Digital banking, made for you

Get cash back on your debit card. Earn 3.75% APY on every savings goal.* Track your spending with tools you'll actually use.

Monzo Pro is $10 a month. Subscription applies.

Monzo is a financial technology company; not a bank. Banking services are provided by Lead Bank or Sutton Bank; Members FDIC, pursuant to a license from Mastercard International Incorporated. T&Cs apply.

Make your money more Monzo

Cash back on your debit card

Earn rewards on where you really spend. Paid straight into your account, as real cash.

Earn 3.75% APY on Savings*

Interest is paid monthly on every Savings Jar. There’s no minimum balance and you can take your money out whenever you need to.

All your money in one place

Stop switching between countless apps and accounts. Link your other bank, credit or savings accounts and see everything in one place.

See your money in a whole new light

Get to know your spending habits with weekly and monthly insights. Get alerts if you’re spending too fast (if you want them).

Instant spending notifications

Stay in the loop with real-time alerts that show exactly how much you spent and with a business name you’ll recognize.

Categorize your spending

Create categories that tell your story. From “Groceries” to “Pets” to “Coffee” you customize how you see your finances.

FDIC protection meets cutting-edge security

With Monzo, your money is eligible for pass-through insurance up to $250,000 through our partners Sutton Bank or Lead Bank; Members FDIC.** And we use advanced security features, like Biometrics and PIN protection, to give you extra peace of mind.

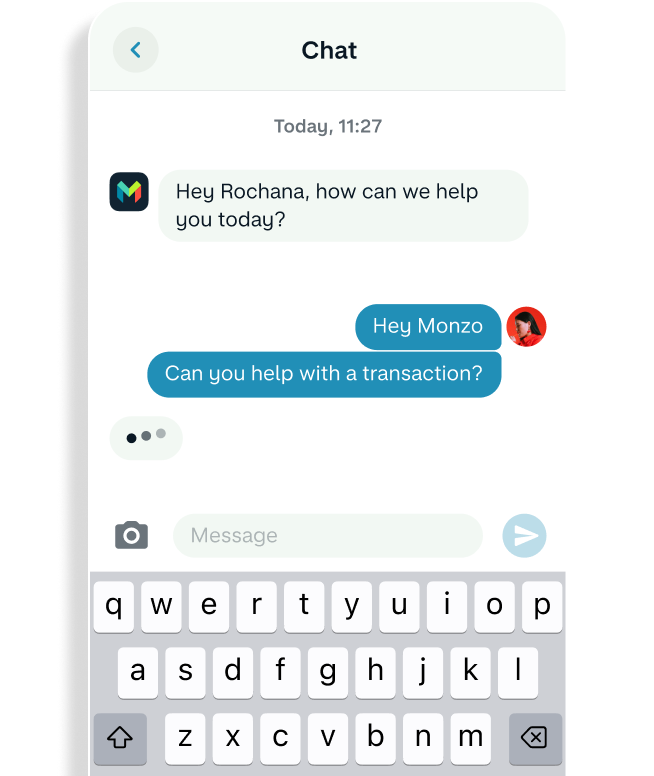

Help whenever you need it

Speak to us whenever you need, wherever you are. Our team’s there to help you through in-app chat.

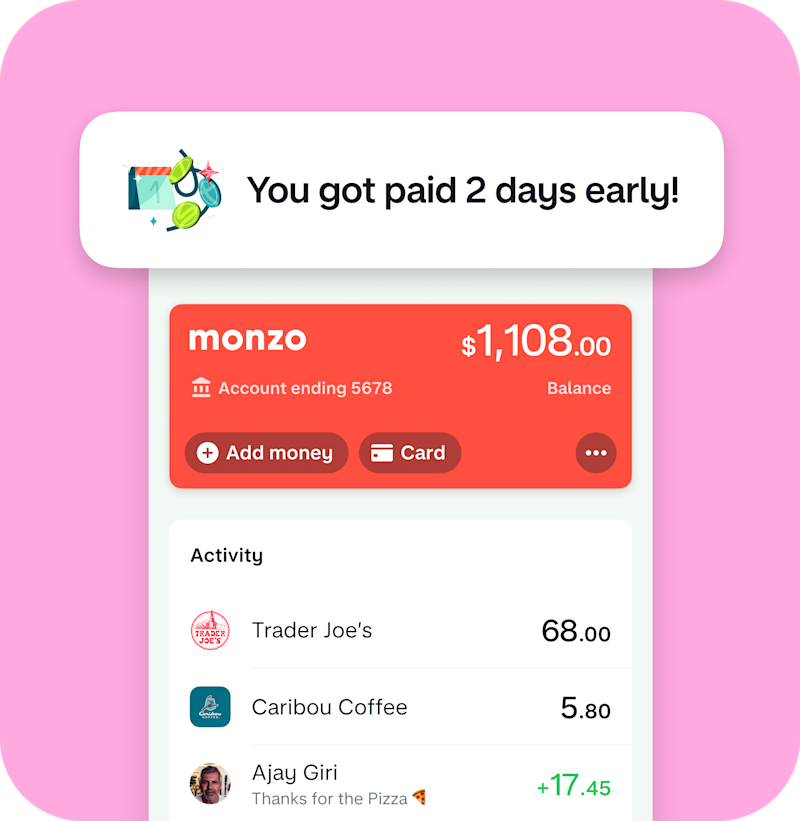

Get paid up to 2 days early

If you get your paycheck into Monzo, you can get access to your money earlier.

Free ATM coverage nationwide

Choose from 40,000+ MoneyPass ATMs where you can withdraw cash for free.

Save as you spend

Every time you spend money, we’ll round it up to the nearest dollar and put the spare change in a Jar for you. All you need to do is switch on roundups.

* How does APY work? As of June 18, 2025, you'll earn 3.75% APY (Annual Percentage Yield) with a Monzo Pro subscription and 2.00% APY for Monzo Base users. No minimum deposit needed. Interest rates are variable and may change. Fees may reduce earnings. The interest comes from us, not Lead Bank or Sutton Bank. Your total Savings Jar balance is capped at $100,000. Monzo isn't a bank. Banking services and debit card are issued by our partners, Lead Bank or Sutton Bank, Members FDIC. T&Cs apply.

** How does FDIC insurance work? Your funds are held at Lead Bank or Sutton Bank, Members FDIC. Monzo is a financial technology company, not a bank or FDIC-insured depository institution. Monzo accounts are subject to pass-through FDIC insurance up to $250,000 per ownership category, should Lead Bank or Sutton Bank fail. Certain conditions must be satisfied for pass-through FDIC deposit insurance coverage to apply, which you can learn more about here.