Is it just me or have prices increased when going to the grocery store or eating out? If you’re like me, it can be a bit stressful not knowing where you’re at during the month or if you’re making the right decisions on when to stay in or cut back.

We’ve heard from customers that managing their budgets with spreadsheets or budgeting apps didn’t cut it. It’s too much work to manually enter all the data or to wait hours for the app to get fresh data.

We recently launched category targets in Trends to help you spend with confidence. Whether you're a budgeting novice or looking for a more streamlined approach, category targets are a simple way to help you stay on track with your finances.

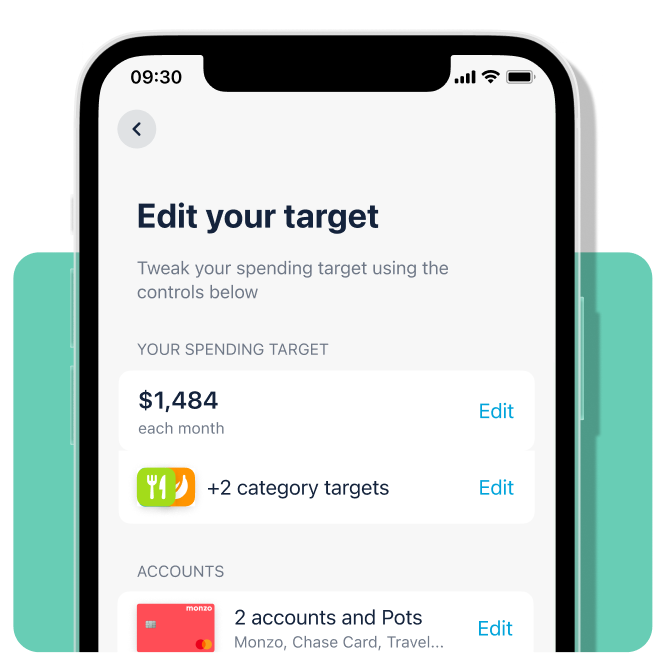

In a few easy steps, you'll get a personalized spending target by category across any accounts you have, including credit cards.

Set your spending goals

Go to the Trends section in the app and tap Targets, then select which accounts and cards you’d like to track. We’ll track your spending on your Monzo card as well as any external account or credit card. Your spending is broken down into standard categories, like groceries, entertainment, and transport, or you can create custom categories tailored to your specific needs.

Assign budgets to categories

After selecting a category, you can set a monthly spending target. We’ll give recommendations based on your previous spending patterns, making it easier to set realistic goals. Remember, the key is to establish achievable targets that align with your financial situation and goals.

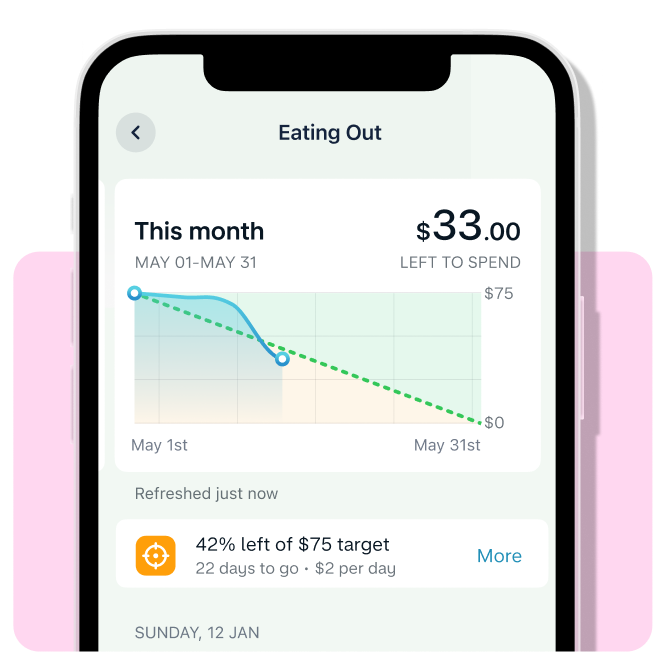

Monitor your progress and make adjustments as needed

Once you've set your category targets, we’ll start tracking your spending in each category. You'll receive notifications when you're close to reaching your target or if you've overspent in a particular category.

We know life can sometimes come fast, and there might be times you need to make adjustments to your targets. If you find that you need to modify your budget for a specific category, simply revisit the Trends section in the app and make the adjustments to best fit your needs. Flexibility is key to maintaining a sustainable budget.

Category targets help you regain control of your budget. By following these simple steps, you can set realistic spending goals, track your progress, and make adjustments along the way. Remember, budgeting is a journey, and it's okay to refine your targets as your financial situation evolves. Set a target today and transform the way you see, save, and spend your money.

We hope that category targets help pave the way for you to achieve your financial goals. See what else we’re working on with our public roadmap and let us know what you think in our community forum.