When we launched Monzo back in 2015, there were a few features people loved, and hadn’t really seen before.

First were instant notifications. We notify you when you spend, and update your balance instantly. It sounds simple enough, but back then no banks were doing it. And even today it isn’t the norm.

We also added the option to freeze and defrost your card through the app. So if you misplace your card, you can freeze it while you frantically look for it.

Some of the big banks have followed our lead and added these features too, which is handy! 😉 And we’re genuinely glad to see them adding helpful features customers want.

But there are still a lot of Monzo features that most high street banks don't have. Or at least not yet anyway!

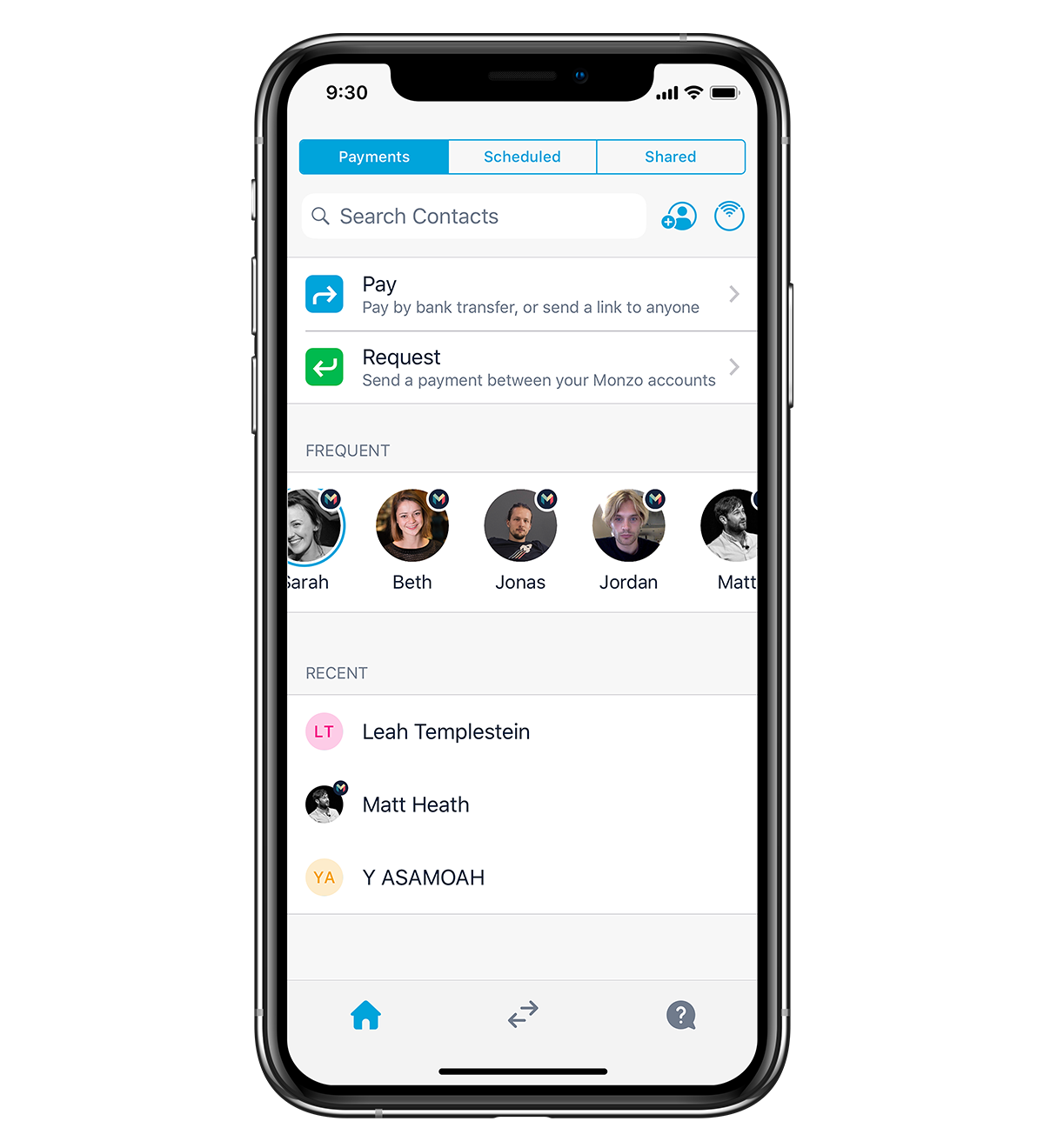

1. Paying your friends: pay your pals who are also on Monzo, in just a few taps

When you have Monzo, you don’t need to do the dance of the bank details to pay your friends back.

