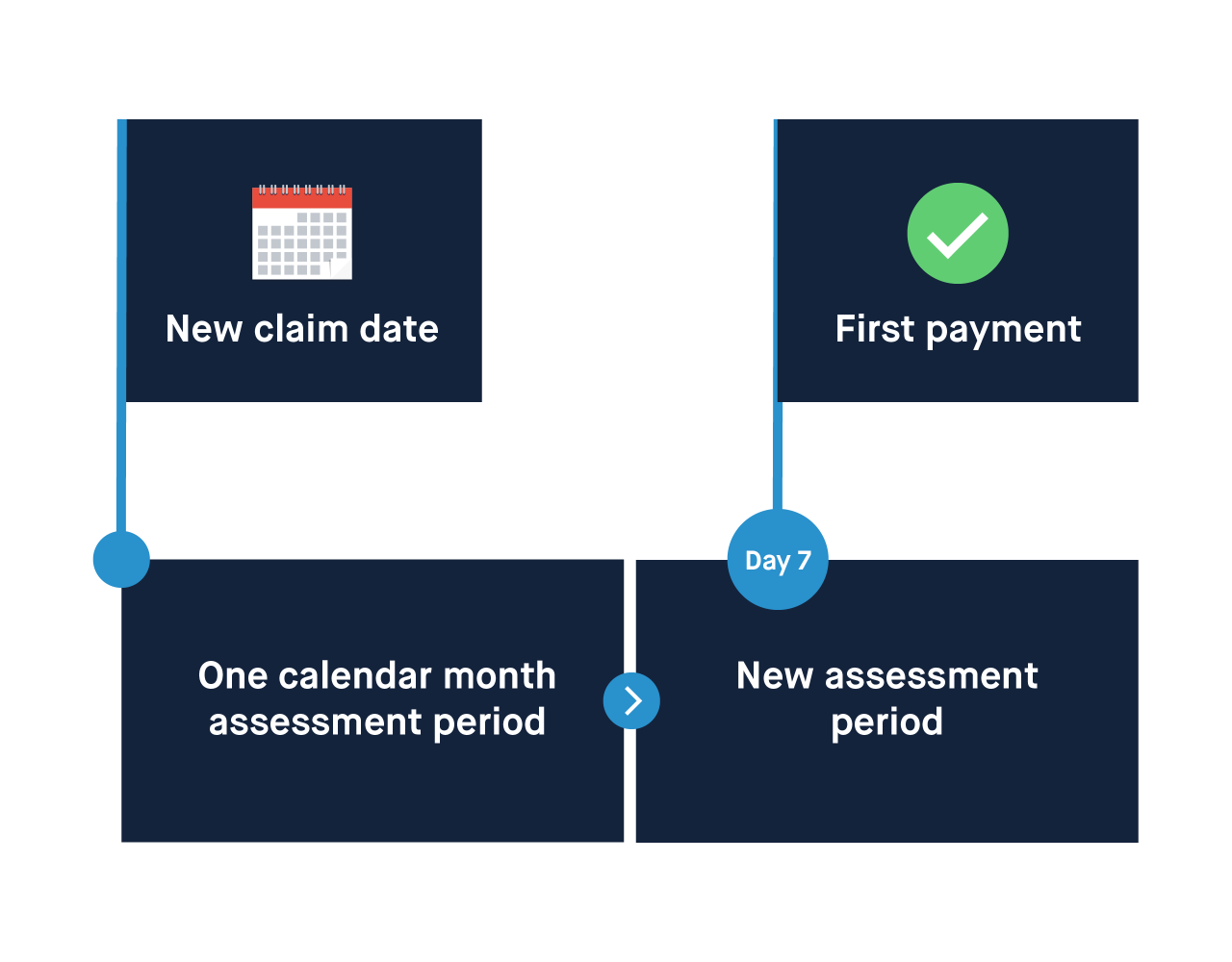

Once the government approves you for Universal Credit, it’ll normally take five weeks after the date you submitted your claim for you to get the first payment.

It takes HMRC four weeks to assess your earnings from last month, and a further week to process the payment.

I can't wait five weeks until my first payment

Five weeks can be a long time. And if you don’t have enough money to tide you over until your first payment, there are a few things you can do.

