Managing money between two people doesn't have to be difficult.

Whether you’re just starting out or you’ve known each other for years, you can both benefit from using a joint account to help manage your money more effectively. Say goodbye to manual spreadsheets or calculating how much you owe each other at the end of every month.

Here's how a joint Monzo account can help you manage your shared finances:

Organize your spending by account 🗃️

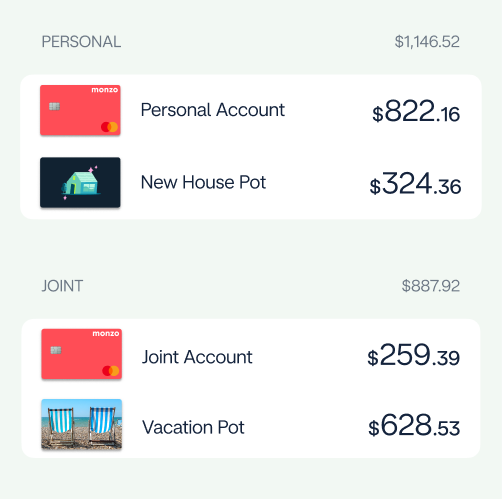

You’ll get both a personal account and a joint account, each with its own card, to keep your spending separate. Put your Spotify Family subscription on your joint account and your gym membership on your personal one.

Add both your personal Monzo card and your joint Monzo card to Apple Pay or Google Pay so you don’t have to carry both cards around. You can also switch between your accounts within the app to see your account activity - no more jumping between different apps to manage your money.

Set aside money for your shared goals 🏅

Pots let you segment your money the way you want to and can help you track your goals. Saving for a new house together? Put money aside in a Pot. Want to stay on top of your bills? Put it in a Pot. You can easily see who’s contributing to your financial goals.

If you get your paycheck deposited into your joint account, use Salary Sorter to divide it up into your different joint account Pots.

Pay shared bills and expenses 💡

One of the most common reasons for opening a joint account is to manage household expenses together. Use Pots to separate your funds for the electric bill or water bill. Or put it all into one Pot to cover everything, including the unexpected.

Your joint account comes with its own account number so you can pay your bills directly from your shared funds. A way to pay directly from your Pots is coming soon, so watch this space!

See who spent what and where in real time 👀

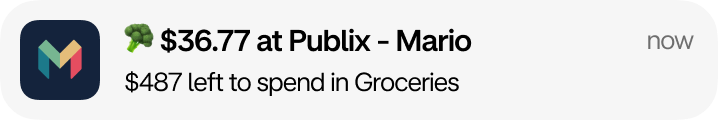

All your joint account spending shows up in one unified transaction feed. Every transaction is automatically tagged with your profile photo, so you can keep track of who made which transaction.

Instant spending notifications also include the name of who made the transaction. No more panicking if it was you or your partner who spent that money.

Categorize transactions and split the cost ⚖️

Choose from standard categories, like Bills and Groceries, or create your own so you can see what areas you spend the most on. You can also tag each transaction with keywords or hashtags so you can search for them later.

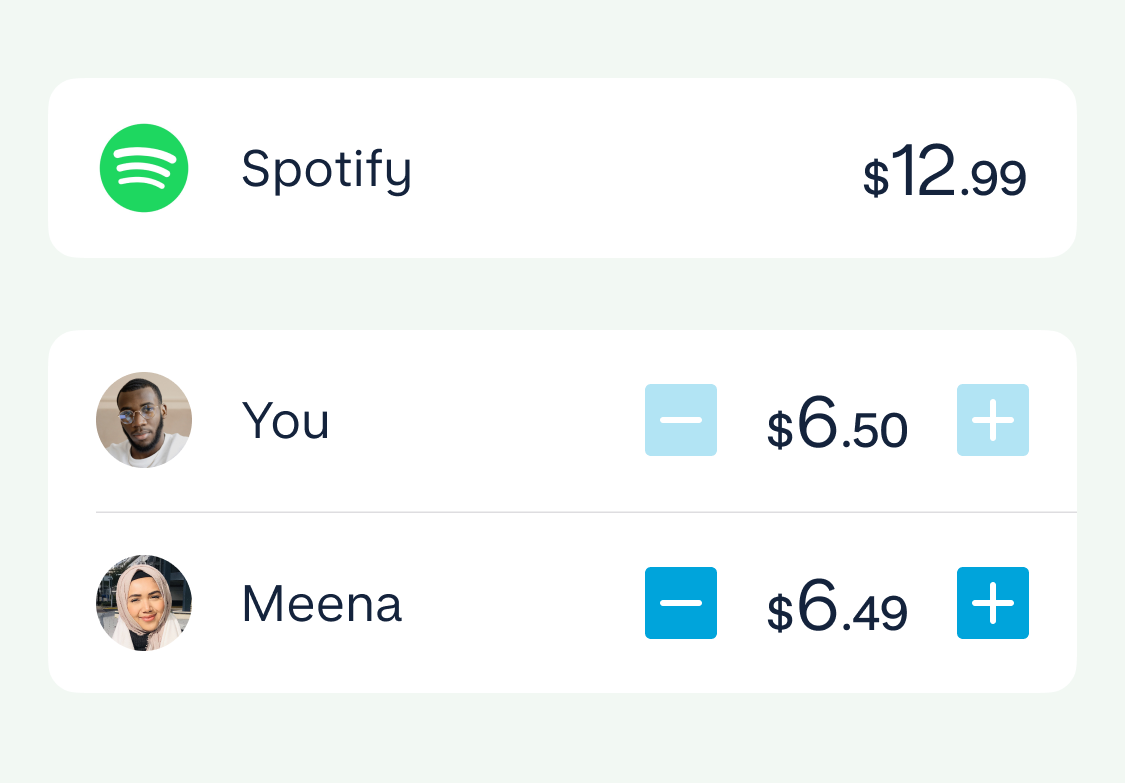

You can split transactions across multiple categories, or even split the cost of the transaction itself. If your partner bought the newest Call of Duty game for themselves while you’re grocery shopping together, split that transaction and only have to pay for what was actually spent on groceries.

Connect your external accounts for full visibility 🔗

Link your bank accounts and credit cards to view them all within Monzo and easily move money between any of your accounts and Pots. For example, transfer money from your personal Monzo account right into your joint account Vacation Pot.

Your account co-owner won’t see what accounts you’ve connected and vice versa, unless you both link the same account.

Understand how your joint account spending affects your personal Trends 📊

Including your joint account and Pots in your personal Trends graphs can help you set appropriate spending targets for yourself when budgeting. If you choose to include your joint account, any joint account transactions will show up in yours and your co-owner’s personal Trends graphs.

A joint Monzo account can be good for people who want to share certain aspects of their finances, like everyday spending or household bills. You don’t have to be married or in a relationship – siblings, other family members, or even roommates, can share a joint account too.

You should only open a joint account with someone you trust - you’ll both have full access to everything in the joint account.

Ready to be more in control of your finances together?