Banking made easy

Spend, save and manage your money, all in one place. Open a full UK bank account from your phone, for free.

UK residents only. Ts&Cs apply.

Apply for a full UK current account in 15 minutes

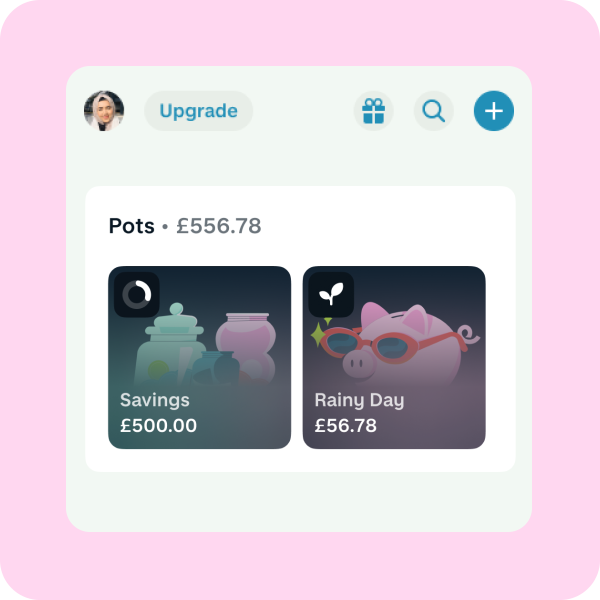

Organise your money however you like with Pots

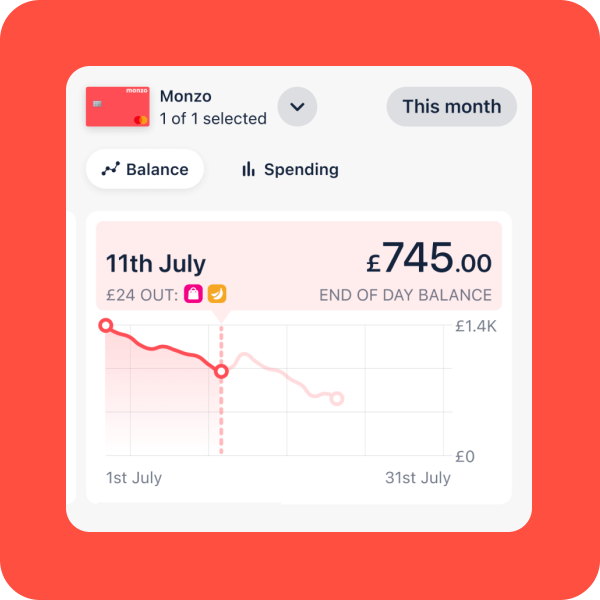

See your money in a whole new light with Trends

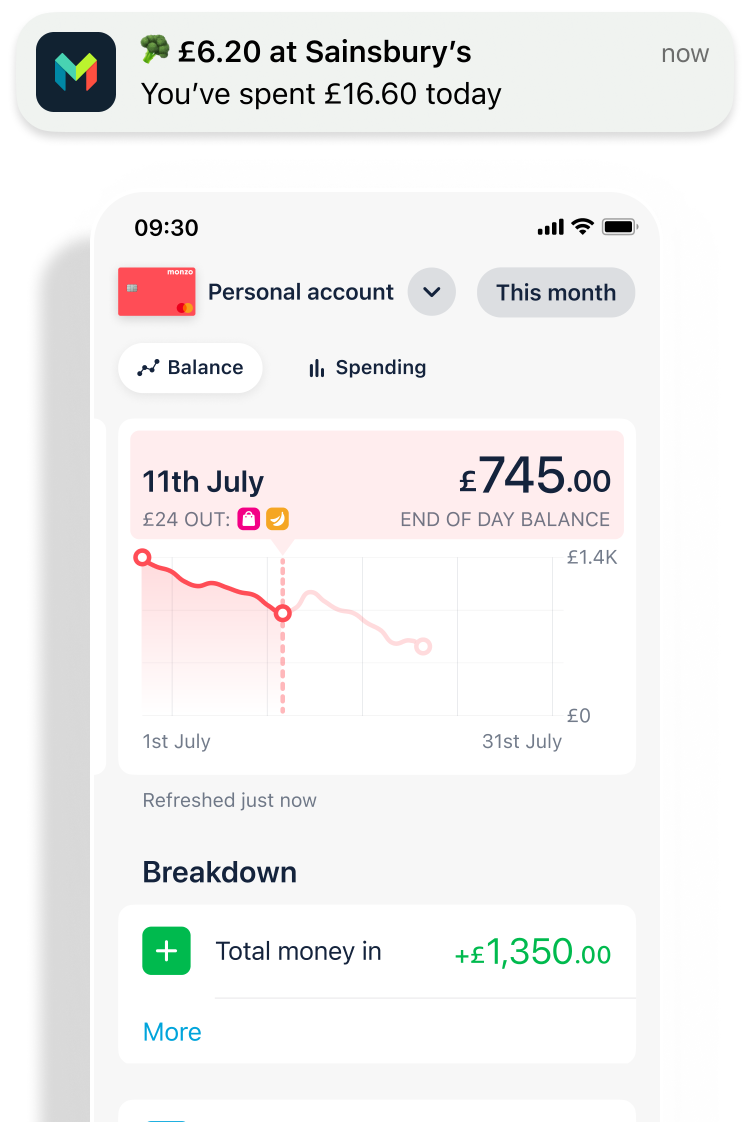

Spend

Get instant notifications the second you pay. Set budgets for things like groceries and going out, and get warnings if you’re spending too fast (if you want them).

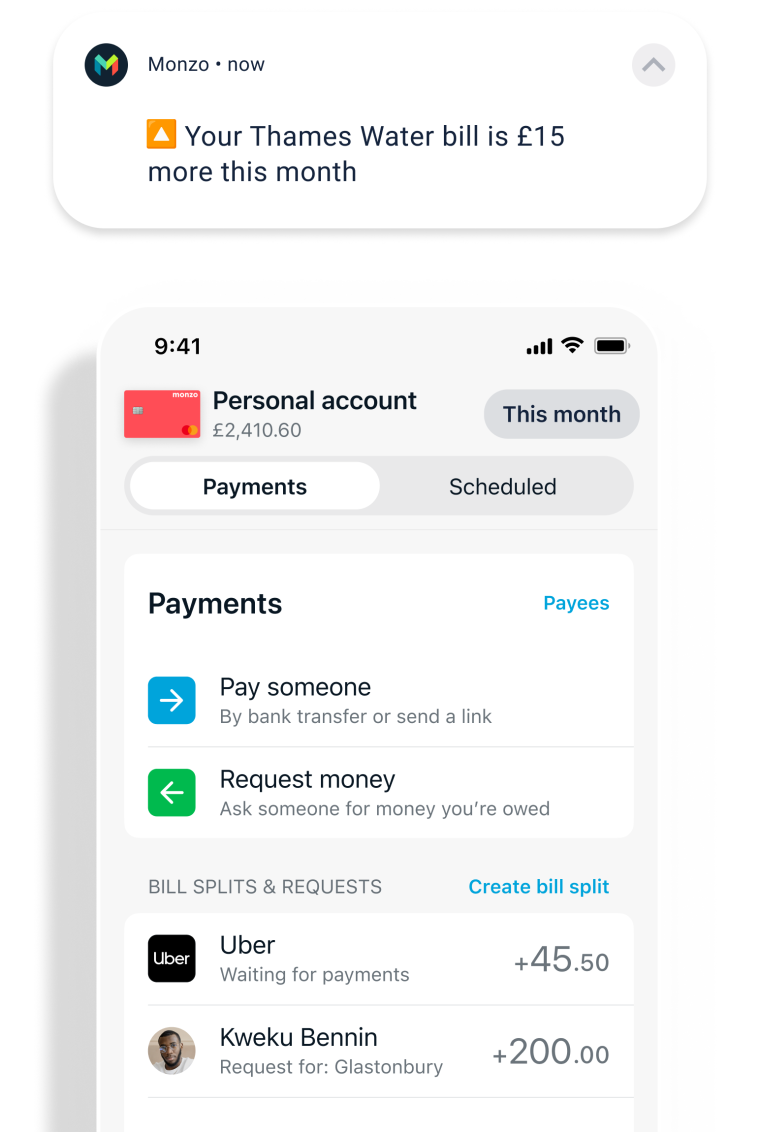

Manage

Pay Direct Debits through Monzo and we’ll tell you if they’re higher for the upcoming month. So no nasty surprises.

Get more life for your money

Monzo Max comes with worldwide travel and phone insurance, UK & Europe breakdown cover, advanced money management tools, a weekly Greggs treat, an annual Railcard, and 4.60% AER (variable) interest on Instant Access Savings

Max starts at £17 a month • Aged 18-69 • UK resident • Ts&Cs apply

Make money that bit easier

Monzo Extra lets you unlock the best in Monzo money management: see your other banks in one place, dig into your credit health, group and label purchases your way, and more.