You can pay any of your contacts with Monzo in just a few taps! And when someone pays you, you can even say thanks with an emoji 🤗

2. Nearby Friends: pay people near you, even you don't have their number

Through the magic of Bluetooth, you can send and receive payments from people around you who are also on Monzo. So if you split the bill at dinner and don’t have someone’s number, they can pay you back without a fuss.

3. Split the bill: divide costs between friends and get paid back

Handy to use with your partner or your friends, it lets you split bills between you (we’ll do the maths) and pay what you owe in just a few taps.

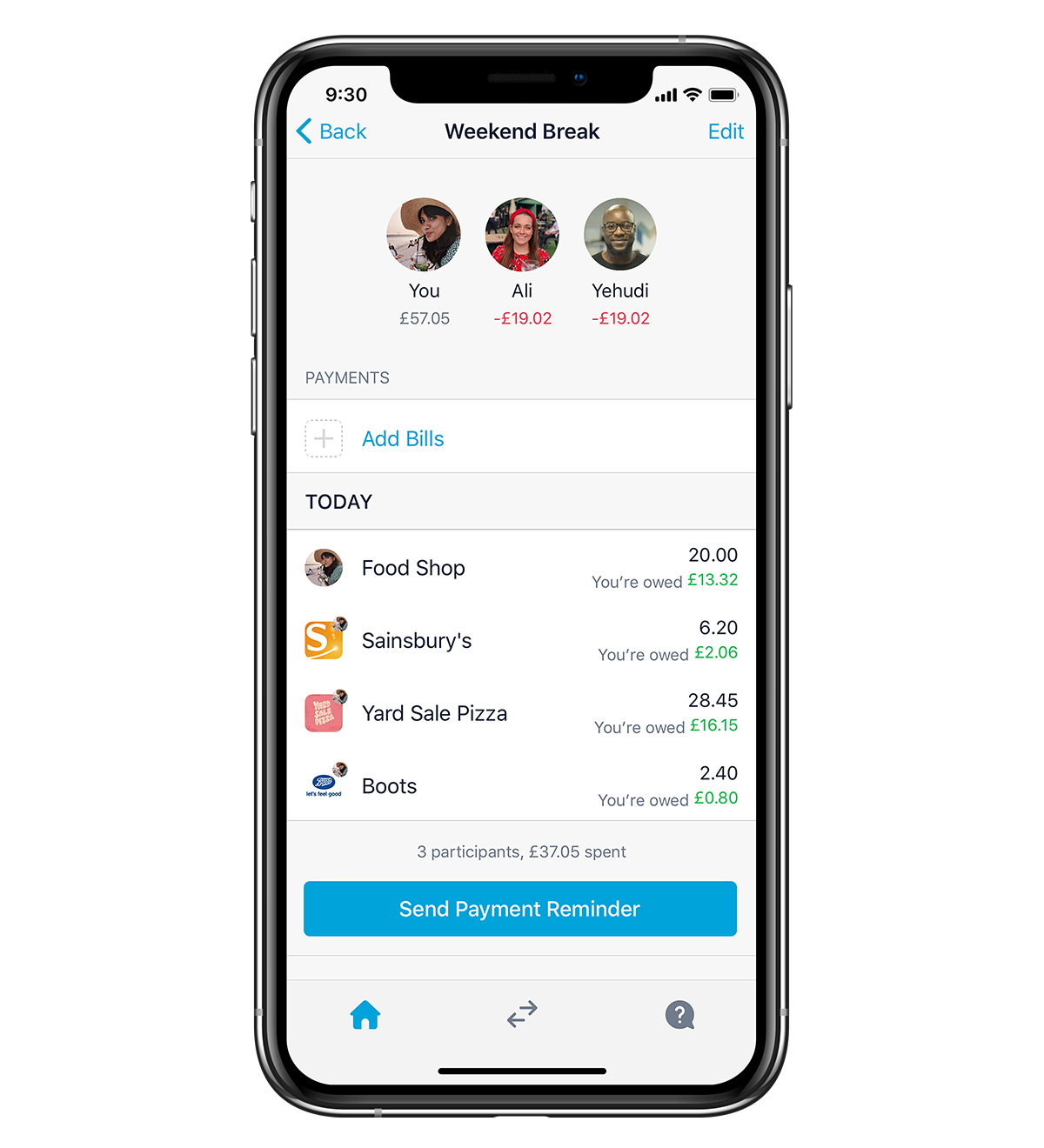

4. Shared Tabs: keep track of who owes what

Finally! A helpful way to keep track of shared costs and settle up super easily.

Use it to go on a group holiday or split costs with your housemates. Everyone can add payments to the tab. We’ll work out who owes what and make it easy to pay each other back.

5. Get paid early: get your salary a day before you’re meant to

You can get your salary an entire day early, if you get paid into your Monzo account.

Most salaries (and student loans) come into Monzo accounts through a system called Bacs (short for Bank Automated Clearing System). It’s a bit outdated, so from the day your employer sends you the money, it usually takes three days to reach your account.

By 4pm on the day before payday, we can see it coming in the system and be confident it’ll arrive. Once that happens, we give you the option to get your money sooner! (A heads up: we can stop offering get paid early, or change this service, at any time.)

Download Monzo to try these features today!

