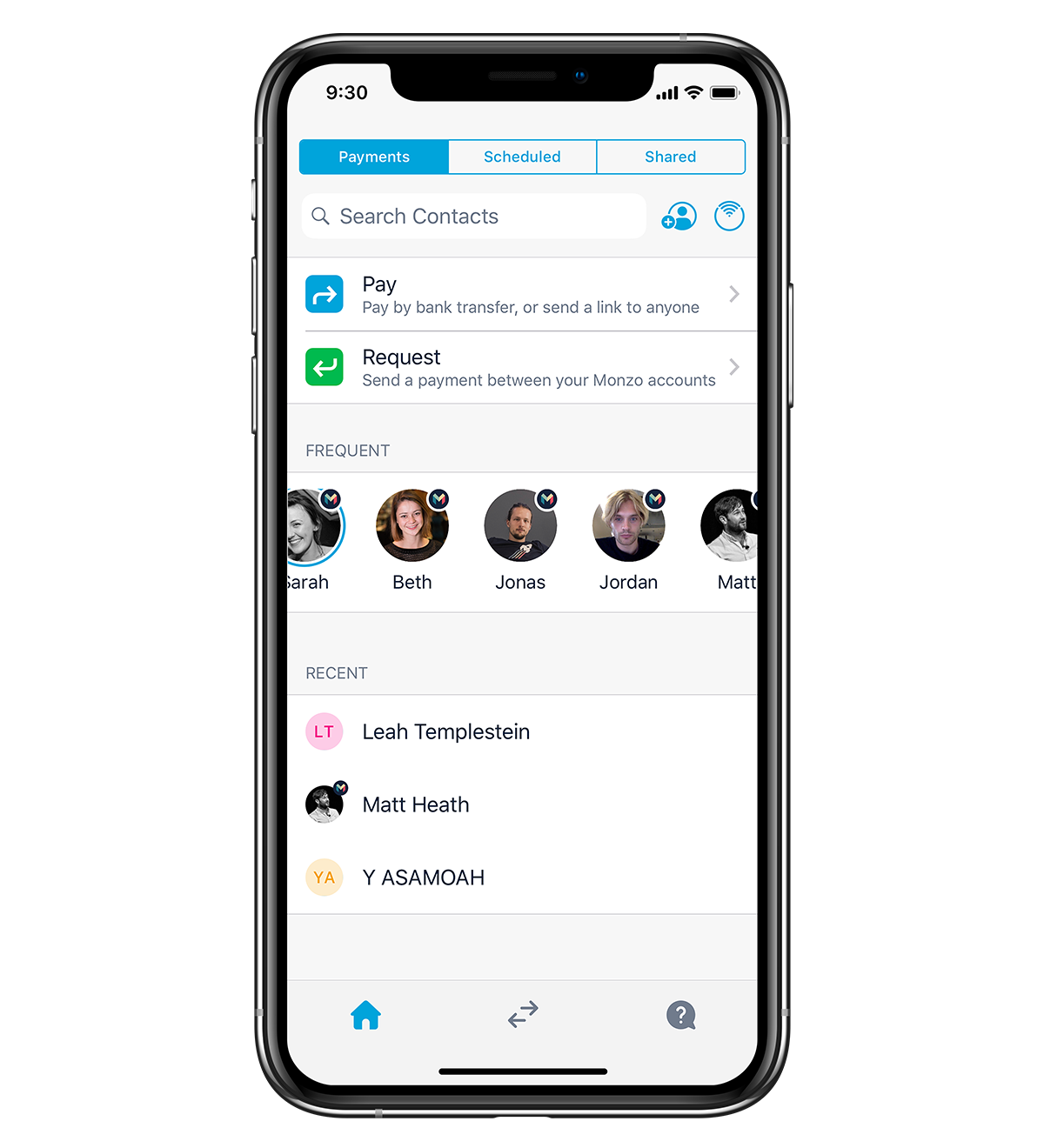

1. Pay your friends super easily

Great for you if: you’re fed up of back and forths exchanging bank details

If you have Monzo, you can pay any of your contacts who have it too. And in just a few taps.

