Digital banking that rewards you

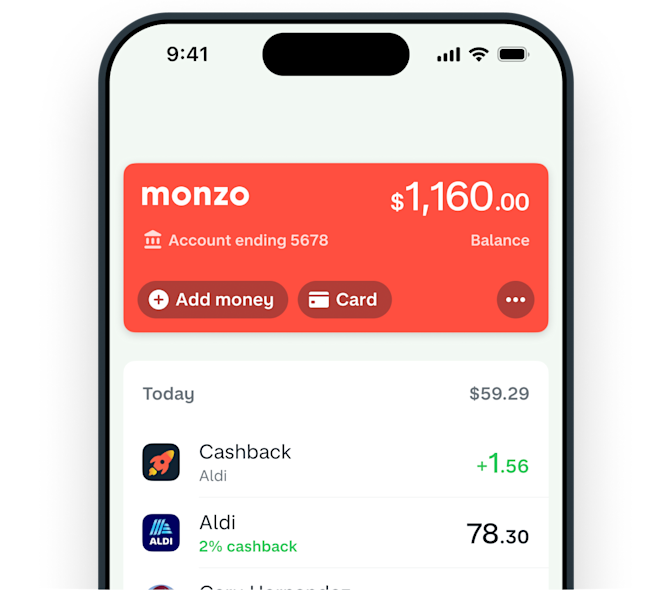

Get up to 5% cash back on all your spend for your first month.

Monzo is a financial technology company; not a bank. Banking services are provided by Lead Bank or Sutton Bank; Members FDIC. T&Cs apply.

Get cash back on all your purchases for your first month*.

After your first month, choose your 5 favorite places to get cash back at. You can even suggest places you want added to our list. It's the best way to be rewarded for being you.

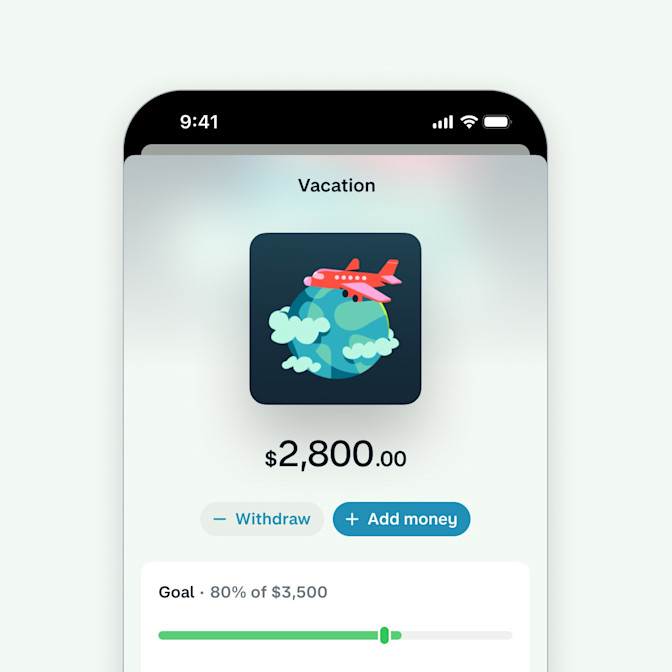

Each of our accounts gives you the chance to save more, your way. Interested?

With Monzo, your money is eligible for pass-through insurance up to $250,000 through our partner Lead Bank or Sutton Bank, Members FDIC.**

Everyday | Preferred | Plus | Plus | |

|---|---|---|---|---|

| Cash back on debit | 1% at 5 places* | 5% at 5 places* | Chime deals | |

| Savings APY | 2.00% APY | 3.75% APY | 3.50% APY | 3.60% APY |

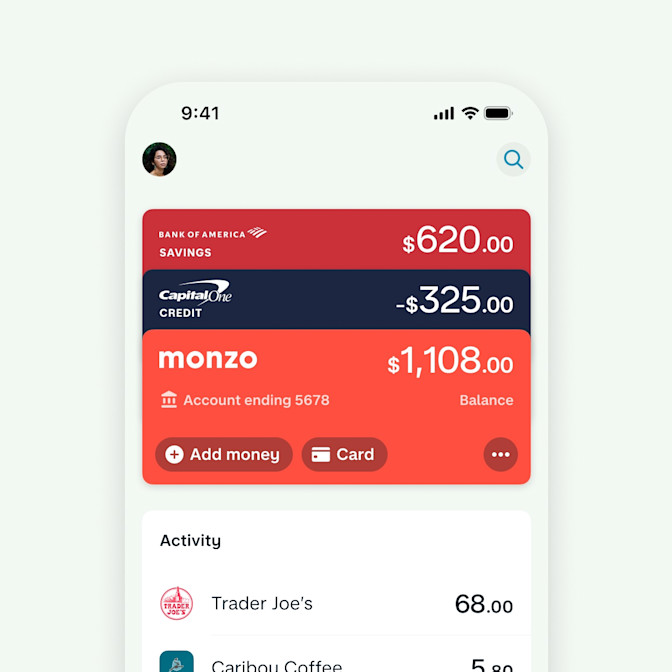

| Linked accounts | ✓ | ✓ | ✓ | |

| 24/7 support | ✓ | ✓ | ✓ | ✓ |

| Monthly cost | $0 | $10 | Direct deposit required | $10 or direct deposit required |

Data as of December 8, 2025. Competitor features and fees may change. Please check their websites for the latest information.

*How does cash back work? Earn up to $60 a month. Exclusions apply.

**How does FDIC insurance work? Your funds are held at Lead Bank or Sutton Bank; Members FDIC. Monzo is a financial technology company, not a bank or FDIC-insured depository institution. Monzo accounts are subject to pass-through FDIC insurance up to $250,000 per ownership category, should Sutton Bank fail. Certain conditions must be satisfied for pass-through FDIC deposit insurance coverage to apply, which you can learn more about here.