At the start of the new year, we asked a large group of our US users to help inform the future of our product! To do this, we sent a survey out to thousands of users, with a range of questions to get a general, anonymized idea of our user’s demographics and money management habits.

We’ve already started using this data to get an idea of what to build next, but we wanted to pause for a moment and share some of the most interesting points we saw with you all - maybe you’ll see yourself in some of these results. 🪞

Monzo ❤️ NY

A little over half of our users told us they live in urban areas, like Los Angeles, San Francisco, Miami, Seattle, etc. But, by a decent margin, the most popular city we saw was New York. 🍎

Next time you're taking the subway around the city, you may just see one of our hot coral cards being used at the gate.

Even though most of our users told us they lived in a big city - almost as many users told us they live in suburban or rural areas. So who knows, even if you don’t live in New York - you may be surprised where you’ll find other Monzo users.

Users of all ages love Monzo

When we asked you all to tell us your general age range, it turns out that we have a surprising number of users of all ages!

Most of our users fall in the 25-34 age range, which we expected - but we also loved seeing that we had many college students, a lot of users over 65, and everything in between. And in each group, we heard many great comments about how Monzo has helped people manage their money.

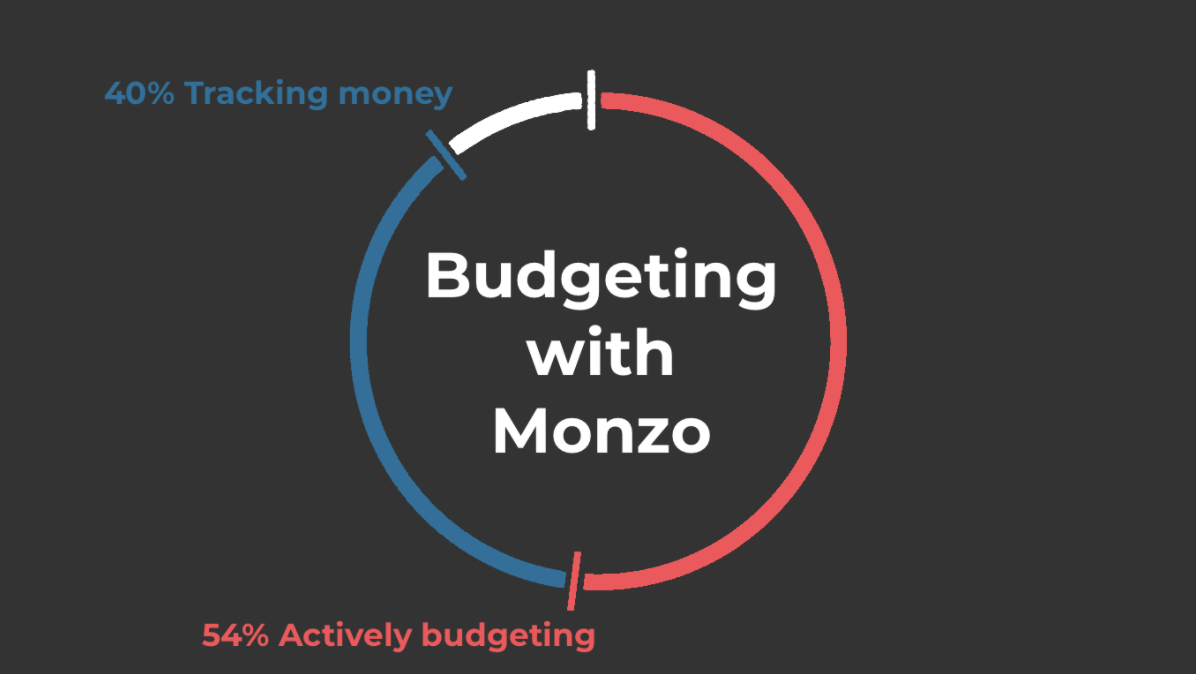

Many of you are very active budgeters 📈

We asked survey takers to tell us where they fell on a spectrum of 4 options ranging from “I rarely think about money” to “I actively manage my money”.

More than 50% of you told us that you are actively keeping a track of your dollars and trying your best to optimize. On top of that, an additional 40% of users chose the option just below “actively managing money”, which told us they track their rough balances and spending patterns but didn’t worry as much about each dollar spent.

As a note - we intentionally phrased the first option in such a way to include users who are budgeting to break a paycheck to paycheck cycle, as well as users who are already past that and now want to make sure their longer term goals are on track.

Combined that’s 94% of our users who do some form of finance tracking, and only 6% who lean towards not budgeting 💵

This is no surprise, when you consider that the Monzo mission is all about helping people manage their money! Coming soon - we’ve been working behind the scenes on some features that will further improve our budgeting toolset, so watch this space for more announcements.

