Borrowing is when a bank lends you money and charges you interest (we'll explain what this is in a second). Lending money and charging interest is one of the ways that banks make money.

Borrowing money can be really helpful – student loans and mortgages let you do things you couldn't afford to normally. But it can also get out of control and be hard to manage, and you can end up paying a lot of money in interest.

It can also be confusing. There are a lot of unfamiliar words and concepts to get your head around (ever wondered what a credit score actually is?).

Key words and terms

Let's start with some useful definitions:

Interest - the cost of borrowing money. It makes lending worthwhile – after all, the lender can’t use their money while someone else is using it, and there may be a risk they won’t get it back. You’ll pay interest for taking out credit, and earn it for putting money into a savings account.

Compound interest - interest on top of interest. When you’re saving, any interest you earn can then earn interest itself. And when you’re borrowing, any interest you owe can rack up interest too.

Credit score - a rating used by financial institutions like banks and lenders to decide whether or not to lend you money. (Other factors like your income, savings and investments, and employment history are also factors.)

Your credit score is a measure of how ‘creditworthy’ you are, which is how likely you are to pay back the money they’ve lent you. Banks and lenders also use it to decide how much they can lend to you and at what interest rate.

APR - Annual Percentage Rate, this is both the interest rate and any additional charges as a percentage of the amount you want to borrow.

AER - Annual Equivalent Rate, this shows you when interest is paid and how it’ll build up. The idea is it shows what you'd get over a year if you put money in the account and left it there.

Borrowing: money you have to pay back

Borrowing money is when a company (like a bank) lends you money and expects you to pay it back, either over time or by a set date. Often when you borrow money it comes with an interest rate which the company sets. This interest rate can be fixed for the length of time you borrow or may change over time.

Deciding between the different types of borrowing

It's difficult to decide how to borrow the money you need, especially since there are so many types of borrowing out there.

Credit cards

Most useful for: small, short-term borrowing (but maybe longer if you can find an interest-free deal).

A credit card is a form of ‘revolving credit’, which means you can keep reusing and repaying it (as long as you stay within the limit). Most credit cards let you be flexible about how much you repay each month, although you’ll need to meet the minimum payment.

You’re usually charged interest on the amount you owe. Racking up card debt can get expensive, so it’s best to clear your balance every month if possible.

Credit cards often have high interest rates, but some offer an interest-free period. Some people use these to spread the cost of a big purchase over several months or years. It’s a good idea to pay it off before the promo ends and your rate goes up.

You may want to shop around before picking a card, as there’s a huge variety available. Find out more about credit cards here.

Overdrafts

Most useful for: small, short-term borrowing.

An arranged overdraft lets you borrow money via your current account. It’s another type of revolving credit, and is best suited for small, short-term borrowing. So, if your car suddenly breaks down or your roof springs a leak, an overdraft could tide you over until next payday.

One common advantage overdrafts have over credit cards is that you can use them to get cash, without being charged more than usual for the withdrawal.

Importantly, an arranged overdraft is different from an unplanned overdraft. This happens if you spend more than what’s in your account without the lender’s permission, or go over the agreed limit.

An overdraft is technically 'repayable on demand' which basically means the lender could ask for the money you owe them at any time. But most banks will normally give you 30 days notice.

Loans

Most useful for: large, long-term borrowing.

A loan is a lump sum that you repay over several months or years, plus any interest or fees. Loans are commonly used for large, one-off expenses, like home improvements or a wedding.

They’re different from credit cards and overdrafts in a few ways. For example, you can typically borrow bigger amounts at lower rates with a loan, but you can't reuse the funds once they've been repaid. Loans tend to give you less flexibility, as your payments will normally be the same each month.

Loans generally fall into two categories: secured and unsecured.

With a secured loan, you normally use your house or car as 'collateral’. If worst comes to worst and you can't repay the loan, the lender may use the collateral to recover their money.

Unsecured loans (sometimes called ‘personal loans’) don’t require collateral, but you may need a healthy credit score to get one.