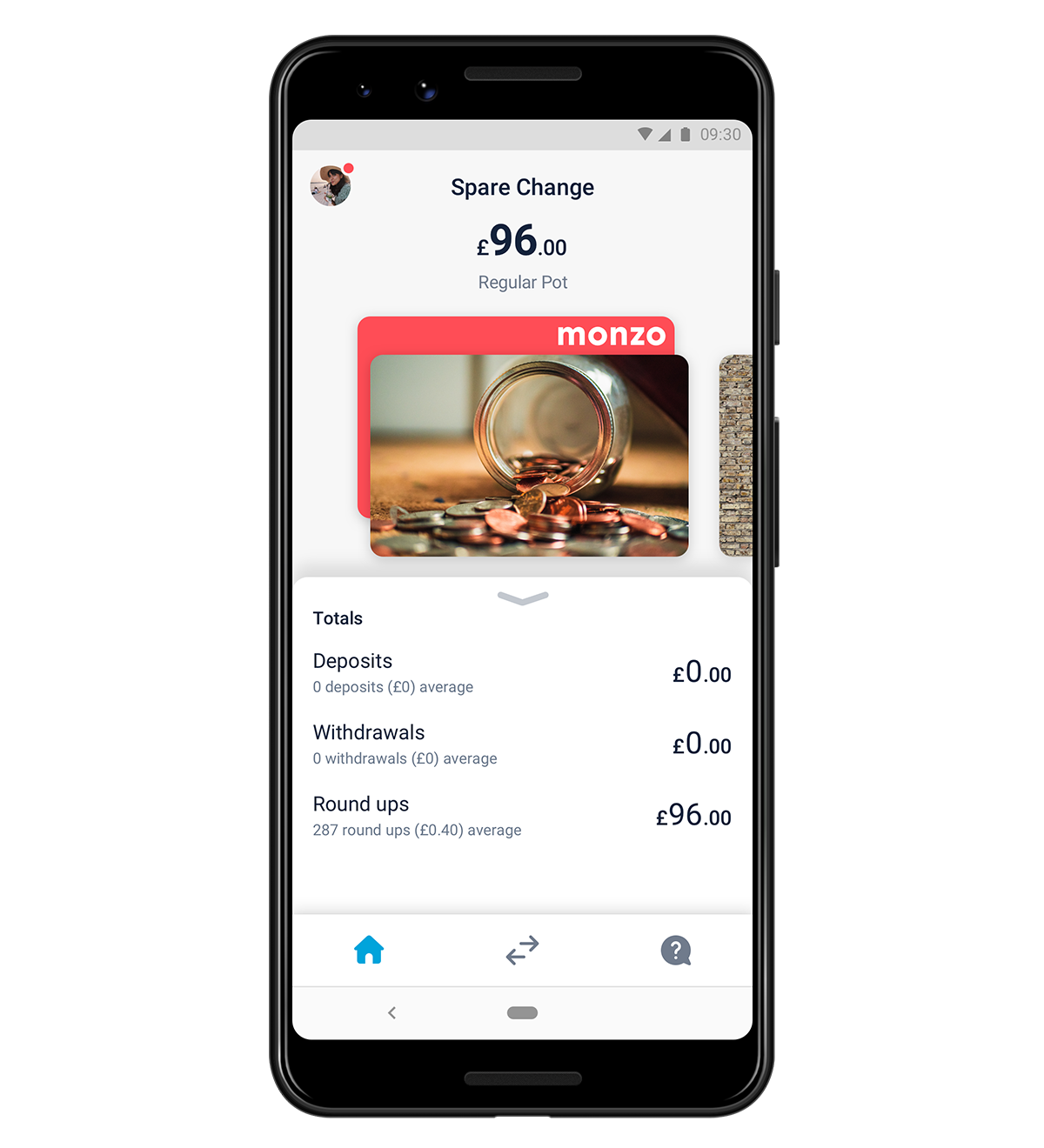

Download Monzo6. Round-ups: save your spare change automatically

Turn on ‘round-ups’ to automatically save your spare change into a Pot. It’s the modern-day equivalent of having a piggy bank chock-full of pennies.

Every time you pay with Monzo, we’ll round your purchase up to the nearest pound and put the difference in your Pot. It adds up surprisingly quickly!

7. IFTTT: connect your financial life to the rest of your life

If This Then That (IFTTT) is a service that lets you connect all sorts of internet services together in useful and fun ways.

It lets you connect your Monzo account to over 500 other internet services, including Twitter, Strava and Amazon Echo.

Create your own custom Applets to automate things like saving money and filing expenses. Or turn on some great pre-made ones.

Here are some examples of things you can do really easily with Monzo and IFTTT.