Extra is £3 a month • Aged 18+ • UK resident • Ts&Cs apply

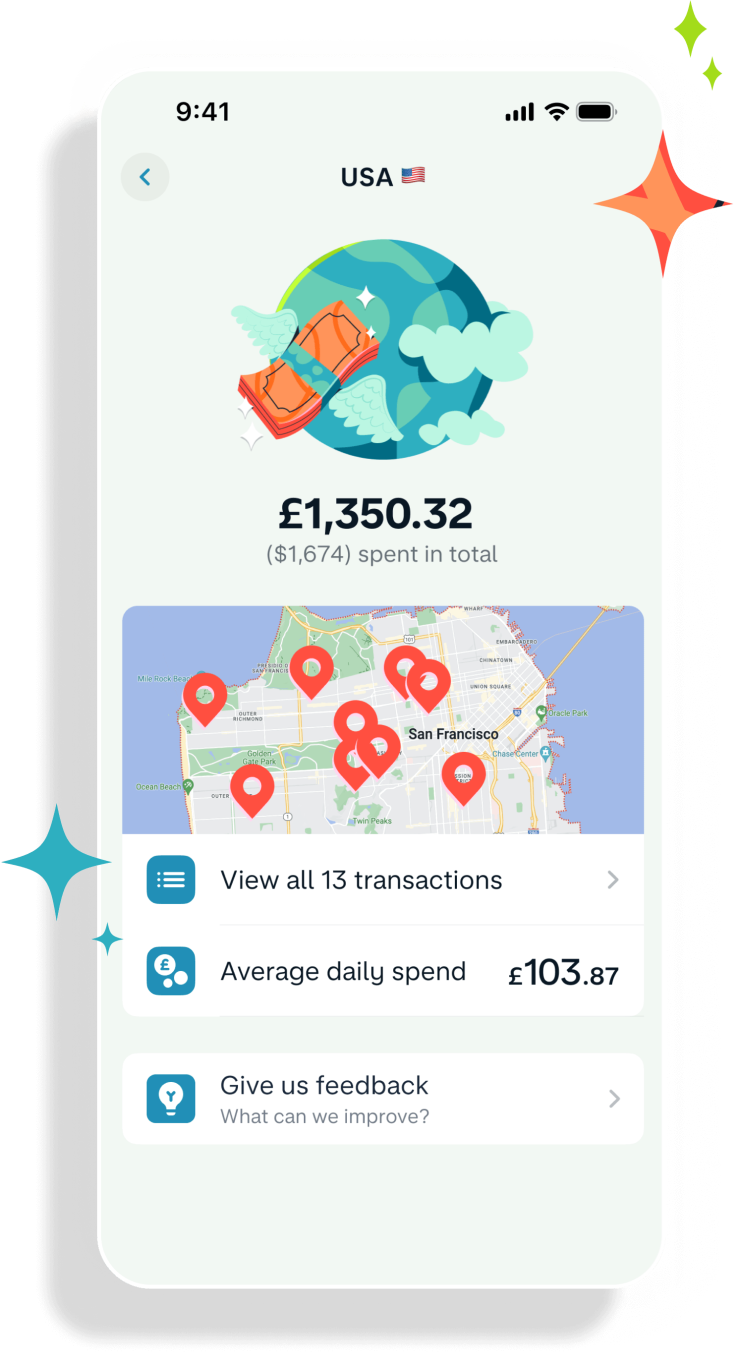

Using Monzo abroad

Use Monzo anywhere in the world that accepts Mastercard. We don't charge any fees for paying abroad and we pass Mastercard's exchange ratedirectly onto you, without sneaky fees or extra charges.