We've got a whole blog post on student loans if you're interested in learning about those.

Hire purchase or conditional sale

Useful for: big, one-off purchases (especially if you can’t get a loan, or have enough for a deposit).

Hire purchase is a common option when you’re looking to buy a car, although it can be available for things like furniture too. You might know it by other names, like PCP (personal contract purchase) or PCH (personal contract hire).

It’s a bit different to other forms of credit, and the clue is in the name. Essentially, you hire the car while making regular payments towards its cost and any interest. You aren’t actually the owner until you’ve paid in full.

Conditional sale is similar to hire purchase, except that you have to buy the car outright at the end of the agreement. Hire purchase gives you the choice to do this by paying an ‘option to buy’ fee.

In both cases, you’ll put down a non-refundable deposit at the start of the agreement.

Buy now pay later

Useful for: paying for something 30 days later or paying off a large purchase over 3 or more months.

Buy now pay later is an increasingly popular option offered by online retailers. Some options are free and others charge an interest rate.

Take clothing, for example. If you're between sizes, buy now pay later lets you buy a few sizes of shoes or clothing and return the ones that don't fit, without parting with any money. Paying 30 days later is usually free of charge, but you'll have to pay the full amount minus returned items after 30 days.

You can also split a larger purchase into 3 equal monthly payments, which there's usually no charge for.

A lot of providers offer longer arrangements where you spread the cost across 6-36 monthly payments, but they'll charge you a fixed interest rate on top. Buy now pay later doesn't require a deposit or collateral (like your house or car), but you may need a healthy credit score to use the longer term options.

And remember: it's important you budget for what's affordable to you. Paying later still means you'll have to pay for whatever you buy.

Compare offers to find the right type of credit for you

Remember that interest rates don’t always tell you the true cost of credit – you should also think about things like penalty fees, Annual Percentage Rate (APR) and how the interest is calculated.

Deciding whether to borrow money

How do you work out if borrowing money is the right thing for you? Thinking about ‘good’ and ‘bad’ debt is a useful way to decide.

Good debt

Good debt helps you manage or improve your money. It should leave you better off in the long run. You can use it to build wealth, save money and make life a little easier. Here are some examples of when it might make sense to go into debt:

Spreading costs. It isn’t always realistic to use your savings for large or unexpected costs. So credit can be a convenient way to pay these costs over time.

Say you need a new car for your work, but you haven’t saved up enough to buy one outright. So you buy an affordable car using a loan, which you repay over a set period of time. You have to pay interest, so the car does cost more. But you’re better off because the loan makes it possible for you to earn a living.

Debt can sometimes even help you save money. Say you travel to work by train. It costs £7,000 for a year’s worth of day tickets or £5,600 for an annual season ticket. You use a loan to buy the season ticket and pay it off over the year. You pay £350 in interest. By using a loan to purchase the annual ticket, you’ll have saved a total of £1,050 (assuming you make your monthly repayments on time).

Making a sensible investment. This could include:

Taking out a mortgage to buy property that increases in value over the years

Getting a student loan to pay for education that will increase your earning potential

Taking out a business loan to start or grow a profitable company

Building your credit score. Managing a credit account responsibly can improve your credit score. A good credit score makes it easier to get accepted for better credit deals, meaning you can borrow money at cheaper rates. Just remember that taking out credit is likely to lower your credit score temporarily. It should recover and improve over time, as long as you stay well below your credit limit and meet the repayments on time and in full.

Good debt is affordable

Good debt doesn’t damage your overall financial position. The repayments shouldn’t eat into money you need for rent, bills and other essentials. And it shouldn’t get in the way of important financial goals, such as saving for a house deposit or contributing to your pension.

You need to be sure you can meet the repayments for as long as you have the debt. It’s usually best to pay off debt as quickly as possible, to minimise its cost and impact.

You can get an idea of how much you can afford to repay by looking at your household budget.

Good debt suits your needs, bad debt doesn't. We'll talk about bad debt in more detail a bit later.

How credit cards work

How companies decide to lend you money

You might also want to read this post on credit scores.