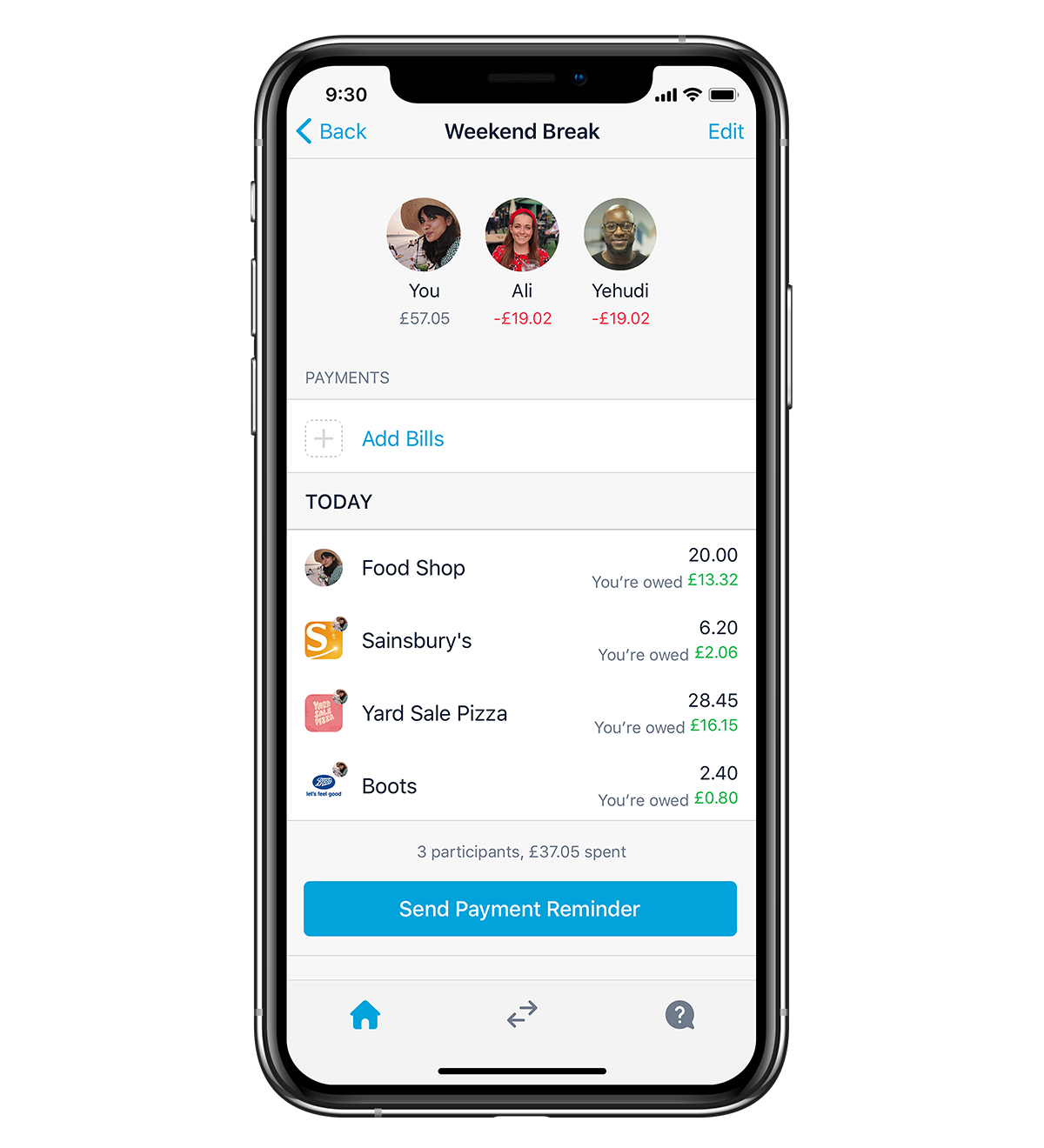

2. Split bills without the faff

Handy for you if: you hate chasing friends for money as much as you hate doing maths

Monzo makes it easy to split the bill at dinner or go in on a group present. We’ll help you work out how much everyone owes, and your friends can pay you back in a few taps.

3. Keep track of shared costs

A must-have for you if: you live with housemates or you’re going on a group holiday

We’ve got a feature called Shared Tabs, which makes it easy to keep track of who paid for drinks or bought the bog roll last.

Everyone can add payments to the tab. We’ll work out who owes what and help you settle up.

4. Get paid a day early

Useful for you if: it sometimes feels like you've got more month than money

If you get paid into Monzo, we can advance you the money at 4pm on the day before it’s due. That’s right. You can get paid an entire day early if you have a Monzo account. A heads up: we can stop offering get paid early, or change this service, at any time.

