The debit card that helps you save

Cash back on your Monzo debit card.* High-interest savings. Manage all your money in one app.

*Subscription applies. Monzo Pro is $10 a month. Monzo is a financial technology company; not a bank. Banking services are provided by Lead Bank or Sutton Bank; Members FDIC. T&Cs apply.

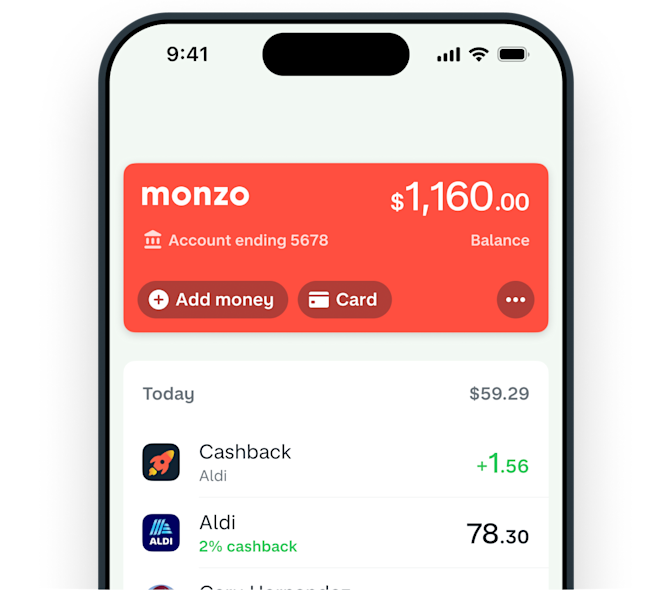

5% cash back on the places you choose†

Offer available to Minnesota residents.

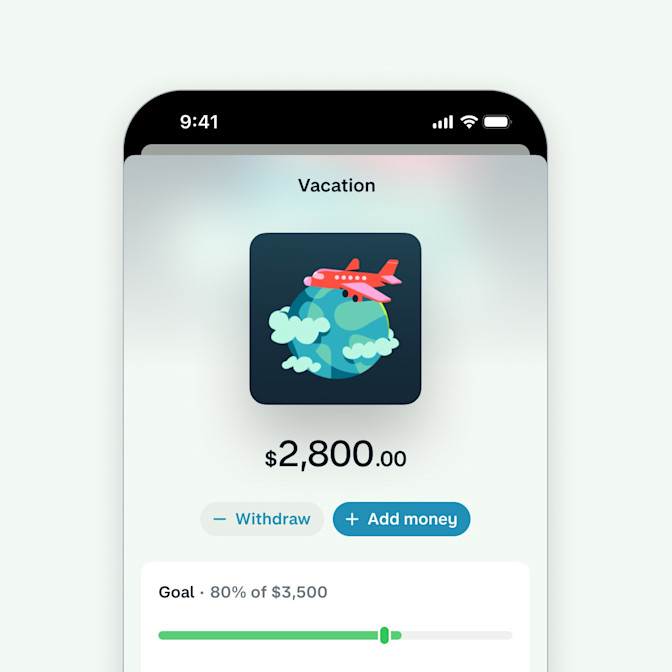

Save more with 3.75% APY‡

Get paid up to 2 days early

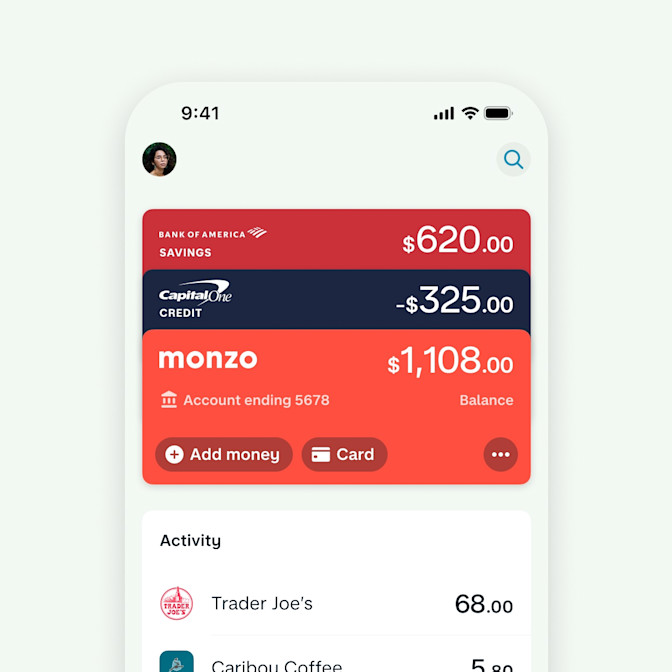

All your money, one app

FDIC protection meets cutting-edge security

With Monzo, your money is eligible for pass-through insurance up to $250,000 through our partner Lead Bank or Sutton Bank, Members FDIC.§

Compare plans

Monzo Base

Monzo Pro

Bank of America

Capital One

Join 13 million customers on Monzo

† How does cash back work? If you’re a Minnesota resident, we’re testing something new in your area — you’ll get 5% cash back on 5 places you choose. In all other states/territories, you’ll earn 2% cash back on eligible groceries and eating out purchases. Cash back is up to $60 per month.

‡ How does APY work? As of June 18, 2025, you’ll earn 3.75% APY (Annual Percentage Yield) with a Monzo Pro subscription and 2.00% APY for Monzo Base users. No minimum deposit needed. Interest rates are variable and may change. Fees may reduce earnings. The interest comes from us, not Lead Bank or Sutton Bank. Your total Savings Jar balance is capped at $100,000. Monzo isn’t a bank. Banking services and debit card are issued by our partners, Lead Bank or Sutton Bank, Members FDIC. T&Cs apply.

§ How does FDIC insurance work? Your funds are held at Lead Bank or Sutton Bank; Members FDIC. Monzo is a financial technology company, not a bank or FDIC-insured depository institution. Monzo accounts are subject to pass-through FDIC insurance up to $250,000 per ownership category, should Lead Bank or Sutton Bank fail. Certain conditions must be satisfied for pass-through FDIC deposit insurance coverage to apply, which you can learn more about here.