Banks and lenders use credit scores to decide whether or not to lend you money. They’re a measure of how ‘creditworthy’ you are, which is how likely you are to pay back the money they’ve lent you.

When banks lend you money, they take on a risk: there’s always a chance people might not pay the money back. Your creditworthiness helps them decide how much they’re willing to lend you, and what interest rate they’ll charge.

Creditworthiness can be difficult to predict, because it takes into account a lot of different factors, like how likely you are to pay back the loan and if you can afford it.

Credit scores are a useful way of taking all those factors into account, and summarising them in one simple number. Along with some other information, that number’s then used to assess how risky or safe it is to lend you money.

Your credit score isn't the only thing lenders consider

A credit score is a useful indicator of how likely you are to repay what you borrow. But it isn’t the only thing that lenders take into account.

When deciding whether to lend you money, they consider a few different things:

Creditworthiness – how likely are you to repay?

Affordability – can you afford the loan?

Income verification - can the lender confirm that the income you've declared is correct.

Affordability capacity - can you afford to repay, without putting yourself in financial difficulty. For example, cutting out paying essential bills or buying food.

Sustainability – can you keep paying money back for the length of the loan?

Each lender will set their own rules to help them decide whether or not to lend someone money. And these rules depend on how much risk and what kind of risk they’re willing to take.

For example, some lenders might not lend to people who don’t have enough credit history (a record of borrowing and reliably repaying money), others might only give credit to people who have a current account at that bank and use it on a regular basis.

So, when they decide whether to lend you money, lenders consider a range of different criteria. Your credit score is usually one of the most important, but it isn’t the only thing.

What makes up your credit score?

| What | Why |

|---|---|

| Your payment history | The way you’ve used your money in the past is usually the best indicator of your creditworthiness. If you’ve missed payments, defaulted on loans, had to use repayment plans or declared bankruptcy, you’ll have negatively affected your credit score. |

| How you've used debt in the past | Using lots of debt is usually an indicator of financial stress. While this doesn’t automatically make you more risky to lend to, it’s an important factor in the credit score. |

| The length of your credit history | If you have a track record of borrowing and reliably repaying money, it can show that you know how to manage debt. Lenders use your credit history to judge how reliable you’ll be at paying back what you borrow. |

| The types of credit you use | From overdrafts to payday loans, the different types of credit you use each indicate different levels of risk. |

| Recent applications for credit | If you’ve applied for credit recently, lenders might assume you’re in greater need of debt. That might not necessarily be a bad thing, but if you’ve applied for credit a lot recently, it could be a sign of financial stress or even fraud. |

| How much credit you're using | Using more than 25% of the total amount of credit across all your products can have a negative impact on your credit score. Using more than 50% can be a sign to lenders that you're not repaying credit as fast as you're using it. |

How are credit scores calculated?

Credit reference agencies calculate credit scores using statistics. They find patterns in your previous behaviour that show things like how often you’ve missed payments, the total debt you’ve taken out, or the ratio between your income and the amount of money you’ve borrowed.

They use these things to predict the risk that you won’t pay back the credit. Each thing is given a ‘weight,’ and the more likely it is to predict that you won’t repay, the less weight it’ll carry. These ‘weights’ are all gathered together to determine your credit score.

Usually, a higher credit score means you’re less risky to lend to.

Who calculates my credit score?

Credit scores are calculated by credit reference agencies. There are three in the UK: TransUnion (which used to be called CallCredit), Equifax and Experian. These companies gather and record information about your credit history, and use it to calculate your credit score.

Lenders will ask one or more of these agencies for information about you, to decide whether they’re willing to lend you money.

How do lenders use credit scores to make decisions?

Different lenders offer different products, and want to lend to different kinds of customer. They use credit scores to work out what you’re like as a borrower, and decide whether or not they’re willing to lend you money.

Some lenders want to lend to high-risk customers (often known as sub-prime lending). Because they’re taking on more risk, they can charge more interest or offer less favourable terms. Those lenders might choose to lend to customers who have very low credit scores. Other lenders are more conservative and less willing to take on risk, so they might only want to lend to customers with higher credit scores.