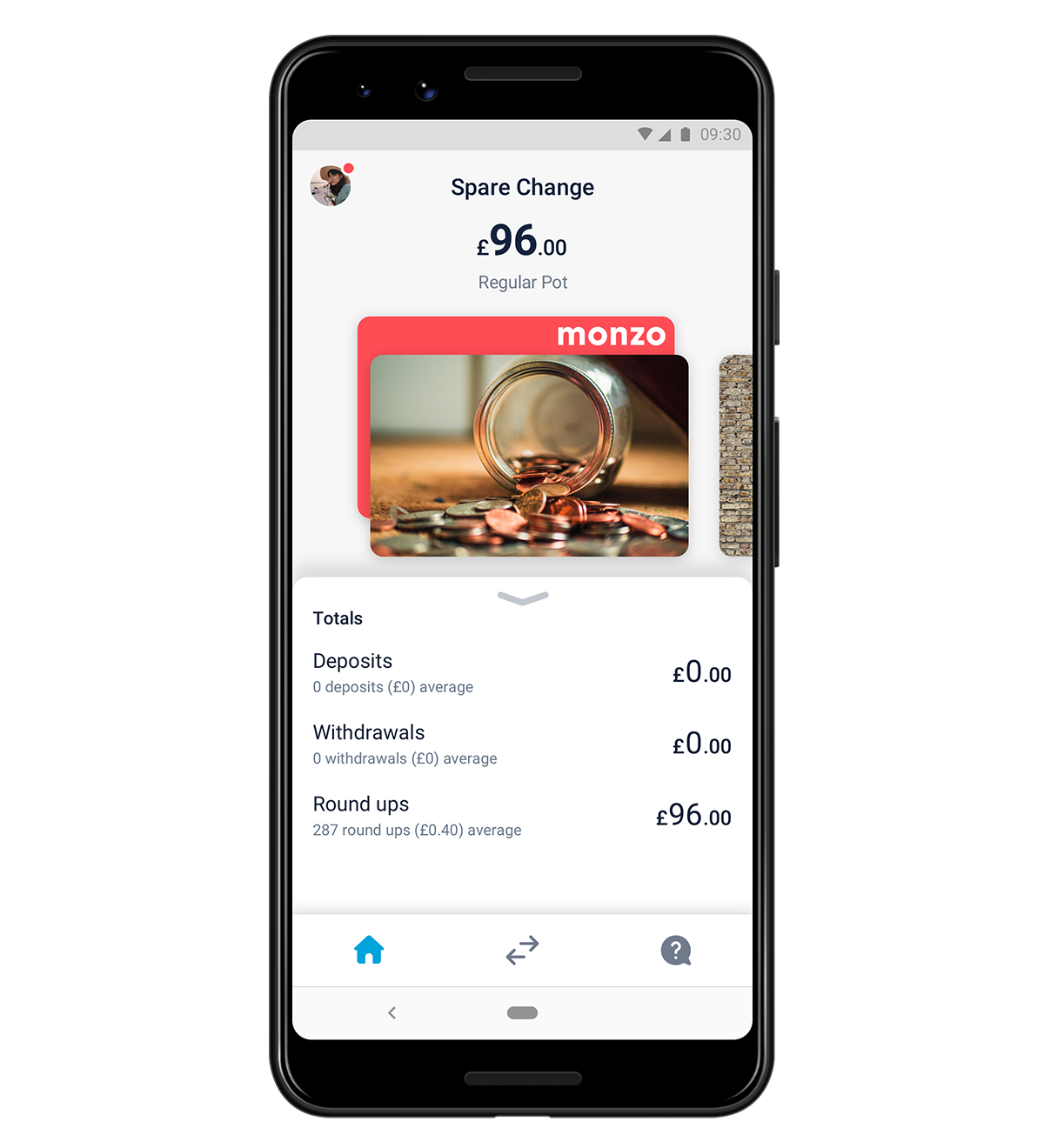

5. Save your spare change

A game-changer if: you miss having a piggy bank full of 1p coins but it’s 2019 and you’re not 6 anymore

Turn on ‘round-ups’ to automatically save your spare change into a Pot.

Every time you pay with Monzo, we’ll round your purchase up to the nearest pound and put the difference in your Pot. It adds up surprisingly quickly!

