The bank your money’s been waiting for

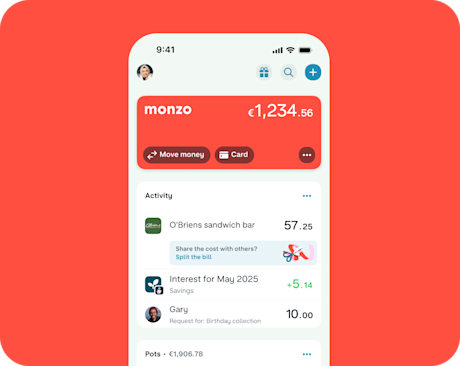

Get on the waitlist for early access to a free Monzo bank account. If you’re invited to join, we’ll give you a €25 reward when you activate your card.

Limits, account Ts&Cs and promotion Ts&Cs apply.

We’re new to Ireland, but in the UK we’re the award-winning bank that’s spent the last 10 years helping people feel good about their money. Families, roommates and businesses already use Monzo to spend and save smarter – now it’s Ireland’s turn.

Free Monzo accounts coming to Ireland

No hidden charges or maintenance fees, just total clarity on your money.

Get early accessMake life easier for you and your customers with free instant bank transfers, deposit protection, instant notifications and more.

Get early accessPartner, housemates or soulmates, if you’re both Monzo customers then you’re eligible to apply.

Get early accessOur account for 6–15 year olds, with no up-front costs, subscriptions or top-up fees. Set limits and schedule pocket money from the app. Free for every child.

Get early accessOur account for 6–15 year olds, with no up-front costs, subscriptions or top-up fees. Set limits and schedule pocket money from the app. Free for every child.

Get early accessOur account for 6–15 year olds, with no up-front costs, subscriptions or top-up fees. Set limits and schedule pocket money from the app. Free for every child.

Get early accessIrish-regulated with a local IBAN, we're a new kind of bank rooted in Ireland.

Speak to a real-life human if something urgent comes up. We're available through in-app chat when you need us.

We’re fully regulated by the Central Bank of Ireland, and your money is protected up to €100,000 by the Deposit Guarantee Scheme.

With local IBANs, Monzo's in Ireland for the long run.