Your credit score helps a lender decide whether they’re willing to lend to you, and determine other things like:

How much they’re willing to lend you:

Lenders use credit scores to help decide the size of the loan they’re willing to give you. It’s common that lenders will offer smaller loans to higher risk customers and vice versa.

The price of the loan:

Lenders often use credit scores to develop risk-based-pricing (RBP), which means offering lower prices to low risk customers and vice versa.

The collateral you need to put up:

When you take out a secured loan, you pledge something you own (like a car or a house) as collateral for the loan. Lenders often use credit scores to determine what kind of collateral they’ll ask you to put down, and what loan-to-value ratio they’ll require.

How can I find out my credit score?

The three agencies that calculate credit scores are Experian, TransUnion and Equifax. You have a legal right to check your file with any of these providers – although you might have to pay a small fee.

There are also companies that can tell you your credit score for free, every month. You can use ClearScore to check your Equifax score, but it’s worth getting your Experian and TransUnion reports too.

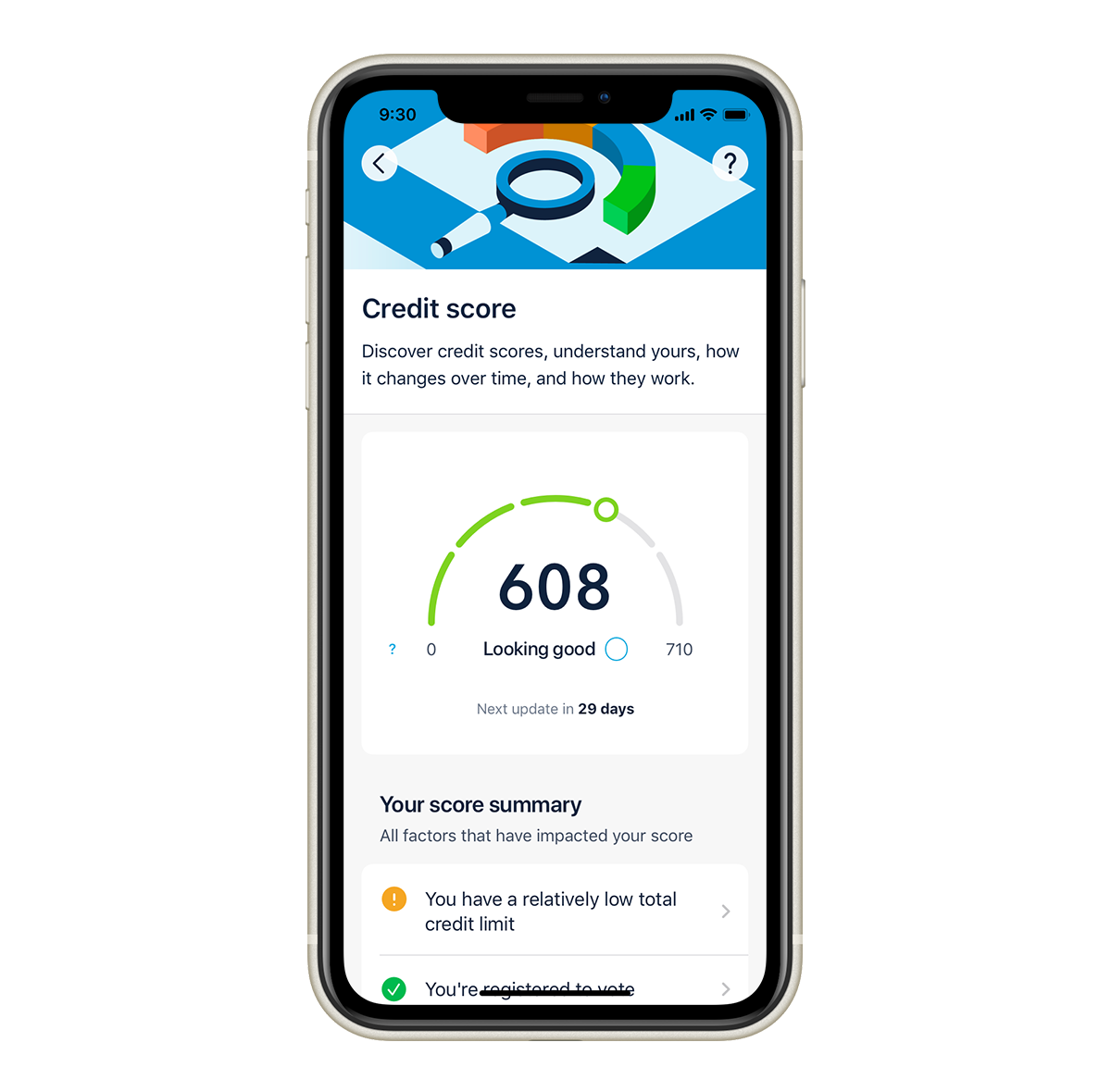

You can see your TransUnion credit score in the Monzo app with Monzo Plus and Monzo Premium, and track how your score changes every month.

How many credit scores do I have?

You actually have multiple credit scores. This is because your score may be calculated by different credit reference agencies (CRAs), each with their own way of doing it.

You can check your credit score with any of the three CRAs in the UK: Equifax, Experian and TransUnion (formerly Callcredit).

Your score may vary with each CRA. This is because:

They may use different sources of information – for example, your lender may send data about you to only two of the three CRAs

They may weight things differently – for example, one CRA may see your debt more negatively than the other two

They use different scales – TransUnion’s score is out of 710, Experian’s is 999 and Equifax’s is 700

Equifax, Experian and TransUnion have bands to indicate how ‘good’ your credit score is

| Equifax | Experian | TransUnion | |

|---|---|---|---|

| Excellent | 466–700 | 961–999 | 628–710 |

| Good | 420–465 | 881–960 | 604–627 |

| Fair | 380–419 | 721–880 | 566–603 |

| Poor | 280–379 | 561–720 | 561–565 |

