Hey, it’s Kate and Antonio here 👋

I’m a researcher and Antonio is a product manager for Monzo Flex. It’s been just over a year since we launched this new way to spread the cost of pretty much anything. To celebrate Flex’s first birthday we wanted to share more about why we launched a new 0-1 product to help people pay for purchases later and how a mixed-method research discovery led to the product that over hundreds of thousands of customers use and love today!

Before we get started, as Flex is a credit product there’s a few things we’re required to say:

Not everyone will be eligible for Flex. We will run a soft credit search to assess if you are eligible, and a hard search if you go ahead and open Flex

As a minimum, you’ll have to be over 18 and a UK resident. The representative APR for Flex is 29%. Ts&Cs apply.

When making a purchase with Flex, it’s worth considering if you need to use credit and are comfortable with the costs. If you miss a payment this may negatively impact your credit score.

How did we decide we wanted to build a product that helped people pay later?

Speaking to customers to get a deep understanding of their needs is a core part of Monzo’s approach to building products. Early on in our discovery we learned that the ability to ‘pay later’ for purchases was a big customer need, and more importantly, a key need that Monzo was not meeting through existing products. We heard customers talk about different short-term borrowing products such as credit cards and buy-now-pay-later, and the pain points associated with these.

Customers wanted the ability to pay later for purchases in a way that helps them still feel in control of their personal finances. We realised pretty quickly that having this option all in one place, alongside other finances with the same intuitive and delightful experience customers are used to with Monzo was a key gap in the market and something we were uniquely positioned to solve!

How did the team approach discovery?

We wanted to make sure we understood the whole picture before jumping into any ideas. That started with understanding the needs that different existing short-term borrowing products serve today (and their gaps!), why people use them, the value they add to customers' lives and the biggest pain points and frustrations our customers have with existing products.

Skip forward multiple surveys, desk research, depth interviews and more… we spotted a big gap in the market and shaped 4 key principles that guided our entire product vision and design.

Certainty. Control. Visibility. Convenience.

How did those 4 principles go on to shape the product?

Certainty

Customers wanted to know for certain that they’d be accepted before they made the purchase they had in mind. They also didn’t want the friction of having to apply again each time they needed to pay later for a purchase.

If something unexpected happens, they need confidence and trust in knowing their upfront limits and that they can access them when needed. This was a key motive for why customers were using credit cards.

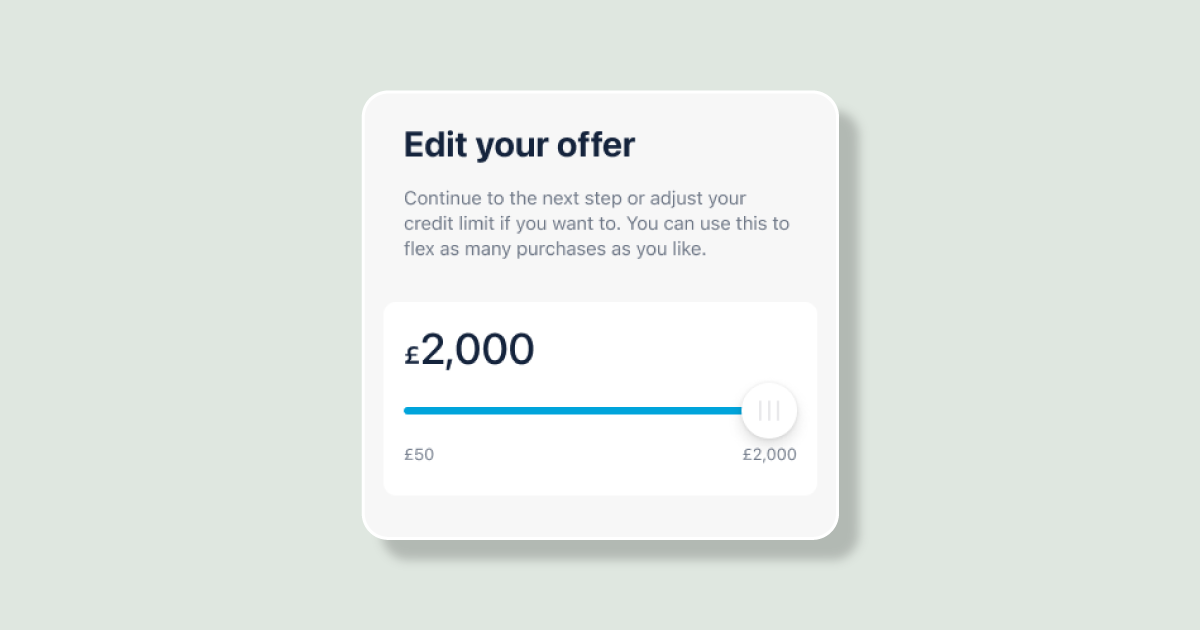

Through this insight we decided Flex would give customers a single spending limit for all their purchases. When a customer opens Flex, they go through a credit and affordability assessment and are asked to choose their limit. We believe giving customers choice over their limit balances the customer's need for certainty, whilst still being in control over their total credit.

Control

We heard customers talk about their worries and frustrations with credit cards. They told us that when you spend on those products, it can feel difficult to keep track of the individual purchases you’ve made and you end up with a rolled up ‘lump sum’ of money to pay back. When you are paying things back, it can feel difficult to know the difference between minimum payments and the actual balance you owe.