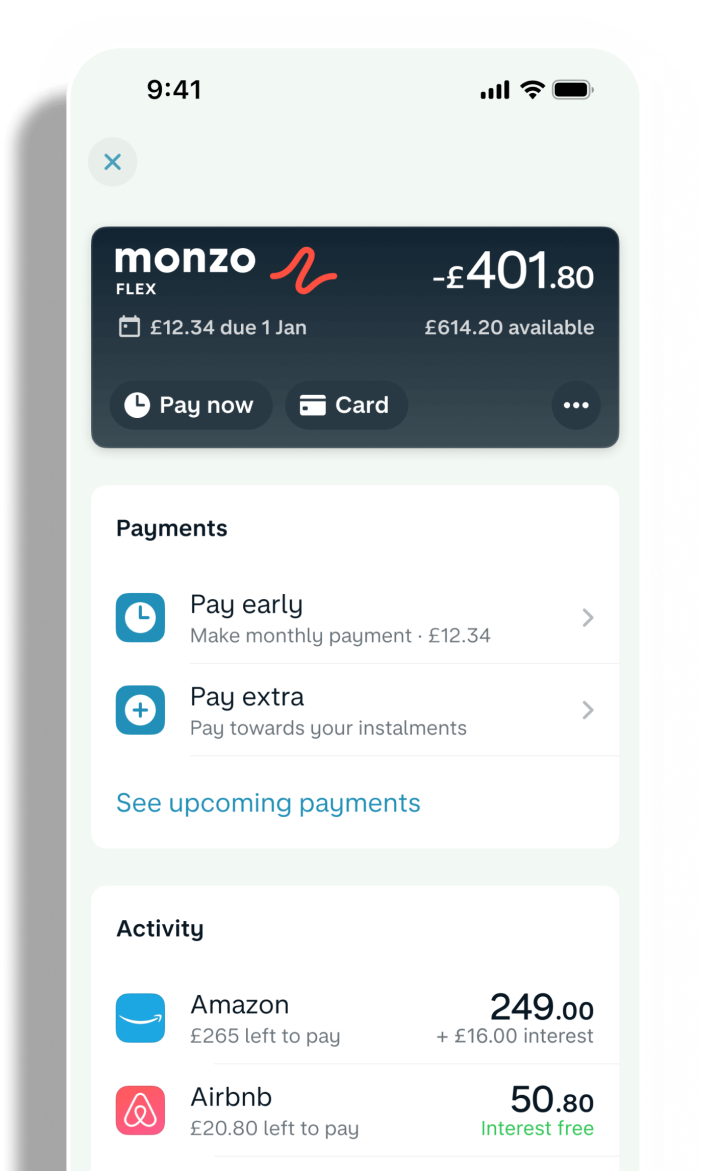

Credit with a dash of Monzo magic

Use Monzo Flex to get more time to pay for pretty much anything. It’s 0% interest when you pay in full on your next payment date or in 3 monthly payments. For more wiggle room it’s 29% APR representative (variable) when you pay in up to 24 monthly payments.

Representative example: 29% APR representative (variable), with an assumed credit limit of £1,200 and an annual interest rate of 29% (variable).

Eligibility criteria and Ts&Cs apply. 18+ year olds only. Missed payments can negatively impact credit scores and you may lose the interest-free rate on existing plans.