| Very poor | 0–279 | 0–560 | 0–550 |

But, these bands are just a way to help you understand where you sit on the CRA’s scale. As you’ll see in a moment, they don’t always reflect what lenders think of you.

Do lenders see the same score as I do?

No, lenders see a different credit score to you. Theirs may be calculated with a specific product (like a loan or credit card) in mind, to help them better predict if you’ll pay them back. Some lenders work out scores themselves and may use information that CRAs don’t have (like details on your credit application, such as your income).

The credit score you get from a CRA is more generic than the one lenders see. It’s designed to give you an idea of your chances of getting credit, but it can’t tell you for certain if you’ll be approved.

So, you may still get turned down for credit even if a CRA says you have a high score. Equally, some lenders may be more willing to lend to you than your score lets on.

Things to avoid

Bad debt

Bad debt doesn’t pay for itself. It drains your wealth and leaves you worse off. This often happens if you use debt for an impulse buy or a luxury item – especially something that loses value quickly. For example, the average car loses 60% of its value in the first three years. If you need the car to earn a living, then a loan may be sensible. But if you don’t need the car – or you buy a more expensive car than you need to – then debt is usually a bad idea.

Bad debt wastes your money

Expensive debt is often bad debt, even if you can afford to make the repayments. If you haven’t looked for the best deal, you may be throwing money down the drain – money you could be using to buy nice things, reach your savings goals or invest.

Bad debt is unaffordable

Bad debt can force you to live on a shoestring budget, which isn’t good for financial security or your wellbeing. And being unable to repay debt can lead to serious problems, such as:

More debt. Compound interest can make your debt grow by itself – and the longer you’re in debt, the faster it will grow. If you miss minimum repayments you may be charged penalty fines, which can also add to your debt. Finally, bad debt can use up money you need for bills, which can put you in debt with other companies.

A defaulted account. This means the lender closes your account and can take legal action to get their money back. They may take your home or car if you have used them as collateral.