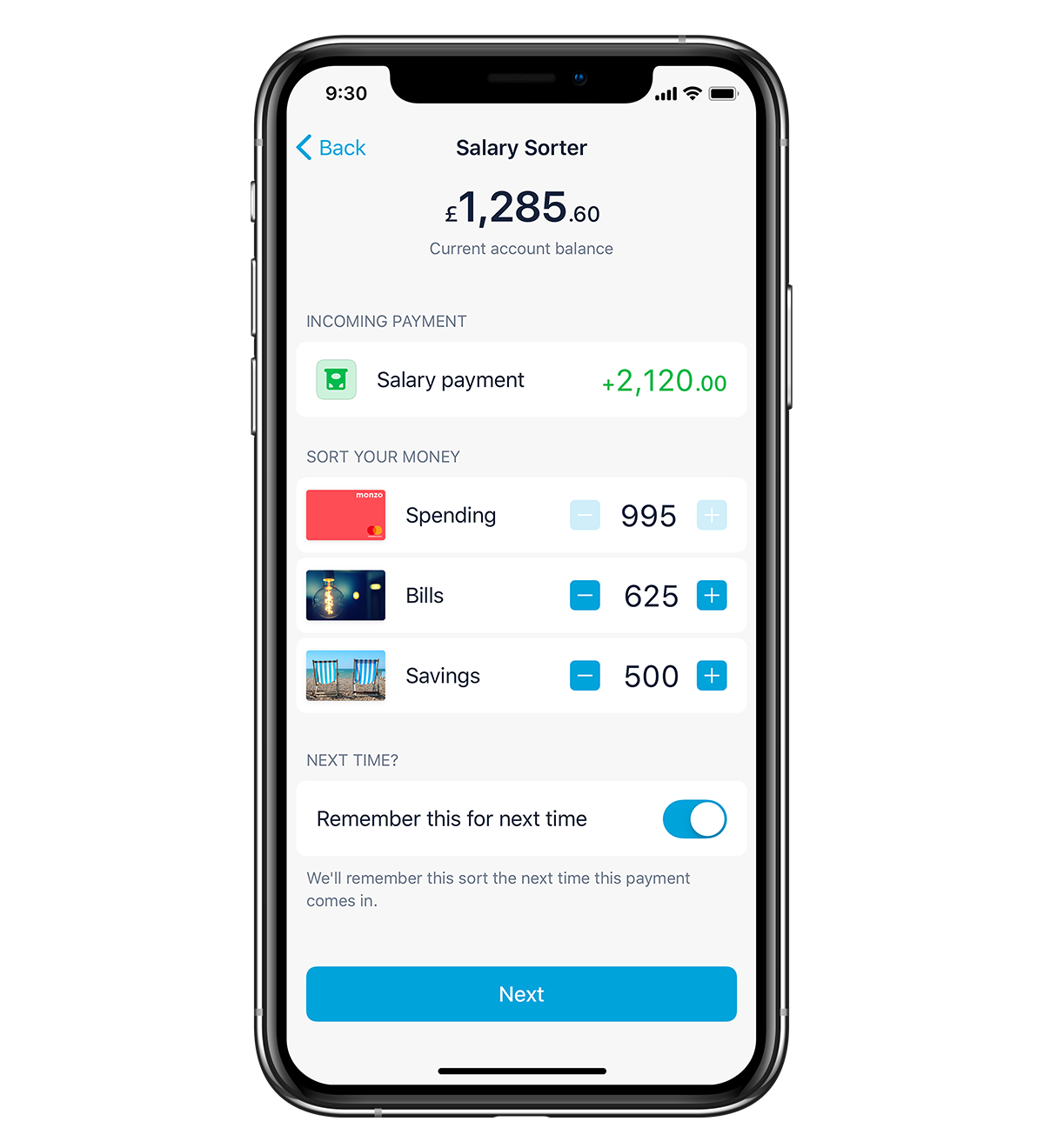

6. Organise your money

Indispensable if: you’re a neat freak

Pots let you organise the money in your Monzo account. You can use them for budgeting, to save up for something special, or just to make sure you don’t spend your rent money.

We’ve also got a handy feature called Salary Sorter, that lets you neatly sort your money between spending, bills and savings as soon as you get paid. You can then setup your Monzo direct debits to be taken from these pots - paying your bills automatically!

7. A way to earn interest on your savings

Great for you if: you want to grow your money

Savings Pots let you earn interest on your savings. And you can create one in seconds to earn up to 1.54% (AER, fixed) interest on your money.

See our savings accounts and interest rates, or open a Savings Pot now.

