money.