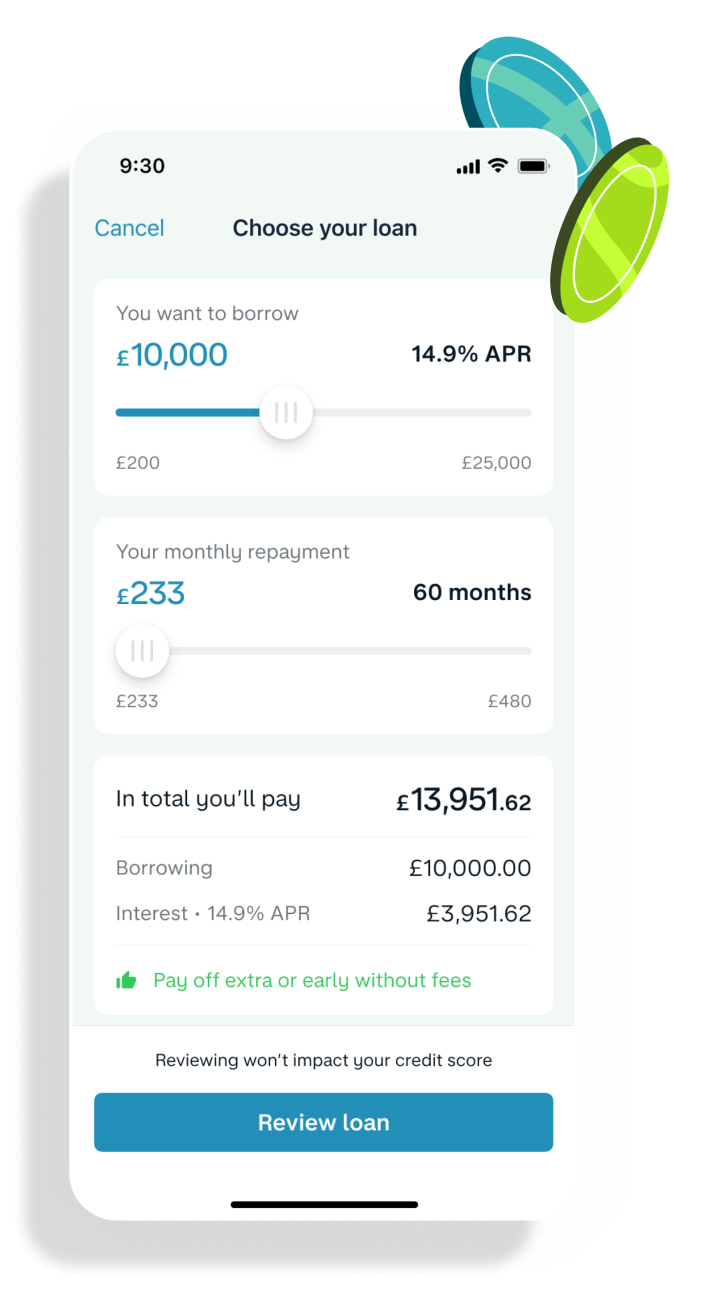

Loans and Overdrafts

We offer overdrafts up to £2,000 and loans up to £25,000. Checking if you're eligible won't leave a mark on your credit score, there are no lengthy forms to fill in, and no charges for paying us back early.

Our representative APR is 14.8% for loans more than £10,000, up to £25,000. For loans up to £10,000 it's 25.7%.

How does our overdraft compare? Our representative APR is 39.0%. You can use the APR to compare the cost of different credit products.

Protect yourself from fraud

Don’t make payments or share your data if something seems unusual or unexpected - stop and challenge.

Take a look at some common scams and learn how they work so you can keep your money safe. Fraudsters are clever and use sophisticated tactics, so knowing what to look out for can help stop them.

Keep your money safe

Cutting-edge technology, FSCS protection and 24/7 support if you need us urgently. Just a few of the reasons over 11 million customers trust us to keep their money safe.

Compare plans

We're making money work for everyone, so we have different plans for different needs.