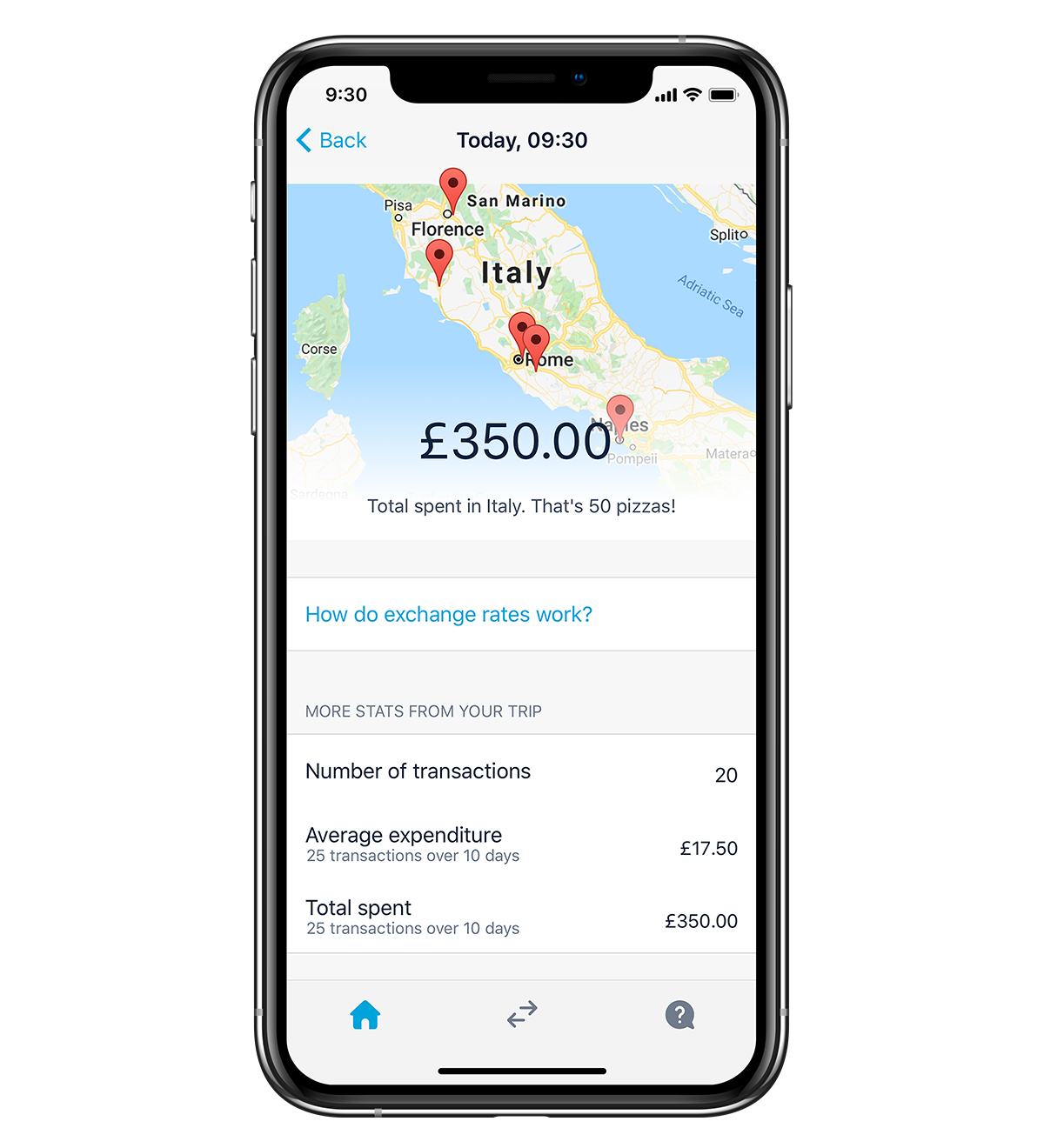

8. Use Monzo for free when you’re abroad

Essential for you if: You’ve got a holiday coming up

We don’t charge fees or extra charges just because you’re spending money abroad. Instead, we pass Mastercard’s exchange rate directly on to you.

We’ll never charge you to pay with your card when you’re away. And if you want to withdraw money, you can take out up to £200 in cash for free when you’re in another country. If you withdraw more than £200 in 30 days, you’ll pay a 3% charge each time after that.

9. Get amazing customer support when you need it

Good for you if: You want access to human help, whenever you need it

You can get in touch with real people through the Monzo app. We’re fast to respond, super friendly, and we use emojis.

Our customer service is so good Which? recently voted Monzo the best consumer bank in the UK.

Get access to these features and plenty more by opening a Monzo bank account!