A lower credit score. Missing payments or defaulting on your account can damage your credit score. This can make it harder to get accepted for credit in the future – even for things like mobile phone contracts and energy tariffs.

Tips

6 questions to ask yourself before borrowing

If you answer ‘no’ to any of these, it’s probably not a good idea to borrow:

Have you compared credit to find the best offer for you?

Are you sure you can comfortably meet the repayments?

Is there a chance your interest rate could rise? If so, could you still meet the repayments?

Do you understand the risks involved? And are you willing and able to accept them?

Do you have a clear, specific reason for borrowing money?

Will borrowing the money improve your financial situation in the long run?

Improving your credit score

Register to vote

It might sound odd, but getting yourself on the electoral roll will add points to your credit rating. It helps lenders confirm your identity and address when you apply for credit. This means they’re more likely to approve you, which will help improve your score.

If you live in the UK, you can register to vote online in about 5-10 minutes.

Build your credit history

It’s not just a poor credit history that can lower your score. Having little or no credit history is also a common problem, especially for young adults and people who are new to the UK.

Your credit history shows companies how you’ve managed money in the past. This helps them decide whether to lend to you. If there’s not enough information, they may refuse to give you credit or might not offer you the best deal.

Luckily, there are a few ways to build a credit history. For example, you could open a bank account, put household bills in your name, or get a basic form of credit like a mobile phone contract. This may cause a temporary dip in your score, but after a few months you should see it improve.

Space out your credit applications

When it comes to applying for credit, it’s tempting to hedge your bets. But making several applications in a short space of time could put a serious dent in your score.

Too many applications could make lenders think you’re desperate for credit, and therefore more of a risk. That means you’re less likely to have your application accepted, which will in turn make your score go down.

So, the best approach is to apply for one product at a time. Use an online eligibility checker to see which credit deals you’re more likely to get. And if you do need to make another application, try and wait several months.

Make payments on time

Paying your bills on time and in full will improve your score in the long-term. It shows lenders that you’re a responsible borrower, so they may start trusting you with higher limits and lower rates.

On the flip side, late or missed payments can damage your score. After several missed payments your lender may decide to close or ‘default’ your account. This will be recorded on your credit report for six years, whether or not you pay off the debt eventually. It can make your rating drop like a stone, so it’s definitely something to avoid if you can.

Minimise your credit use

Maxing out your credit card or overdraft doesn’t look too good to lenders, so your score may fall if you do. On the other hand, you’ll usually gain points if you use no more than 25% of your agreed credit limit. For example, if you have a bank overdraft of £1,000, try to only use £250 of it at a time.

Ultimately, improving your credit score is about showing lenders you’re a reliable customer, who’ll use credit responsibly and pay them back.

How to manage a credit card

Always meet the minimum payment. Setting up a Direct Debit from your current account to your credit card, means you'll never forget a repayment. Just make sure you have enough money in the bank when the payment comes out.

Stick to your credit limit. See if you can set up alerts to let you know when you're getting close to it. Try not to use your full limit, as this can put you in long-term debt and damage your credit score.

Watch out for rate changes. Some companies give you a low or 0% interest rate when you first take out a credit card. But your rate can go up a lot once the introductory period has ended. You could look at changing to a better deal when this happens, but you may be charged an early repayment fee.

Avoid credit card cheques. Credit card cheques are like normal cheques, but the money comes from your credit card instead of your bank account. They’re rare these days and it’s best not to ask for them. They charge a higher interest rate and extra fees, and you won’t have the same protection under section 75 of the Consumer Credit Act.

Watch out for theft and scams. Contact your provider immediately if your credit card is lost or stolen. If you have a Monzo account you can also freeze your card in the app. Keep an eye out for unusual transactions on your credit card statement – and make sure you know how to protect yourself from identity fraud and theft.

Watch out for fees when withdrawing cash. Some credit card providers charge you for taking cash out at an ATM. Make sure you're happy to pay those fees if you think you may need to withdraw cash with it.