But not being a budgeter doesn’t necessarily mean using a budget app 📱

There’s another interesting detail around budgeting though - when we asked users what kind of financial apps they regularly use on their phone, only 27% of users said they used a standalone budgeting app.

To be quite honest, we didn’t expect this! Especially after seeing how many of our users self-identified as budgeters - we thought there would be more users regularly using a third-party app to fill that gap.

Our team has a few theories here - and we’re definitely looking to dive a bit deeper into this, so we may reach out to some users in the future and ask some more detailed questions.

However, what we do know already is that there is a split in how people like to budget - many people have their own systems they’ve developed specifically for their needs. ⚖️

We think we can build a great budgeting experience directly into our app - but no matter what we provide, some people will prefer their own system or app. We want to lean into that as well. We’re aiming to make Monzo the best product in the US - no matter how you manage your money.

You helped highlight a couple key areas to work on 🔍

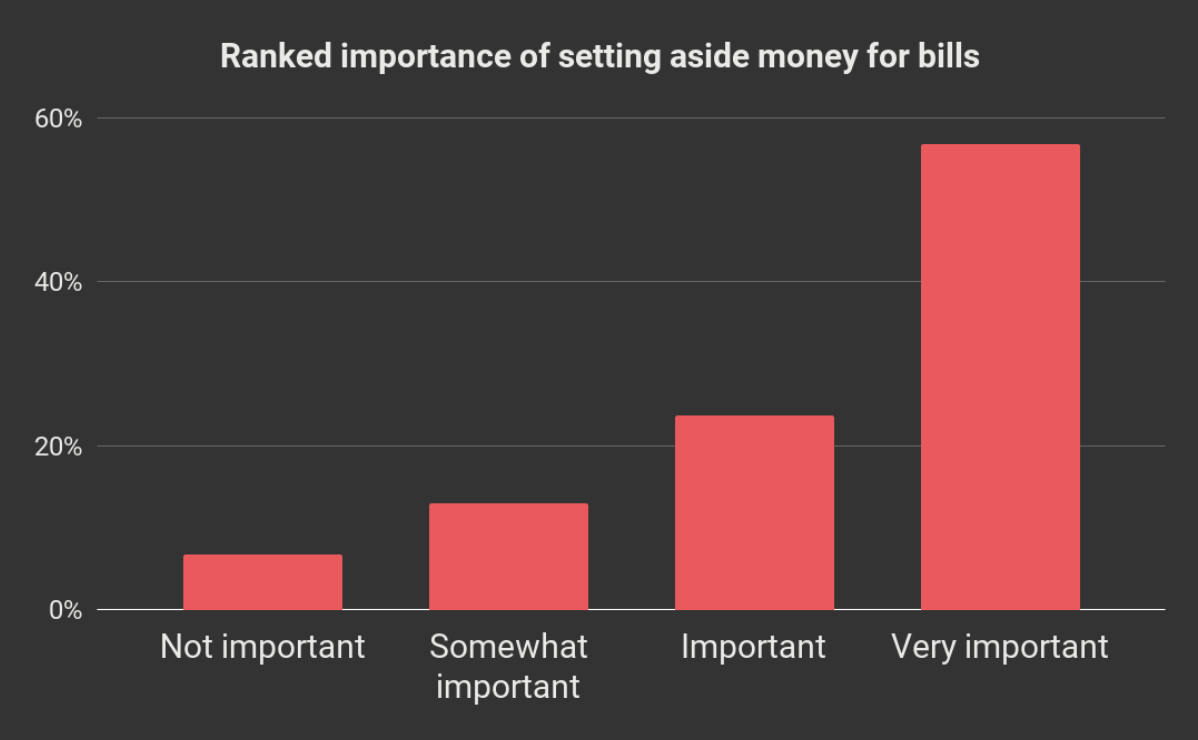

We asked users to rank their most important financial objectives, and also tell us how well they think we are currently helping with those objectives.

As an average across all users, the two objectives rated as most important were “setting aside enough money for bills” and “tracking money across different accounts”. 🍯

As expected, for tracking money across different accounts, almost every user said this is something we don’t do well at all - which makes sense since it is a feature we don’t provide yet. We have some new features already in the works (and this just might be one of them) - so keep a look out for more announcements!

Making sure there was enough money set aside for bills was consistently rated as more important between these two objectives though. While some users said that we did do a good job at helping with this objective (many users use different Pots for this exact purpose), lots of people let us know that we weren’t quite doing a good enough job helping with this objective. This has sparked a bit of conversation in our team and we think we can ship something to address this problem in the near future. 🚢

Thank you for sharing your great feedback for us. Together, we can build an amazing product. If you think of any other feedback, please feel free to reach out to us on Twitter or our community forum anytime!