Finding room in your budget to save at the end of every month is no easy task. A quarter of adults and half of 20-somethings in the UK don’t have any savings, so you’re definitely not alone if you find it difficult too.

Now that it’s getting warmer outside and the temptation to spend money is harder than ever, we’re seeing a growing number of people ‘micro-saving’. Micro-saving is investing small amounts regularly to make easier to actually start saving.

It’s one of the most realistic ways to save, especially if you find it difficult. By building savings habits into your day-to-day, over time you’ll see smaller amounts begin to add up and the pennies eventually turning into pounds.

Here are 3 ways to start micro-saving using Monzo:

1. Round up your transactions and save the spare change

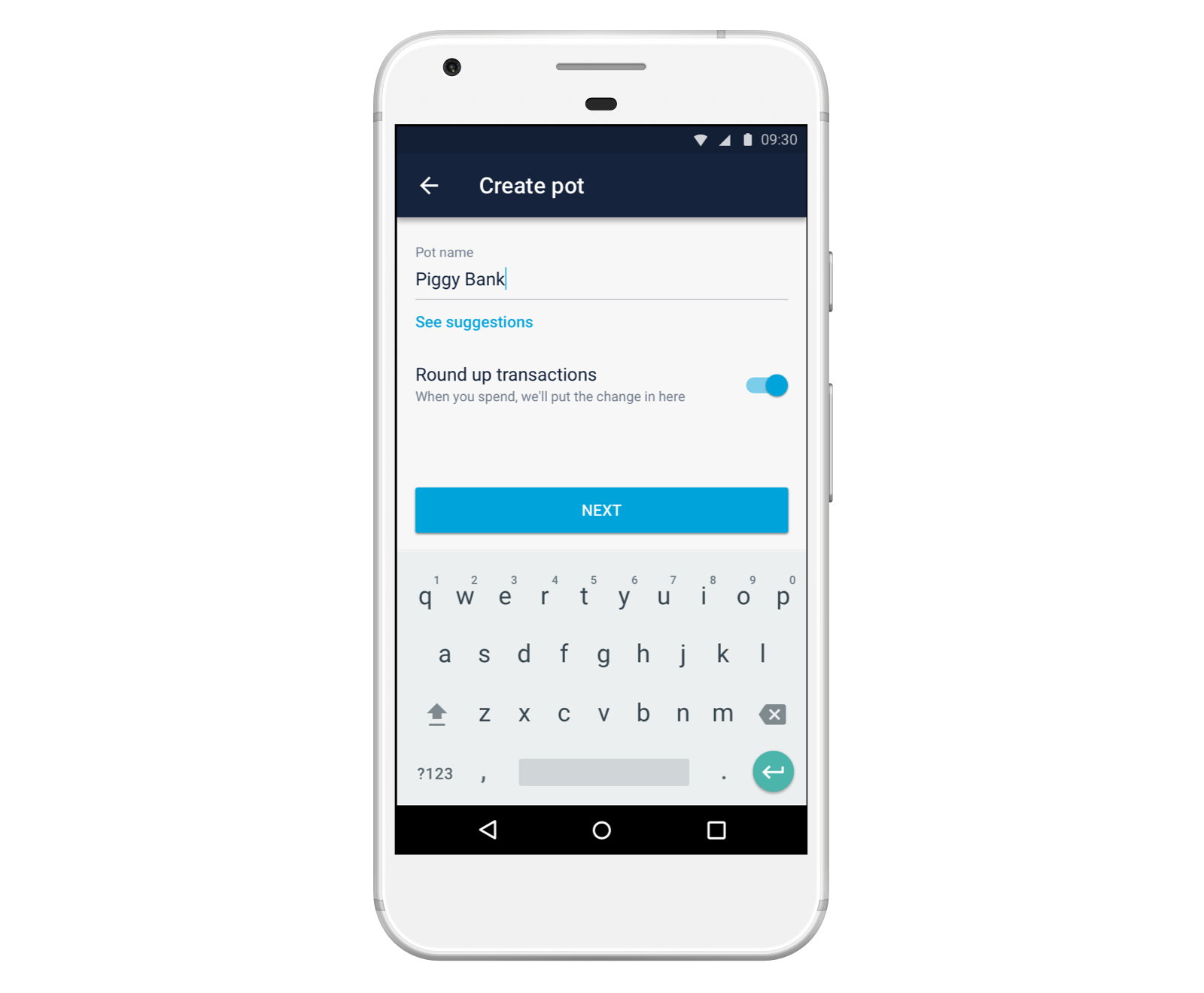

Whenever you buy something with Monzo, you can choose to round up your purchases and put the spare change in a Pot.

Round up your transactions to the nearest pound by heading to the Account tab in your app. Create a Pot (or edit an existing one) and turn on the switch to ‘Round up transactions’.

If you want to start smaller, you can round up your purchases to the nearest 50p or 10p instead, through our integration with automation platform If This, Then That (IFTTT).

You’ll need to connect your Monzo account to IFTTT – just click the links above and follow the instructions to get started!

Use Monzo to round up your purchases and set the spare change aside.

UK residents only, Ts&Cs apply

Download Monzo2. Take on the 1p Savings Challenge

The 1p Saving Challenge involves saving a little money every day, starting with 1p. The next day you save 2p, the day after 3p. On the final day you’ll set aside £3.65, and have a total of £667.95 in savings!

Skint Dad's 2018 1p Savings Challenge 😎

Not only is it an easy way to save; if you manage to complete to whole 365 days of savings, you'll have a tidy sum of £667.95 saved 😮

Get your free printables here >> https://t.co/onxOVNYSWQ

Happy savings & a very happy New Year! 😁 pic.twitter.com/r6LiAlIQNn

— Skint Dad (@SkintDad) January 1, 2018If you use Monzo, you can do it automatically with IFTTT.

Head to the 1p Saving Challenge on IFTTT and tap ‘Get Started’

You’ll need to log into Monzo and agree to some terms

Next, choose which Pot you’d like to put your savings in (or go to your Monzo app to make a new one)

Tap ‘Save’ to get started!

You can do the 1p Saving Challenge backwards, if you’d rather start big. Or try the 52 Week Savings Challenge to save almost £1,500 a year.

If you're thinking of starting the 1p Savings Challenge or you've already started and you're looking for some extra motivation, join our Saving Squad group on Facebook!

3. Save £1 every day

You can schedule payments to move money out of your main Monzo balance and into a Pot regularly.

So you could try and save £1 every day (less than the cost of a morning coffee!). Or set aside £10 at the start of every week if you can afford it.

Choose an amount and frequency that works for you, then set up payments to move the money into your Pot automatically.

Head to the Account tab in your app and tap the Pot you want to pay into (or make a new one)

Tap to add money

Then tap ‘Set scheduled payment’

Choose how much and how often you want to pay into your Pot, then tap ‘Schedule’

We’ll move the money into your Pot automatically.

Worried you’ve left it too late to start saving? Read our post on how to start saving from scratch.

Download Monzo to try these techniques for saving little and often today!