Getting out of debt

Debt is rarely discussed, and it's something that people feel ashamed about. Debt isn't shameful and good debt can often be really useful. But bad debt can be stressful and feel isolating.

Pay off your debts in the right order

Paying off your debts in a certain order may help you save money, clear debt faster or keep yourself motivated. But first, it’s important to make sure you can cover:

Priority debts

These are debts where you can get in serious trouble if you don’t pay – such as losing your home, having your electricity cut off or going to prison. This type of debt may include court fines, council tax, child maintenance, utility bills, mortgage and rent. It may also include debt that’s become urgent (for example, because you missed lots of payments). You can avoid serious problems by paying this type of debt off first.

Minimum payments

When you borrow money from a company, you normally agree to pay a minimum amount every month. Skipping this payment can lead to fines or the company closing your account and taking legal action. So it’s important to try and make these payments before clearing other debt.

Once you’ve taken care of priority debts and minimum payments, you can look at ways to prioritise the rest of your debts.

Here are two common methods:

1. Expensive debts first (the ‘avalanche’ method)

Paying off expensive debt first can save you money, meaning you may be able to pay off your debt faster or more easily. You can identify your most expensive debt by looking at the interest rate and fees you’re paying. For example, let’s say you owe £500 on a credit card with a 20% interest rate and £1,000 on a loan with a 5% interest rate. Using the avalanche method you would pay off the credit card first.

2. Small debts first (the ‘snowball’ method)

Some people pay off their debts from the smallest to largest – no matter what these charge in interest and fees. This method isn’t cost efficient, but it can suit people who need quick wins to motivate them. The idea is that you’ll pay off smaller debts quickly, which will give you the stamina to tackle bigger ones.

Try putting your debt in one place

Instead of paying off your debts in a specific order, you can decide to group them into a single account. This is called debt consolidation – it works by paying off your old accounts with credit from a new one.

Putting your debt in one place can make it easier to manage payments and see how much you owe. You may also save money by moving debt to an account with a lower interest rate. Debt consolidation isn’t right for everyone, though. There are potential drawbacks, such as:

Lower credit score – applying for a new account and closing old ones can damage your credit score

Eligibility – you may not get approved for a consolidation account with a lower rate than your old accounts

Total cost – even if your consolidation account has a lower rate, you may end up paying

if you clear the debt more slowly

Setup fees – some accounts charge a fee when you first open them, so pick your consolidation account carefully

Early repayment penalties – you may get charged for paying off old accounts before their term is up

More debt – you may be tempted to rack up more debt by reusing your old credit accounts

Common ways to consolidate debt

One way to consolidate debt is with a personal loan. This type of loan is unsecured, which means your home isn’t forfeited if you miss payments. You’ll normally need to repay a fixed amount each month until the loan is cleared.

If you’re only consolidating credit card debt, you might consider a balance transfer card instead. These typically offer a 0% interest rate for a fixed period. Just be aware that there’s often a setup fee. Also, you may end up with a higher interest rate if you don’t clear the debt before the 0% period ends.

Make sure you stay motivated

Debt and a tight budget can get you down, so make sure to look after your mental state as much as your financial one. Try to:

Ask for emotional support – budgeting is easier when your friends and family understand what you’re trying to do

Get inspired – reading stories from people who’ve beaten debt, measuring your progress or joining communities of people who are paying off debt too

Have fun on a budget – look for free events or set yourself money-saving challenges

Take care of yourself – debt can take a toll on your mental health, read our guide on the importance of telling your provider if you're struggling.

Using Monzo

At Monzo we offer a range of borrowing products, including overdrafts and loans. You can borrow between £200 and £3,000 from us for up to 60 months 💰

If you're eligible, our representative APR is 26.6% on loans up to £3,000.

For overdrafts we charge interest rates of 19%, 29% or 39% EAR (variable). Your exact rate will depend on your credit score.

As a representative example, if you use an arranged overdraft of £500 for 30 days, with 39.0% EAR/APR (variable), it would cost you £13.72.

We’ll always tell you the exact rate you’ll pay, and what that means in pounds, before you borrow from us.