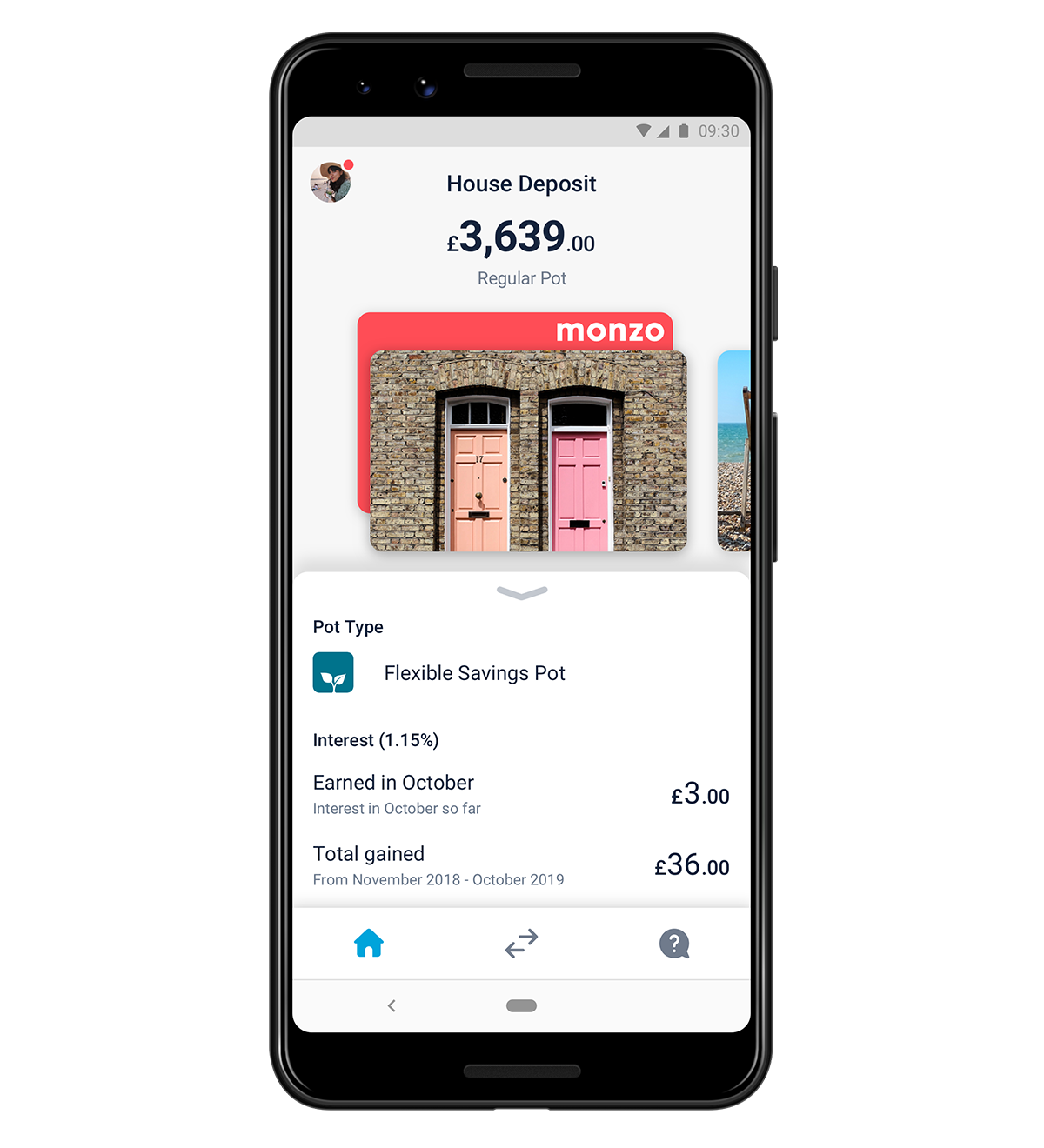

8. Pots: organise the money in your Monzo account

Pots let you organise the money in your Monzo account. You can use them for budgeting, to save up for something special, or just to make sure you don’t spend your rent money.

Set a goal for your Pot and we’ll help you keep track of your progress.

And lock your Pot until a certain date, and if you try to dip in, we’ll remind you not to 🔒

You can even add an image to remind you what you’re saving for, or just to organise your Pots and make them all look pretty.