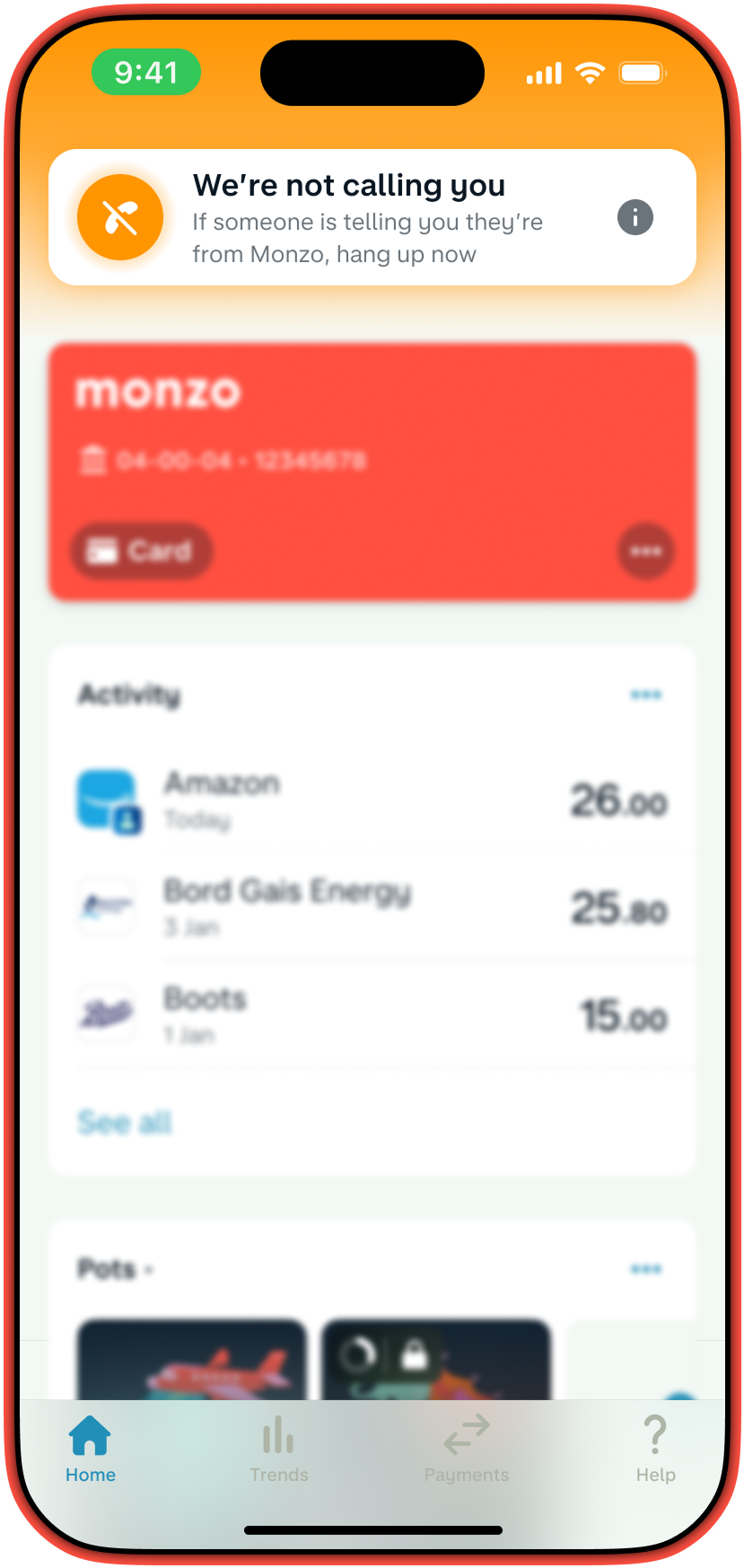

With industry-first fraud protection and real human support, your money isn’t going anywhere you don’t want it to.

If we invite you to get early access you’ll get €25 after you sign up and activate your card – plus another €25 if you set up a business account.

Sign up in a couple of minutes. Download the app to see your position on the list, and how to jump ahead.

If an invite arrives in your inbox, you can then sign up to an early version of the app.

No, really. Early users get €25 as a thank you for shaping Monzo with their feedback.

We're the bank that makes you feel differently about your money. We're new to Ireland but more than 14 million customers trust us with their money in the UK.

When we started out over 11 years ago we made it our mission to make money work for everyone. And that's exactly what we're here to do in Ireland.

It really is. A Monzo current account is completely free, with no sneaky maintenance fees, ATM withdrawal fees or foreign exchange fees.

Yes! We're a regulated Irish bank with an office in Dublin, an Irish banking licence, local Irish IBANs. We're authorised and regulated by the Central Bank of Ireland and part of the Deposit Guarantee Scheme, which means your eligible deposits are protected up to €100k.

Absolutely, we're a licensed bank that's authorised and regulated by the Central Bank of Ireland and part of the Deposit Guarantee Scheme, which means your eligible deposits are protected up to €100k.

We have an office in Dublin and although we're new to Ireland we have 14 million customers in the UK already.

Our industry-first security controls for large payments – like trusted contacts, QR code scanning and known locations – are just a few ways we’re protecting you and your money. Plus things you might already be familiar with, like card freezing if your card gets lost or stolen, and fingerprint or facial recognition to approve online shopping and getting into your Monzo app.

We do, and not just any savings either. We have the best free Instant Access Savings rate in Ireland right now for personal bank accounts and business bank accounts.

Earn 1.6% AER (Annual Equivalent Rate) variable interest on your savings, paid monthly and subject to DIRT (Deposit Interest Retention Tax).

We're different in loads of ways.

By solving your problems, treating you fair and square and being totally transparent, we can make banking better. Banking that keeps your money safe and really helps your savings grow. Banking that’s there when you need it and not just when we’re open. Banking that’s so much more than a snazzy app for payments.

We don’t think you should have to pay fees for day-to-day banking, either. Which is why we have free accounts for you, your business, your better half, your little (and not so little) ones.

We're launching fully in Ireland very soon but until we do, we've set up a waitlist for people to get their hands on an early access version of Monzo.

Here's how it works. You pop your name on the waitlist and download the Monzo app to find out your position. Once you secure your spot on the waitlist you'll have opportunities to move up the list, earning rewards along the way.

When you get to the front we'll invite you to sign up for early access. And then once you’re in and you’ve activated your card we’ll give you €25 to get you started.

Early access is all about shaping the Monzo experience in Ireland together. Which is why we’ll work with you to get your feedback and hear how we could make things even better before we launch fully.

Speak to a real-life human if something urgent comes up. We're available through in-app chat when you need us.

You can chat to us in the app or email us at help@monzo.com.

Or, phone us on our toll- free local number 1800849291 from anywhere in Ireland. To call us from outside Ireland, the number is +35312337650 (operator charges may apply).