We saw how these existing product features were creating customer anxiety and we heard that it’s a reason why some people preferred instalment plan products over credit cards. We knew that the product we created needed to put customers at the heart and make them feel fully in control of their purchases and their repayments.

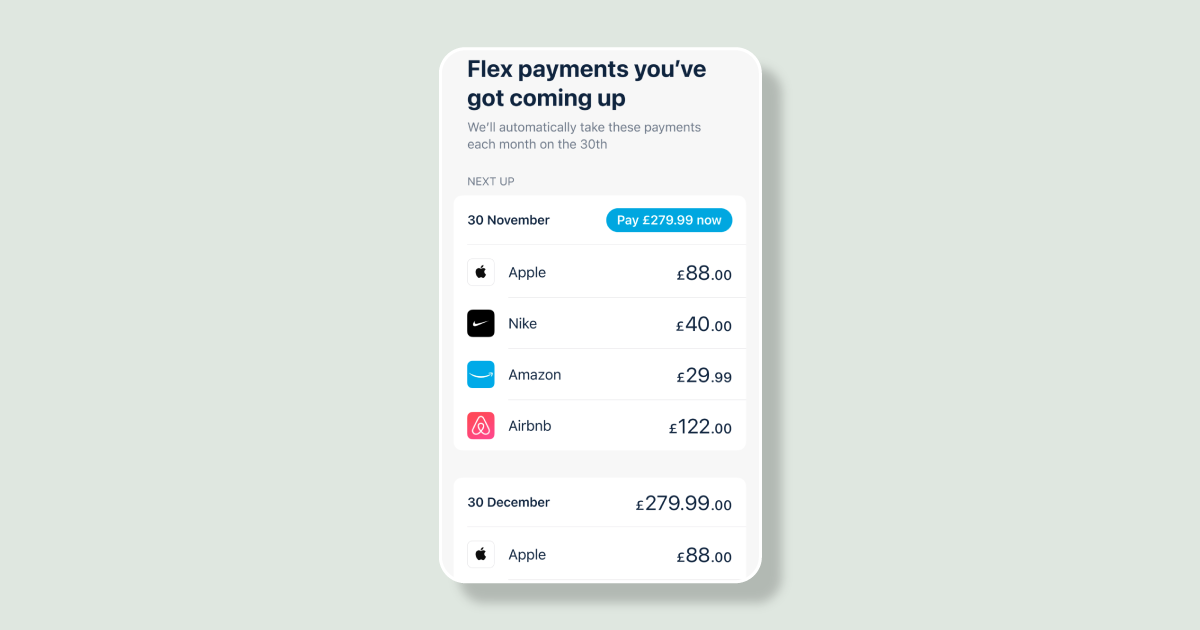

We made the decision to build the product with a fixed repayment structure where customers can choose to split a purchase over 3, 6 or 12 instalments. It means every purchase they use Flex for has a clear end date and increases feelings of control with a clear and visible monthly repayment amount they expect and can plan for month on month.

Visibility

Visibility and control were deeply linked. Customers needed the ability to see their total Flex spend broken into individual purchases. They also wanted to be able to see and keep track of the individual repayment progress for each purchase they’d made.

The feeling of repaying and progression was a huge psychological motivator and we introduced individual progress bars for every item on a customer's Flex feed to visualise how much they’d paid back and how much they had left to pay to increase visibility.

Convenience

Our customers lead busy lives and don’t have the time to be managing multiple payments across multiple apps. This isn’t just a time inconvenience, it makes keeping track of upcoming payments tricky and this was a key frustration with existing products customers were using.

We instantly spotted this as a unique opportunity. With over 6 million current account customers, we can solve this inconvenience by allowing them to pay later for things alongside their day to day bank account. It means they can keep track of all of their purchases and repayments all in one place.

The types of reasons people needed to pay later were also widely varied! Some customers needed help purchasing their dream wedding dress, some needed a new laptop for work, some needed to pay an unexpected pet bill and some just needed to defer a payment until they’d returned and got a refund for half of their online clothes shop.

We knew the product needed to match these varying use cases. Flex allows customers to pay later for purchases online, in a physical store and even purchases they’ve already made on their Monzo current account (for up to two weeks later) making things extremely convenient.

What’s next for Flex?

One year later, we feel super proud that our first principles approach to building the product is paying off. We have a market leading product NPS and our customers are actively reaching out to tell us how the product is creating value in their lives!

Launching a 0 - 1 product doesn’t happen overnight and Flex was a huge collaborative team effort. A big thank you goes out to the talented designers, engineers, BAs, product marketers, data scientists, testers, operations, legal and compliance teams that made the product what it is today!

Our research work here is also definitely not done. Now we’re live we have a much wider range of insights to help shape our understanding and figure out where we take the product next. We made the conscious decision to launch the product with an ‘always on research programme’. It captures key experience measures like product NPS and ease of use scores alongside customer verbatim that helps us quickly spot areas we need to improve. We pump this insight into our customer pulse slack channel for all our teams to see, discuss and ideate on

We also continue to develop our research roadmap and learning goals alongside our product roadmap to ensure customers are always at the heart of our Flex decisions as we build and explore new features!

We’re excited to see where we take the product next!

Working at Monzo

We love working here and how tightly product, design and research work together to create products like Flex. We’re always looking for new amazing people to join the team, if you’re interested you can find more information here.