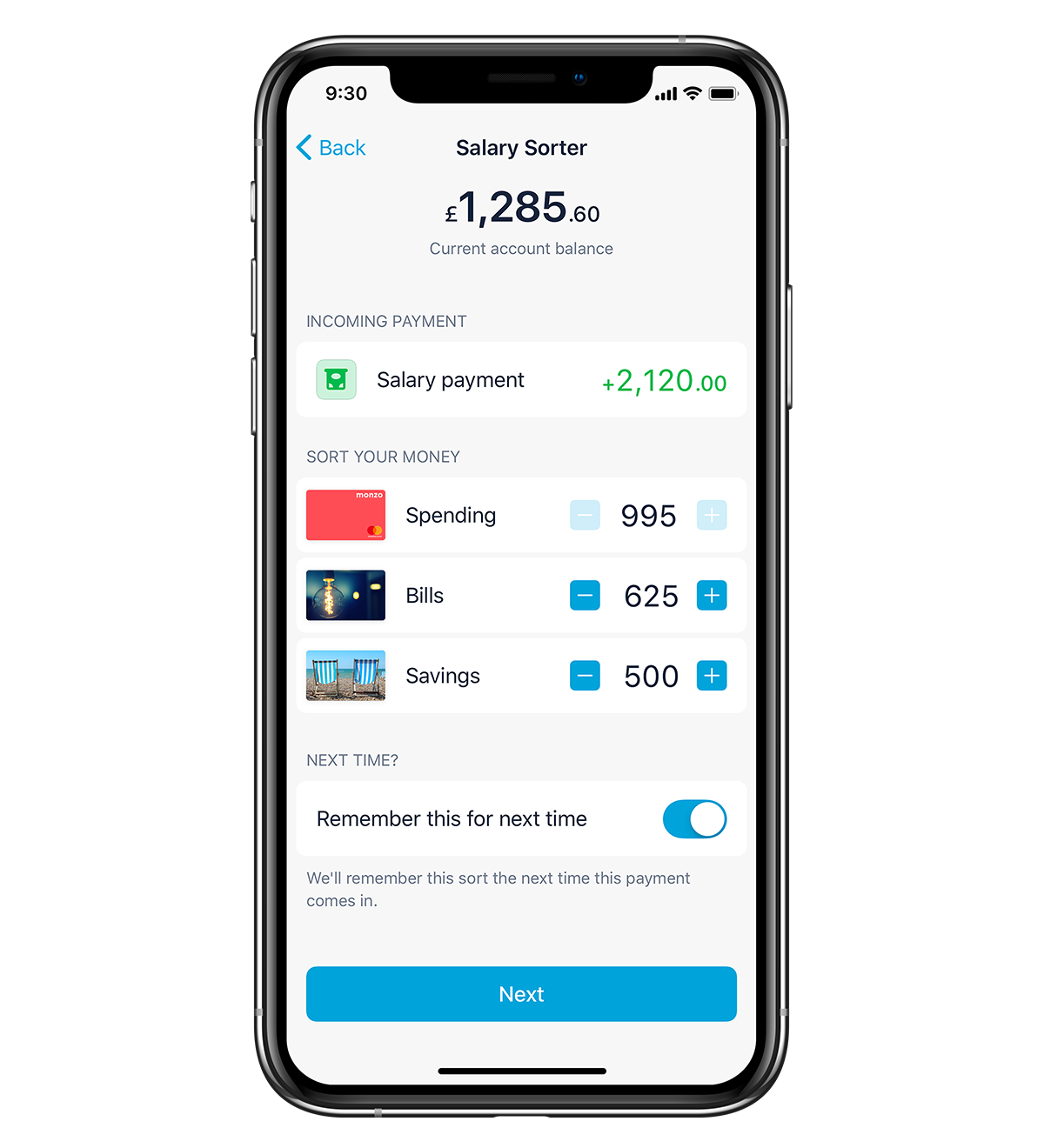

9. Salary Sorter: automatically sort your money between spending, bills and savings

Salary Sorter lets you neatly sort your money between spending, bills and savings, all in one convenient place (your Monzo account!). It means there’s no more shifting around to see where your money is.

It’s useful if you’re trying a budgeting method like piggy banking or the 50/20/30 rule. Or if you simply don’t want to worry about accidentally spending the rent.