Free

Extra

Perks

Max

Free

months minimum

Free

Free

months minimum

A UK current account

Your eligible deposits are protected by the FSCS up to £85,000 per person

All the Monzo features you know and love

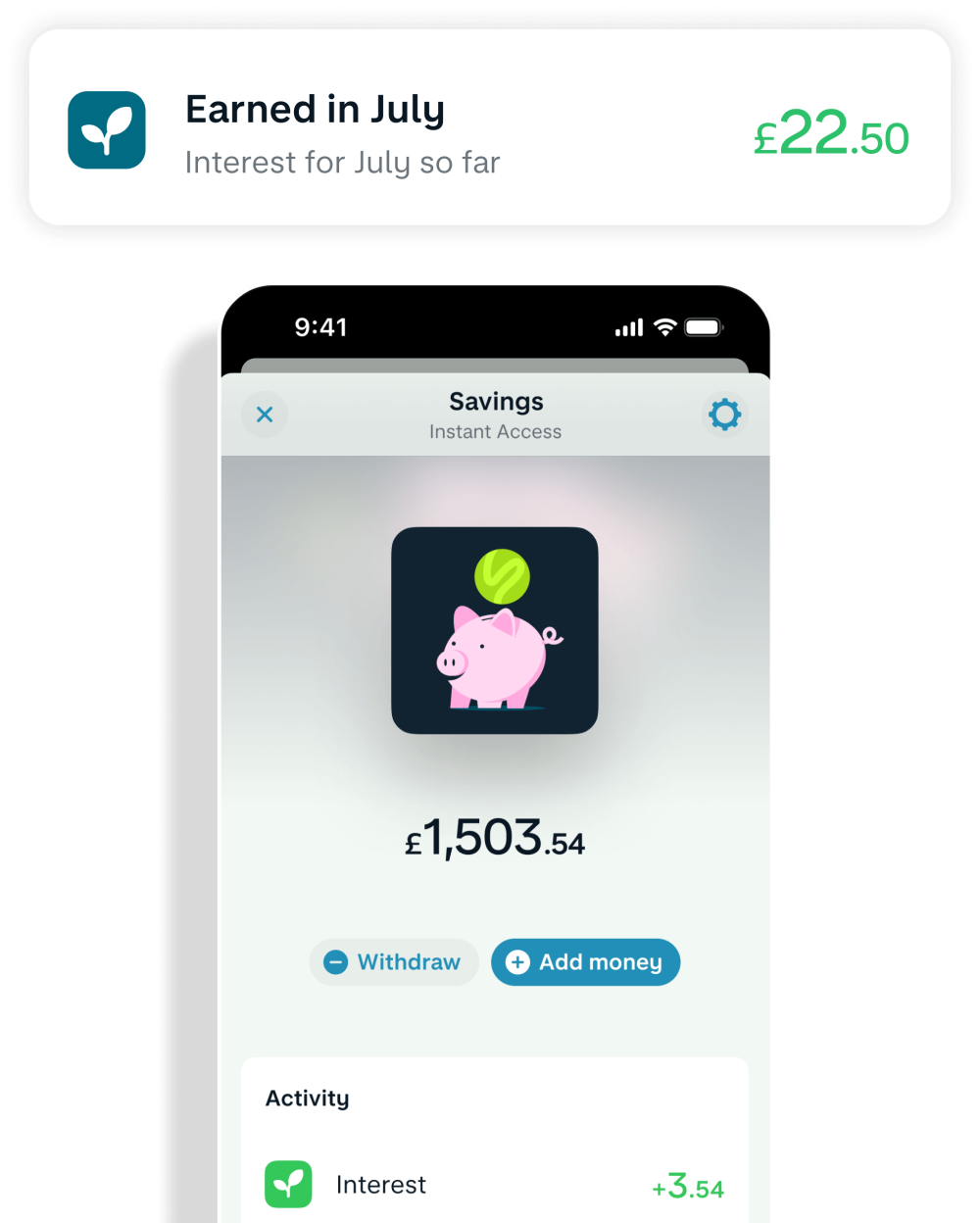

4.10% AER (variable) interest, paid monthly

Extra

£3 a month

months minimum

Includes all features from Free

A UK current account

Your eligible deposits are protected by the FSCS up to £85,000 per person

All the Monzo features you know and love

4.10% AER (variable) interest, paid monthly

Includes everything from Free, plus:

Connected banks and credit cards

Virtual cards

Advanced roundups

Custom categories

Auto-spreadsheet

Credit insights

Fee-free withdrawals up to £200

18+ • Ts&Cs apply

Perks

£7 a month

months minimum

Includes all features from Free

A UK current account

Your eligible deposits are protected by the FSCS up to £85,000 per person

All the Monzo features you know and love

4.10% AER (variable) interest, paid monthly

Includes all features from Extra

Connected banks and credit cards

Virtual cards

Advanced roundups

Custom categories

Auto-spreadsheet

Credit insights

Fee-free withdrawals up to £200

Includes everything from Free, Extra, plus:

4.60% AER (variable) interest, paid monthly

Fee-free withdrawals up to £600

3 fee-free cash deposits

Discounted investment fees

Annual Railcard

Weekly Greggs treat

18+ • Ts&Cs apply

Max

From £17 a month

3 months minimum

Includes all features from Free

A UK current account

Your eligible deposits are protected by the FSCS up to £85,000 per person

All the Monzo features you know and love

4.10% AER (variable) interest, paid monthly

Includes all features from Extra

Connected banks and credit cards

Virtual cards

Advanced roundups

Custom categories

Auto-spreadsheet

Credit insights

Fee-free withdrawals up to £200

Includes all features from Perks

4.60% AER (variable) interest, paid monthly

Fee-free withdrawals up to £600

3 fee-free cash deposits

Discounted investment fees

Annual Railcard

Weekly Greggs treat

Includes everything from Free, Extra, Perks, plus:

Personal worldwide travel insurance – provided by Zurich, powered by Qover

Personal worldwide phone insurance – provided by Assurant

Personal UK & Europe breakdown cover - provided by RAC

Add your family to your insurance and cover for an extra £5 a month

18-69 • Ts&Cs apply

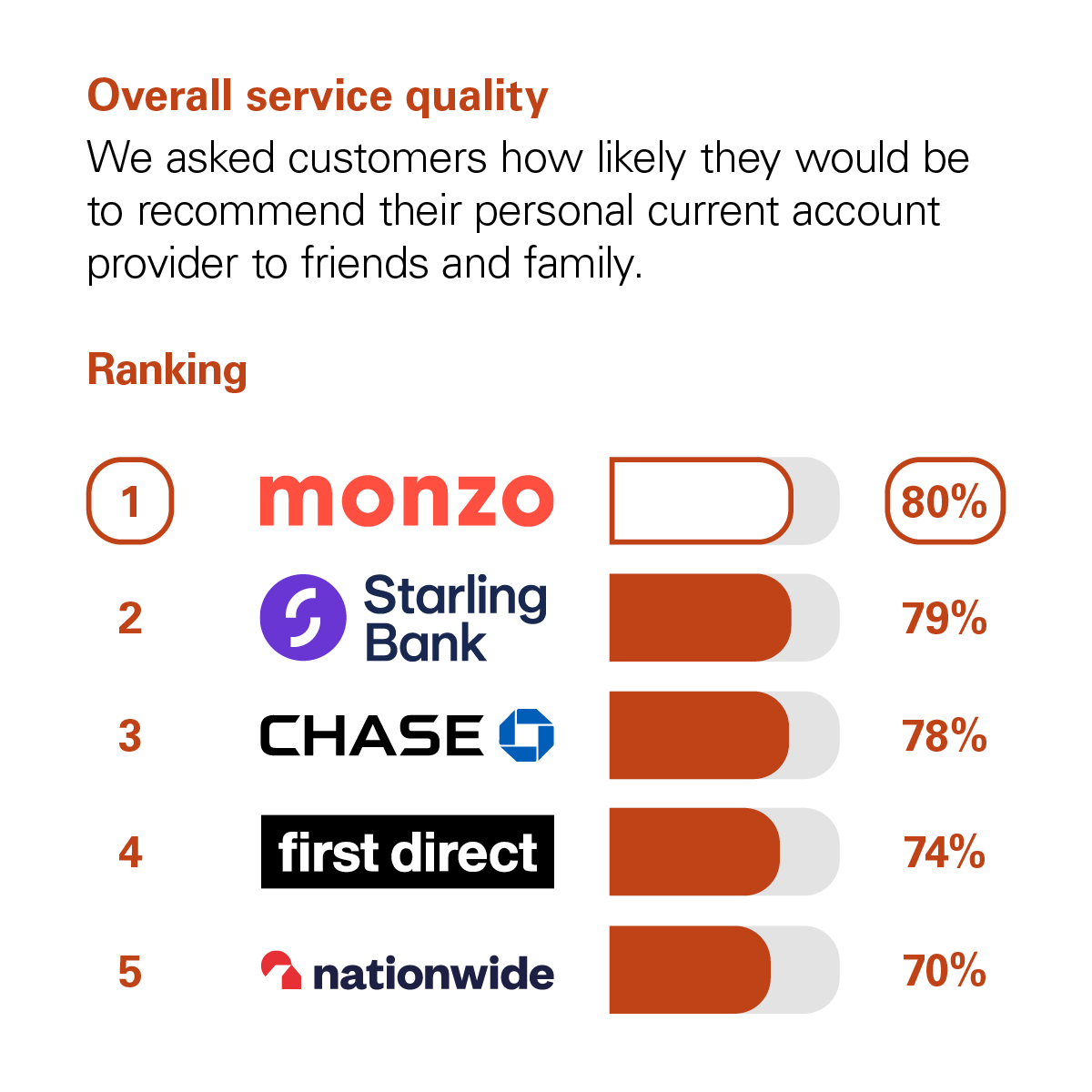

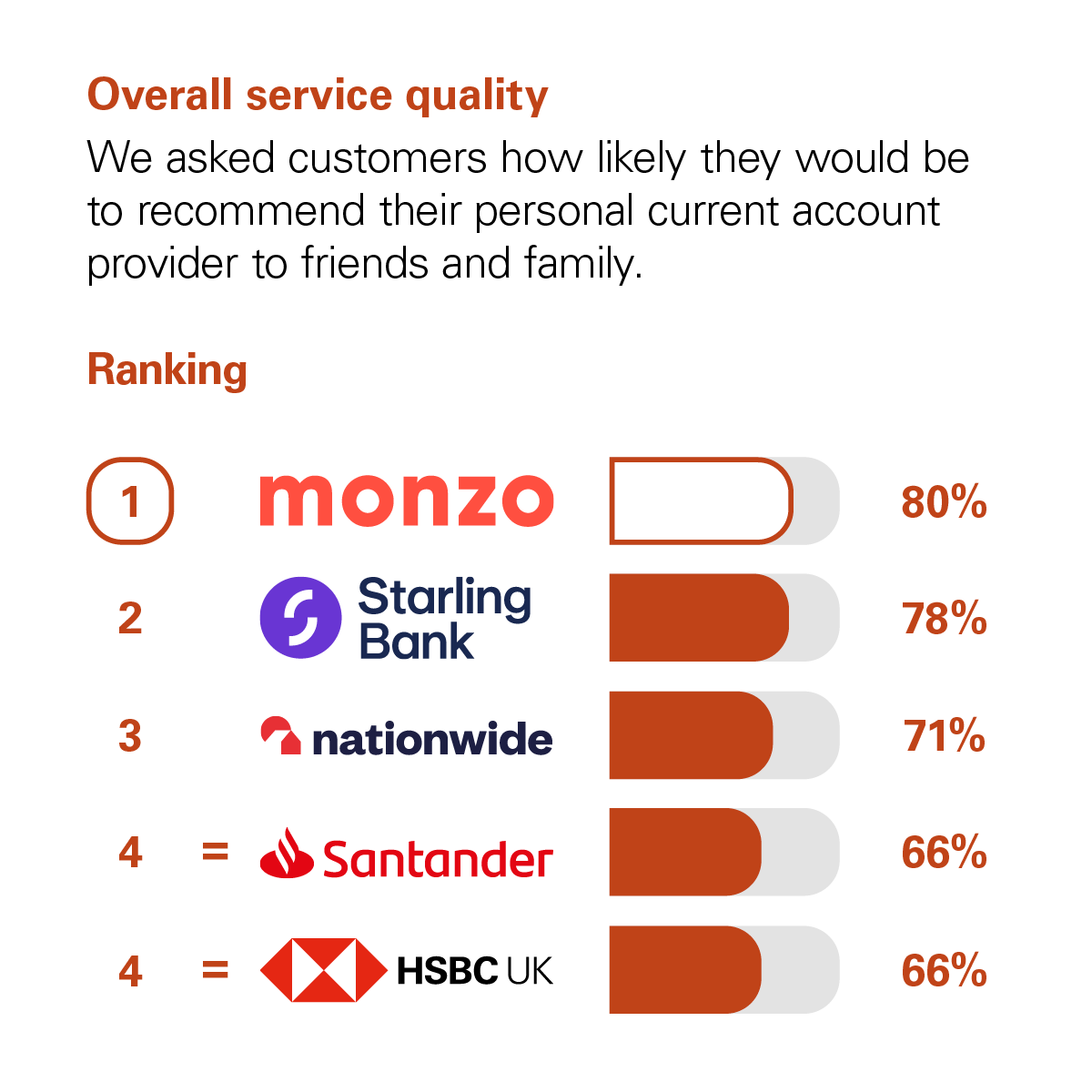

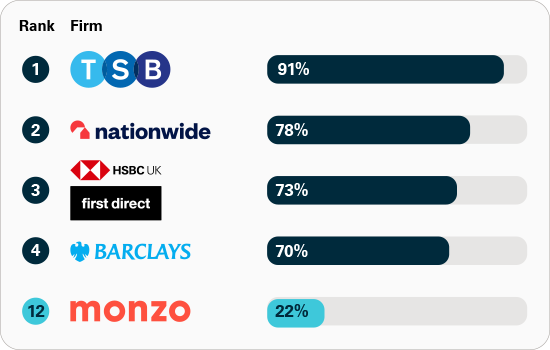

Independent service quality survey results

Personal current accounts

As part of a regulatory requirement, independent surveys were conducted to ask customers of the largest personal current account providers in Great Britain and Northern Ireland if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

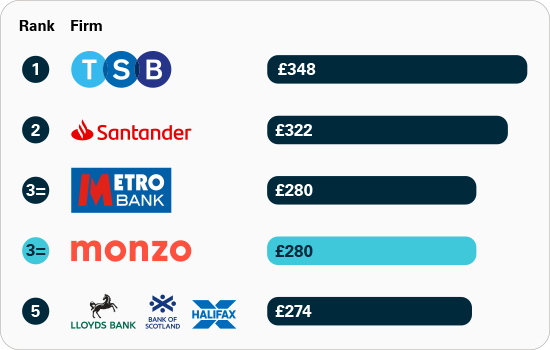

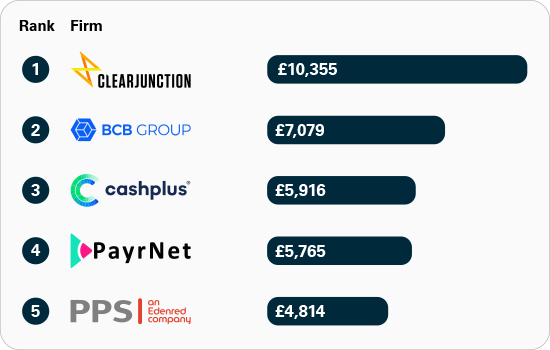

Authorised push payment (APP) fraud rankings in 2022

Authorised push payment (APP) fraud happens when someone is tricked into transferring money to a fraudster's bank account.

These charts use data given to the Payment Systems Regulator (PSR) by major banking groups in the UK in 2022.

You can read the full report by visiting www.psr.org.uk/app-fraud-data

Share of APP fraud refunded

This data shows the proportion of total APP fraud losses that were reimbursed, out of 14 firms. Higher figure is better.

APP fraud sent per £million transactions

This data shows the amount of APP fraud sent per million pounds of transactions, out of 14 firms. Lower figure is better.