Josh*, 26, is a software developer for a startup who earns £60k a year. He works remotely, splitting his time between Europe and living at home in Southampton with his two cats.

A lifelong travel lover and a Monzo user since 2017, Josh uses Monzo to save for and organise trips abroad. At any one time, he’s using Pots to save for two or three holidays which he’s either already booked, or will book as soon as he hits his savings goal.

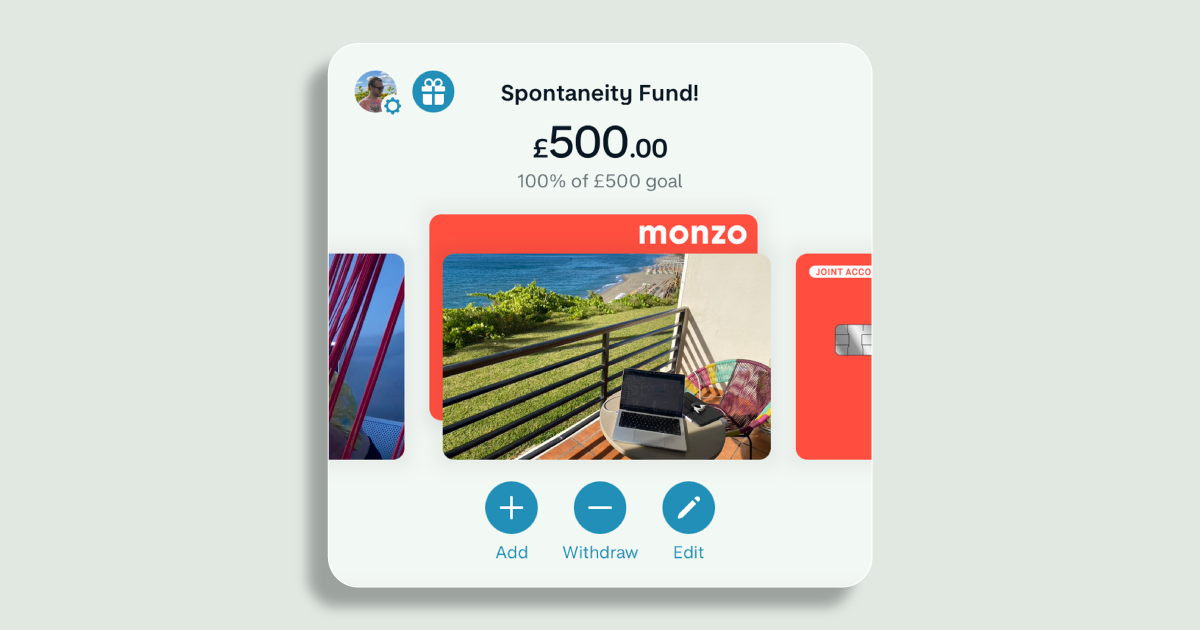

He has another Pot for his 'Spontaneity Fund', which he dips into without guilt if he spots a particularly attractive last-minute package holiday online, or wants to visit his partner who lives in Estonia.

As someone with ADHD who struggles with impulse control, Josh appreciates being able to organise his money visually into Pots with custom images from his travels. It allows him to keep his finances under control while factoring spontaneous travel into his budget.

Here, Josh shares his holiday savings strategy and how his 'Spontaneity Fund' gives him the freedom to travel guilt-free.

“The idea for my ‘Spontaneity Fund’ came to me during a solo remote work trip to Spain”

My ‘Spontaneity Fund’ is a Pot that enables me to do spontaneous things without worrying about the financial impact. It always sits at £500 and when I spend it, I replenish it at the expense of my regular savings.

I love to travel and it’s always been my thing. But I never used to have any money and was always bad at saving. A couple of weeks after I got my current job, which pays me more than I’ve ever earned before, I realised I could just go and work abroad.

I went to Torremolinos in Spain for three days, stayed in an Airbnb and worked on a balcony by the sea. It was such a mental health boost to be able to have a quick dip in the sea between meetings.

I came back and knew I wanted to be able to do that more often, so I created a special fund for impromptu trips.

“My ‘Spontaneity Fund’ is really good for me as I struggle with impulse control”

I have ADHD and I really struggle with organisation. So not having to worry about the financial implications of spontaneity is really helpful for me. It allows me to not feel bad about making decisions to do these things at short notice, and I enjoy them a lot more.

“There are two types of situations where I spend my ‘Spontaneity Fund’ – to work abroad in the sun or make a surprise visit to see my partner”

I browse last-minute package holiday deals about once a week, because there's often pretty good stuff floating around that companies are desperate to sell for any amount of money and they tend to be departing in the next week or so.

Either I’ll see something I like the look of and it’s a place I can work from, such as £300-400 for a week in the Canary Islands. Or I’ll use my ‘Spontaneity Fund’ to go to Estonia to see my partner.

“I spend most of my time abroad in Estonia and Spain”

The company I work for is fully remote and I don't have any constraints on where I can work, so I spend a lot of my time outside of the UK. I only come back when I feel bad for my cats.