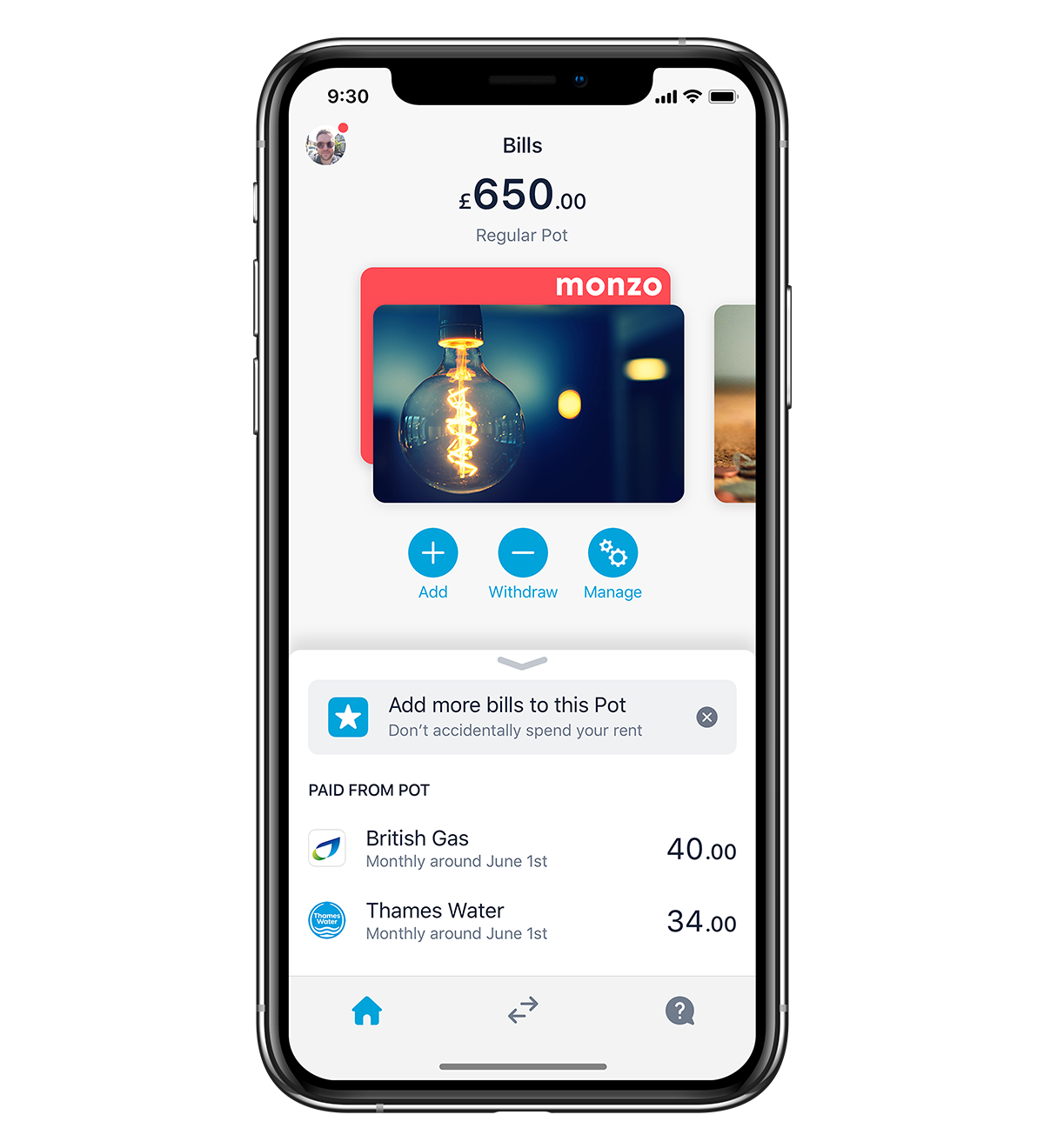

You can set up a Bills Pot to set aside money to pay for the essentials. Then when the bill’s due, we’ll automatically move enough money from your Pot into your main account and pay it for you. Easy!

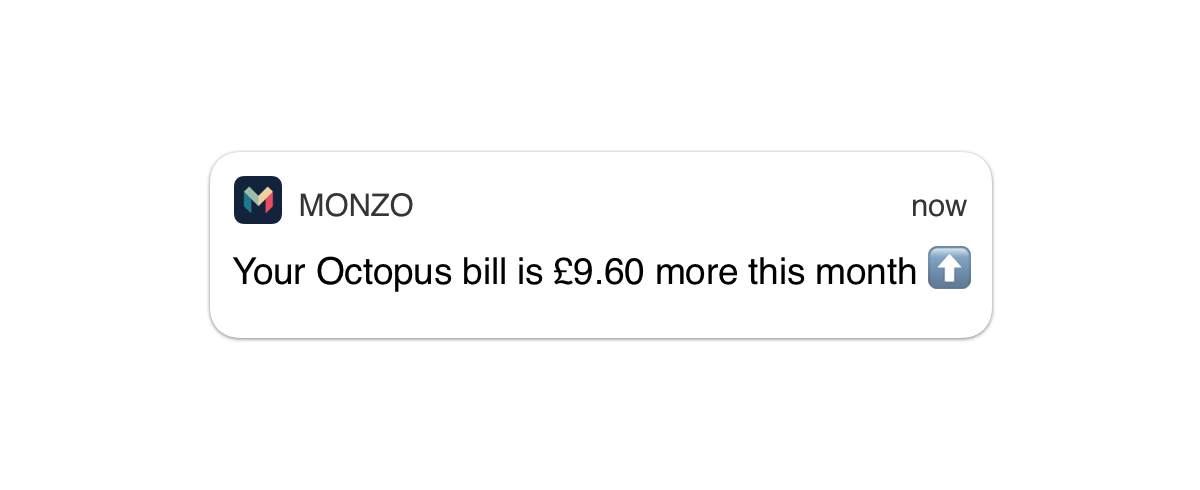

10. Bill tracker: we’ll keep an eye on the cost of your bills and tell you when one changes

We’ll keep track of your regular Direct Debits – like phone contracts and utility bills – and let you know if one of them changes.

So if your energy provider raises their prices, or you rack up a big phone bill while you’re away, you’ll know.

Get a Monzo account today to take advantage of these features (and many more!)