See your finances like never before

Get a crystal-clear perspective of your money with Monzo

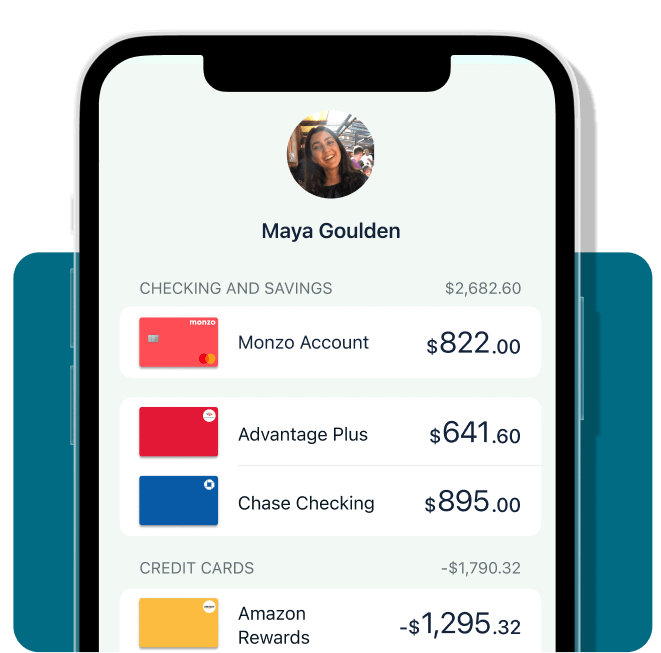

All your banks, one app

We make it easy to see and control all your accounts and spending, right from the Monzo app. Get a better understanding of your money with a comprehensive view of your income, spending, and savings.

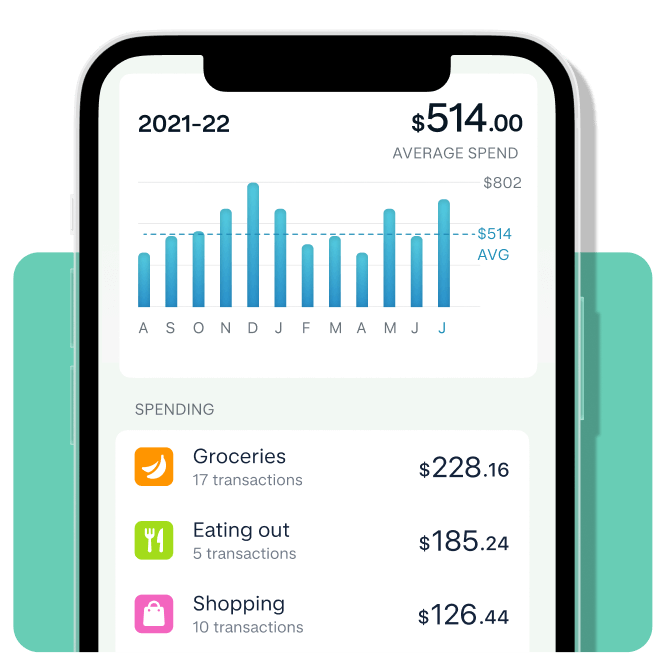

See where your money goes

Understand your spending habits through graphs and personalized insights that help you find trends, identify areas for improvement, and celebrate your progress. Organize your spending with custom categories and tags, and track your money the way you want.

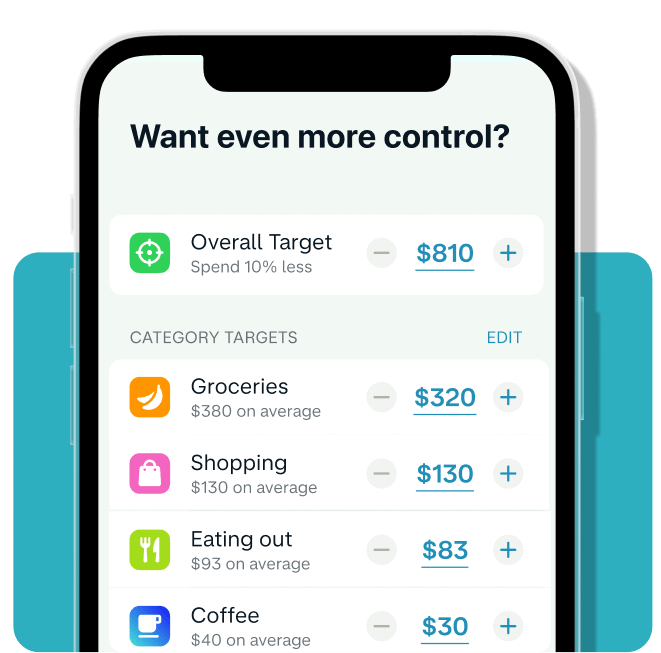

Budget smarter, not harder

Make every dollar count with our easy-to-use budgeting tools. Set separate budgets for different categories, like Groceries, Bills, or even your own custom categories. We’ll track how much you have "left to spend" based on what you set, so you can stay focused on your goals and the bigger picture.

Protection for your money

With Monzo, your money is insured up to $250,000 through our partner Sutton Bank, Member FDIC*

Support from real humans

Our friendly support team is here for you when you need it. Whether you have a question or need help, chatting with us is just a tap away.

40,000+ fee-free ATMs nationwide

Get cash without stress and without fees, thanks to our network of over 40,000 fee-free MoneyPass ATMs.

And since we don’t bury our footnotes

* How does FDIC insurance work?

Your funds are held at Sutton Bank, Member FDIC. Though Monzo is not an insured bank, money in your Monzo account benefits from pass-through FDIC insurance that would protect up to $250,000 in the unlikely event that Sutton Bank failed.

Certain conditions must be satisfied for pass-through FDIC deposit insurance coverage to apply, which you can learn more about here.