Usually I’m either in Estonia with my partner, or if I’m travelling on my own, I’ll go to southern Spain or the Balearic Islands. They’re convenient to get to from Southampton and the time zones are good.

“I get uncomfortable if I don’t have a trip abroad planned in the next six weeks. Pots help me save for them”

They allow me to visualise the financial situation I’ll need to be in to afford my travels, work out what I can afford and how close I am to hitting my goals for upcoming trips.

I have six Pots in total, three of which are for travel, including my ‘Spontaneity Fund’. I usually have one Pot per holiday. These are decorated with photos from previous holidays and given the requisite goals, so I can see immediately how close I am to hitting my target and being able to save for another one!

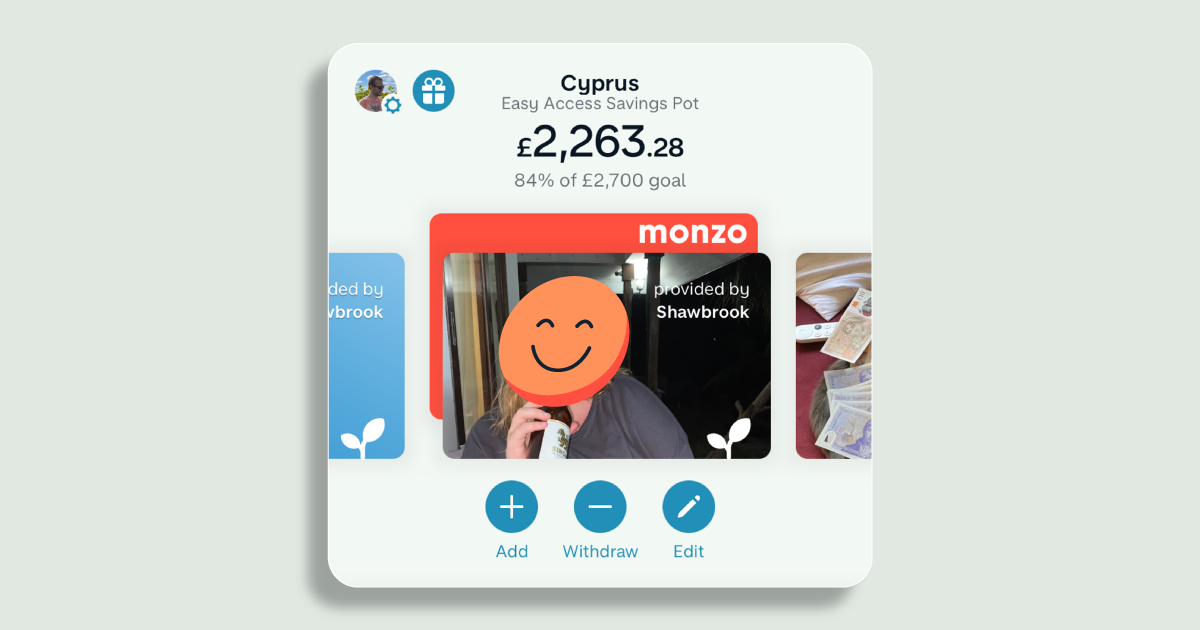

“One holiday Pot is called ‘Cyprus’ and there’s about £2.3k in there right now”

I’m going to Amsterdam to see Harry Styles with my partner in June, and then we're going to fly straight to Cyprus for our summer holiday. It’s a package holiday and I’ve paid the deposit.

I try to put £500 a month into this Pot and my roundups go into it as well – £153 has gone into it through roundups since July 2022. The image is a picture of my partner last time we were in Cyprus at that same hotel.

“I also put £500 a month into a travel Pot called ‘Next Cruise’”

My partner and I went on a cruise around the Caribbean in February and we absolutely loved it, so we want to do it again next year. The Pot image is me and my partner sitting on the balcony of our cruise cabin with a glass of champagne.

Halfway through our cruise, I found a security vulnerability in the cruise line’s app. I showed it to them and they gave us a free cruise, which we ended up doing back to back. We tacked it on and turned our eight day cruise into 14 days away!

We had to switch around our original flights, which I did using money from my ‘Spontaneity Fund’. Importantly, it also meant we could still afford to buy drinks on the second cruise.

“My Pots also help me budget while I’m away”

Before I go away I read lots of articles to work out how much I need to pay for a holiday and the spending money I need when I'm there. I put that amount in the relevant Pot.

When the holiday comes around, I'll get all the money out and use it for spending during the holiday.

“Knowing what I'm saving for makes me more disciplined with my money and gives me more freedom to travel”

Having my savings Pots there when I open my Monzo is really helpful. It reminds me of what I'm saving up for.

It sounds stupid, but just having the pictures and the titles on my Pots reminds me that ‘actually, this is what you're saving for, it's important. You need to keep at it and not take the money out’.

I like seeing my combined balance across all my accounts and Pots and it's good watching that go up. There are a lot of little dopamine hits in the Monzo experience which is really helpful for me.

What would you spend your ‘Spontaneity Fund’ on? Open a Monzo Pot today to get started.

To apply for a Monzo bank account and access Pots you must be a UK resident. Ts&Cs apply.

*We’ve changed his name.