1. Use Advice Local to search for other welfare benefits provided by the council in your area

2. If you're within your first assessment period and have had your interview, you could apply for a Universal Credit advance payment

You can apply for a Universal Credit advance through your online account or by calling the Universal Credit helpline. There are more details on how to apply on the gov.uk website. You’ll usually get a decision on wether or not they've accepted your application on the same day.

The most Universal Credit you can get as an advance is the amount of your first estimated payment. You'll pay it back in instalments when you start to get Universal Credit.

3. If you get any of the benefits below, you can also apply for an interest-free 'budgeting loan' from the government:

Income-based Jobseeker’s Allowance

Income-related Employment and Support Allowance

Pension Credit

Income Support

I’m struggling to adjust to monthly payments

When you get Universal Credit, the government will usually pay you once a month.

This might be different from your old benefits, where you might get paid more often (like every week). It can be difficult to adjust if you're not used to budgeting monthly. Or if you have lots of expenses, it can be hard to make the money last.

Set up an alternative payment arrangement (APA)

Alternative payment arrangements are different ways the government can pay you your Universal Credit.

They can be useful if getting paid once a month doesn’t work for you, and you're falling behind on rent or bills. Your work coach may refer you for one of these if you're struggling to keep up with payments. But you can also request one through your work coach. Universal Credit staff consider APAs on a case-by-case basis, depending on your circumstances. So there's no guarantee you'll have access to these options.

There are three types of alternative payment arrangements which you can set up:

The DWP can pay your landlord directly

The DWP can pay your Universal Credit more often that once a month, usually one a fortnight (every two weeks)

The DWP can split the money between a couple

The decisions the DWP makes about alternative payment arrangements are final, so you can’t appeal them. But they regularly review your circumstances to check if anything’s changed. And if something has changed, you should let them know as soon as possible. If you don’t, they could be paying you more (or less) than they should be, and could ask you to pay the money back.

How will having a job affect my Universal Credit payments?

How much Universal Credit you get will depend on how much you earn. As you earn more, your Universal Credit payments will go down. The government will reduce your payment by 63p for every £1 you earn.

There’s no limit to how many hours you can work. Just remember it’ll affect how much Universal Credit you can get.

How do deductions work?

Sometimes, the DWP will take away some of your Universal Credit before they pay you. They’ll use it to pay your bills if you’re behind, or if you got an advanced payment and you need to pay it back, for example. The DWP can take a maximum of 30% of your Universal Credit payments at a time.

But this 30% limit doesn't include ‘last resort deductions’, ‘third party deductions’, or monthly utility bills. These can happen if you’re behind on payments for your housing or fuel (in ‘arrears’) and at risk of getting evicted or having your gas or electricity cut off. The DWP can take ‘last resort deductions’ from your Universal Credit payments to pay for your bills.

If the deductions the DWP are making from your Universal Credit mean you don’t have enough money to live, you can ask them to take off smaller amounts instead. But you’ll have to prove that you can’t afford them by showing them evidence of your income and a financial statement that shows what you’re spending your money on.

You should be able to submit these through your online account. But if you don’t have one, you can give them this information in your online journal or by writing a letter.

My Universal Credit payment won't cover my rent

If your Universal Credit payment won’t cover your rent, your local council might be able to help you make up the difference.

The government gives your local council pots of money to use for ‘discretionary housing payments.’ The council can give you this money if you’re struggling to make up the gap between the amount of Universal Credit you get and how much your housing costs.

How you claim ‘discretionary housing payments’ and if you're eligible differs depends on your local council.

If you’re moving from housing benefit to Universal Credit, you’ll keep getting housing benefit for two weeks. But remember, it usually takes five weeks to get your first Universal Credit payment, so you might need to think about how this affects your ability to pay rent on time.

Will I get housing support if I live in supported accommodation?

If you live in a hostel, refuge or supported accommodation, you can claim Universal Credit. But if you get support from your local authority, the DWP might not pay your housing costs.

To cover your housing costs, you may have to claim housing benefit from your local authority, who found and placed you in your current home.

Ask your landlord or housing provider if you don’t know if you can claim housing benefit at the same time as Universal Credit.

Read more about how to access Universal Credit here.